East Africa Power Market Size, Share, Trends and Forecast by Generation Source, and Country, 2026-2034

East Africa Power Market Size and Share:

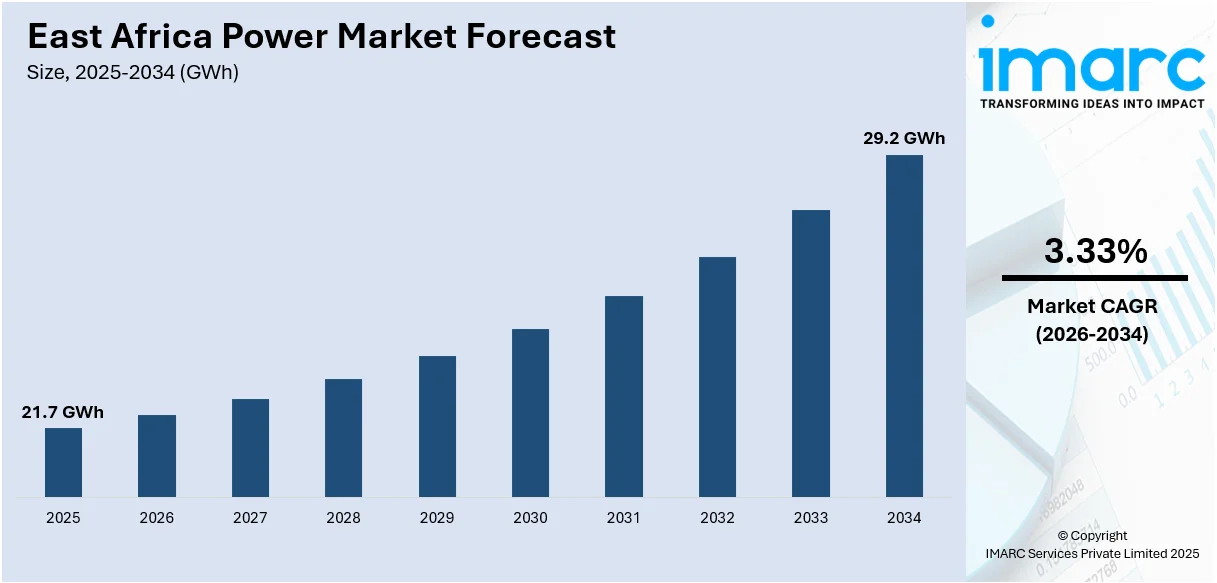

The East Africa power market size reached 21.7 GW in 2025. Looking forward, IMARC Group estimates the market to reach 29.2 GW by 2034, exhibiting a CAGR of 3.33% from 2026-2034. The market growth is primarily influenced by magnifying investments in sustainable energy ventures and swiftly developing infrastructure. Moreover, the robust focus on proliferating access to ensure reliability and actively promote long-term energy security, as well as economic growth, is impacting the market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 21.7 GW |

| Market Forecast in 2034 | 29.2 GW |

| Market Growth Rate (2026-2034) | 3.33% |

The burgeoning demand for electricity, driven by significant population expansion and urban development, is a key driver for the East Africa power market. For instance, according to the UNICEF, the population of Eastern and Southern Africa is projected to surpass 1 billion by 2050 and reach 1.5 billion by the year 2090. Moreover, expanding industries, infrastructure development, and efforts to enhance electrification rates in underserved rural areas have fueled investments in power generation. Governments in the region are prioritizing energy access to support economic development, with significant public and private sector involvement in developing new power projects. The emphasis on sustainable energy solutions is further reinforced by global partnerships and funding aimed at increasing renewable energy adoption and improving grid reliability.

To get more information on this market Request Sample

Technological advancements in power generation and transmission are driving the East Africa power market forward. Advancements in renewable energy technologies, including efficient solar panels and cutting-edge wind turbines, have lowered costs and enhanced adoption rates throughout the region.For instance, as per industry reports, Craftskills Wind Energy International Limited, a UN-awarded Kenya-based power generation firm, has the second largest wind farm in the nation with a total 60 General Electric (GE) turbines. This farm powers around 250,000 households daily and neutralize 175,741 tons of carbon dioxide each year. Furthermore, supportive policies, including tax incentives, subsidies, and favorable regulatory frameworks, are encouraging both domestic and foreign investment in the energy sector. Additionally, regional collaborations through interconnectivity projects are facilitating cross-border electricity trade, enhancing energy security, and optimizing resource utilization across East Africa. These factors collectively facilitate the market’s consistent expansion and diversification.

