East Africa Prefilled Syringes Market Size, Share, Trends and Forecast by Design, Material, Closing System, Application, End User, and Country, 2026-2034

East Africa Prefilled Syringes Market Summary:

The East Africa prefilled syringes market size was valued at USD 37.7 Million in 2025 and is projected to reach USD 76.6 Million by 2034, growing at a compound annual growth rate of 8.21% from 2026-2034.

The East Africa prefilled syringes market is expanding as healthcare systems modernize and chronic disease management becomes a regional priority. Growing diabetes prevalence, rising vaccination campaigns, and increasing hospital infrastructure investments are accelerating demand for safe, ready-to-use injectable delivery systems. Advances in pharmaceutical packaging, expanding biologics adoption, and government-backed healthcare reforms are reinforcing the shift toward prefilled syringes, positioning the region for sustained East Africa prefilled syringes market share.

Key Takeaways and Insights:

- By Design: Single-chamber prefilled syringes dominate the market with a share of 53% in 2025, owing to their streamlined dosing accuracy, reduced preparation time, and minimized contamination risk. Growing preference for single-dose biologic therapies is fueling adoption.

- By Material: Glass prefilled syringes lead the market with a share of 60% in 2025. This dominance is driven by superior chemical inertness that prevents drug-container interactions, preserving efficacy for sensitive biologics and ensuring regulatory compliance.

- By Closing System: Staked needle system represents the largest segment with a market share of 45% in 2025, demonstrating the general preference for integrated needle designs that improve patient safety during administration, eliminate needlestick accidents, and cut down on assembly procedures.

- By Application: Diabetes dominate the market with a share of 33% in 2025, owing to the rapidly escalating diabetes burden across East Africa, driving sustained demand for precise insulin delivery through convenient prefilled syringe formats.

- By End User: Hospitals exhibit a clear dominance in the market with 51% share in 2025, reflecting high patient volumes, centralized procurement systems, and the critical need for sterile, ready-to-use injectable devices in acute and chronic care settings.

- Key Players: Key players drive the East Africa prefilled syringes market by expanding distribution networks, investing in advanced drug delivery technologies, strengthening partnerships with regional healthcare providers, and improving product accessibility to meet the growing demand for safe, efficient injectable solutions across diverse clinical settings.

The East Africa prefilled syringes market is advancing as healthcare modernization efforts gain momentum across the region, supported by expanding chronic disease management programs and strengthened pharmaceutical supply chains. Rising demand for biologics and biosimilars is propelling the need for precise, contamination-free drug delivery systems that minimize preparation errors and improve patient outcomes. Governments and international development partners are prioritizing healthcare infrastructure upgrades, aiming to address stark disparities in healthcare facility coverage across the continent. The growing emphasis on self-administration capabilities for chronic conditions, coupled with expanding vaccination programs targeting infectious diseases, is further strengthening demand for ready-to-use prefilled formats. Technological innovations in syringe materials, safety-engineered needle systems, and tamper-evident packaging are enhancing product functionality and regulatory acceptance, while strategic investments in local pharmaceutical manufacturing capacity are building long-term supply resilience across East African markets.

East Africa Prefilled Syringes Market Trends:

Rising adoption of self-administration devices for chronic disease management

East Africa is witnessing growing adoption of self-injection devices as healthcare systems shift toward patient-centered care models for chronic conditions. Increasing diabetes and autoimmune disease prevalence is driving demand for prefilled syringes designed for home-based medication delivery. Healthcare providers are promoting self-administration to reduce hospital visits, alleviate workforce shortages, and improve treatment adherence. This trend is reshaping drug delivery preferences, with manufacturers prioritizing user-friendly designs featuring ergonomic grips, intuitive injection mechanisms, and integrated safety features that facilitate convenient and safe self-medication experiences, supporting East Africa prefilled syringes market growth.

Expansion of local pharmaceutical manufacturing and vaccine production capacity

East African nations are accelerating pharmaceutical manufacturing investments to reduce import dependency and strengthen health security. Governments are fostering partnerships with international organizations to establish vaccine production facilities and fill-finish operations across the region. This manufacturing expansion directly increases demand for prefilled syringe containers and packaging components. The push toward regional self-sufficiency in health product manufacturing, aligned with continental targets for local vaccine production, is creating sustained opportunities for prefilled syringe suppliers and supporting long-term infrastructure development across the pharmaceutical value chain.

