Drone Logistics and Transportation Market Size, Share, Trends and Forecast by Platform, Range, Sector, and Region, 2026-2034

Drone Logistics and Transportation Market Size and Share:

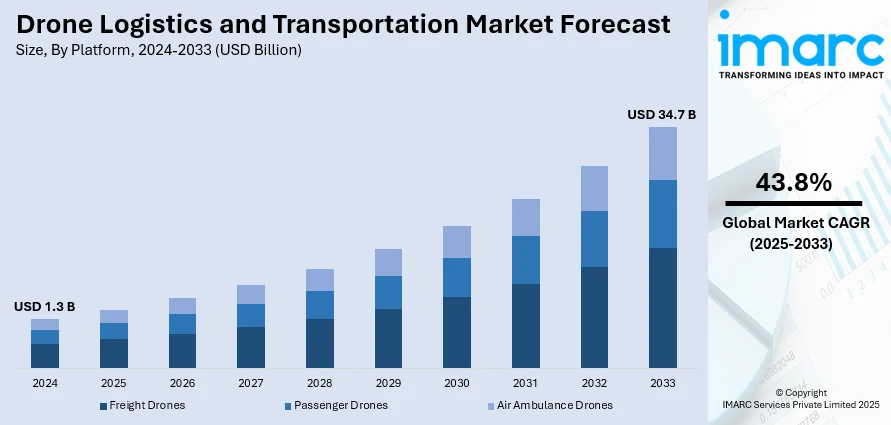

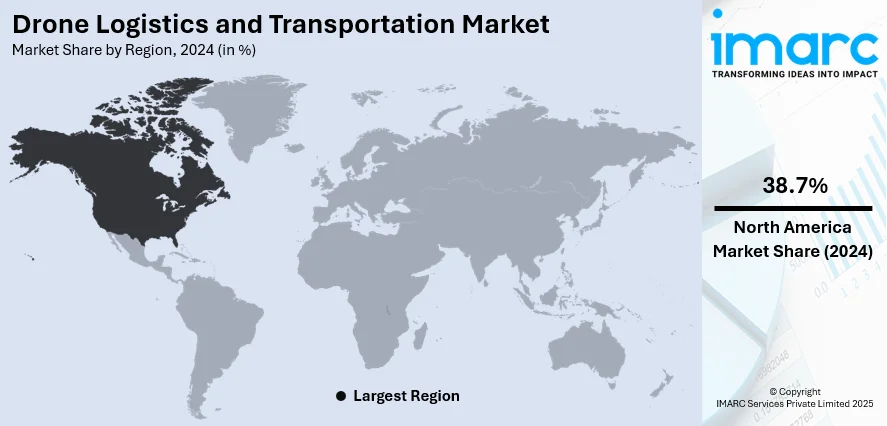

The global drone logistics and transportation market size was valued at USD 1.3 Billion in 2025. The market is projected to reach USD 34.7 Billion by 2034, exhibiting a CAGR of 43.8% from 2026-2034. North America currently dominates the market, holding a market share of over 38.7% in 2024. The market is driven by increased e-commerce, healthcare deliveries, and industrial use with quick, inexpensive, and efficient solutions. Improvements in technology like artificial intelligence (AI), machine learning (ML), GPS, and autonomous navigation are driving operational efficiency and dependability. Urban traffic, regulatory backing, and sustainable logistics solutions are additionally fueling adoption in civil, commercial, and defense domains. Sustained innovation and industry-wide strategic deployment are defining operational excellence and growing the global drone logistics and transportation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.3 Billion |

|

Market Forecast in 2034

|

USD 34.7 Billion |

| Market Growth Rate 2026-2034 | 43.8% |

Growing demand for fast and agile supply chain solutions in various industries is driving the global use of drone logistics and transportation. Businesses globally are looking toward unmanned aerial vehicles for use beyond online shopping, such as industrial inspection, field monitoring for agriculture, and remote maintenance of infrastructure. These drones provide the capability to access areas that would otherwise be hard or time-consuming to reach, lowering operational expenses and improving efficiency. As per the sources, in August 2025, Grid Aero unveiled its Lifter-Lite cargo drone with U.S. Air Force backing and \$6 million seed funding, aiming to enhance long-distance military logistics and contested supply operations. Furthermore, the combination of advanced navigation systems, AI, and autonomous control features is making accurate and trustworthy operations in complex environments possible. Moreover, governments from several regions are developing regulatory structures to safely integrate drones in business operations, further promoting uptake. The growing environmental emphasis on carbon footprint reduction in logistics is also fueling interest in drones as a less carbon-intensive substitute for conventional delivery systems. All these factors help to spur the constant growth of the global market.