East Africa Power Market Trends:

Expansion of Renewable Energy Investments

East Africa is experiencing a substantial escalation in investments for renewable energy ventures, especially in geothermal, solar, and wind segments. This trend is principally boosted by a tactical inclination towards sustainable energy services and the region's ample natural resources. In addition, both private investing and governmental bodies are increasingly funding mega-scale renewable ventures to improve energy security and augment energy sources. The falling expenditure of renewable technologies have further bolstered this shift, establishing clean energy as more economically feasible option. This investment growth is anticipated to significantly expand the share of renewables in East Africa's energy mix, incentivizing economic growth as well as environmental sustainability. For instance, recent industry reports state that in early 2024, Kenya was granted a significant investment of USD 70 million by CIF under its Renewable Energy Integration Program to aid the nation in adapting and advancing its energy system to clean sources of energy.

Increase in Regional Power Integration Efforts

Initiatives to incorporate East Africa's power infrastructure are gaining significant traction, targeting to build an effective and unified regional power market. The founding of the Eastern Africa Power Pool (EAPP) fosters cross-border electricity trade, enhancing supply dependability and upgrading resource consumption. For instance, in January 2025, Ethiopia and Kenya are announced to adopt renewable energy for electricity generation. The Ethiopia-Kenya Electricity Highway, supported by the World Bank, serves as a key component of the Eastern African Power Pool (EAPP) initiative and aligns with the structure of other interconnectors across Africa. Furthermore, several key ventures are actively under development to improve interconnectivity among the nations. Such projects are anticipated to lower electricity costs and appeal heavy investments in the power segment, facilitating regional cooperation and economic expansion.

Advancements in Off-Grid Energy Solutions

There is an amplifying adoption of off-grid energy solutions across East Africa, specifically of mini-grids and solar home systems, to mitigate electricity availability issues underserved and remote areas. Such decentralized systems provide a comprehensive and cost-efficient substitute of conventional grid extension, offering quick relief to energy undersupply. Moreover, leading-edge business models, typically including pay-as-you-go financing, have positioned off-grid solutions as more accessible option to low-income households. Additionally, this trend is supporting the magnified electrification rates, enhanced quality of life, and the activation of local economies across the region. For instance, as per industry reports, off-grid solar energy kits sales in East Africa are currently exhibiting remarkable growth as it surpassed 2.5 million units during July-December 2023, with Kenya emerging as the dominant off-grid solar market, accounting for 74% of the total sales.

East Africa Power Industry Segmentation:

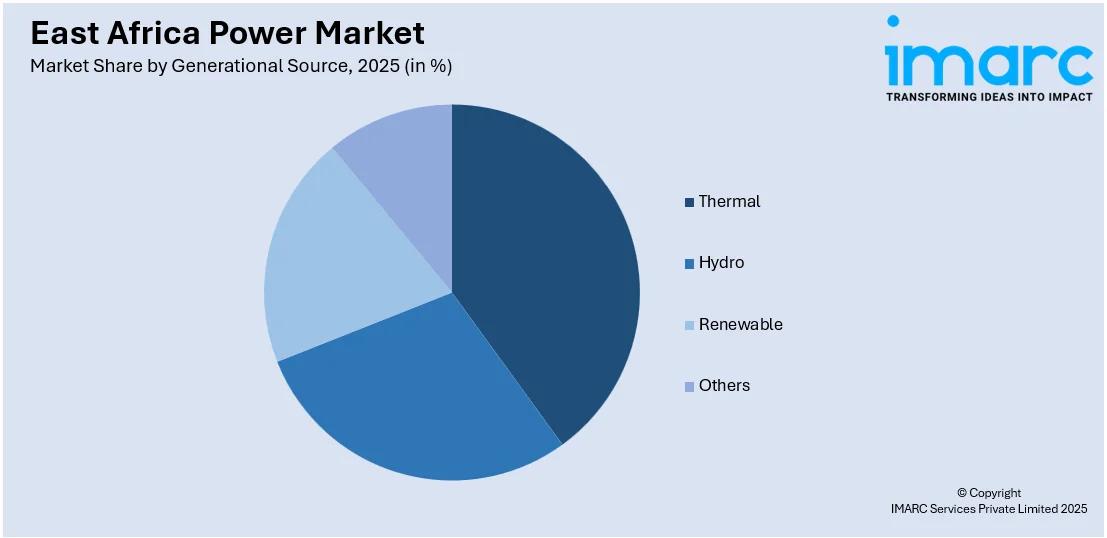

IMARC Group provides an analysis of the key trends in each segment of the East Africa power market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on generational source.

