Drug Screening Market Size, Share, Trends and Forecast by Product and Service, Sample Type, End User, and Region, 2025-2033

Drug Screening Market Size and Share:

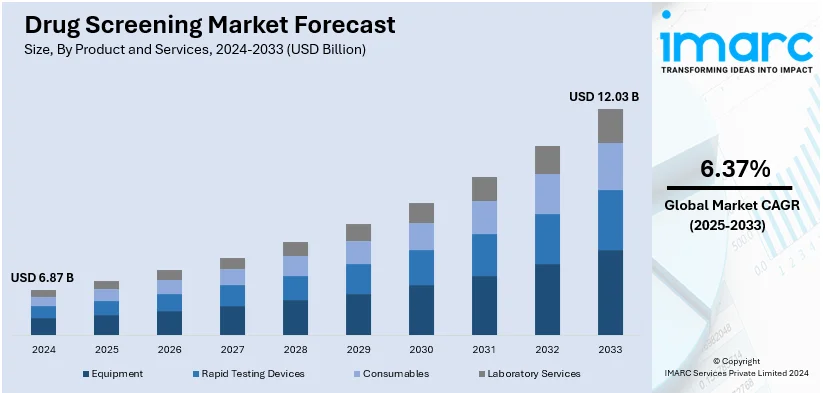

The global drug screening market size was valued at USD 6.87 Billion in 2024. Looking forward, it is estimated that the market to reach USD 12.03 Billion by 2033, exhibiting a CAGR of 6.37% from 2025-2033. North America currently dominates the market, holding a market share of over 51% in 2024. The growth of the North American region is driven by stringent workplace regulations, advanced testing technologies, and increased substance abuse awareness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.87 Billion |

|

Market Forecast in 2033

|

USD 12.03 Billion |

| Market Growth Rate 2025-2033 | 6.37% |

The rising focus on ensuring workplace safety, particularly in high-risk industries such as transportation and construction, is leading to the widespread implementation of drug screening programs to comply with strict regulatory requirements and minimize workplace accidents. Besides this, the growing prevalence of drug abuse worldwide, coupled with its impact on public health and productivity, is encouraging organizations and governments to adopt drug screening as a preventive and corrective measure. Moreover, the development of innovative testing solutions, including rapid and accurate devices with user-friendly features, is significantly boosting the adoption of drug screening in both clinical and non-clinical environments. In addition, the increasing use of drug screening in healthcare settings for monitoring medication adherence, diagnosing substance abuse disorders, and supporting treatment programs is driving the demand for reliable testing solutions.

The United States is a key region in the market, driven by the stringent workplace regulations, advancements in drug testing technologies, and high substance abuse rates. Additionally, the implementation of policies and regulations mandating the availability of drug detection tools in public establishments reflects the growing commitment to public safety. These measures aim to prevent drug-related crimes and protect individuals from harm, thereby driving the demand for advanced drug screening solutions and raising awareness about their importance. In 2024, California enacted Assembly Bill 1013, requiring 2,400 bars and clubs to provide drink-spiking drug test kits, such as test strips and straws, to help patrons detect substances like Rohypnol, Ketamine, and GHB. Establishments must also display signs alerting customers to the availability of these kits. Non-compliance could result in license penalties from the Department of Alcoholic Beverage Control.

Drug Screening Market Trends:

Rise in Drug and Alcohol Consumption

The increasing consumption of drugs is resulting in an increased demand for drug-screening products. For instance, according to the 2023 European Drug Report, approximately 83.4 Million adults (29%) residing in the European Union reportedly utilized illicit drugs at least once. Cannabis represents a key illicit drug taken in Europe, with an approve 8% of European adults using it in 2022, as per national surveys. Therefore, a considerable number of the population consumes drugs that impacts lives of people and is likely to increase demand for drug screening, thereby bolstering the drug screening market’s recent price. Additionally, the rising utilization of drugs and alcohol, along with the need for treatment, is anticipated to drive up the demand for drug screening in hospitals. For instance, as per National statistics published by GOV. UK, in December 2023, between April 2022 and March 2023, around 290,635 adults received support for substance use issues. This is a small rise compared to the previous year, around 289,215. Moreover, the same source stated that the number of adults entering treatment from 2022 to 2023 was approx. 137,749, which is higher than the previous two years’ figures of 130,490 and 133,704. Such a significant rise in the number of people undergoing substance use is anticipated to propel the drug screening market demand.

