Edge Banding Materials Market Size, Share, Trends and Forecast by Material, End User, and Region, 2025-2033

Edge Banding Materials Market Size and Share:

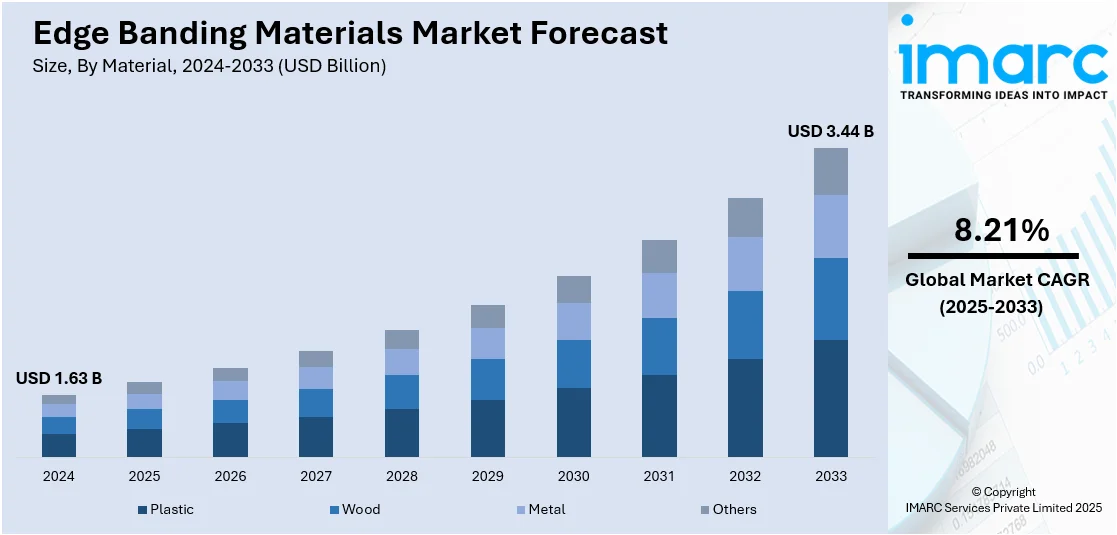

The global edge banding materials market size was valued at USD 1.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.44 Billion by 2033, exhibiting a CAGR of 8.21% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 38.5% in 2024. The dominance of the region is stimulated by high-speed industrialization, expanding construction and furniture industries, and rising demand for custom and sustainable products. Technological innovation in production processes also fuels edge banding materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.63 Billion |

| Market Forecast in 2033 | USD 3.44 Billion |

| Market Growth Rate (2025-2033) |

8.21%

|

The edge banding materials market growth is stimulated by rising demand for attractive and long-lasting finishes in furniture and interior design. The growth in residential and commercial building activities, along with the growth of the real estate industry, has heightened the demand for premium wood-based products. Moreover, advancements in edge banding materials, including the use of eco-friendly materials and high-performance adhesive technologies, are also driving market demand. The move towards sustainability, along with consumer inclination toward customized furniture, is also accelerating the use of edge banding materials. In the United States, the demand for edge banding materials market growth is driven by growing consumer needs for customized and premium-quality furniture. For instance, in April 2025, OAV Equipment and Tools introduced the Compact Edge Bander with multi-functional capabilities, designed to save space while maintaining high quality and performance. It handles various edge materials like PVC, veneer, and solid wood, offering ease of use through an intuitive control panel. Built for durability and precision, it’s ideal for cabinetry, furniture, and decorative items. These factors, combined with enhanced durability and ease of maintenance, position edge banding materials as a key element in modern interior design and furniture manufacturing.

The rising trend of house renovation, coupled with the booming demand for contemporary interiors, is driving the edge banding materials market growth in the United States. Moreover, technological advancements have resulted in stronger, affordable, and environmentally friendly edge banding materials, which are driving higher adoption. The expansion of the automotive and packaging industries, in which edge banding is implemented for different components, also contributes to market growth. Additionally, the need for energy-saving and eco-friendly products in the American market is promoting the application of more environmentally friendly edge banding materials, which is enhancing market growth.

Edge Banding Materials Market Trends:

Increasing Influence of Western Design Trends

Edge banding provides a finishing touch to surfaces, such as furniture, countertops, and cabinetry, by covering the exposed edges of panels or boards. As interior design trends evolve, there is a growing demand for edge banding materials that complement or enhance the overall aesthetic appeal of the finished product. This includes a wide range of colors, textures, and patterns, which allows designers and manufacturers to create customized and visually appealing surfaces. The global furniture market reached USD 664.9 Billion in 2024 and is projected to grow to USD 707.5 Billion by 2033. This growth highlights the expanding need for innovative design elements, including edge banding, to enhance product appeal and functionality. Additionally, edge banding materials that mimic natural materials like wood or stone are highly sought after, as they offer cost-effective alternatives to achieve a premium look.

