Drug Device Combination Products Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Drug Device Combination Products Market Size:

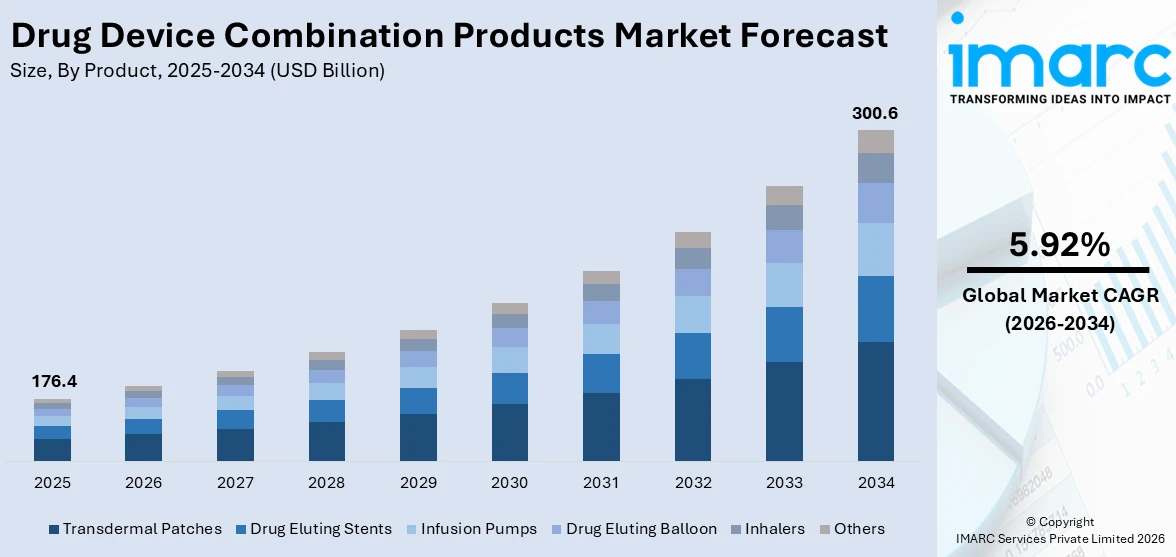

The global drug device combination products market size was valued at USD 176.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 300.6 Billion by 2034, exhibiting a CAGR of 5.92% from 2026-2034. North America currently dominates the market, holding a market share of 41.7% in 2025. The dominance of the segment is attributed to its well-established healthcare infrastructure, strong regulatory frameworks, and high investment in research activities. Advanced technological innovations, significant healthcare expenditure, and a growing focus on improving patient outcomes, are further contributing to the expansion of the drug device combination products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 176.4 Billion |

|

Market Forecast in 2034

|

USD 300.6 Billion |

| Market Growth Rate 2026-2034 | 5.92% |

Drug Device Combination Products Market Analysis:

- Major Market Drivers: As per the drug device combination products market analysis, the rising prevalence of chronic diseases and the requirement for more efficient and convenient treatment alternatives are propelling the demand for drug-device combination products. The drug device combination products market growth is also stimulated by the burgeoning geriatric population worldwide, which has surged the demand for new healthcare approaches, as elderly people are producing more lifestyle-related health problems. Additionally, companies have increasingly adopted approaches to personalized medicine, including drug delivery gadgets for targeted therapy, which is further positively contributing to the drug device combination products market share. Other factors that have fueled the drug device combination products market outlook include regulatory support and economic incentives for combination product development, as well as expanding healthcare spending in developing countries.

- Key Market Trends: As per the drug device combination products market research, the most substantial trends in the drug-device combination products are the growing interest in wearable drug delivery devices for the patient’s mobility and quality of life improvement. Another factor that propels the drug device combination products market value is the increasing use of smart devices to control patient adherence and therapy response and adjust the dose and treatment regime as necessary in real-time. In line with this, the incorporation of digital technology into products and their ability to utilize the Internet of Things (IoT) increases patient engagement and outcomes monitoring, which is further driving the drug device combination products market demand. Apart from this, as per the drug device combination products market forecast, the progression of three-dimensional (3D) printing technology is projected to create new opportunities for individualizing device manufacturing based on patient anatomy and needs.