Government Regulations

Several laws and regulations mandate drug and alcohol testing in various sectors, and the implementation of such laws is augmenting the demand for drug-screening products and devices. For example, the Federal Motor Carrier Safety Administration (FMCSA) issued updates outlining the drug and alcohol testing requirements in November 2022. These updates mention the individuals subject to testing, circumstances and frequency of testing. Additionally, the regulations safeguard employee privacy by limiting the use and disclosure of sensitive drug and alcohol testing information by employers and service agents. Besides the regulatory framework, government authorities of various nations are also taking initiatives to help severe addicts and individuals suffering from drug abuse, which is further propelling the drug screening market share. For instance, Nasha Mukt Bharat Abhiyaan is a program by the Indian Government that intends to reach out to the masses and spread awareness about substance abuse through various activities like awareness generation programs. Similarly, the government authorities of Canada are also investing in anti-drug strategy projects to help people with addiction come out of substance abuse. For example, the Calgary John Howard Society in Alberta, Canada, focuses on assisting youths aged 13 to 24 who face the risk of school dropout due to drug addiction.

Advancements in Testing Technologies

Ongoing advancements in drug screening technologies, such as rapid testing kits, laboratory-based assays, and point-of-care devices, are further driving the market growth by offering faster, more accurate, and cost-effective screening solutions. Moreover, the continuous improvement of drug screening technologies is resulting in enhanced accuracy and reliability and reduced likelihood of false positives or false negatives, ensuring confidence in test results and minimizing the need for confirmatory testing, thereby streamlining the screening process and reducing costs. For instance, in February 2024, Mobile Health introduced a new rapid drug testing service in New York clinics for employers to screen and hire candidates easily. Similarly, in October 2023, ProciseDx Inc. gained de novo FDA approval for the therapeutic drug monitoring (TDM) tests for adalimumab (Humira and the biosimilar Amgevita) as well as infliximab (Remicade and its biosimilars Inflectra and Renflexis). The assays known as Procise ADL and Procise IFX are utilized to measure adalimumab (ADL) and infliximab (IFX) levels in patients with inflammatory bowel diseases (IBD) who are undergoing treatment with these medications. For example, as reported by the NSW Bureau of Crime Statistics and Research (BOCSAR), New South Wales, Australia has seen an 836% rise in drug driving detections over the last ten years. This increase is linked to the growth of mobile drug testing and focused identification of chronic offenders. The anticipated rise in the approval of new drug tests and instruments is expected to drive revenue growth in the drug screening market in the upcoming years.

Drug Screening Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global drug screening market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and service, sample type, and end user.

Analysis by Product and Services:

- Equipment

- Immunoassay Analyzers

- Chromatography Instruments

- Breath Analyzers

- Rapid Testing Devices

- Urine Testing Devices

- Oral Fluid Testing Devices

- Consumables

- Assay Kits

- Sample Collection Cups

- Calibrators and Controls

- Others

- Laboratory Services

Rapid testing devices (urine testing devices and oral fluid testing devices) stand as the largest component in 2024, holding 30.0% of the market share. Rapid drug screening test devices are portable, easy-to-use tools designed for quick detection of drugs in various sample types, such as urine, saliva, or blood. These devices offer several benefits, including rapid results within minutes, enabling on-the-spot decision-making in scenarios like workplace testing or roadside screening. Their simplicity allows for minimal training requirements, making them accessible to a wide range of users. Moreover, rapid tests are cost-effective, reducing the need for laboratory analysis and turnaround time. For instance, Dräger, a German company based in Lübeck that makes breathing and protection equipment, gas detection and analysis systems, and non-invasive patient monitoring technologies, introduced a rapid test named DrugTest 5000. In this test, saliva samples can be analyzed immediately for an accurate result on the spot. Furthermore, rapid screening devices play a crucial role in emergencies, aiding in the quick identification of drug intoxication or overdose for prompt medical intervention.