To get more information on this market, Request Sample

In the United States, drone logistics and transportation market growth is highly spurred by the growing healthcare and pharmaceutical delivery industry. With 84.30% share in 2024 in the United States, drones are being deployed to transport critical medical supplies, laboratory samples, and vaccines, particularly in underserved or remote areas where traditional transport faces delays. The integration of advanced navigation, AI-enabled route optimization, and real-time monitoring ensures timely and secure delivery, enhancing operational efficiency for emergency response and routine healthcare operations. In addition, increasing domestic trade and boosting e-commerce networks have compounded the necessity of fast, secure delivery solutions that supplement available infrastructure. According to the reports, in June 2025, Walmart, in partnership with Wing, expanded drone delivery to 100 new U.S. stores across Atlanta, Charlotte, Houston, Orlando, and Tampa, enabling rapid, app-based deliveries within minutes. Moreover, the use of drones in these industries not only enhances the availability of services but also lessens reliance on traditional channels of transportation, facilitating the development of smart logistics systems. As a result, the US market is experiencing rapid growth, with drones at the center of transforming delivery and healthcare supply chains.

Drone Logistics and Transportation Market Trends:

Growth in E-Commerce and Retail Logistics

Logistics and transport via drones are utilized in the e-commerce sector due to the rise in online shopping and the need for effective delivery of goods. As per the U.S. USCBN Census Bureau News, online sales during the first quarter of 2025 increased by 6.1% compared to the same quarter in 2024 and represented 16.2% of total retail sales. This growth in internet shopping is pushing the use of drones for last-mile delivery to shorten transit times and improve customer satisfaction. Drones are being relied upon more and more by retailers to deliver parcels quickly, especially in congested urban areas where it is difficult for conventional methods of delivery. Moreover, automation and speed offered by drones lower operational expenses and reduce the dependence on human resources. Consequently, the use of drones for retail and e-commerce logistics is proving to be a key growth opportunity for the global market, enabling faster, efficient, and cost-effective networks of delivery.

Defense and Military Operations Adoption

Logistics and transportation of drones find widespread uses in the defense and military industry because of the increasing instances of cross-border terrorism, drug trade, and illegal border crossing occurrences. The United States Center for Strategic and International Studies (CSIS) points out that close to one-third of all defense procurement expenditure in 2025 goes into commercial innovation, with most of it going into unmanned systems, such as drones. These drones are utilized for surveillance, border monitoring, intelligence gathering, and quick delivery of key tools to the farthest frontlines. Their capability to function independently in hostile territory increases situational awareness and operational effectiveness while reducing exposure of humans to hazard. In addition, advancements in drone navigation systems, GPS systems, and obstacle avoidance systems are enhancing the dependability and accuracy of these platforms. Heightening emphasis on modernization in military operations continues to drive the demand for drones, fuelling the consistent growth of the market worldwide.

HealthCare Integration and Applications of Advanced Technology

In the health care industry, drones are being applied for diagnosis, perioperative assessment, remote area telemonitoring, and delivery of urgent medical supplies, such as laboratory specimens, medicines, vaccines, and emergency equipment. The accelerating incidence of chronic disease among populations also stimulates the use of drones for timely health care delivery. Furthermore, the increasing volume of transportation activities and intracountry trade has been providing a positive picture for the market. Drone logistics and transportation market trends suggest that integration with artificial intelligence (AI), machine learning (ML), cloud computing, blockchain, GPS, and advanced navigation systems is enhancing drone performance, such as flight path planning, obstacle avoidance, and payload management. These technologies provide safe data exchange between drones and the ground station, enabling real-time monitoring and control of operations. Such innovations are enabling broad-based adoption across sectors and consolidating the market's growth path in the global arena.

Drone Logistics and Transportation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global drone logistics and transportation market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on platform, range, and sector.

Analysis by Platform:

- Freight Drones

- Passenger Drones

- Air Ambulance Drones

The freight drones platform segment is experiencing high growth with 77.7% market share in 2024. Freight drones are being widely used for the transportation of products over short and medium distances due to their potential to offer faster delivery and higher supply chain efficiency. Freight drones cater to numerous industries such as retail, e-commerce, and industrial logistics by offering flexible and economical solutions compared to conventional modes of transportation. Advanced automation, AI-based route planning, and payload management systems enable freight drones to fly safely in cluttered environments, enhancing reliability and operational performance. Moreover, regulatory schemes in several countries are changing to support drone-based freight operations, allowing broader adoption. With growing needs for contactless delivery and environmentally friendly logistics, the segment of freight drone platforms is anticipated to keep expanding strongly, facilitating easy integration into existing supply chains and encouraging air-based cargo transportation innovation.