Integration of advanced safety features and smart packaging technologies

Prefilled syringe manufacturers are increasingly incorporating advanced safety mechanisms and digital integration capabilities into their product portfolios. Passive needle guards, tamper-evident closures, and radio-frequency identification-enabled packaging are gaining traction as healthcare facilities seek to reduce needlestick injuries, prevent medication errors, and improve inventory management. These technological enhancements address critical safety concerns in resource-constrained healthcare settings while supporting regulatory compliance requirements. The convergence of safety engineering and digital health solutions is elevating product standards across the injectable drug delivery landscape.

Market Outlook 2026-2034:

The East Africa prefilled syringes market is positioned for robust expansion as the region's healthcare landscape undergoes significant transformation driven by infrastructure investments, rising chronic disease prevalence, and growing pharmaceutical manufacturing ambitions. The market generated a revenue of USD 37.7 Million in 2025 and is projected to reach a revenue of USD 76.6 Million by 2034, growing at a compound annual growth rate of 8.21% from 2026-2034. Increasing government expenditure on healthcare, expanding hospital networks, and strengthening cold chain logistics are establishing the foundational infrastructure necessary to support wider prefilled syringe adoption. The growing pipeline of biologic therapies requiring parenteral delivery, combined with rising vaccination coverage targets across East African nations, will sustain demand for ready-to-use injectable formats. Furthermore, evolving regulatory frameworks that align with international pharmaceutical standards are improving market access for advanced drug delivery systems, while public-private partnerships are channeling investment toward modernizing regional healthcare supply chains and building sustainable manufacturing ecosystems.

East Africa Prefilled Syringes Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Design |

Single-chamber Prefilled Syringes |

53% |

|

Material |

Glass Prefilled Syringes |

60% |

|

Closing System |

Staked Needle System |

45% |

|

Application |

Diabetes |

33% |

|

End User |

Hospitals |

51% |

Design Insights:

To get detailed segment analysis of this market, Request Sample

- Single-chamber Prefilled Syringes

- Dual-chamber Prefilled Syringes

- Customized Prefilled Syringes

Single-chamber prefilled syringes dominate with a market share of 53% of the total East Africa prefilled syringes market in 2025.

Single-chamber prefilled syringes are the most widely adopted design configuration in East Africa, valued for their straightforward functionality that integrates medication and delivery mechanism into a single sealed unit. This design optimizes dosing precision while significantly reducing preparation time and contamination risk during clinical administration. The preference for single-chamber formats is reinforced by their compatibility with a broad range of injectable therapeutics, including vaccines, insulin, and anticoagulants, making them essential in both hospital and outpatient care environments across the region.

The dominance of single-chamber designs is further supported by the global pharmaceutical industry's focus on streamlining fill-finish manufacturing processes for high-volume injectable products. In September 2024, BD commercially released the Neopak XtraFlow Glass Prefillable Syringe, an advanced single-chamber platform approved for more than 24 therapeutic indications including autoimmune and cardiovascular diseases. Such innovations in single-chamber technology are expanding the range of biologic therapies deliverable through prefilled formats, strengthening the segment's position as the preferred choice for cost-effective and reliable drug delivery across East African healthcare settings.

Material Insights:

- Glass Prefilled Syringes

- Plastic Prefilled Syringes

Glass prefilled syringes lead with a share of 60% of the total East Africa prefilled syringes market in 2025.

Glass prefilled syringes maintain a commanding position in East Africa owing to their exceptional chemical inertness, which prevents drug-container interactions and preserves the stability and potency of sensitive pharmaceutical formulations. The material's impermeability to gases and moisture ensures long-term drug integrity, making it the preferred choice for biologic therapies, vaccines, and high-value injectable medications. Healthcare facilities across the region rely on glass syringes for their proven track record of regulatory acceptance and established compatibility with diverse therapeutic compounds. The material's transparency also facilitates visual inspection of drug contents prior to administration, enhancing patient safety protocols across clinical settings.