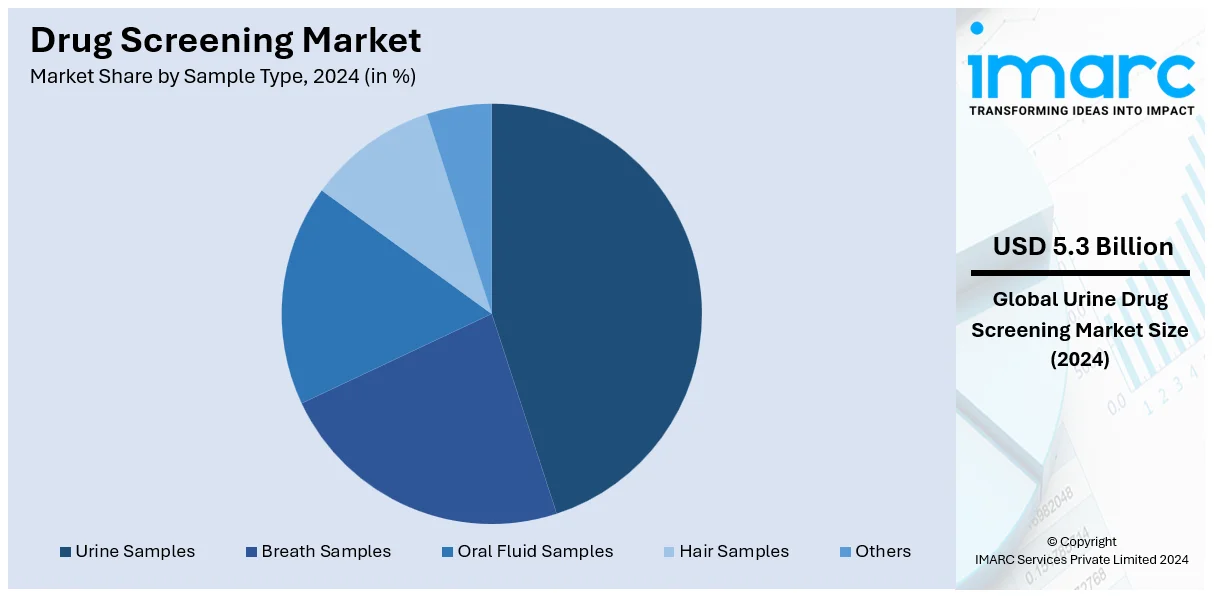

Analysis by Sample Type:

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Others

Urine samples dominate the drug screening market, accounting for 77.0% of the market share in 2024, due to their numerous advantages over other sample types. Urine drug testing is a non-invasive, simple, and convenient method, encouraging employee cooperation and minimizing procedural discomfort. Its ability to detect a wide range of drugs and their metabolites ensures comprehensive screening, making it highly effective for workplace and clinical applications. The cost-effectiveness of urine testing supports its use in large-scale programs, particularly for industries requiring routine or high-volume testing. Additionally, urine tests are well-suited for identifying recent drug use, which is critical in safety-sensitive fields like transportation and construction. The method also offers high reliability, as it is less prone to adulteration or tampering compared to other sample types, especially when coupled with observed collection processes. These features collectively make urine testing a trusted and practical choice in ensuring workplace safety and regulatory compliance.