Analysis by Generational Source:

Access the comprehensive market breakdown Request Sample

- Thermal

- Hydro

- Renewable

- Others

Thermal power remains a significant contributor to East Africa's energy generation portfolio. It primarily relies on fossil fuels such as diesel and heavy oil, often used to meet baseload and peak energy demands. Thermal plants are strategically positioned to address the intermittent nature of other energy sources, ensuring a reliable power supply during periods of high demand. Moreover, this segment is crucial for countries with limited access to renewable resources or inconsistent hydrological conditions. However, the focus on thermal power highlights the need for balancing energy security with environmental sustainability in the region.

East Africa power market analysis indicates that hydropower is a prominent generational source in East Africa, leveraging the region’s abundant water resources. Major rivers and reservoirs serve as key assets for large-scale and small-scale hydroelectric projects, providing a cost-effective and renewable energy solution. The reliance on hydropower underscores its role in supporting national grids and rural electrification initiatives. Furthermore, hydroelectric plants often contribute significantly to the baseload supply, ensuring stable energy output. This segment reflects East Africa’s commitment to utilizing its natural water resources for sustainable energy generation and regional economic development.

The renewable energy segment in East Africa is rapidly growing, driven by the region’s vast potential in solar, wind, and geothermal resources. Solar power, in particular, benefits from high levels of solar irradiation across the region, while geothermal energy is concentrated in the Great Rift Valley. Moreover, investments in renewable energy projects emphasize sustainability and energy independence, positioning the sector as a key pillar of future energy strategies. Additionally, renewable sources are increasingly integrated into national grids and off-grid solutions, showcasing their versatility and alignment with global energy transition efforts.

Country Analysis:

- Ethiopia

- Kenya

- Tanzania

- Uganda

- Sudan

- Rwanda

- Others

Ethiopia plays a significant role in the East Africa power market due to its abundant renewable energy resources, particularly hydropower. The country has prioritized large-scale infrastructure projects, including the Grand Ethiopian Renaissance Dam (GERD), to enhance its power generation capacity. Additionally, Ethiopia's focus on energy exports to neighboring countries also positions it as a strategic player in the regional electricity trade. The government’s commitment to electrification, supported by international investments, underpins its market share in the East Africa power market. This further solidifies Ethiopia’s role as a key contributor to regional energy development.

According to the East Africa power market forecast report, Kenya is emerging as a prominent contributor to the power market, driven by its well-developed renewable energy sector. The country is at the forefront in geothermal energy production, leveraging its vast geothermal reserves in the Rift Valley. Kenya’s investments in wind and solar projects further diversify its energy mix, ensuring sustainable power generation. In addition, with a robust regulatory framework and private sector participation, Kenya continues to expand its power infrastructure. Furthermore, the nation's efforts to increase electricity access and support regional grid interconnectivity underscore its strategic position in the East Africa power market.

Tanzania's energy market share in East Africa is bolstered by its focus on expanding electricity access and enhancing generation capacity. The country has invested largely in hydropower, natural gas, and renewable source energy to fuel the increasing demand. Strategic partnerships and government initiatives aim to modernize the national grid and integrate rural areas into the power network. Tanzania's energy development aligns with its economic growth goals, contributing to its standing as an essential participant in the East Africa power market and supporting regional energy cooperation.

Uganda’s role in the East Africa power market growth is driven by its strong reliance on hydropower and increasing investments in renewable energy sources. The country’s extensive hydropower potential has positioned it as a reliable energy supplier, both domestically and to neighboring regions. Additionally, efforts to improve electricity transmission and distribution infrastructure complement Uganda’s generation capabilities. Public-private partnerships and favorable energy policies further enhance the nation’s competitiveness in the regional market. Uganda remains a vital player in advancing East Africa’s energy integration and ensuring sustainable development across the power sector.

