Distribution Transformer Market Size, Share, Trends and Forecast by Insulation Type, Mounting, Phase, Power Rating, and Region, 2025-2033

Distribution Transformer Market Size and Share:

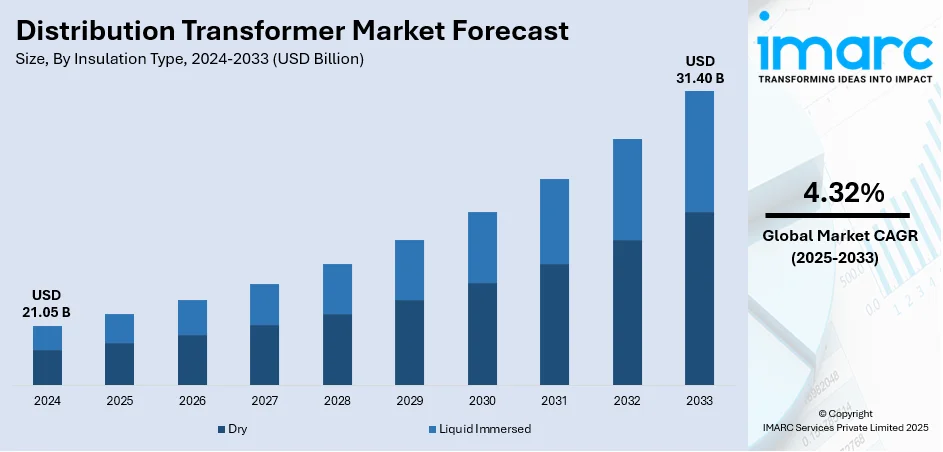

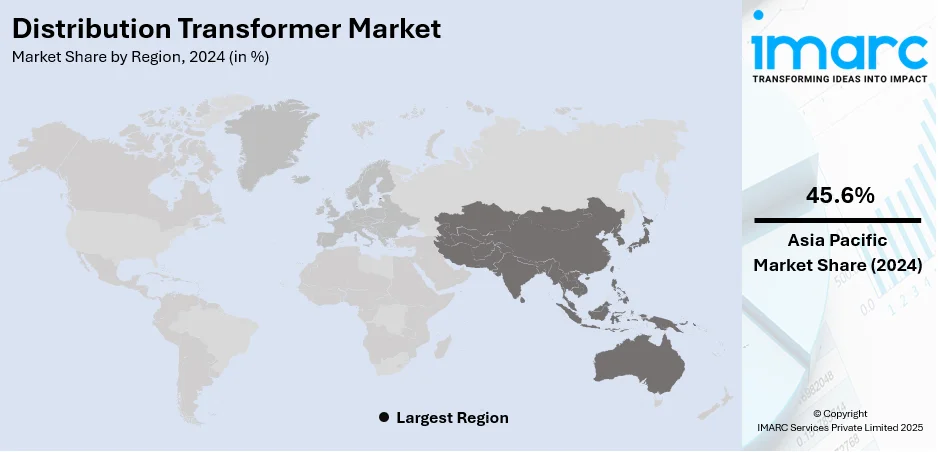

The global distribution transformer market size was valued at USD 21.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.40 Billion by 2033, exhibiting a CAGR of 4.32% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 45.6% in 2024. The market is witnessing significant growth driven by rising electricity demand, urban developments in emerging economies, and the shift towards renewable energy sources. Moreover, stringent regulations on energy efficiency are prompting upgrades in transformer technology. Additionally, as global power consumption increases, advancements in transformer efficiency and smart grid integration are expanding the distribution transformer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 21.05 Billion |

|

Market Forecast in 2033

|

USD 31.40 Billion |

| Market Growth Rate 2025-2033 | 4.32% |

The market for distribution transformers is experiencing rapid growth because of the rising need for electricity in different industries. Firms are constantly replacing old infrastructure and upgrading it to keep pace with rising power usage requirements. With the globe moving toward renewable energy sources, there is also growing demand for efficient transformers to withstand fluctuations in energy generation. Producers are vigorously working on advanced technologies, such as enhancing transformer efficiency, lowering energy losses, and extending their lifespan. There is also an increasing focus on smart grid technologies, which has resulted in producing more advanced distribution transformers with built-in monitoring systems. These transformers are configured to send real-time information so that better control and management of the electricity distribution network can be achieved. Governments and utility organizations are also enacting policies and incentives that encourage the use of energy-efficient transformers, further fueling the distribution transformer market growth.

