E. Coli Testing Market Size, Share, Trends and Forecast by Product, Test Type, End User, and Region, 2025-2033

E. Coli Testing Market Size and Share:

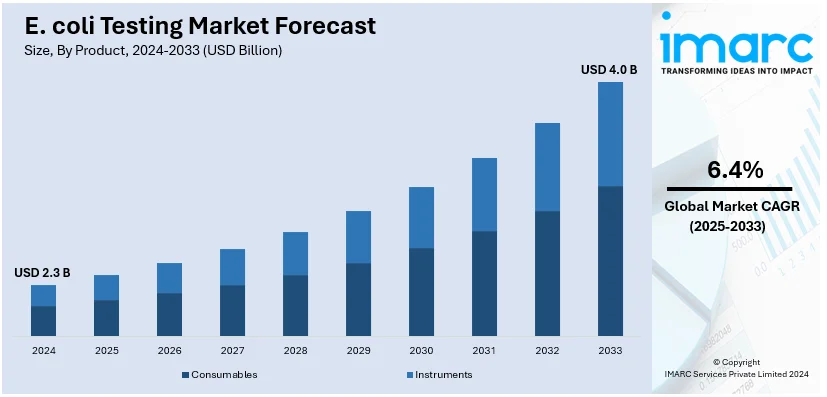

The global E. coli testing market size was valued at USD 2.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.0 Billion by 2033, exhibiting a CAGR of 6.4% from 2025-2033. North America currently dominates the market, holding a market share of over 35.8% in 2024. This regional market is mainly influenced by strict regulatory protocols, robust healthcare infrastructure, and magnified requirement for water and food safety testing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.3 Billion |

|

Market Forecast in 2033

|

USD 4.0 Billion |

| Market Growth Rate (2025-2033) | 6.4% |

The global E. coli testing market is witnessing expansion chiefly due to heightening awareness regarding water and foodborne illnesses, combined with stricter regulatory frameworks for water and food safety. Amplifying incidents of E. coli outbreaks have incentivized accelerated need for innovative testing methods in emerging as well as developed regions. In addition to this, technological innovations in molecular diagnostics and the bolstering utilization of automated testing systems are further fueling market growth. Moreover, the growing emphasis on public sanitation and health, specifically in urban zones, is prompting heavy investments in advanced testing infrastructure, magnifying the adoption of E. coli testing solutions worldwide.

The United States accounts for a crucial share in the global E. coli testing market, majorly propelled by stringent implementation of food safety policies, resilient healthcare infrastructure, and amplifying public awareness associated with foodborne illnesses. The heightening occurrence of E. coli outbreaks in the food and beverage sector has significantly strengthened the requirement for dependable testing solutions. For instance, in November 2024, Grimmway Farms, a prominent U.S.-based carrot producer, recalled organic baby carrots due to E. coli outbreak, resulting in 39 cases across 18 U.S. states. In addition, elevating investments in research projects and advancements in rapid testing technologies further aid in market expansion. Furthermore, with regulatory bodies, encompassing the USDA and FDA enforcing stringent adherence, several businesses are rapidly opting for leading-edge diagnostic tools to address risks and facilitate customer safety. This resilient regulatory landscape supports constant market growth.

E. oli Testing Market Trends:

Growing Demand for Rapid Diagnostic Tests

Increases in the demand for quicker diagnostics in gastrointestinal infections, with the pathogen E. coli among the most relevant, have led towards high-speed testing methodologies. While classical laboratory culture takes two weeks for identification of the organism E. coli, newer PCR-based tests, such as Thermo Fisher's TaqPath Enteric Bacterial Select Panel, yield results within approximately two hours. This rapid turnaround allows health providers to diagnose and treat infections more promptly, which consequently decreases patient wait times and hospital stays. For instance, according to a research article, the TaqPath panel provides sensitivity and specificity of over 98%, ensuring that the results are always dependable. The trending towards fast diagnostic methods has been crucial in controlling foodborne disease outbreaks by being able to intervene in a timely manner to reduce the spread and effect of infections. It also allows for testing 93 samples in one run, which can improve laboratory throughput and increase the possibility of rapid diagnosis even with high-volume clinical settings.

