East Africa Gypsum Plaster Market Size, Share, Trends and Forecast by Type, Sector, and Region, 2025-2033

East Africa Gypsum Plaster Market Size and Share:

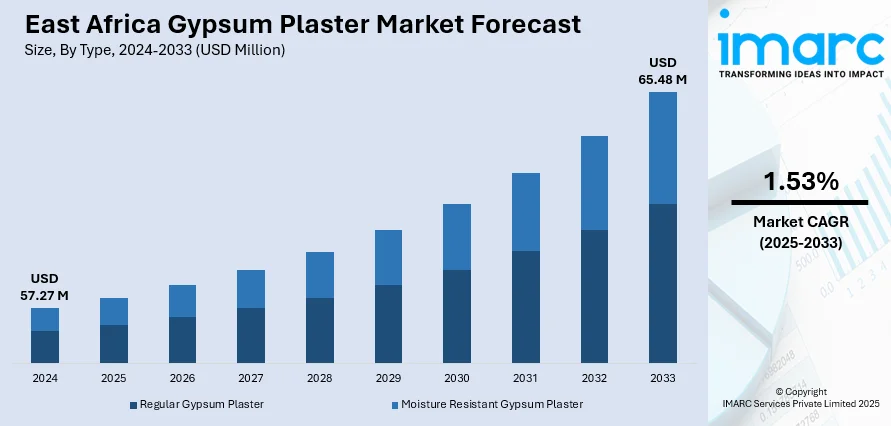

The East Africa gypsum plaster market size was valued at USD 57.27 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 65.48 Million by 2033, exhibiting a CAGR of 1.53% during 2025-2033. Tanzania currently dominates the market in 2024. The market is driven by rapid urbanization and infrastructure growth, particularly in Kenya, Tanzania, and Ethiopia, where government initiatives and private investments are accelerating construction activities. Rising demand for cost-effective, fire-resistant, and thermally efficient building materials further enhances gypsum plaster adoption. Additionally, stricter green building regulations, local manufacturing expansion, and sectoral demand from hospitality and healthcare industries are further augmenting the East Africa gypsum plaster market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 57.27 Million |

|

Market Forecast in 2033

|

USD 65.48 Million |

| Market Growth Rate 2025-2033 | 1.53% |

The market is majorly driven by urbanization and infrastructure development in the region, with nations such as Kenya, Tanzania, and Ethiopia experiencing increasing growth of construction due to private and government financing in residential, commercial, and industrial developments. East Africa's property market is expected to grow by 12% in 2025, driven by rising demand for housing and commercial properties, particularly in areas of high demand, such as Kololo in Kampala and Westlands in Nairobi. With 80% of the Ugandan population prioritizing proximity to amenities, property investment in the residential sector can yield significant returns. As infrastructure and building projects continue to expand, the growing demand for products such as gypsum plaster presents significant opportunities for investors and suppliers in the area. The demand for cost-effective and durable building materials has increased, with gypsum plaster emerging as a preferred choice due to its fire resistance, thermal insulation, and ease of application. Additionally, the rising middle-class population and increasing foreign direct investment (FDI) in real estate further propel East Africa gypsum plaster market growth, as developers seek sustainable and efficient construction solutions.

To get more information on this market, Request Sample

Moreover, the growing realization of eco-friendly building materials, particularly with gypsum plaster being known to have a lesser environmental impact compared to conventional cement products, is also fueling the market. Governments in East Africa are also encouraging green building in the form of legislation and incentives, and this has enhanced the uptake of gypsum-based products. East African governments are actively encouraging green building practices through policies that are urging energy-efficient building and environmental sustainability. By 2025, the adoption of green buildings is expected to increase, particularly in the residential sector, where environmental sustainability is the most highly valued aspect, with a mean score of 4.92. To counter issues such as high start-up expenses, with an average score of 4.49, one can anticipate the government providing more incentives in the form of tax relief and grants. This move towards sustainability stems from responding to the growing demand for green building materials, such as gypsum plaster, which is necessary for enhanced building performance. The region's growing manufacturing capacity and enhanced supply chains have enhanced product availability and reduced reliance on imports. Furthermore, more healthcare and hospitality sectors are applying gypsum plaster to interior uses for its aesthetic and performance benefits. Such factors, combined with growing disposable incomes and a rising population, are expected to drive ongoing market development.

East Africa Gypsum Plaster Market Trends:

Increasing Demand for Sustainable Building Materials

Gypsum plaster is rapidly replacing traditional sand cement plaster in East Africa due to its environmentally friendly properties. The production of traditional cement is responsible for 8% of global CO2 emissions, according to the World Economic Forum (WEF). Gypsum, on the other hand, generates less heat and has fewer shrinkage cracks, making it a favorable alternative. As awareness of sustainability grows, the demand for gypsum plaster is increasing. This is particularly relevant in East Africa, where rapid urbanization and a focus on eco-friendly construction practices are driving the market. The use of gypsum plaster reduces environmental impact while offering superior insulation, fire resistance, and impact resistance. Consequently, the shift toward sustainable building materials in East Africa is creating a positive East Africa gypsum plaster market outlook.