The continued dominance of glass materials is reinforced by ongoing global capacity expansions aimed at meeting rising demand for biologic drug delivery systems. Leading pharmaceutical glass manufacturers are investing substantially in expanding production infrastructure across multiple continents, reflecting the industry's sustained commitment to glass-based prefilled syringe platforms. These capacity enhancement initiatives are ensuring adequate supply availability to support the growing demand for sterile injectable packaging solutions across emerging healthcare markets, including East Africa, where vaccination programs, chronic disease management, and biologics adoption continue to accelerate steadily.

Closing System Insights:

- Staked Needle System

- Luer Cone System

- Luer Lock Form System

The staked needle system exhibits a clear dominance with a 45% share of the total East Africa prefilled syringes market in 2025.

Staked needle systems represent the leading closing system configuration in East Africa, offering an integrated needle design that is permanently affixed to the syringe barrel during manufacturing. This configuration eliminates the need for separate needle attachment during clinical use, significantly reducing preparation steps and minimizing the risk of needlestick injuries for healthcare professionals. The streamlined design enhances workflow efficiency in busy hospital environments and supports accurate subcutaneous and intramuscular drug delivery for chronic disease management applications across the region.

The preference for staked needle systems aligns with the global pharmaceutical industry's emphasis on safety-engineered injection devices that protect both patients and clinicians. In October 2024, BD partnered with ten23 health to develop radio-frequency identification-enabled prefillable syringe systems featuring staked needle configurations, designed to enhance traceability and efficiency during aseptic fill-finish manufacturing processes. These advancements in staked needle technology are improving quality assurance standards for injectable drug products, reinforcing the system's established position as the dominant closing mechanism in East African prefilled syringe procurement.

Application Insights:

- Diabetes

- Anaphylaxis

- Rheumatoid Arthritis

- Oncology

- Others

Diabetes represent the leading segment with 33% share of the total East Africa prefilled syringes market in 2025.

Diabetes is the primary application driving prefilled syringe demand in East Africa, fueled by the rapidly escalating burden of the disease across the continent. The requirement for frequent insulin administration makes prefilled syringes an essential delivery format, offering patients precise dosing, reduced contamination risk, and improved convenience for daily self-management routines. Healthcare systems across East Africa are increasingly prioritizing diabetes care infrastructure to address the growing patient population, creating sustained demand for reliable and accessible prefilled insulin delivery solutions.

The urgency of diabetes management in the region is underscored by alarming epidemiological projections. According to the International Diabetes Federation's 2024 Diabetes Atlas, the Africa region had more than 24 Million adults living with diabetes in 2024, with projections indicating a 142 percent increase to 60 Million cases by 2050, representing the highest percentage growth of any global region. This escalating disease burden, compounded by a 73 percent undiagnosed rate across the continent, is intensifying the need for accessible prefilled syringe-based insulin delivery systems across East African healthcare facilities.

End User Insights:

- Hospitals

- Clinics

- Others

Hospitals hold the largest share with 51% share of the total East Africa prefilled syringes market in 2025.

Hospitals constitute the dominant end-user segment for prefilled syringes in East Africa, driven by high patient volumes, centralized procurement systems, and the critical need for sterile, ready-to-use injectable devices across multiple clinical departments. The controlled clinical environment of hospitals supports efficient utilization of prefilled syringe formats for emergency care, surgical procedures, chronic disease treatment, and vaccination programs. Institutional buyers favor prefilled syringes for their ability to reduce medication errors, minimize drug wastage, and streamline nursing workflows in resource-constrained healthcare settings. The concentration of specialized medical personnel and established pharmaceutical supply chain relationships within hospital networks further reinforces their position as the primary consumption channel for prefilled injectable formats.

The growth of hospital-based prefilled syringe consumption is closely linked to ongoing healthcare infrastructure expansion across East Africa. Governments and international development organizations are prioritizing investments in secondary and tertiary healthcare facilities as strategic priorities for strengthening regional health systems. These infrastructure development initiatives, which include construction of specialized treatment centers and modernization of existing hospital networks, are creating expanded institutional demand for advanced drug delivery systems including prefilled syringes. The continued expansion of hospital capacity across urban and peri-urban areas is expected to sustain long-term growth in prefilled syringe procurement volumes.