- Geographical Trends: As per the drug device combination products market research report, North America is the leading region in the industry due to the developed healthcare infrastructure, extensive investment in research and development (R&D), and lenient regulation. Besides this, the high health expenditure supported by the massive burden of diseases in the region has driven adoption of new and emerging treatment alternatives, which is further accelerating the drug device combination products market price. Europe is a close follower in the drug device combination products market segmentation, given its strong healthcare systems and focus on quality and safety. On the other hand, the Asia-Pacific region is an increasingly growing market supported by rising health expenditure, increasing knowledge of modern treatment approaches, and a growing number of chronic conditions, which is further boosting the drug device combination products market revenue.

- Competitive Landscape: As per the drug device combination products market statistics, some of the key players in the market include Abbott Laboratories, Baxter International Inc., Bayer AG, Becton Dickinson and Company, Boston Scientific Corporation, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, Smith & Nephew plc, Stryker Corporation, Terumo Corporation, etc.

- Challenges and Opportunities: As per the drug device combination products market overview, the market has many challenges, including the high level of regulatory requirements, which can lead to an increase in development time and as a result, increase the cost. Ensuring the compatibility of the drug and device, which must meet all safety and effectiveness standards, is a big difficulty. Many of the same factors present opportunities for innovation. In particular, new approaches to increasing the efficiency of devices and increasing the convenience for the patient. A favorable opportunity is also to replenish the market for countries with a potential demand for advanced medical solutions that are not being solved.

To get more information on this market Request Sample

Regulatory agencies are progressively offering clear routes for the approval and market entry of drug-device combination products, promoting investment in the creation of these solutions. Supportive regulatory environments enable innovative products to access the market more effectively, contributing to the market growth. Additionally, drug-device combination products are intended to be easy to use, simplifying the process of administering medication. This user-friendliness and the convenience of self-administration result in improved patient compliance with treatment plans, an essential element for the long-term management of chronic illnesses. Furthermore, ongoing advancements in medical devices and drug delivery technologies are improving the performance and efficacy of combination products. Innovative drug delivery methods, including auto-injectors and infusion pumps, provide more accurate, convenient, and effective treatment choices, resulting in higher patient satisfaction.

The United States is a crucial segment in the market, propelled by continuous technological advancements in medical devices and pharmaceuticals. Developments in drug delivery methods, such as auto-injectors and infusion pumps, are enhancing the efficiency and ease of use of drug-device combination products. For instance, in 2025, the FDA authorized SPN-830 (Onapgo), the initial subcutaneous apomorphine infusion device for Parkinson’s disease, enabling continuous delivery to minimize motor fluctuations and OFF time, further enhancing treatment choices. Besides this, the robust healthcare system and significant funding in medical research in the country are leading to the creation of sophisticated drug-device combination products.

Drug Device Combination Products Market Trends:

Technological Advancements in Drug Delivery Systems

New drug delivery systems, including auto-injectors, inhalers, and infusion pumps, are transforming healthcare administration, making treatments more precise, convenient, and effective. These systems enable targeted drug delivery, allowing patients to achieve the desired therapeutic outcomes while minimizing the risk of adverse drug reactions. Auto-injectors, for instance, have revolutionized daily medication management by enabling patients to administer their own treatments easily and comfortably, thereby improving patient autonomy. Additionally, devices like inhalers and infusion pumps offer highly controlled and consistent drug delivery, which is especially critical for managing chronic conditions. The launch of Pyzchiva® by Sandoz in 2025, the first ustekinumab biosimilar auto-injector commercially available in Europe, highlights this shift toward enhanced self-administration. The device, designed to improve comfort and convenience, also boosts patient adherence, particularly in treating chronic inflammatory diseases. As a result, these innovations are not only reshaping patient care but also supporting the drug device combination products market growth.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic illnesses, including cardiovascular diseases (CVDs), diabetes, and cancer, is a major factor driving the need for personalized and innovative drug-device combination products designed for intricate therapeutic requirements. Industry reports indicate that 6 in 10 individuals in America have at least one chronic disease, and 4 in 10 have two or more chronic diseases. Mortality statistics emphasize the extensive influence of these conditions on populations worldwide. In Australia, for example, the Australian Institute of Health and Welfare indicates that 47% of the people have at least one chronic illness, while 20% deal with two or more chronic diseases. The increasing prevalence of chronic diseases underscores the necessity for innovative medical solutions that can provide focused, effective treatment delivery, thus driving the drug-device combination products market demand. The continuous need for efficient, customized treatments highlights the significance of these advancements in the medical field.