Population Growth and Housing Demand

East Africa's population is growing rapidly, with estimates from Worldometers suggesting that the population will account for 6.24% of the global population in 2025, growing at a rate of 2.55% annually. This demographic rise is driving the demand for housing in the region, which in turn fuels the need for construction materials such as gypsum plaster. As the population increases, there is a growing need for affordable, durable, and efficient building materials to meet the demand for residential and commercial construction. Gypsum plaster, with its lightweight properties and easy application, is becoming an essential material for the fast-growing construction industry in East Africa. According to the East Africa gypsum plaster market forecast, this trend is further supported by the region's increasing focus on cost-effective and time-saving building solutions.

Availability of Gypsum Ore and Cost-Effectiveness

Gypsum ore availability in most East African countries is a key determinant for the growing use of gypsum plaster. With gypsum easily accessible, this region can manufacture gypsum plaster locally and affordably for building projects. The ready availability of raw materials today for making gypsum plaster results in inexpensive transportation of gypsum and an overall lower cost of building. Gypsum is a widely utilized building material in most regions, producing over 300 million tons of gypsum annually worldwide. East African nations, including Tanzania, Kenya, and Uganda, have substantial gypsum reserves, and Tanzania alone produces approximately 1.5 million tons of gypsum per year currently. Additionally, as gypsum plaster is lightweight, it reduces the load on the building structure, further lowering construction costs. Housing costs are rising as housing demand increases in East Africa, especially in nations with large gypsum ore deposits. Moreover, greater demand for low-cost and sustainable building products is most likely to support gypsum plaster, favoring it over other products for developers and builders to use.

East Africa Gypsum Plaster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the East Africa gypsum plaster market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and sector.

Analysis by Type:

- Regular Gypsum Plaster

- Moisture Resistant Gypsum Plaster

Regular gypsum plaster stands as the largest component in 2024, accounting for the majority of demand due to its versatility, affordability, and widespread availability. It is widely used, both in residential and commercial construction, to finish walls and ceilings. By using methods, practices, and codes established over decades, it provides an element of stability. Regular gypsum plaster strikes a balance between workability, quick drying, and smooth finish (with the advantage that it is not a specialty product), so it remains the material of choice for contractors and builders. The segment also benefits from well-established supply chains, with many local sources of supply, that keep prices competitive compared to imported products. As it supports conventional construction techniques, the material suits both urban and peri-urban whereabouts, allowing gypsum plaster to have varied applications across projects. While premium plasters have a greater uptake in specific applications, general-use gypsum still leads in overall applications due to pricing per unit, ease of use, and often larger projects. In recording materials and property trends, both the infrastructure sector and housing demand indicate that gypsum plaster will continue to lead in its segment as long as the supply of raw materials remains steady and technical disruption from the adoption of other materials is low.

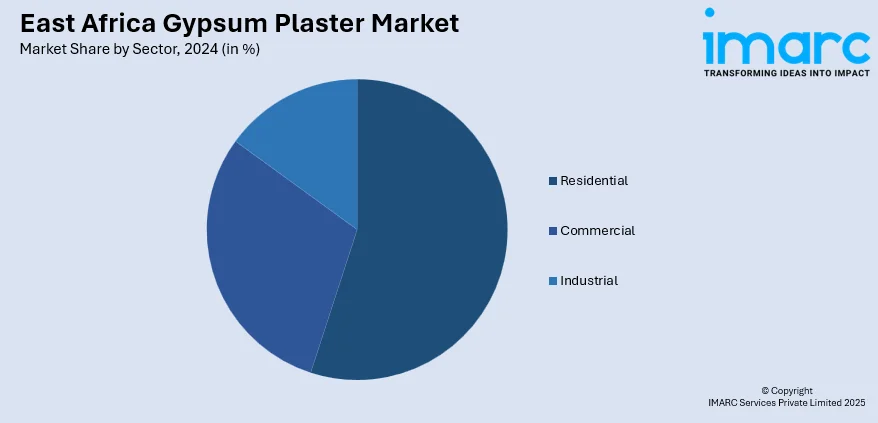

Analysis by Sector:

- Residential

- Commercial

- Industrial

Residential leads the market with in 2024, driven by rising urbanization, population growth, and a rising demand for affordable housing. Governments in Tanzania, Kenya, and Ethiopia are promoting housing schemes in response to urban migration and housing shortages, which is triggering significant residential construction. Gypsum plaster is utilized in housing schemes as it is cost-effective, quick, and simple to use and provides an improved finish compared to most other materials. Gypsum plaster would also stand to gain from the developing middle class in these nations, who are investing money in their new living standards to improve their homes further. The smooth looks and thermal properties of gypsum are attractive. While other forms of building, such as industrial and commercial buildings, depend on project-based or specialty products that take a long time to develop into complete construction, residential development utilizes the most generic products that are user-friendly, sustainable, and highly repetitive in use, which facilitates stable demand. In addition, residential sector operations are subject to policy facilitation, for example, tax relief for low-cost housing construction, as well as Public-Private Partnerships (PPPs) aimed at enhancing accessibility to housing. These nations urbanize at some of the highest rates globally, and demand for housing remains ongoing. The housing industry is going to remain the continually high-demand consumer of gypsum plaster in the area.