To get more information on this market, Request Sample

The United States market for distribution transformers is experiencing significant growth with the increased demand for efficient and reliable power distribution. Utility organizations are eagerly upgrading their existing infrastructure to address the rising electricity demand from residential, commercial, and industrial consumers. There is a strong push with the growing emphasis on renewable energy sources to develop transformers able to address the intermittency of renewable power generation like wind and solar power. US manufacturers are also innovating, with the latest developments in transformer design, materials, and smart technology. Smart distribution transformers, which include sensors and Internet of Things (IoT) functions, are being designed to support real-time monitoring and enhanced grid reliability. This is an important trend with utility companies looking to upgrade their grids and make them more resilient. In 2025, Hitachi Energy revealed at CERAWeek further significant investments exceeding $250 million USD by 2027 to enhance worldwide manufacturing of essential transformer components. This swift response to the recently revealed $6 billion USD investment throughout the company portfolio highlights the growing transformer shortage, which keeps rising. The U.S. investment involves recruiting over 100 individuals to enhance the production of essential components domestically, thereby reinforcing the local supply chain.

Distribution Transformer Market Trends:

Rising Demand for Electricity

The growing population and rapid urbanization are driving the need for reliable electricity supply which is further driving the demand for distribution transformers. According to the report of Enerdata, electricity consumption increased by 9% in 2022 to 1320 TWH, after a 4% progression in 2021. It grew rapidly over 2010-2019 (7%/year) and fell by 6.7% in 2020. According to the National Institute of Urban Affairs, the urban population has experienced a six-fold increase since 1951, growing from 62.4 Million to three 77.1 Million in 2011, and it is estimated that 590,000,000 will live in Indian cities by 2030, which is twice the entire population of the USA. This is expected to boost the distribution transformer market forecast over the coming years.

Growing Renewable Energy Sources

The rising shift toward sustainable energy sources such as wind and solar requires upgrades to existing grid infrastructure like the deployment of advanced distribution transformers to handle variable energy inputs. According to the Office of Energy, the US electric grid is an engineering marvel with more than 9,200 electric generating units having more than 1 Million megawatts of generating capacity connected to more than 6,00,00 miles of transmission lines. The electric grid is more than just generation and transmission infrastructure. This is further influencing the distribution transformer statistics across the globe.

Increasing Stringent Regulations for Energy Efficiency

One of the major distribution transformer market trends is the rising implementation of strict regulations on energy efficiency and emission reductions by governments across the globe, prompting utilities and industries to adopt newer, more efficient transformer technologies. According to the Ministry of Power, Government of India (GoI), the primary energy demand in India has grown from about 450 Million tons of oil equivalent (toe) in 2000 to about 770 Million toe in 2012. This is expected to increase from about 1250 (estimated by the International Energy Agency) to 1500 (estimated in the Integrated Energy Policy Report) Million toe in 2030. Moreover, the Ministry of Power, through the Bureau of Energy Efficiency (BEE), has initiated several energy efficiency initiatives in areas of household lighting, commercial buildings, standards, and labeling of appliances, demand side management in agriculture/municipalities, SME and large industries including the initiation of the process for the development of energy consumption norms for industrial sub-sectors, capacity building of SDA’s etc.

Distribution Transformer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global distribution transformer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on on insulation type, mounting, phase, and power rating.

Analysis by Insulation Type:

- Dry

- Liquid Immersed

Liquid immersed stands as the largest component in 2024, holding around 68% of the market. The demand for liquid immersed insulation types in the market is majorly influenced by their superior cooling properties and high efficiency in heat dissipation. This type of transformer is favored in areas with high load demands and compact urban settings owing to its ability to operate at higher loads without overheating. Advancements in eco-friendly and fire-resistant insulating liquids like silicon and biodegradable esters are addressing environmental and safety concerns which is further fueling their adoption. For instance, in November 2023, Hitachi Energy presented its groundbreaking solution for liquid filled Transformers to protect distribution Transformers from transient voltage: Transformers Transient Voltage Protection (TVP) Technology. The company held a major event to inaugurate its state-of-the-art Transformers factory in Bac Ninh, Vietnam, and it was the perfect occasion to unveil this pioneering technology for the industry.