Analysis by Range:

- Close-Range (<50 Kilometers)

- Short-Range (50 to 150 Kilometers)

- Mid-Range (151 to 650 Kilometers)

- Long-Range (>650 Kilometers)

Close-range (<50 kilometres) drone segment is on the rise in 2024. Close-range drones are best suited for last-mile delivery, urban logistics, and time-critical applications where conventional transportation is hampered by congestion or infrastructure limitations. With their capacity for quick deliveries over short distances, they are best for applications in healthcare, e-commerce, and food services. Technological innovations like autonomous navigation, real-time monitoring, collision avoidance, and secure data communication enhance operational safety and effectiveness. Support by regulations to operate drones at low altitudes in densely populated areas is further facilitating their deployment. The emphasis on lowering operation costs and delivery times and improving service quality is prompting logistics providers to incorporate close-range drones into their distribution networks. Consequently, this segment is witnessing consistent growth, which is significantly contributing to the growth of drone logistics and transport solutions.

Analysis by Sector:

- Civil and Commercial

- Military

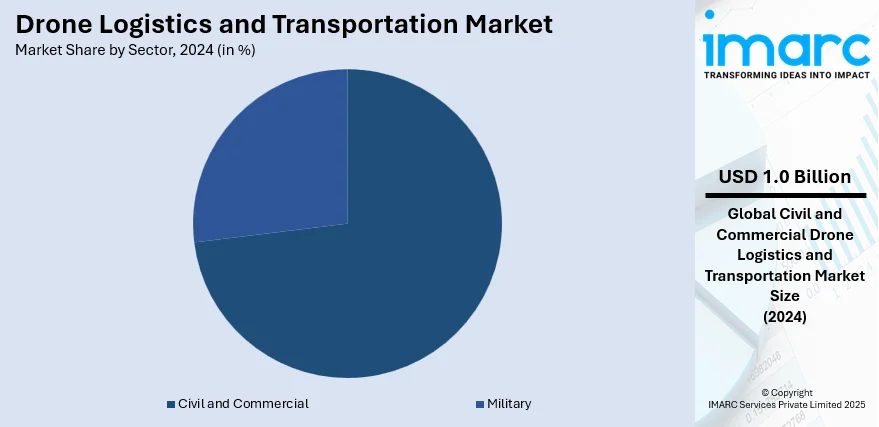

Civil and commercial is spearheading strong usage of drone logistics with 73.2% market share in 2024. Drones are being progressively applied for uses like industrial inspections, agribusiness monitoring, and commercial deliveries, enabling a broad variety of civil applications. In business applications, drones increase working efficiency, cut labor dependence, and offer scalable solutions for last-mile delivery, inventory tracking, and express transport of items. The inclusion of AI, machine learning, GPS, and cloud connectivity provides accurate navigation, secure data transmission, and real-time management control to ensure safe and efficient deployment. Government investments and policies in drone infrastructure, as well as increasing domestic trade and technology uptake, are driving the industry's growth. The North American commercial and civil market continues to enjoy high technological maturity as well as conducive regulatory conditions that make the region a leader in applying advanced drone logistics and transport solutions in various industries.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is led by the civil and commercial industry in adopting strong drone logistics with 38.7% in 2024. Drones are now more widely used to conduct industrial inspections, agricultural monitoring, and commercial delivery, and they support many civil applications. Drones improve operational efficiency in commercial industries, minimize labor reliance, and offer scalable last-mile delivery, inventory tracking, and fast transport of products. Incorporation of AI, machine learning, GPS, and cloud connectivity provides accurate navigation, secure data transmission, and real-time operational command, ensuring effective and safe deployment. Government policies, investment in drone infrastructure, increasing domestic commerce, and technological uptake are driving the sector's development. The North American commercial and civil market continues to enjoy high levels of technological maturity and supportive regulatory climates, making the region a prime positioner for executing advanced drone transportation and logistics solutions across various industries.