Analysis by End User:

- Hospitals

- Drug Testing Laboratories

- Workplaces

- Drug Treatment Centers

- Pain Management Centers

- Personal Users

- Criminal Justice System and Law Enforcement Agencies

Workplaces dominated the market in 2024 with 33.0% of market share. Workplaces represent the largest segment, driven by the critical need for maintaining safety, productivity, and compliance in professional environments. Many organizations implement robust drug testing policies to ensure a drug-free workplace, particularly in safety-sensitive industries like transportation, manufacturing, and construction. Pre-employment screening and random drug tests help employers mitigate risks associated with impaired performance or accidents, safeguarding both employees and organizational assets. Workplaces also benefit from advancements in rapid testing methods, which provide quick and reliable results, minimizing downtime during the hiring or compliance process. The growing emphasis on employee wellness programs further supports the adoption of drug screening as part of broader health and safety initiatives. Moreover, stringent regulatory requirements in certain regions mandate regular drug testing, solidifying workplaces as a key driver for the market. With cost-effective and scalable testing solutions readily available, workplaces continue to lead as the dominant end-user segment in drug screening.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America accounted for the largest market share of 51.0% in 2024. Some of the factors driving the North America drug screening market included the growing cases of substance abuse, the increasing number of drug dealers, and the rising black marketing of prescribed drugs. Moreover, drug screening market statistics by IMARC indicate that the growing substance abuse rates in the region are bolstering the need for drug screening. For instance, in February 2023, according to an article published by the Pennsylvania State University, around 63% of adults aged 18 years and above were reported to alcohol consumption in the United States in 2022. Among these, males (66%) had higher alcohol consumption as compared to females (61%). Therefore, a considerable number of alcohol consumers raises the requirement for drug-testing products and services and is augmenting the market growth in North America. Moreover, the government authorities of North America are mandating drug screening tests in various sectors, which is further catalyzing the market growth. For instance, in May 2023, the United States Department of Transportation regulated the drug testing program by including oral fluid testing to improve safety and reduce the chances of cheating involved with urine drug tests.

Key Regional Takeaways:

United States Drug Screening Market Analysis

United States accounted for 70% of the total North American market share. Drug screening provides significant benefits by enhancing workplace safety, particularly in industries where impaired performance can result in severe consequences. Employers can maintain a healthier work environment by identifying potential substance abuse issues early. This contributes to reduced workplace accidents, improving overall operational efficiency. Additionally, drug screening serves as a preventive measure, discouraging employees from engaging in substance misuse due to the possibility of detection. Organizations implementing these measures often experience lower absenteeism rates and higher productivity. Drug screening also plays a critical role in compliance with federal regulations, particularly for safety-sensitive industries. According to Quest Diagnostics, workforce drug positivity rates reached a 20-year high at 4.6% in 2021, marking a 31.4% increase from the 2010-2012 low, highlighting critical implications for drug screening in creating safer workplaces amid recruitment and retention challenges. Moreover, it assists employers in mitigating liability risks, as identifying drug use reduces the chances of incidents caused by impaired individuals. By fostering a culture of accountability and safety, drug screening strengthens employer-employee trust and aligns with public health objectives. It also contributes to reducing healthcare costs by minimizing substance-related health issues. Comprehensive screening policies can act as a deterrent, helping maintain a competitive and responsible workforce.

Europe Drug Screening Market Analysis

Drug screening in Europe promotes compliance with stringent occupational health and safety standards while ensuring operational continuity. By fostering a culture of responsibility, organizations reduce instances of misconduct or errors, leading to enhanced organizational performance. Drug screening also facilitates early intervention, allowing employees to access rehabilitation services before substance abuse impacts their careers or health. As Europe continues to prioritize mental health and workplace well-being, drug screening complements these initiatives by addressing underlying causes of workplace disruptions. According to National Library of Medicine, oral fluid drug screening devices, tested on 1,212 drivers in Germany, demonstrated varying sensitivities (71–100%) and specificities, highlighting their potential for rapid roadside drug detection despite limitations in THC specificity and benzodiazepine sensitivity. Furthermore, this process helps employers protect their reputations, as incidents caused by substance misuse can harm corporate credibility. For industries requiring security clearances or public interaction, drug screening bolsters public trust and confidence. By maintaining a drug-free work environment, businesses can attract top talent who value safe and professional workplaces, contributing to long-term organizational growth and sustainability.