Increasing Focus on Food Safety Regulations

Stringent food safety regulations globally are propelling the demand for advanced E. coli testing solutions. Regulatory bodies are emphasizing compliance with testing protocols to mitigate risks of contamination in food production and distribution chains. For instance, as per industry reports, E. coli contamination causes approximately 73,000 illnesses each year in the U.S., resulting in around 2,200 hospitalizations and 61 fatalities. Moreover, this trend is driving the adoption of automated testing systems that deliver reliable and reproducible results, ensuring compliance while optimizing operational efficiency. In addition, rising consumer awareness regarding food safety and hygiene is further encouraging industries to invest in robust testing frameworks to safeguard public health and maintain brand integrity.

Expansion of Point-of-Care Testing

Point-of-care (POC) testing for E. coli increasingly gains support through molecular diagnostic technologies like PCR, LAMP, and mass spectrometry, which provide rapid, on-site results for pathogens in water, food, and stool samples. PCR, particularly, is requisite for the detection of E. coli from water and stool samples, providing a more reliable method for healthcare providers to diagnose infections and initiate treatment in real time. The LAMP DNA amplification technique can also sense the presence of E. coli in food, stool and environmental samples in one step using a process that could be suited for field applications as well as resource-limited settings. According to a research article, the use of mass spectrometry is also realized in the typing of bacteria and viruses, such as E. coli, to study the subtypes and sources of infection in detail. IMS (immunomagnetic separation) facilitates the increase in the yield of recovery of E. coli O157:H7 from environmental water samples essential for outbreak studies. Other emerging technologies, including CRISPR/Cas platforms and smartphone-based digital methods, improve the accessibility and speed of E. coli detection, further pushing the adoption of molecular diagnostics in POC settings. These innovations contribute to more efficient and timely diagnosis, reducing healthcare costs and improving patient outcomes, particularly in urgent care and remote areas.

E. Coli Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global E. coli testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, test type, and end user.

Analysis by Product:

- Consumables

- Instruments

Consumables leads the market with around 83.7% of market share in 2024. This domination is principally propelled by the elevated frequency of test utilization and the requirement for disposable items to guarantee contamination-free and precise results. This category encompasses media, reagents, and test kits leveraged across variety of testing platforms. The recurring profile of consumables in diagnostics prompts a stable need, specifically in major industries, typically including water quality and food safety testing. Furthermore, with the magnifying cases of E. coli outbreaks, the market is actively witnessing amplified utilization of ready-to-use testing kits that adhere to laboratory workflows. Advancements in consumable design, like automated and pre-packaged systems, further improve both precision and efficacy, positioning them as requisite component for on-site as well as laboratory testing. This segment’s expansion is highlighted by the extensive demand for constant testing protocols to cater to the safety and regulatory standards on a global level.

Analysis by Test Type:

- Environmental Test

- Membrane Filtration (MF)

- Multiple Tube Fermentation (MTF)

- Enzyme Substrate Methods

- Clinical Test

- Polymerase Chain Reaction (PCR) Tests

- Enzyme Immunoassays (EIA)

- Others

Environmental testing (enzyme substrate methods) leads the market with around 61.8% of market share in 2024. This testing exhibits a critical role in assessing E. coli contamination in soil and water, with enzyme substrate methods emerging as an ideal testing procedure. Such methods utilize enzyme-based reactions to detect E. coli with elevated speed and specificity, facilitating feasible evaluations in crucial purposes, including agricultural safety and municipal water testing. Moreover, the cost-efficiency and user-friendliness of enzyme substrate methods have supported their broad range deployment, especially in regions with stringent environmental policies. Furthermore, the test includes adding a substrate to a sample, which exhibits a measurable fluorescence or color change upon interacting with the enzymes of E. coli. This technique significantly lowers the requirement for sophisticated laboratory infrastructure while sustaining resilience, establishing it as a keystone of environmental testing tactics. Additionally, constant innovations in enzyme-based technologies are poised to further solidify this segment’s market share.