Key Regional Takeaways:

United States Drone Logistics and Transportation Market Analysis

The United States drone logistics and transportation market outlook is experiencing steady growth, driven by the increasing integration of advanced automation technologies across the supply chain. Rising demand for time-sensitive deliveries, especially in urban and remote areas, is prompting logistics firms to invest in drone fleets. According to the Federal Aviation Administration (FAA), over 822,039 drones were registered in the U.S. as of July 2025, underscoring the vast scale of drone operations in the country. Moreover, the U.S. is witnessing heightened deployment of drone-based systems in defense supply operations, enabling rapid, contactless, and on-demand distribution. Expanding infrastructure for air traffic management tailored for unmanned aerial vehicles (UAVs) is further fostering adoption. Additionally, the market benefits from the increasing emphasis on carbon-neutral operations, with drones emerging as a sustainable alternative for short-haul transport. The proliferation of AI-powered navigation and route optimization tools is enhancing delivery accuracy and operational efficiency. Furthermore, support for pilot programs in drone corridors is accelerating testing and validation of commercial applications. Strategic collaborations among logistics providers and tech developers are also promoting system innovation and scalability.

Europe Drone Logistics and Transportation Market Analysis

The drone logistics and transportation market in Europe is advancing due to a growing emphasis on green mobility solutions aligned with the region's environmental objectives. Urban centers are increasingly leveraging drone technology to alleviate last-mile delivery congestion, especially in zones with restricted vehicular access. The European Drone Outlook projects market expansion from USD 4.96 Billion USD in 2024 to approximately USD 50 Billion USD by 2034 is reflecting a 26% compound annual growth rate. Enhanced integration of autonomous aerial systems into existing logistics frameworks is also gaining traction. The rise of precision agriculture and forestry management is contributing to wider drone-based supply applications. Furthermore, the increasing use of drones for transporting high-value and perishable goods is enhancing their utility in specialized logistics. Regulatory initiatives promoting BVLOS operations are promoting innovation and extended-range delivery capabilities. As infrastructure adapts, drone deployment expands across sectors. Educational and research institutions are developing scalable drone logistics systems through pilot studies and simulation programs.

Asia Pacific Drone Logistics and Transportation Market Analysis

The Asia Pacific drone logistics and transportation market is expanding rapidly due to strong demand for faster, contactless delivery in densely populated urban areas. Regional industries are adopting drone services to meet growing consumer expectations for same-day fulfillment. Government-backed modernization of postal and cargo transport systems is supporting drone deployment across varied terrains. As noted by the State Council of the People’s Republic of China, port cargo throughput is expected to reach 17.5 Billion Tons in 2025, with foreign trade throughput rising by 7% year-on-year, creating massive opportunities for drone integration in port-linked logistics. Moreover, the region is witnessing increased adoption in construction and infrastructure monitoring, where drones are used for delivering tools and supplies. Advancements in high-capacity battery systems and real-time telemetry are also enhancing operational range and reliability. Educational institutions and tech incubators are promoting innovation in payload handling and automated fleet management, enabling widespread adoption in industrial, emergency, and inter-island logistics beyond retail.

Latin America Drone Logistics and Transportation Market Analysis

The Latin American drone logistics and transportation market is gaining momentum as industries explore cost-effective delivery methods to overcome geographical barriers. Vast rural expanses and limited infrastructure are encouraging the use of drones for efficient transport of supplies and goods. According to the World Bank, Brazil now has over 20 local drone manufacturers, reflecting a steady boost in regional capabilities and supply chain localization. Agricultural sectors are also utilizing drone delivery for input distribution across remote farming zones. Increased participation in pilot programs and regional tech accelerators is nurturing ecosystem development. Additionally, drones are being explored for facilitating intra-city transport of time-sensitive packages, especially in areas with limited road connectivity. Public and private sector partnerships are fostering a supportive regulatory environment to encourage innovation in aerial logistics.

Middle East and Africa Drone Logistics and Transportation Market Analysis

The drone logistics and transportation market in the Middle East and Africa is witnessing growth propelled by rapid digital transformation in supply chain systems. Desert terrains, mountainous regions, and remote settlements are prompting increased reliance on drones to enhance connectivity and service reach. According to the Transport General Authority, Riyadh accounts for 45.04% of total delivery volume, followed by Makkah at 21.17% and the Eastern Province at 15.87%, reflecting significant regional demand for aerial logistics solutions. The market is also benefiting from rising demand for emergency delivery of supplies, especially in humanitarian logistics. Adoption of solar-powered drones and advanced telemetry systems is enabling longer-range operations in harsh environments. Furthermore, the integration of drone technology into national smart infrastructure strategies is supporting broader deployment across logistics networks.