Asia Pacific Drug Screening Market Analysis

In Asia-Pacific, drug screening enables effective management of workforce productivity while addressing region-specific challenges like the growing prevalence of substance abuse in certain areas. Proactive testing helps reduce the financial impact of absenteeism and ensures project deadlines are met. In sectors such as transportation and construction, drug screening is vital for accident prevention, ensuring the safety of the public as well as employees. For instance, According to International Journal of Community Medicine and Public Health, nearly 50% of truckers in Haryana, India, reported alcohol and drug use to combat fatigue and loneliness, highlighting the urgent need for targeted drug screening programs to enhance road safety and driver health. The practice also reflects a commitment to organizational integrity, which aligns with corporate governance priorities. Employers can identify potential drug-related risks and offer support mechanisms like counseling programs, enhancing employee retention and morale. In a region with diverse legal and cultural attitudes toward substance use, implementing drug screening demonstrates a forward-thinking approach to workplace policies, fostering a cohesive and motivated team. This ultimately supports regional economic development by reinforcing safe and productive work environments.

Latin America Drug Screening Market Analysis

In Latin America, drug screening enhances workplace reliability by addressing challenges such as absenteeism and decreased productivity linked to substance misuse. Employers gain a competitive edge by ensuring employee performance meets organizational standards. The preventive nature of drug screening contributes to accident reduction, especially in high-risk industries, fostering a safer environment for employees and clients. According to National Library of Medicine, substance use disorders (SUD) affect 82.07% of anesthetists in Brazil indirectly, with 23% admitting personal use, primarily opioids (67.05%). Additionally, early detection of substance abuse allows businesses to implement corrective actions, mitigating long-term issues and ensuring workforce stability. This proactive approach aligns with regional goals of economic growth, helping organizations improve operational efficiency and build trust among stakeholders in dynamic and evolving markets.

Middle East and Africa Drug Screening Market Analysis

Drug screening market in the Middle East and Africa is significantly being driven by the alarming consumption of drugs in the region. The WHO reported a rise in UAE's per capita alcohol consumption from 3.1L in 2010 to 3.6L in 2016, alongside alarming drug use and crime statistics, including a 20.8% increase in drug-related arrests in 2021. These trends highlight the urgent need for advanced drug screening to combat addiction and crime efficiently. Also, UNODC estimates suggest that the annual prevalence of cannabis use in Africa with around 6.3% of the population aged 15-64 clearly above the global average (3.8 per cent), with the highest estimates calculated for West and Central Africa (9.3 per Page 2 2 World Drug Report 2020, regional trends cent). The drug screening contributes to economic stability, as organizations prioritize accountability and quality standards, fostering trust with stakeholders and aligning with regional efforts to advance industrial and commercial growth, thereby favoring the market growth.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges, incorporating cutting-edge technologies, and improving service options to cater to various end-user requirements. They are putting funds into research and development to develop testing solutions that are more accurate, faster, and easier to use. Strategic alliances and partnerships are being sought to enhance their global market presence and distribution networks. Furthermore, these businesses are utilizing digital platforms and automation to enhance efficiency in testing procedures and reporting systems. In 2024, SPT Labtech and ICE Bioscience, located in Beijing, established a collaborative laboratory in China that incorporates SPT Labtech’s firefly® liquid handling system to enhance automated drug screening and automation in life sciences. The laboratory emphasizes high-throughput screening and the creation of assays to meet unfulfilled healthcare demands. Executives from both firms highlighted the partnership's capability to foster innovation in safety pharmacology and assay solutions.

The report provides a comprehensive analysis of the competitive landscape in the drug screening market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Alfa Scientific Designs Inc.

- Bio-Rad Laboratories Inc.

- Drägerwerk AG & Co. KGaA

- Laboratory Corporation of America Holdings

- Lifeloc Technologies Inc.