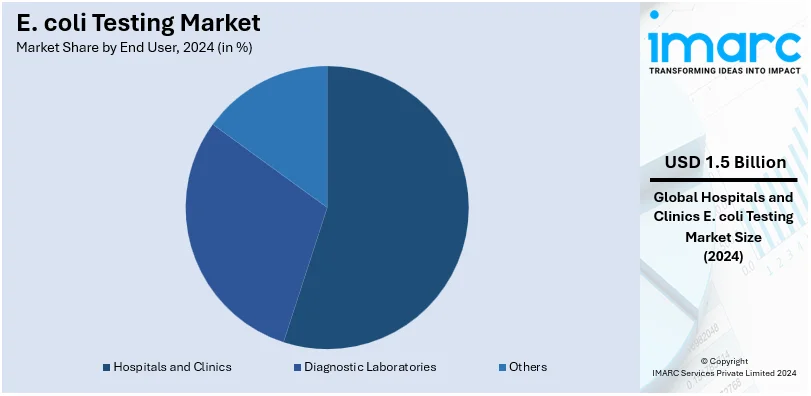

Analysis by End User:

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

Hospitals and clinics lead the market with around 65.8% of market share in 2024. This dominant end user is mainly impacted by their critical role in diagnosing and managing infections. These facilities handle a high volume of patients presenting symptoms of E. coli-associated illnesses, necessitating prompt and accurate diagnostic services. The prevalence of healthcare-associated infections (HAIs) further bolsters the demand for E. coli testing in clinical settings. Moreover, advanced diagnostic tools and rapid testing technologies are extensively employed in hospitals and clinics to ensure timely treatment, reducing complications and preventing outbreaks. In addition, the growing burden of foodborne diseases globally amplifies the need for reliable testing in healthcare institutions. The segment's leadership is further reinforced by stringent regulatory requirements mandating infection control and reporting, which place hospitals and clinics at the forefront of adopting comprehensive E. coli testing protocols.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. This regional market is typically driven by a well-established healthcare infrastructure and resilient regulatory systems. The region's strict food safety frameworks, implemented by agencies like the CDC or FDA, have prompted the utilization of cutting-edge testing solutions across the key sectors, such as healthcare, food, or water. Heightening customer awareness related to foodborne illnesses further magnifies need for robust diagnostics. Moreover, technological innovations, encompassing automated detection systems and rapid testing kits, support the market expansion by providing effective and accurate solutions. In addition, substantial investments in research and development initiatives by leading market players fortify the region's domination on a global level. Furthermore, with accelerating incidences of E. coli outbreaks and a resilient emphasis on preemptive measures to guarantee public health, North America continues to bolster advancement and establish benchmarks for global E. coli testing strategies. For instance, as per industry reports, in the 2024-2025 fiscal year, 139 recalls were recorded in Canada, including those related to E. coli risks.

Key Regional Takeaways:

United States E. Coli Testing Market Analysis

In 2024, United States accounted for the 87.60% of the market share in North America. E. coli infections are an important public health concern in the United States because it causes around 265,000 cases and 100 deaths per year. According to a research article, outbreaks and serious illnesses most often occur by Shiga toxin-producing E. coli, or about 40% of all infections from STEC are due to E. coli O157:H7. It shows the symptoms of infection in cases, including diarrhea, abdominal cramps, nausea, vomiting, and low-grade fever; its complications may be kidney failure or HUS. Young children, the elderly, and others who may be suffering from other illnesses fall within those at a higher risk of complications. E. coli further causes UTIs in up to 80% to 90% cases; this is especially seen among women. Recent outbreaks in the U.S. have included contaminated organic carrots and a severe outbreak linked to McDonald's Quarter Pounders in Mountain West states. Due to that, the demand for good E. coli testing in food safety, healthcare, and water treatment continues to grow.