Rising Sustainability and Environmental Concerns

Consumers are increasingly concerned about the environmental impact of their purchasing decisions and are seeking materials that are sourced, manufactured, and disposed of in an environmentally responsible manner. As a result, there is a growing demand for edge banding materials made from sustainable and recyclable sources, such as FSC-certified wood or recycled plastics. Additionally, low volatile organic compound (VOC) edge banding materials are gaining popularity as they contribute to healthier indoor air quality. This shift aligns with the rapid expansion of the global green building materials market, which reached USD 374.7 Billion in 2024 and is projected to grow to USD 739.9 Billion by 2033, at a CAGR of 7.85% during 2025-2033. Manufacturers are responding to this demand by developing innovative edge banding solutions that prioritize sustainability without compromising on quality or aesthetics.

Ease of Installation and Maintenance

Consumers and manufacturers value materials that streamline the installation process, which saves time and labor costs. Edge banding materials are easy to cut, apply, and adhere to the panel surface without specialized tools or expertise are highly sought after. They require minimal maintenance, such as being easy to clean and resistant to stains and discoloration, are preferred. According to Edge Bands, the popularity of edge banding tape has surged by 25% among professionals, reflecting its growing demand due to convenience, efficiency, and durability. These factors contribute to the overall convenience and efficiency of using the product in various applications, thereby creating a positive edge banding materials market outlook.

Edge Banding Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edge banding materials market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on material and end user.

Analysis by Material:

- Plastic

- Wood

- Metal

- Others

Plastics stand as the largest component in 2024, holding around 30.8% of the market. The plastics segment dominates the edge banding materials market due to their durability, versatility, and cost-effectiveness. Plastic edge bands, particularly those made from PVC, ABS, and acrylic, offer superior resistance to moisture, scratches, and impacts, making them ideal for both residential and commercial applications. Their ability to be easily molded into different shapes, colors, and finishes adds to their appeal, allowing for customization to meet various design preferences. Additionally, plastic edge banding is relatively inexpensive compared to other materials like wood, which further enhances its popularity among manufacturers and consumers.

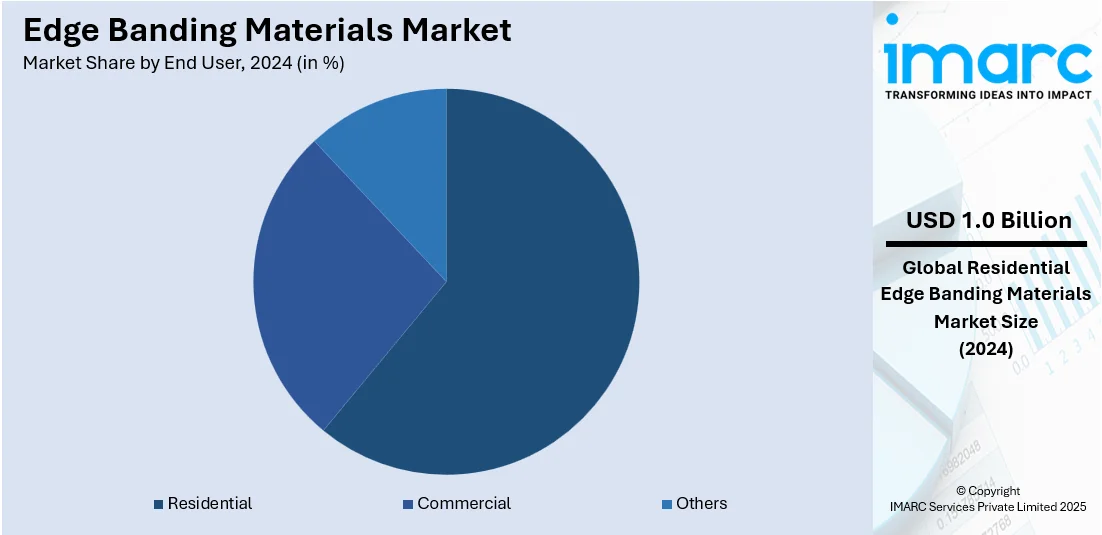

Analysis by End User:

- Residential

- Commercial

- Others

Residential leads the market with around 60.6% of market share in 2024. The edge banding material market forecast projects the residential segment to be the dominant segment, driven by the increasing demand for home improvement and interior design, where both aesthetics and functionality play a crucial role. As homeowners prioritize high-quality finishes, edge banding materials like PVC, wood veneer, and acrylic offer an affordable and durable solution for achieving smooth, refined edges on furniture and cabinetry. The popularity of DIY projects and the expansion of residential construction further boost demand. Additionally, the increasing trend of customized and modern furniture designs, along with advancements in edge banding technology, contribute to the sustained growth and dominance of the residential sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.5%. Asia-Pacific dominates the edge banding materials market due to its strong manufacturing base, particularly in countries like China, India, and Japan. The region's robust furniture, automotive, and construction industries drive the demand for high-quality edge banding solutions. Additionally, the availability of affordable raw materials, skilled labor, and advanced manufacturing technologies gives Asia-Pacific a competitive edge. The increasing adoption of modern interior designs, coupled with rapid urbanization and growing disposable incomes, further boosts the market in this region. The presence of major manufacturers and exporters also contributes to its dominance in the global edge banding materials market. For instance, in February 2025, OAV Equipment and Tools presented the MAX370A PLUS Edge Banding Machine at INDIAWOOD 2025 in India. The exhibition highlighted over 600 brands and 300 product launches, showcasing cutting-edge machinery, tools, and technologies for the woodworking and furniture industries.

Key Regional Takeaways:

United States Edge Banding Materials Market Analysis

In 2024, the United States held a market share of around 87.90% in North America. The United States edge banding materials market is witnessing steady growth, driven by increasing demand in furniture manufacturing, cabinetry, and interior design applications. The country's furniture market was valued at USD 189.8 Billion in 2024 and is projected to reach USD 250.9 Billion by 2033, growing at a CAGR of 3.1% from 2025 to 2033, according to IMARC Group. This expansion is fueling the need for high-quality, durable, and aesthetically appealing furniture, leading to greater adoption of advanced edge banding materials such as PVC, ABS, and wood-based products. Technological advancements in adhesive solutions and production techniques are enhancing efficiency, durability, and design versatility. Additionally, the growing preference for seamless and customized furniture designs is driving innovations in edge banding applications. Sustainable and eco-friendly materials are gaining traction as environmental consciousness increases among manufacturers and consumers. The market is further supported by robust construction and renovation activities, which contribute to the consistent demand for edge banding solutions in residential and commercial spaces. As modernization and urbanization continue, the edge banding materials market is expected to maintain a positive growth trajectory in the coming years.

Europe Edge Banding Materials Market Analysis

The Europe edge banding materials market is expanding due to rising consumer preference for premium furniture and modern interior designs. The region's strong manufacturing sector, particularly in furniture and cabinetry, is a key driver of demand. Sustainability is playing a crucial role, with a growing shift toward recyclable materials and energy-efficient production processes. According to the European Commission, as of September 2024, nearly 3,000 Ecolabel licenses were awarded for 98,977 products on the EU market, highlighting the increasing focus on eco-friendly solutions. Technological advancements, such as laser edge banding and seamless application techniques, are improving product durability and aesthetic appeal. Urbanization and rising residential and commercial construction activities further contribute to market growth. The demand for high-quality, visually appealing, and long-lasting edge banding materials continues to rise, driven by evolving consumer expectations and ongoing innovations in furniture manufacturing and interior design.

Asia Pacific Edge Banding Materials Market Analysis

The Asia Pacific edge banding materials market is experiencing rapid growth due to expanding construction and furniture industries, rising disposable incomes, and evolving consumer preferences for modern furniture solutions. Manufacturers are focusing on cost-effective production techniques and innovative designs, while sustainable materials and eco-friendly production methods are shaping market trends. Advancements in adhesive technologies and automated edge banding processes are also improving efficiency. The construction sector plays a vital role in driving market expansion, with significant contributions to economic growth. According to Invest India, the sector is expected to contribute around USD 1 Trillion to India's economic output by 2030. This surge in construction activities is fueling demand for edge banding materials, particularly in residential and commercial spaces, reinforcing the market's growth trajectory across the region.

Latin America Edge Banding Materials Market Analysis

The Latin America edge banding materials market is witnessing steady expansion due to increasing construction and renovation activities. The demand for aesthetically appealing and durable furniture solutions is fueling the adoption of advanced edge banding materials in residential and commercial sectors. The region's construction industry plays a crucial role in driving market growth, with the Brazil construction market reaching USD 150.0 Billion in 2024. Looking ahead, IMARC Group expects it to grow to USD 211.4 Billion by 2033, at a CAGR of 4% from 2025 to 2033. This upward trend in construction activities is boosting demand for high-quality interior solutions, including edge banding materials. Manufacturers are enhancing designs and production techniques to meet consumer preferences while growing awareness about sustainable materials and eco-friendly manufacturing processes is influencing market dynamics.

Middle East and Africa Edge Banding Materials Market Analysis

The Middle East and Africa edge banding materials market is expanding due to urbanization, infrastructure development, and modern furniture demand. Technological advancements in manufacturing processes, such as improved adhesive solutions, enhance product performance and design versatility. Additionally, the expanding furniture sector is fueling market growth, with the Saudi Arabian furniture market reaching USD 6.5 Billion in 2024 and expected to grow at a CAGR of 6.3% from 2025 to 2033, reaching USD 11.3 Billion by 2033, according to IMARC Group. This surge in demand for furniture is contributing to the increased use of advanced edge banding materials. The shift toward sustainable and environmentally friendly materials is also shaping market trends.