Breakup by Region:

- Ethiopia

- Kenya

- Tanzania

- Uganda

- Sudan

- Rwanda

- Others

In 2024, Tanzania accounted for the largest market share, fueled by robust infrastructure development, urbanization, and proactive government policies. The construction sector in this nation is growing, with flagship projects such as the new capital in Dodoma and the Dar es Salaam Metro, set to employ the use of new construction materials. Gypsum plaster is gaining from this industry's business prospects that arise from the affordable housing developments with commercial developers and new housing needs of the increasing urban middle-class individuals seeking very high-quality finishes. Compared to other regional countries, Tanzania has a local supply of gypsum, which reduces its dependence on gypsum imports while offering relative price competitiveness. The Tanzanian government is encouraging the construction sector in its strategy of industrialization, particularly with the Special Economic Zones (SEZs) that will offer incentives for construction private investment, cementing gypsum plaster as a "go to" product. The adoption of stricter building codes, which demand the use of non-combustible products and environmentally friendly materials, also complements the positive features of gypsum plaster well and supports its place in the market. In the context of urban migration and development, Tanzania's construction and infrastructure projects are developing at a faster rate than those of other East African nations, particularly in the area of gypsum plaster.

Competitive Landscape:

The industry comprises a variety of regional manufacturers and multinationals that seek to differentiate themselves by expanding capacity, developing new products, and forming strategic partnerships. Top companies are also making significant investments in domestic production facilities to cut costs and strengthen their supply chains. In contrast, smaller domestic manufacturers focus on filling niche markets, such as custom finishes. Saint-Gobain has recently developed substitute plaster products that are water-resistant and extremely lightweight, more appropriately priced for upscale construction uses. Meanwhile, Mada Gypsum is busy developing larger distribution networks in Tanzania and Kenya. The price climate will continue to be competitive, as large builders are still eligible for volume discounts. Therefore, prices slightly lower than those of rivals are an incentive for volume sales. Firms highlight recyclable gypsum and sustainability in their marketing as a way to align with green building. Mergers and distributor alliances will also be part of the picture as companies strive to consolidate their presence in urban corridors that offer the most growth prospects.

The report provides a comprehensive analysis of the competitive landscape in the East Africa gypsum plaster market with detailed profiles of all major companies, including:

- Erdemann Gypsum Limited

- Decordura

- Shazad Enterprise

- Tanzania Gypsum Limited

- Orathens Decor Limited

Latest News and Developments:

- May 2025: Uganda’s National Planning Authority (NPA) commenced construction of its Planning House in Kampala's Central Business District, partnering with Roko Construction Limited. Gypsum plaster is widely used in such projects for its fire resistance and smooth finish.

- April 2025: Ethiopian Airlines announced that it would begin construction of a USD 6 Billion mega airport near Bishoftu by November 2025. Designed to handle up to 110 million passengers annually, the project emphasizes sustainability and innovation. Such large-scale constructions typically utilize gypsum plaster for interior finishes due to its fire resistance and smooth finish.

- February 2025: The Savannah Creek Estate in Kigali, a joint venture between Bank of Kigali and TT Africa, announced that it would construct 590 high-end residential units over five years in Kangondo. Featuring multiple architectural styles, the project emphasizes precision construction to minimize material waste. Such developments typically use gypsum plaster for its fire resistance and smooth finish.

East Africa Gypsum Plaster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Regular Gypsum Plaster, Moisture Resistant Gypsum Plaster |

| Sectors Covered | Residential, Commercial, Industrial |

| Regions Covered | Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, Others |

| Companies Covered | Erdemann Gypsum Limited, Decordura, Shazad Enterprise, Tanzania Gypsum Limited and Orathens Decor Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the East Africa gypsum plaster market from 2019-2033.

- The East Africa gypsum plaster market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the East Africa gypsum plaster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gypsum plaster market in East Africa was valued at USD 57.27 Billion in 2024.

The East Africa gypsum plaster market is projected to exhibit a CAGR of 1.53% during 2025-2033, reaching a value of USD 65.48 Billion by 2033.

The East Africa gypsum plaster market is driven by rapid urbanization, infrastructure development, and government initiatives in Kenya, Tanzania, and Ethiopia. The demand for cost-effective, fire-resistant, and thermally efficient building materials, along with eco-friendly construction practices and stricter building regulations, is further propelling the market growth.

Some of the major players in the East Africa gypsum plaster market include Erdemann Gypsum Limited, Decordura, Shazad Enterprise, Tanzania Gypsum Limited and Orathens Decor Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)