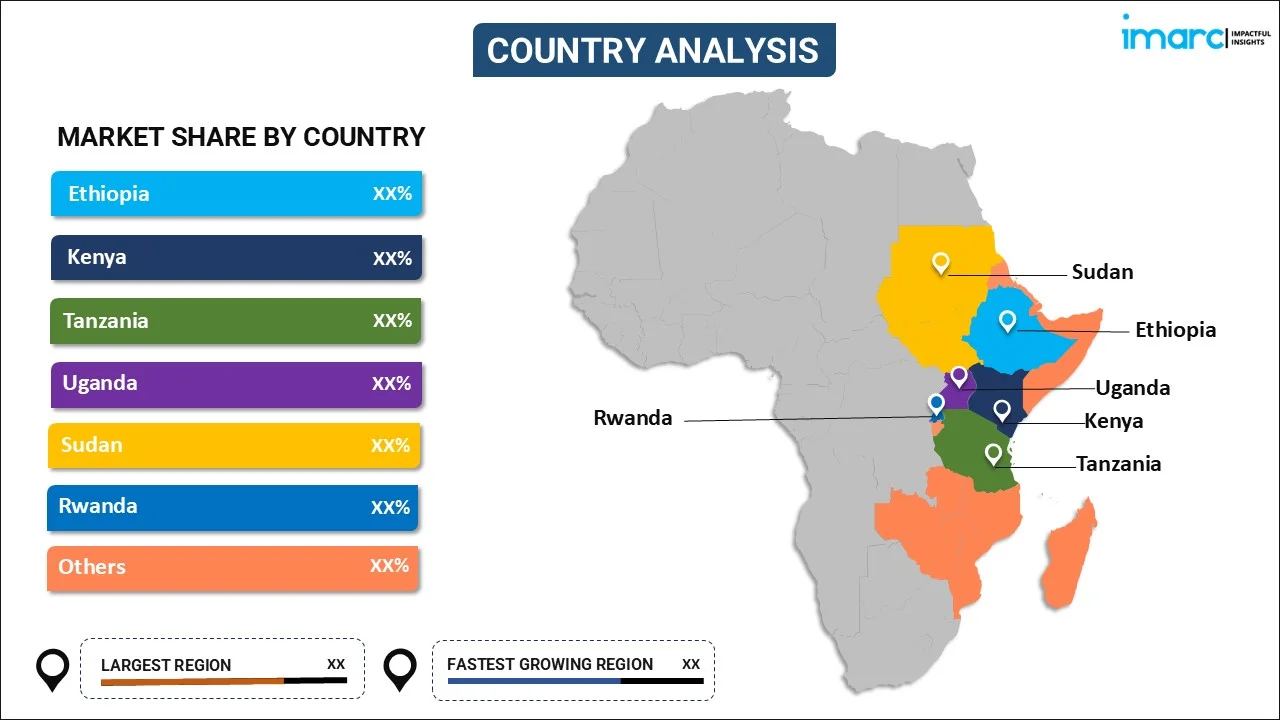

Country Insights:

To get detailed regional analysis of this market, Request Sample

- Ethiopia

- Kenya

- Tanzania

- Uganda

- Sudan

- Rwanda

- Others

Ethiopia's prefilled syringes market is expanding as the government invests heavily in healthcare infrastructure modernization and chronic disease management programs. The country's growing pharmaceutical sector, supported by partnerships with international vaccine manufacturers, is increasing demand for advanced injectable drug delivery systems. Rising diabetes prevalence and expanding vaccination campaigns are driving hospital procurement of prefilled formats, while ongoing health system reforms aim to improve medicine accessibility across urban and rural populations.

Kenya represents a significant market for prefilled syringes in East Africa, supported by a well-developed private healthcare sector and growing pharmaceutical distribution networks. The country's position as a regional healthcare hub attracts international medical technology investments, while government initiatives to expand universal health coverage are increasing demand for efficient drug delivery solutions. Rising chronic disease prevalence, active vaccination programs, and expanding hospital capacity are strengthening prefilled syringe adoption across clinical settings.

Tanzania's prefilled syringes market is growing alongside broader healthcare system strengthening initiatives that prioritize improved medication delivery and patient safety. Government investments in hospital construction and health workforce development are expanding the institutional base for prefilled syringe utilization. The country's increasing focus on managing chronic conditions such as diabetes and cardiovascular diseases, combined with ongoing immunization programs, is generating sustained demand for reliable, ready-to-use injectable delivery formats across healthcare facilities.