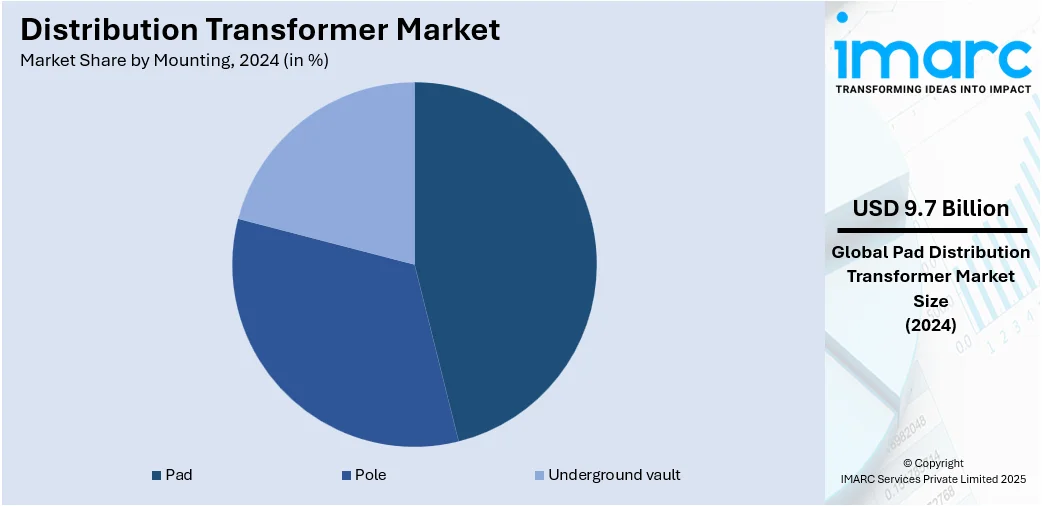

Analysis by Mounting:

- Pad

- Pole

- Underground vault

Pad leads the market with around 32% of market share in 2024. The demand for pad-mounted Transformers in the market is influenced by their compact size and low-profile design, which make them ideal for urban and suburban environments where space is limited. These Transformers are also favoured for their aesthetic appeal and reduced visibility, which blends well with the surrounding infrastructure. Pad-mounted transformers offer enhanced safety features like underground connectivity and tamper-resistant enclosures, which makes them safer in public areas. Since they are ground-mounted, these transformers are easy to access for maintenance and repairs. The design also allows for quick replacement or servicing, reducing downtime and improving operational efficiency. These transformers also tend to operate quietly compared to overhead transformers, reducing noise pollution, which is especially beneficial in residential or commercial settings.

Analysis by Phase:

- Single

- Three

The demand for single-phase transformers in the market is driving due to their increasing use in residential areas and small commercial settings where lower voltage and power are sufficient. These transformers are favored for their cost-effectiveness, eagle constellation, and simplicity. The increasing number of decentralized energy systems such as rooftop solar installations are further influencing their demand. The shift towards rural electrification in developing regions also contributes to the demand as these transformers exchange and distribute electricity to individual homes or small businesses.

The demand for three-phase transformers in the market is influenced by their necessity in large commercial complexes and industrial applications which need a stable, high power supply. These transformers are essential for efficiently handling high loads and providing the consistent power necessary for heavy machinery and extensive electrical systems. They are also integral to grid integration and renewable energy projects which facilitate the effective distribution of generated power. The expansion of industrial sectors and large-scale infrastructure projects globally also drive their adoption.

Analysis by Power Rating:

- Up to 500 kVA

- 501 kVA–2500 kVA

- Above 2500 kVA

Up to 500 kVA leads the market with around 32% of market share in 2024. The demand for distribution transformers with power ratings up to 500 kVA is influenced by this suitability for light commercial and residential applications. These Transformers are cost-effective, compact, and efficient for low load requirements. The ongoing expansion of urban residential areas and small-scale commercial sectors including small industries and shopping complexes, further influences their adoption. The rising shift toward rural electrification in emerging economies is driving the demand for these transformers to support the distribution of electricity in less densely populated areas. Many transformers in this range are designed with environmentally friendly materials and construction methods, reducing the environmental footprint during production and operation. Additionally, the energy-efficient performance contributes to a greener operation overall.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.6%. Rapid industrial developments and urban initiatives in the region are offering a favorable distribution transformer market outlook in Asia Pacific. The increasing investment in upgrading and expanding the power structure to meet the growing electricity demand from both rural and urban areas in countries like India and China. The rising push towards renewable energy integration is driving the need for advanced and efficient distribution Transformers to handle variable loads from sources such as wind and solar across the region. Government initiatives aimed at improving energy efficiency and reducing losses in transmission and distribution networks are also contributing to the growth of the market. For instance, in 2024, Toshiba Transmission and Distribution Systems-India (TTDI), with a manufacturing facility close to Hyderabad, opted to enhance its production capacity of power and distribution transformers in the next three years by investing Japanese Yen (JPY) 10 billion (approximately ₹500 crore).

Key Regional Takeaways:

United States Distribution Transformer Market Analysis

United States has witnessed an increasing demand for distribution transformers driven by the rising electricity demand across residential, commercial, and industrial sectors. According to U.S. Energy Information Administration, power demand will rise to 4,189 Billion kilowatt hours in 2025 and 4,278 Billion kWh in 2026, up from a record 4,097 Billion kWh in 2024. Growing investments in power infrastructure, modernization of aging electrical grids, and expansion in electrification initiatives have accelerated transformer installations. Enhanced focus on energy reliability and the integration of advanced monitoring technologies further fuel market growth. Smart grid implementation and the expansion of electric vehicle charging networks also support the need for efficient and scalable power distribution solutions. As electricity demand continues to climb, utilities and private sector operators are enhancing their distribution systems to reduce transmission losses.

Asia Pacific Distribution Transformer Market Analysis

Asia-Pacific is experiencing significant distribution transformer adoption driven by rapid industrialization across emerging economies. According to Ministry of Statistics & Programme Implementation India, Index of Industrial Production (IIP) saw a 1.2 % year-on-year increase in May 2025, driven by growth in manufacturing sector at 2.6%. Massive expansion in manufacturing, automotive, and processing industries is demanding reliable power infrastructure, pushing governments and utilities to enhance electricity distribution capabilities. Industrial zones, export hubs, and technology parks are witnessing rising energy loads, necessitating the deployment of high-capacity distribution transformers. Infrastructure development, along with large-scale transportation and logistics corridors, is further supporting the need for robust electricity delivery.

Europe Distribution Transformer Market Analysis

Europe is increasingly adopting distribution transformers due to the growing renewable energy sector, requiring efficient integration into existing power grids. According to internation energy agency, the European Union (EU) has increased its commitment to clean energy, with investment reaching almost USD 390 Billion in 2025. As solar, wind, and other renewable sources expand across urban and rural areas, there is a critical need for advanced transformers to stabilize fluctuating energy outputs and distribute electricity effectively. Grid operators are investing in smart and eco-friendly distribution systems to enhance grid flexibility and accommodate variable renewable generation. Distribution transformers are being deployed to manage decentralized energy flows, especially in regions transitioning toward low-carbon energy models. The focus on reducing emissions, energy transition policies, and grid digitalization is accelerating transformer installations.

Latin America Distribution Transformer Market Analysis

Latin America is witnessing increased adoption of distribution transformers fuelled by rapid urbanization across expanding metropolitan and peri-urban zones. For instance, by 2025, 315 Million people will live in Latin America’s large cities where the per-capita GDP is estimated to reach USD 23,000. As cities grow in population and infrastructure, the demand for stable and reliable electricity surges, leading to enhanced deployment of distribution transformers. Utilities are focusing on grid extension and modernization to accommodate new residential developments, commercial hubs, and transport systems. Rapid urbanization is driving electrical load densities, necessitating efficient power delivery solutions.

Middle East and Africa Distribution Transformer Market Analysis

Middle East and Africa are observing rising distribution transformer adoption supported by growing smart city and construction projects. For instance, the Middle East expects to invest nearly USD 50 Billion in smart city projects through to 2025. These initiatives require robust power infrastructure to deliver consistent electricity across new residential zones, commercial centres, and public services. Smart city development emphasizes intelligent grid systems where modern transformers play a key role in real-time load management and efficiency.