Competitive Landscape:

Competition within the drone logistics and transport market is defined by quick technology advancement, strategic partnerships, and growing research and development investment. Firms are concentrating on increasing payload capacity, flight time, navigation technology, and integration with artificial intelligence, machine learning, and GPS technologies to make their offerings stand out. Collaborations with logistics companies, healthcare facilities, and e-commerce companies are being utilized to mount service networks and operational efficiencies. Apart from this, regulatory compliance, safety measures, and certification procedures have a crucial role in achieving market recognition and sustaining growth. The market also experiences ongoing innovation in autonomous flight procedures, real-time tracking, safe data transfer, and route planning, supporting effective last-mile delivery and essential supply transportation. Drone logistics and transportation market forecast stipulate that these strategic actions and innovations combined will propel growth in the market, enhance competitive positioning, and allow stakeholders to maximize emerging opportunities in civil, commercial, and defense markets.

The report provides a comprehensive analysis of the competitive landscape in the drone logistics and transportation market with detailed profiles of all major companies, including:

- Cana LLC

- Dronamics

- Drone Delivery Canada

- Flytrex Aviation Ltd.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Hardis Group

- Matternet

- Volocopter Gmbh

- Wing Aviation (Alphabet Inc.)

- Zipline International Inc.

Latest News and Developments:

- July 2025: blueflite and Airspace Link announced a partnership during Michigan’s Reindustrialise 2.0, combining tiltrotor UAVs and drone operations management systems to enable secure, autonomous logistics. Backed by government funding and aligned with Michigan’s AAM Initiative, they launched a parts delivery project with Jack Demmer Ford to ease urban supply chain bottlenecks.

- July 2025: Volatus Aerospace launched its Condor XL heavy-lift drone program, advancing Canadian aerospace innovation with a platform capable of carrying 180 kg over 200 km. Backed by national defence goals, the initiative positioned Volatus to modernize logistics, enhance resilience, and support remote operations, with flight testing scheduled for late 2025.

- June 2025: Aviation Sans Frontières partnered with Windracers to deploy ULTRA MK2 heavy-lift drones in Africa, delivering medical supplies to remote areas. With a 150 kg payload and 1,000 km range, the initiative aimed to create a scalable, sustainable model for humanitarian logistics, starting with vaccine delivery trials and operations in Malawi.

- April 2025: Skye Air expanded its drone delivery operations to Delhi-NCR, targeting high-density areas in Delhi, Faridabad, and Gurugram. After delivering 1.2 million packages in 2024, the company aimed for 5 million in 2025, partnering with major logistics firms like Blue Dart and DTDC to scale quick-commerce and ecommerce deliveries.

- February 2025: Apollo Hospitals and TECHEAGLE introduced India’s first 10-minute diagnostic drone delivery service. Launched at THIT 2025, the initiative used AI-powered drones to transport biopsy samples swiftly, addressing delays in cancer diagnostics. The autonomous system marked a major step in integrating drone tech into healthcare and emergency medical logistics.

Drone Logistics and Transportation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Freight Drones, Passenger Drones, Air Ambulance Drones |

| Ranges Covered | Close-Range (<50 Kilometers), Short-Range (50 to 150 Kilometers), Mid-Range (151 to 650 Kilometers), Long-Range (>650 Kilometers) |

| Sectors Covered | Civil and Commercial, Military |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cana LLC, Dronamics, Drone Delivery Canada, Flytrex Aviation Ltd., Guangzhou EHang Intelligent Technology Co. Ltd., Hardis Group, Matternet, Volocopter Gmbh, Wing Aviation (Alphabet Inc.), Zipline International Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the drone logistics and transportation market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global drone logistics and transportation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the drone logistics and transportation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drone logistics and transportation market was valued at USD 1.3 Billion in 2024.

The drone logistics and transportation market is projected to exhibit a CAGR of 43.8% during 2025-2033, reaching a value of USD 34.7 Billion by 2033.

The drone logistics and transportation market is driven largely by the growing need for fast, affordable delivery options across sectors. Growing e-commerce, healthcare, and industrial usage is propelling uptake. The adoption of AI, machine learning, GPS, and advanced navigation systems drives the efficiency of operations. Urban congestion, regulatory backing, and the demand for green logistics also drive the market forward worldwide.

North America currently dominates the drone logistics and transportation market, accounting for a share of 38.7%. The country enjoys a well-developed technological infrastructure, favorable policy environment, and high uptake in civil, commercial, and defense industries. Growing e-commerce, healthcare logistics, and industrial deliveries contribute to the leading position of the market. Ongoing innovation and strategic partnerships further enhance the competitive edge of North America.

Some of the major players in the drone logistics and transportation market include Cana LLC, Dronamics, Drone Delivery Canada, Flytrex Aviation Ltd., Guangzhou EHang Intelligent Technology Co. Ltd., Hardis Group, Matternet, Volocopter Gmbh, Wing Aviation (Alphabet Inc.), Zipline International Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)