Rising Geriatric Population

The worldwide growth of the elderly population and the increase in life span pose major obstacles in gerontology, leading to a higher need for sophisticated medical solutions, such as drug-device combination products. The World Health Organization (WHO) states that by 2030, one out of every six people will be 60 years or older, resulting in an elderly population of 1.4 billion. By 2050, it is anticipated that the worldwide population of individuals aged 60 and older will reach 2.1 billion, while those aged 80 and above are expected to grow to 426 million, which is three times the figure noted in 2020. This change in demographics requires creating more efficient treatment solutions to address age-related issues, fostering the need for innovative drug-device combinations that provide better treatment delivery, patient adherence, and superior health outcomes. As a result, the drug-device combination products market outlook remains highly positive, driven by the growing demand for tailored solutions for the aging global population.

Drug Device Combination Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global drug device combination products market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Drug Eluting Stents

- Transdermal Patches

- Infusion Pumps

- Drug Eluting Balloon

- Inhalers

- Others

Transdermal patches dominate the market with 24.2%, accredited to their capacity to ensure controlled and reliable drug delivery for a prolonged duration. This approach enhances patient adherence by removing the requirement for regular dosing or invasive interventions. The non-intrusive characteristics of transdermal patches enhance patient comfort and lower the likelihood of complications linked to oral medications or injections. Moreover, transdermal patches benefit drugs that experience considerable first-pass metabolism in the liver by circumventing the gastrointestinal system, resulting in enhanced drug absorption. Their simple application and subtle nature also make them a favored option for chronic conditions, enabling patients to handle their treatment plan without interfering with everyday life. Additionally, continuous improvements in patch design and technology are increasing the adaptability and efficacy of transdermal systems. The latest drug device combination products market trends highlight a rising demand for transdermal patches, driven by their ability to provide convenient, effective, and non-invasive treatment options, particularly in the management of chronic diseases.