- Omega Laboratories Inc.

- OraSure Technologies Inc.

- Psychemedics Corporation

- Quest Diagnostics Incorporated

- Siemens AG

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- February 2024: Veriteque USA partnered with OraSure Technologies under a new distribution agreement. This collaboration enables OraSure to include Veriteque's SwabTek surface test kits in its lineup of oral fluid drug screening products. SwabTek offers single-use, dry reagent tests for narcotics and explosives, designed for use at home, in educational settings, and workplaces. The partnership expands OraSure's drug testing offerings, enhancing its ability to serve businesses, educators, and security professionals with comprehensive solutions.

- March 2024: BioXcelerate, a pioneering health data science segment of Optima Partners Limited, unveiled a revolutionary AI tool designed to speed up the identification and development of new pharmaceuticals. The instrument, referred to as PleioGraph, can evaluate intricate medical data 100 times quicker than current leading techniques utilized to uncover biological networks that clarify disease risk and guide drug discovery.

- December 2023: Quest Diagnostics introduced its new confirmatory testing service for new psychoactive substances (NPS). The updated panel, which checks for 88 substances, encompasses a wide range of drug categories, including designer opioids, designer benzodiazepines, designer stimulants, fentanyl derivatives, synthetic cannabinoids, and various illicit additives.

Global Drug Screening Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Sample Types Covered | Urine Samples, Breath Samples, Oral Fluid Samples, Hair Samples, Others |

| End Users Covered | Hospitals, Drug Testing Laboratories, Workplaces, Drug Treatment Centers, Pain Management Centers, Personal Users, Criminal Justice System and Law Enforcement Agencies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Alfa Scientific Designs Inc., Bio-Rad Laboratories Inc., Drägerwerk AG & Co. KGaA, Laboratory Corporation of America Holdings, Lifeloc Technologies Inc., Omega Laboratories Inc., OraSure Technologies Inc., Psychemedics Corporation, Quest Diagnostics Incorporated, Siemens AG, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the drug screening market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global drug screening market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the drug screening industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Drug screening is the process of analyzing biological samples to detect the presence of drugs or their metabolites. It commonly includes methods like urine, blood, saliva, and hair testing, offering reliable results for monitoring substance use and maintaining regulatory standards. It is widely used in workplaces, healthcare, sports, and law enforcement to ensure safety, compliance, and fair practices.

The drug screening market was valued at USD 6.87 Billion in 2024.

IMARC estimates the global drug screening market to exhibit a CAGR of 6.37% during 2025-2033.

The purpose of drug screening in the drug screening market is to detect the presence of drugs or their metabolites in biological samples to ensure compliance, safety, or diagnose substance use.

The drug screening market utilizes various sample types for testing, including urine, blood, hair, saliva, sweat, and breath.

The global drug screening market is driven by increasing workplace safety regulations, rising substance abuse rates, and advancements in testing technologies. The growing adoption of pre-employment and random testing by organizations, coupled with stringent government policies, further drive demand. Additionally, the need for efficient diagnostic tools in healthcare and law enforcement are contributing to the market growth.

In 2024, rapid testing devices represented the largest segment by product and service, driven by their efficiency, ease of use, and quick results, making them ideal for workplaces, healthcare, and law enforcement applications.

Urine samples lead the market by sample type owing to their non-invasive collection, cost-effectiveness, broad drug detection range, and reliability, making them ideal for workplace and clinical drug testing programs.

Workplaces are the leading segment by end user, driven by the need to ensure safety, enhance productivity, comply with regulations, and mitigate risks associated with drug use in safety-sensitive environments.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global drug screening market include Abbott Laboratories, Alfa Scientific Designs Inc., Bio-Rad Laboratories Inc., Drägerwerk AG & Co. KGaA, Laboratory Corporation of America Holdings, Lifeloc Technologies Inc., Omega Laboratories Inc., OraSure Technologies Inc., Psychemedics Corporation, Quest Diagnostics Incorporated, Siemens AG, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)