Europe E. Coli Testing Market Analysis

The E. coli testing market in Europe is growing because of strict food safety regulations and increasing health care issues. According to the European Centre for Disease Prevention and Control, in 2023, the EU had the incidence of third-generation cephalosporin-resistant E. coli bloodstream infections at 10.35 per 100,000 people, which is a problem that is increasing with respect to antimicrobial resistance. The ECDC also reported that E. coli isolates harbouring the blaNDM-5 gene were associated with travel abroad from the EU/EEA to Africa and Asia countries. STEC continues to remain a risk, and a recommendation has been made through ECDC to maintain correct hand hygiene, food preparation, and washing of the vegetables. E. coli continues to be a prominent cause of bacterial infections related to enteritis, urinary tract infections, septicaemia, and neonatal meningitis. The above factors increase the demand for high-tech diagnostic tools. Moreover, the countries driving the most demand and innovation are Germany, France, and the UK. Furthermore, food traceability and sustainability have gained focus, leading to investment in novel testing technologies, hence supporting the growth of this market.

Asia Pacific E. Coli Testing Market Analysis

Asia Pacific E. coli testing market is growing at a higher rate due to increased food production and awareness of food safety. According to China's National Health Commission, rapid urbanization and industrial agriculture increase foodborne illnesses including E. coli infections. India reported more than 500 outbreaks of diarrheal diseases in 2023. Among the patient samples, the most common bacteria isolated were E. coli. This means that the governments and private sectors are focusing more on installing efficient testing systems, especially for food and beverage companies. Multiplex PCR and lateral flow immunoassays are popular emerging technologies. In addition, states like Japan and South Korea are actively introducing the most advanced testing processes for food exports. Furthermore, India is increasingly improving the testing infrastructure for domestic purposes. Asia Pacific is considered to be the key region for E. coli testing market growth due to continuously increasing regulatory pressure.

Latin America E. Coli Testing Market Analysis

Rising food safety concerns and increasing outbreaks of foodborne diseases in Latin America is anticipated to increase the demand for E. coli testing. According to a 2023 industrial report, Brazil is a leading country in Latin America in food production and exports, which fuels the E. coli testing market. The meta-analysis of 4,286 samples found that the general prevalence rate of Shiga toxin-producing E. coli (STEC) in Brazil was 1%, with the highest rate in Mato Grosso at 9%. Hot carcasses had the highest rate of positive samples for STEC at 8%. The Ministry of Health in Brazil has stressed the need for testing in the face of food safety requirements, whether for local consumption or for export. Argentina and Mexico are also investing more in food safety and diagnostics. Furthermore, as awareness of foodborne pathogens increases, the region experiences a shift toward faster, more automated testing solutions. Moreover, harsher regulations and standards instituted by governments also complement demand for advanced testing technologies in the market. Regional cooperation furthers the market growth process, as local manufacturers find partnerships with global players to enhance testing capabilities.

Middle East and Africa E. Coli Testing Market Analysis

The Middle East and Africa E. coli testing market is expected to grow due to increasing health issues and the increasing regulatory demands for food safety. According to the World Health Organization, foodborne diseases, including E. coli infection, are among the most concerning in the region and rise annually. The health ministry of Saudi Arabia in 2020 reported 1,270 cases of foodborne diseases, prompting the government to enforce stronger food safety regulations. Even in South Africa, where home-based producers export agricultural produce around the world, E. coli testing becomes important to reach international standards for food safety. Additionally, there is an expansion of both public and private investments in testing infrastructure within the region. Furthermore, the region's diverse geography as well as infrastructure challenges support widespread adoption of emerging technologies especially portable and rapid test kits.

Competitive Landscape:

The market is highly competitive, with leading players focusing on innovation and strategic partnerships to gain market share. Major companies are actively investing in the development of advanced rapid testing solutions to meet the growing demand for efficient and accurate diagnostics. Furthermore, the market features fierce competition among established as well as emerging firms providing niche solutions. In addition, competitive differentiation is typically bolstered by adherence to regulatory policies, technological innovations, and cost-efficiency. Moreover, several companies are augmenting their geographic reach and improving product lines to address the evolving demands of a broader customer base, further magnifying competition in this dynamic market. For instance, in July 2024, Alden, a biotechnology firm, launched its new food safety and quality testing method Suspended Simultaneous Sandwich Assay. This method can efficiently detect E. coli O157 in beef products.