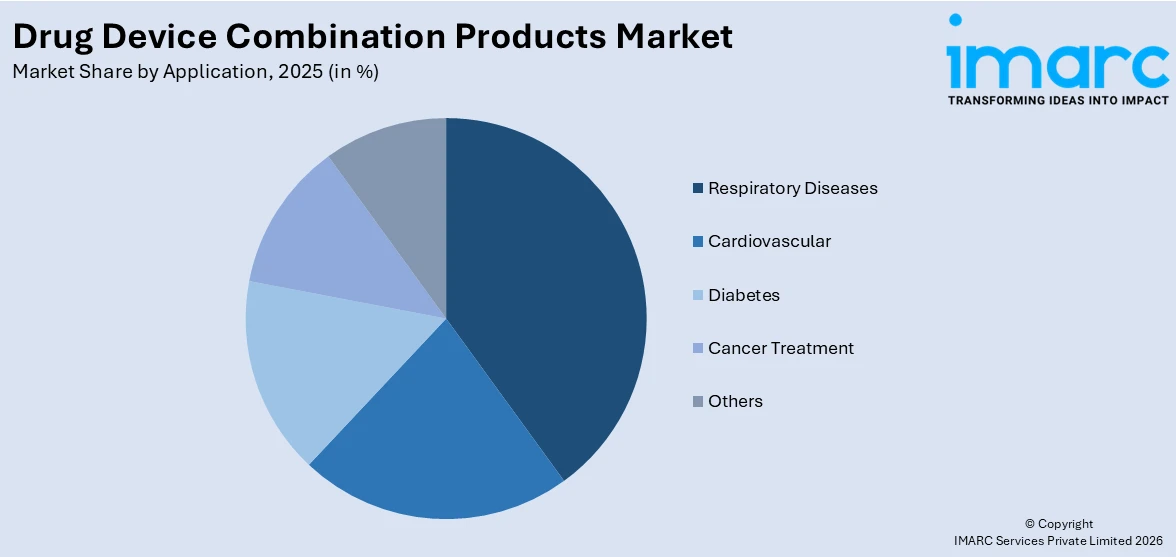

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Cardiovascular

- Diabetes

- Cancer Treatment

- Respiratory Diseases

- Others

Respiratory diseases hold the biggest market share attribute to the widespread occurrence of issues like asthma, chronic obstructive pulmonary disease (COPD), and various other chronic respiratory disorders. These conditions necessitate ongoing management, increasing the need for effective treatments that offer steady relief and enhance patients' quality of life. The intricate nature of respiratory disorders frequently requires sophisticated drug delivery methods, rendering combination products especially advantageous. The growing recognition of respiratory health, along with a heightened global burden of pollution and lifestyle influences, also leads to the higher prevalence of these conditions. As a result, healthcare practitioners are focusing on creating advanced treatments and delivery systems specifically for respiratory care, promoting improved patient results. In addition, respiratory illnesses frequently necessitate accurate and effective drug delivery, and combination products provide the benefit of targeted therapy, reinforcing their prominence in the market.

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals represent the largest segment, accounting 48.7% market share, owing to their essential function in the healthcare system, where many patients with complicated conditions need urgent and specialized treatment. Hospitals feature modern medical facilities, enabling the provision of state-of-the-art therapies, such as drug-device combination products. Consistent monitoring and tailored treatment plans in hospitals encourage the implementation of innovative therapies that enhance patient outcomes. Furthermore, hospitals frequently act as centers for clinical trials, promoting the rapid incorporation of new technologies and products into clinical practice. The concentration of healthcare practitioners and resources in hospitals allows for the efficient and effective use of combination products, guaranteeing their correct administration and oversight. Additionally, with the global rise in the demand for healthcare services, hospitals remain the main setting for addressing critical conditions, reinforcing their leading role in the market for drug-device combination products.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with a share of 41.7%, because of its developed healthcare system, strong regulatory framework, and significant investment in research activities. The region benefits from a robust healthcare system that encourages the extensive use of advanced medical technologies. Significant healthcare expenditure facilitates the swift launch of new drug-device combination products, bolstering the region’s dominance in market expansion. Moreover, North America is home to prominent pharmaceutical and medical device firms, promoting ongoing innovation and the advancement of next-generation treatments. Furthermore, investment in advanced manufacturing capabilities to support the development and commercialization of drug-device combination products is ensuring improved production efficiency. In 2024, PCI Pharma Services announced a $365 million investment in its US and EU facilities to support the clinical and commercial assembly of advanced drug delivery and drug-device combination products. Key projects included expansions in Rockford (Illinois), Philadelphia, and Dublin. These developments aimed to enhance PCI’s global capabilities in injectable formats and patient-centric packaging.

Key Regional Takeaways:

United States Drug Device Combination Products Market Analysis

In North America, the market portion held by the United States is 86.80% owing to scientific advancements and the increased demand for focused therapies. Swift progress in materials science and microfabrication is paving the way for advanced delivery systems, including drug-eluting stents, inhalers, and implantable insulin pumps, which enhance dosage accuracy, patient compliance, and treatment results. Producers are increasingly utilizing biocompatible polymers, nanoparticle carriers, and intelligent sensors to develop integrated systems that enable sustained or on-demand medication delivery. Additionally, clear regulations concerning combination products are simplifying approval processes, fostering investment and innovation. Furthermore, the growing incidence of chronic illnesses like heart disease, diabetes, and cancer is catalyzing the demand for less invasive and more convenient treatment choices. As per the American Heart Association, nearly 48.6% of people in the United States experience various forms of cardiovascular disease, such as high blood pressure and coronary heart disease. The International Diabetes Federation stated that in 2024, 38.5 million people in the United States experienced diabetes. Besides this, payer systems and healthcare providers are emphasizing value-based care, promoting solutions that can reduce hospitalization rates and enhance long-term health results. Strategic alliances between pharmaceutical companies, medtech firms, and contract development organizations are accelerating product pipelines, allowing quicker market launch of combination products.