Uganda is experiencing growing demand for prefilled syringes as healthcare infrastructure development accelerates and chronic disease awareness improves. Government health spending increases, coupled with international development partner support, are expanding hospital networks and modernizing pharmaceutical supply chains. The country's young and growing population, combined with rising urbanization and associated lifestyle disease prevalence, is creating emerging opportunities for prefilled syringe adoption in both institutional and community-based healthcare delivery settings.

Sudan's prefilled syringes market faces unique challenges related to infrastructure limitations and geopolitical factors, yet demand persists driven by essential healthcare needs. The country's ongoing vaccination requirements and chronic disease management necessities sustain baseline demand for injectable drug delivery systems. International humanitarian healthcare interventions and medical supply programs continue to support prefilled syringe distribution, while gradual healthcare system rebuilding efforts are expected to strengthen institutional procurement capacity over the forecast period.

Rwanda has emerged as a progressive healthcare market in East Africa, with strong government commitment to health system innovation and pharmaceutical self-sufficiency. The country's investments in local vaccine manufacturing capacity, including advanced mRNA technology transfer partnerships, are creating downstream demand for prefilled syringe packaging components. Rwanda's high immunization coverage rates and expanding digital health infrastructure position it favorably for growing adoption of modern injectable drug delivery systems across healthcare settings.

Market Dynamics:

Growth Drivers:

Why is the East Africa Prefilled Syringes Market Growing?

Escalating Chronic Disease Burden Driving Demand for Injectable Therapeutics

The rising prevalence of chronic diseases across East Africa is a primary catalyst propelling the prefilled syringes market forward. Diabetes, cardiovascular conditions, autoimmune disorders, and cancer are increasingly affecting populations across the region, driven by rapid urbanization, dietary transitions, sedentary lifestyles, and aging demographics. These chronic conditions frequently require long-term injectable medication regimens, creating sustained demand for reliable and precise drug delivery systems. Prefilled syringes offer critical advantages for chronic disease management, including pre-measured dosing that eliminates preparation errors, reduced contamination risk through sealed packaging, and enhanced convenience for both clinical and home-based administration. Healthcare systems are responding to this escalating disease burden by expanding treatment infrastructure and improving access to essential medicines, which directly translates into higher procurement volumes for prefilled injectable formats. The growing recognition of early diagnosis and consistent treatment adherence as key strategies for managing chronic conditions is further reinforcing demand for user-friendly delivery devices that support patient compliance and improve long-term health outcomes across East African healthcare environments.

Healthcare Infrastructure Expansion and Hospital Modernization Programs

Significant investments in healthcare infrastructure development across East Africa are creating expanded institutional demand for advanced medical devices including prefilled syringes. Governments, international development organizations, and private investors are channeling substantial resources into constructing new hospitals, upgrading existing facilities, and establishing specialized treatment centers equipped with modern pharmaceutical supply systems. These infrastructure projects are expanding the institutional base for prefilled syringe procurement by increasing the number of clinical settings capable of storing, handling, and administering injectable medications according to established quality standards. The modernization of pharmaceutical supply chains, including cold chain logistics improvements and centralized procurement systems, is enabling more efficient distribution of temperature-sensitive prefilled products to healthcare facilities across urban and rural areas. Public-private partnerships are playing an increasingly important role in funding healthcare construction projects and medical technology adoption programs, accelerating the transition toward modern drug delivery standards that favor prefilled formats over traditional vial-and-syringe methods in institutional care settings.

Growing Vaccination Programs and Biologics Adoption Across the Region

Expanding vaccination campaigns and the increasing adoption of biologic therapies represent significant growth drivers for the East Africa prefilled syringes market. Governments across the region are scaling up immunization programs to address infectious diseases, leveraging prefilled syringe formats that offer dosing accuracy, reduced wastage, and simplified logistics for mass vaccination efforts. The continental push toward local vaccine manufacturing self-sufficiency, with targets to produce a majority of required vaccines domestically within the coming decades, is generating additional demand for pharmaceutical-grade syringe packaging and fill-finish components. Simultaneously, the growing availability of biologic and biosimilar medications for treating chronic conditions is expanding the range of injectable therapies requiring prefilled syringe delivery. These large-molecule drugs demand packaging solutions that preserve drug stability and prevent contamination, making prefilled glass syringes particularly essential. The convergence of expanded vaccination coverage targets and increasing biologics utilization is creating a dual demand pathway that supports sustained growth in prefilled syringe consumption across East African healthcare markets.