Competitive Landscape:

Market participants of the distribution transformer market are actively involved in a number of strategic initiatives to remain competitive and address increasing demand. Manufacturers are constantly innovating, with emphasis being given to making transformers more efficient, long-lasting, and high-performing. They are making research and development (R&D) investments to launch newer technologies such as smart transformers with IoT integration to monitor and predict maintenance in real time. Firms are also increasing their manufacturing capacities and venturing into new geographical markets, especially in developing economies, to support urbanization and industrialization. As per the distribution transformer market forecasts, players in the market are expected to emphasize sustainable practices by designing eco-friendly and energy-efficient transformers, due to strict regulatory needs and the world drive towards cleaner energy solutions.

The report provides a comprehensive analysis of the competitive landscape in the distribution transformer market with detailed profiles of all major companies, including:

- CG Power & Industrial Solutions Ltd.

- Eaton Corporation

- GE Grid Solutions, LLC

- Hammond Power Solutions

- HD Hyundai Electric Co., Ltd.

- Hitachi Energy Ltd

- Kirloskar Electric Company

- Schneider Electric SE

- SGB SMIT Group

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Wilson Transformer Company

Latest News and Developments:

- June 2025: JST Power Equipment announced the opening of a new manufacturing facility in Port Klang, Malaysia, which began producing pad-mounted distribution transformers ranging from 25 kVA to 6000 kVA. The plant aimed to manufacture 700 units in 2025 and scale up to 3500 units by 2026, expanding JST’s global transformer production network.

- June 2025: Actom Distribution Transformers launched a new transformer inverter station at Enlit Africa, combining inverter, transformer, ring main unit, and LV combiner into one integrated unit. The innovation, introduced across its offices in South Africa, Kenya, Namibia, and Botswana, was aimed at easing community electricity reliance on Eskom.

- May 2025: Hammond Power Solutions launched a new EV charging distribution transformer to support growing electric vehicle infrastructure and real-world performance demands. The transformer addressed harmonic load challenges and overheating risks, offering k-factor, harmonic mitigating features, and low-temperature rise options in custom-colored enclosures.

- April 2025: R&S Group inaugurated its new 10,000 m² distribution transformer plant in Krzeczów, Poland, marking a strategic expansion into the Baltics, Nordics, and Germany. The facility, launched after overcoming global supply challenges, significantly boosted production capacity and showcased the group’s sustainability focus.

- January 2025: CG Power & Industrial Solutions Ltd approved a USD 85.44 Million investment to set up a greenfield distribution transformer plant, aiming to boost its total transformer manufacturing capacity to 85,000 MVA by March 2028. The plant was planned to produce transformers ranging from 220 kV to 765 kV for both domestic and global markets.

Distribution Transformer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insulation Types Covered | Dry, Liquid Immersed |

| Mountings Covered | Pad, Pole, Underground Vault |

| Phases Covered | Single, Three |

| Power Ratings Covered | Up to 500 kVA, 501 kVA–2500 kVA, Above 2500 kVA |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CG Power & Industrial Solutions Ltd., Eaton Corporation, GE Grid Solutions, LLC, Hammond Power Solutions, HD Hyundai Electric Co., Ltd., Hitachi Energy Ltd, Kirloskar Electric Company, Schneider Electric SE, SGB SMIT Group, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, Wilson Transformer Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the distribution transformer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global distribution transformer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the distribution transformer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The distribution transformer market was valued at USD 21.05 Billion in 2024.

The distribution transformer market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 31.40 Billion by 2033.

Key drivers include rising electricity demand, rapid urbanization in emerging economies, the shift to renewable energy sources, advancements in smart grid technologies, and stricter energy efficiency regulations. These factors are prompting utility companies and industries to upgrade their infrastructure, further fueling the market growth.

Asia Pacific currently dominates the distribution transformer market, accounting for 45.6% of the market share. The region's rapid industrial growth, urbanization, and push for renewable energy are key contributors.

Some of the major players in the distribution transformer market include CG Power & Industrial Solutions Ltd., Eaton Corporation, GE Grid Solutions, LLC, Hammond Power Solutions, HD Hyundai Electric Co., Ltd., Hitachi Energy Ltd, Kirloskar Electric Company, Schneider Electric SE, SGB SMIT Group, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, Wilson Transformer Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)