Europe Drug Device Combination Products Market Analysis

The expansion of the Europe drug device combination products market is primarily driven by a rising need for home healthcare and self-administration therapies, necessitating dependable and easy-to-use delivery systems. The movement towards outpatient care and initiatives to shorten hospital stays is increasing the use of wearable drug delivery devices, including infusion pumps and auto-injectors, allowing patients to handle their treatments with greater independence. Innovations in drug delivery systems, along with a growing emphasis on personalized medicine, are leading to the creation of more advanced and user-friendly combination products. Moreover, increasing awareness among healthcare professionals and patients regarding the advantages of these products, including enhanced compliance, targeted delivery, and minimized side effects, is bolstering the market growth. The regulatory landscape in Europe is adapting to these intricate products, promoting investment and innovation from companies in pharmaceuticals and medical devices. For example, in January 2025, the UK Government reintroduced the Innovative Licensing and Access Pathway (ILAP) for pharmaceuticals. The ILAP plan seeks to reduce the time to market for innovative and transformative medications and drug-device combination products by providing drug researchers with tailored and coordinated support from the ILAP Partners right from the start of clinical development.

Asia Pacific Drug Device Combination Products Market Analysis

The Asia Pacific market for drug-device combination products is growing because of swift urbanization, heightened healthcare awareness, and improved access to medical technologies in developing countries. An expanding middle-class demographic with enhanced healthcare expenditures is driving the need for innovative treatment options, such as combination products that provide convenience and effectiveness. Government efforts to enhance healthcare infrastructure and encourage local production of pharmaceuticals and medical equipment are further contributing to the market growth. Moreover, the rising prevalence of chronic illnesses like asthma, cancer, and heart diseases is generating a continuous demand for precise and effective treatments, especially those suitable for self-administration. In 2023, the Press Information Bureau (PIB) reported more than 1,400,000 cancer cases in India. The Global Asthma Report states that roughly 35 million people in India were affected by asthma in 2022. In addition, the growing use of minimally invasive treatment techniques and the incorporation of digital health technologies into drug delivery systems are improving patient outcomes and fueling innovation.

Latin America Drug Device Combination Products Market Analysis

The market for drug-device combination products in Latin America is influenced by rising investments in healthcare infrastructure and the growth of insurance coverage, enhancing patient access to innovative therapies. Increasing urbanization and shifts in lifestyle are resulting in higher cases of ailments like diabetes and respiratory conditions, driving the need for effective drug delivery methods. For example, according to the International Diabetes Federation (IDF), the count of people with diabetes in Brazil hit 16.6 million in 2024. This figure is projected to rise to 24.0 Million by 2050. Furthermore, the area is experiencing increased cooperation among pharmaceutical and medical device firms to create innovative combination products suited to regional demands. Government efforts aimed at enhancing regulatory systems and accelerating product approvals are further aiding quicker penetration across Latin America. The drug device combination products market forecast for Latin America indicates significant growth as these factors continue to shape the demand for advanced therapies and delivery systems.

Middle East and Africa Drug Device Combination Products Market Analysis

The drug device combination products market in the Middle East and Africa is seeing growth driven by rising healthcare investments and expanding government initiatives focused on enhancing healthcare infrastructure and accessibility. For example, the Saudi Arabian Government assigned SR 99,279,673 to the Ministry of Health (MoH) for FY 2025, showing a notable rise compared to FY 2024, which was SR 86,253,063. Moreover, enhancing local pharmaceutical manufacturing capabilities is improving the availability of combination products designed for regional healthcare requirements. The growing recognition of preventive healthcare and early detection is encouraging the adoption of combination treatments for chronic and lifestyle-related conditions. Additionally, collaborations between public sectors and private companies are enhancing distribution systems, guaranteeing broader access to these products, including in rural and marginalized regions.

Competitive Landscape:

Major participants in the drug-device combination products market are concentrating on innovation and broadening their product ranges to address the increasing need for tailored and effective treatment options. They are making significant investments in research operations to advance drug delivery systems, upgrade device capabilities, and achieve improved patient outcomes. Strategic alliances and collaborations are being established to utilize technological advancements and speed up product development. Furthermore, ensuring regulatory adherence and tackling patient safety issues continue to be key priorities. In 2025, OneSource Specialty Pharma announced that its flagship drug-device combination facility in Bangalore maintained its USFDA compliance status. Following a March 20 to 28, 2025 inspection, the USFDA issued a Form 483 with four observations, later classified as "Voluntary Action Indicated" (VAI). This classification confirms the facility's continued adherence to quality standards.