Market Restraints:

What Challenges the East Africa Prefilled Syringes Market is Facing?

Fragmented Regulatory Frameworks Across East African Nations

The absence of harmonized pharmaceutical regulatory systems across East African countries creates significant barriers for prefilled syringe market development. Varying standards for medical device approval, quality assurance, and import regulations increase compliance costs and extend market entry timelines for manufacturers. Limited regulatory agency maturity levels in several nations result in inadequate oversight capacity, while the lack of mutual recognition agreements between national authorities further complicates cross-border distribution of prefilled injectable products throughout the region.

Limited Cold Chain Infrastructure and Supply Chain Vulnerabilities

Insufficient cold chain logistics and pharmaceutical distribution infrastructure across East Africa restrict the effective delivery of temperature-sensitive prefilled syringe products to healthcare facilities, particularly in rural and remote areas. Unreliable electricity supply, inadequate refrigerated storage capacity, and poor transportation networks compromise product integrity during distribution. These supply chain vulnerabilities increase wastage rates, elevate per-unit costs, and limit the geographic reach of prefilled syringe products, constraining market penetration beyond major urban centers in the region.

High Product Costs and Limited Healthcare Financing Capacity

The premium pricing of prefilled syringes compared to conventional vial-and-syringe alternatives presents a significant affordability challenge in East African markets characterized by constrained healthcare budgets and limited insurance coverage. Many healthcare facilities, particularly public institutions serving low-income populations, face budget restrictions that favor lower-cost traditional injection methods. Inadequate health insurance penetration and reliance on out-of-pocket expenditures further limit the ability of healthcare systems to transition toward more advanced but costlier prefilled drug delivery formats.

Competitive Landscape:

The East Africa prefilled syringes market features a competitive landscape shaped by the presence of established global medical technology companies alongside regional pharmaceutical distributors. International manufacturers dominate supply through advanced production capabilities, extensive product portfolios, and strategic partnerships with healthcare institutions across the region. These companies leverage technological expertise in glass and polymer syringe manufacturing, safety-engineered needle systems, and ready-to-use packaging configurations to maintain market leadership. Competition is intensifying as manufacturers invest in capacity expansions, develop next-generation drug delivery platforms, and pursue regulatory approvals for biologic-compatible prefilled formats. Strategic collaborations between device manufacturers and pharmaceutical companies are accelerating product innovation and improving supply chain efficiency. Regional distributors play a critical role in facilitating market access by managing logistics, navigating regulatory requirements, and building relationships with hospital procurement networks. The competitive dynamics are further influenced by pricing strategies, quality certifications, and the ability to provide technical support and training to healthcare professionals adopting prefilled syringe technologies.

East Africa Prefilled Syringes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Designs Covered | Single-chamber Prefilled Syringes, Dual-chamber Prefilled Syringes, Customized Prefilled Syringes |

| Materials Covered | Glass Prefilled Syringes, Plastic Prefilled Syringes |

| Closing Systems Covered | Staked Needle System, Luer Cone System, Luer Lock Form System |

| Applications Covered | Diabetes, Anaphylaxis, Rheumatoid Arthritis, Oncology, Others |

| End Users Covered | Hospitals, Clinics, Others |

| Countries Covered | Ethiopia, Kenya, Tanzania, Uganda, Sudan, Rwanda, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The East Africa prefilled syringes market size was valued at USD 37.7 Million in 2025.

The East Africa prefilled syringes market is expected to grow at a compound annual growth rate of 8.21% from 2026-2034 to reach USD 76.6 Million by 2034.

Single-chamber prefilled syringes dominated the market with a share of 53%, driven by streamlined dosing accuracy, reduced preparation time, and growing compatibility with biologic therapies requiring single-dose parenteral delivery.

Key factors driving the East Africa prefilled syringes market include escalating chronic disease prevalence, healthcare infrastructure expansion, growing vaccination programs, increasing biologics adoption, and rising demand for self-administration devices across the region.

Major challenges include fragmented regulatory frameworks across nations, limited cold chain infrastructure in remote areas, high product costs relative to conventional alternatives, constrained healthcare budgets, and supply chain vulnerabilities affecting distribution efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)