Competitive Landscape:

The edge banding materials market is highly competitive, with numerous players offering a wide range of products such as PVC, ABS, veneer, and solid wood materials. Key factors driving competition include technological advancements in manufacturing processes, the introduction of eco-friendly and sustainable options, and customization to meet specific customer needs. Companies are focusing on product quality, durability, and precision to differentiate themselves. Additionally, cost-efficiency and the ability to provide tailored solutions for different industries like furniture, automotive, and construction are vital for staying competitive. Strategic partnerships, innovation in materials, and geographic expansion also play crucial roles in gaining market share. For instance, in May 2025, REBON unveiled its 4.0 large-scale smart factory, covering 173 acres with a 1 billion yuan investment. It integrates advanced automation and IoT technology, enabling the production of 200,000 customized cabinetry sets annually. The factory features intelligent systems for cutting, edge banding, drilling, sorting, and packaging, boosting efficiency and product precision.

The report provides a comprehensive analysis of the competitive landscape in the edge banding materials market with detailed profiles of all major companies, including:

- Doellken-Woodtape Inc. (SURTECO GmbH)

- E3 Panels

- EdgeCo Incorporated

- Gdecor Industries India Private Limited

- Paramount Composites India

- REHAU Polymers Pvt. Ltd.

- Square One Décor

- Teknaform Inc.

- Vaibhav Industries

- Veena Polymers

Latest News and Developments:

- May 2025: E3 Edge Band, an Indian manufacturer of edge banding tapes expanded production with a new plant in Andhra Pradesh and announced another in Gujarat. The company enhanced capacity and also entered exports with a Dubai warehouse, aiming for INR 200 crore revenue by launching new materials.

- March 2025: Powerspeed Electrical Ltd inaugurated its Electrosales Timber Factory in Mutare, Zimbabwe. The facility, which spans over 15,000 sqm, features advanced machinery, including an edge banding machine. It boosted production capacity, created 35 jobs, and adopted zero-waste practices through partnerships supporting livestock farming with wood shavings from timber processing.

- April 2024: EXCITECH launched its Laser Edge Banding Machine, revolutionizing the woodworking industry with advanced laser technology. Designed for precision and efficiency, it supports various materials, features user-friendly software, and reduces labor costs with automatic feeding. This innovation reflects EXCITECH's commitment to quality and industry advancement.

- April 2024: GDecor Industries India launched a new PVC edge banding catalogue featuring wood textures, solid colors, fabric matt, and metallic sparkle finishes. Designed for furniture edges, these materials enhance aesthetics and durability in cabinets, doors, and panels. GDecor aims to expand its distributor network across India to increase product accessibility and meet modern interior demands.

- January 2024: Akij Board launched ProEDGE, a premium PVC edge banding material designed to enhance furniture durability and aesthetics. Featuring built-in adhesive, antibacterial and antifungal properties, and resistance to dust and humidity, ProEDGE ensures a seamless finish.

Edge Banding Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Plastic, Wood, Metal, Others |

| End Users Covered | Residential, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Doellken-Woodtape Inc. (SURTECO GmbH), E3 Panels, EdgeCo Incorporated, Gdecor Industries India Private Limited, Paramount Composites India, REHAU Polymers Pvt. Ltd., Square One Décor, Teknaform Inc., Vaibhav Industries, Veena Polymers, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edge banding materials market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global edge banding materials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edge banding materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The edge banding materials market was valued at USD 1.63 Billion in 2024.

The edge banding materials market is projected to exhibit a CAGR of 8.21% during 2025-2033, reaching a value of USD 3.44 Billion by 2033.

The edge banding materials market is driven by growing demand in the furniture, construction, and automotive industries, advancements in material technology, and a shift toward modern interior designs. Increased urbanization, rising disposable incomes, and a focus on aesthetic appeal also contribute to the expanding use of edge banding materials globally.

In 2024, Asia Pacific dominated the edge banding materials market, holding a market share of over 38.5%. This dominance is driven by strong manufacturing sectors, growing demand in furniture and construction industries, cost-effective production, access to raw materials, and rapid urbanization, fueling continuous demand for edge banding materials.

Some of the major players in the edge banding materials market include Doellken-Woodtape Inc. (SURTECO GmbH), E3 Panels, EdgeCo Incorporated, Gdecor Industries India Private Limited, Paramount Composites India, REHAU Polymers Pvt. Ltd., Square One Décor, Teknaform Inc., Vaibhav Industries, Veena Polymers, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)