The report provides a comprehensive analysis of the competitive landscape in the drug device combination products market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Baxter International Inc.

- Bayer AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- GlaxoSmithKline plc

- Johnson & Johnson

- Medtronic plc

- Novartis AG

- Smith & Nephew plc

- Stryker Corporation

- Terumo Corporation

Latest News and Developments:

- June 2025: OneSource Specialty Pharma Limited secured a ‘Voluntary Action Indicated’ (VAI) classification from the U.S. Food and Drug Administration (FDA) for its flagship manufacturing site in Bangalore, India, to verify its ongoing compliance. The flagship plant, Unit 2, is the foundation of the company's production capacity in drug device combination (DDC) products, complex injectables, and biologics drug substances. This milestone demonstrates OneSource's excellent compliance status and underlines its longstanding dedication to quality.

- May 2025: Terumo Corporation confirmed plans for the acquisition of WuXi Biologics’ drug product (DP) facility in Leverkusen, Germany, for approximately 150 Million Euros. Terumo is a Tokyo-based manufacturer of drug delivery devices and drug device combination products. With this acquisition, the company intends to utilize the recently purchased plant as its first international CDMO manufacturing base in order to increase its manufacturing capability and improve international responsiveness.

- March 2025: DDL officially launched a new Good Manufacturing Practice (GMP) laboratory that will specialize in testing drug-device combination products. This strategic expansion aims to support DDL’s capability to provide stringent, legally compliant testing services to the biotechnology, pharmaceutical, and combination product sectors.

- February 2025: Supernus Pharmaceuticals successfully secured U.S. Food and Drug Administration (FDA) authorization for its ONAPGO (apomorphine hydrochloride) drug device combination injection as the very first and sole subcutaneous apomorphine infusion device for treating motor fluctuations in adults suffering from severe Parkinson's disease (PD). Supernus plans to deploy ONAPGO in Q2 2025, supported by an expert team that includes a comprehensive nurse training program and access assistance.

- September 2024: PCI Pharma Services announced an investment of over USD 365 Million in infrastructure for the final assembling and packaging of drug device combination products using cutting-edge drug delivery technologies at clinical and commercial levels. The endeavor, which included both new and expanded sites across North America and Europe, was a part of PCI’s international investment plan and intended to support future development.

Drug Device Combination Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Drug Eluting Stents, Transdermal Patches, Infusion Pumps, Drug Eluting Balloon, Inhalers, Others |

| Applications Covered | Cardiovascular, Diabetes, Cancer Treatment, Respiratory Diseases, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Baxter International Inc., Bayer AG, Becton Dickinson and Company, Boston Scientific Corporation, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, Smith & Nephew plc, Stryker Corporation, Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the drug device combination products market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global drug device combination products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the drug device combination products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drug device combination products market was valued at USD 176.4 Billion in 2025.

The drug device combination products market is projected to exhibit a CAGR of 5.92% during 2026-2034, reaching a value of USD 300.6 Billion by 2034.

The growth of the drug-device combination products market is driven by increasing demand for personalized medicine, technological advancements in medical devices, and the need for more efficient treatment delivery systems. Regulatory support and rising healthcare costs also play significant roles, encouraging innovation and integration to enhance patient outcomes and streamline treatment processes.

North America currently dominates the drug device combination products market, accounting for a share of 41.7%. The dominance of the segment is attributed to its well-established healthcare infrastructure, strong regulatory frameworks, and high investment in research activities. The region also benefits from advanced technological innovations, significant healthcare expenditure, and a growing focus on improving patient outcomes.

Some of the major players in the drug device combination products market include Abbott Laboratories, Baxter International Inc., Bayer AG, Becton Dickinson and Company, Boston Scientific Corporation, GlaxoSmithKline plc, Johnson & Johnson, Medtronic plc, Novartis AG, Smith & Nephew plc, Stryker Corporation, Terumo Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)