The report provides a comprehensive analysis of the competitive landscape in the E. coli testing market with detailed profiles of all major companies, including:

- Accugen Laboratories Inc.

- Alere Inc. (Abbott Laboratories)

- BD (Becton Dickinson and Company)

- bioMérieux (INSTITUT MERIEUX)

- Bio-RAD Laboratories Inc.

- Enzo Life Sciences Inc. (Enzo Biochem Inc.)

- Idexx Laboratories Inc.

- Johnson & Johnson

- Meridian Bioscience Inc.

- Nanologix Inc.

- Pro-Lab Diagnostics

- Qiagen N.V.

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- November 2024: IDEXX’s newly launched Tecta B16 instrument, approved by the EPA, allows testing of E. coli results in 2 hours instead of 24 hours. This is an improvement in the quality monitoring of water in drinking water, ocean water, and wastewater, with faster alerts for bacterial contamination, thus enhancing public health and safety in coastal areas.

- July 2024: The USDA-FSIS chose the GENE-UP Pathogenic E. coli (PEC) assay of the company bioMérieux as the first choice for detecting Shiga toxin-producing E. coli in enriched samples, effective September 16, 2024. This rapid screening test will reduce presumptive positive results and product hold times, thereby improving food safety.

- June 2024: Becton Dickinson and Co. received FDA 510(k) clearance for its molecular test intended to identify harmful intestinal bacteria that cause infectious diarrhea. This approval helps advance the diagnostic testing of bacterial infections, which cause gastrointestinal diseases.

E. Coli Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Consumables, Instruments |

| Test Types Covered |

|

| End Users Covered | Hospitals and Clinics, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accugen Laboratories Inc., Alere Inc. (Abbott Laboratories), BD (Becton Dickinson and Company), bioMérieux (INSTITUT MERIEUX), Bio-RAD Laboratories Inc., Enzo Life Sciences Inc. (Enzo Biochem Inc.), Idexx Laboratories Inc., Johnson & Johnson, Meridian Bioscience Inc., Nanologix Inc., Pro-Lab Diagnostics, Qiagen N.V. and Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the E. coli testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global E. coli testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the E. coli testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

E. coli testing involves the identification and analysis of Escherichia coli bacteria in various samples, including food, water, and clinical specimens. This testing ensures safety by detecting harmful strains, preventing contamination, and supporting compliance with regulatory standards in industries like healthcare, food production, and environmental monitoring.

The E. coli testing market was valued at USD 2.3 Billion in 2024.

IMARC estimates the global E. coli testing market to exhibit a CAGR of 6.4% during 2025-2033.

The market is driven by increasing foodborne illness outbreaks, stringent regulatory standards for food and water safety, advancements in diagnostic technologies, and rising public awareness of health risks associated with contamination. These factors are encouraging the adoption of reliable testing solutions across industries.

In 2024, consumables represented the largest segment by product, driven by frequent testing needs, they dominate due to their recurring demand in E. coli testing processes.

Environmental test (enzyme substrate methods) leads the market by test type, driven by high accuracy and efficiency.

Hospitals and clinics is the leading segment by end user, driven by the growing need for rapid diagnosis and treatment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global E. coli testing market include Accugen Laboratories Inc., Alere Inc. (Abbott Laboratories), BD (Becton Dickinson and Company), bioMérieux (INSTITUT MERIEUX), Bio-RAD Laboratories Inc., Enzo Life Sciences Inc. (Enzo Biochem Inc.), Idexx Laboratories Inc., Johnson & Johnson, Meridian Bioscience Inc., Nanologix Inc., Pro-Lab Diagnostics, Qiagen N.V. and Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)