Sudan’s strategic location and abundant natural resources support its participation in the East Africa power market. The country has invested in hydroelectric dams and thermal power plants to diversify its energy portfolio and meet domestic and regional demand. Moreover, Sudan’s focus on grid expansion and interconnection with neighboring countries enhances its market presence. In addition, collaborative initiatives with international stakeholders aim to modernize energy infrastructure and improve supply reliability. Sudan’s contributions to the East Africa power market emphasize its potential as a regional energy hub and a key player in cross-border electricity trade.

Rwanda’s power market share in East Africa reflects its commitment to sustainable energy development and innovative policies. The country has made notable strides in increasing electricity access through investments in solar, hydropower, and methane gas projects. Rwanda’s emphasis on off-grid energy solutions and rural electrification demonstrates its adaptive approach to meeting growing energy needs. Furthermore, strong government leadership and international partnerships have accelerated infrastructure development and capacity expansion. Rwanda’s progressive energy strategies underscore its influential role in the East Africa power market and its contribution to regional electrification goals.

Competitive Landscape:

The competitive landscape is marked by a blend of international and regional giants gravitated on distribution, generation, and transmission. Leading participants encompass multinational energy companies, government utilities, and independent power producers (IPPs). The market is significantly steered by increasing investment in renewable energy ventures, tactical collaborations, and privatization efforts to proliferate capacity and improve efficacy. Furthermore, firms actively emphasize on both sustainability and advancements to cater to the elevating energy requirements and align with global environmental objectives. Cross-border partnerships and regulatory transformations further impact the competitive ecosystem, thereby impacting the expansion of East Africa market share positively. For instance, in October 2024, the Accelerated Partnership for Renewables in Africa (APRA) Investment Forum commenced to attract large-scale investments aimed at expediting the energy transition APRA member nations. Spearheaded by Kenya, the forum represents a pivotal step in advancing the Nairobi Declaration and its Call to Action, targeting a renewable energy capacity of 300 GW by 2030. APRA countries involved include Ethiopia, Ghana, Kenya, Namibia, Rwanda, Sierra Leone, and Zimbabwe, underscoring their collective commitment to renewable energy advancement.

The report provides a comprehensive analysis of the competitive landscape in the East Africa power market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Kenya Electricity Transmission Company (KETRACO) announced completion of 400kV transmission line connecting Tanzania and Kenya, highlighting a significant achievement in improving regional trade of electricity. This new infrastructure is anticipated to fortify energy relations between the two countries, offering the strategy to amplify power exchange and aid broader incorporation plans for regional energy as well as economic growth.

- In October 2024, the Government of Kenya entered into a strategic partnership with Global Green Growth Institute to launch 1-year project to drive investment in green hydrogen and advance Kenya's shift toward green development and sustainable energy.

- In October 2024, Kaishan Group Co. Ltd, a China-based company, launched a geothermal project in Kenya with the groundbreaking of a 35 MW geothermal power plant in Nakuru County. The Orpower 22 Geothermal Power Plant, with an investment of $90 million, is set to be completed within 17 months. This project will support Kenya's transition to green energy, bolster climate resilience, and drive economic growth.

- In October 2024, Tanzania announced the active negotiations with UK company Gridworks Development Partners and the Adani Group for public-private collaborations encompassing USD 300 million and USD 900 million power-line projects.

- In June 2024, The Ministry of Energy in Uganda announced plans to initiate electricity generation from four geothermal sites. All the geothermal energy sites are estimated to produce 1,500 megawatts of energy.

East Africa Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Generation Sources Covered | Thermal, Hydro, Renewable, Others |

| Countries Covered | Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the East Africa power market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the East Africa power market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the East Africa power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Power is the rate at which energy is transferred or converted, typically measured in watts. It is essential in various applications, including electricity generation, industrial processes, and electronic devices. Power enables the functioning of machinery, lighting, heating, and communication systems, playing a crucial role in modern society.

The East Africa power market size reached 21.7 GW in 2025.

IMARC estimates the East Africa power market to exhibit a CAGR of 3.33% during 2026-2034.

The market is primarily driven by rising energy demand due to population growth and urbanization, increased government investment in infrastructure, and the declining costs of renewable energy technologies, particularly solar. Additionally, efforts to improve energy access and regional cooperation through government initiatives are significant factors boosting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)