Edible Insects Market Size, Share, Trends and Forecast by Type, Product, Application, and Region 2025-2033

Edible Insects Market Size and Share:

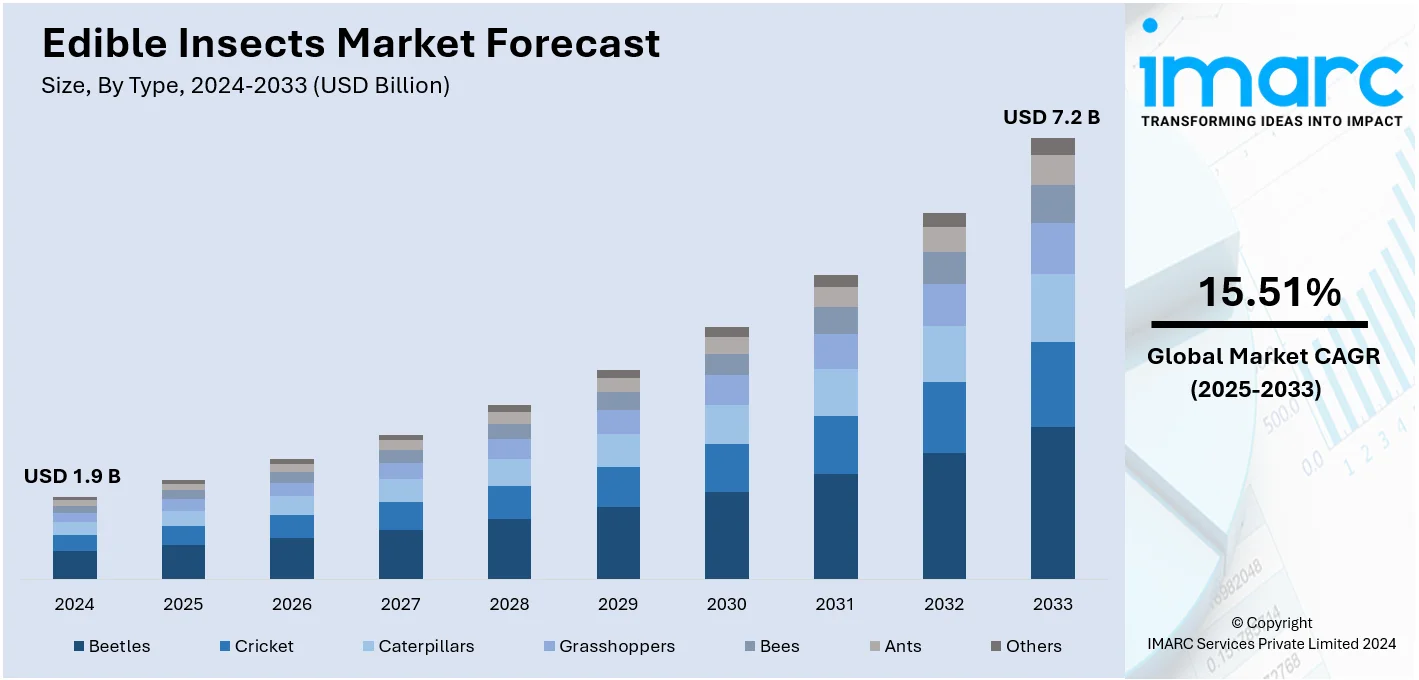

The global edible insects market size was valued at USD 1.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.2 Billion by 2033, exhibiting a CAGR of 15.51% from 2025-2033. North America currently dominates the market, holding a market share of over 28.8% in 2024. The emergence of insect-based protein powders and supplements, increasing investments into insects farming startups and ventures, rise in the acceptance of insects as ingredients for processed foods, and a growing adoption of products as pet food ingredients are some factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.9 Billion |

|

Market Forecast in 2033

|

USD 7.2 Billion |

| Market Growth Rate 2025-2033 | 15.51% |

The edible insects market share is growing due to the increasing demand for sustainable food sources worldwide, as consumers and governments become more conscious of the impact of traditional livestock farming on the environment. Insects are perceived as an eco-friendly alternative as they require significantly less land, water, and feed compared to cattle, poultry, and pork. This sustainability factor has created immense interest among both consumers and investors. The increasing number of people living globally, especially within the urban region, is creating higher demands for more protein-rich diets. Insects have high-quality protein as well as rich amino acids with all micronutrients such as vitamins and minerals. Therefore, edible insects appear as a strong substitute for regular sources of conventional animal proteins. At a time of growing interest in food insecurity issues, the issue of nutrition shortage in those areas can also be solved. In addition, the popularity of plant-based and flexitarian diets has led to the acceptance of insects-based products, such as protein powders, bars, and snacks. Innovations in food product development are expanding consumer choices and driving market adoption.

The United States has emerged as a key market for the edible insects. The market is growing due to increased interest in sustainable protein sources and environmental concerns over conventional livestock farming. With high levels of protein, omega-3 fatty acids, and essential vitamins, insects have emerged as a relatively efficient solution for protein demands without leaving an ecologically massive footprint. Convenience and popularity of plant-based, and flexitarian diets, especially among health-conscious and environmentally aware individuals, further support the tendency toward accepting insects-based foods. Another advantage of the U.S. market is innovations in insects-based products. Companies are engaged in formulating many products such as protein powders and energy bars, right up to snacking products to cater to the growing demand for functional foods. The FDA has approved a list of approved insects for human consumption, putting into place a framework for the development of products and the safety of the consumers.

Edible Insects Market Trends:

Increasing insects inclusion in animal feed for livestock and poultry

The increasing adoption of insects as animal feed for cattle and poultry is increasing the edible insects demand. Since traditional sources of protein face ecological challenges and demand for meat products depletes the resources, insects are a feasible alternative. Insects offer a nutrient-rich alternative source of protein that can be easily converted into animal feed. Their excellent feed conversion ratio and minimal environmental impact make them attractive. The addition of insects to cattle and poultry diets enhances nutrition aside from enhancing animal growth and health. Moreover, decreased dependence on traditional protein sources such as soy and fish meal to prevent stress on the ecosystem and to remove fears of over-fishing. This shift toward insect-based animal feed aligns with the growing global focus on sustainable agriculture and responsible resource management, further fueling the market. For example, in Africa, the most important edible insects orders are Lepidoptera (30.93%), followed by Orthoptera (22.80%), Coleoptera (19.70%), Heteroptera (9.32%), and Blattodea (7.40%), as per an industry report. Around 5.5 million insects species are known to exist worldwide, of which about 1 million have been described. Of these, about 2,100 species are edible, and they include beetles, caterpillars, ants, bees, wasps, grasshoppers, true bugs, dragonflies, termites, cockroaches, cockroaches, insects, and termites.

Rising awareness campaigns promoting the nutritional benefits of insects

The increase in awareness campaigns emphasizing the nutritional advantages of insects has shaped the edible insects market trend. The campaigns are significant in altering the preconceptions of consumers and disseminating attention to the great nutritional value of edible insects, which includes high protein, vitamin, and mineral contents. They also market it very well due to the increasing awareness about the benefits of having edible insects. For instance, protein accounts for most of the composition of nutrients in edible insects, while lipids follow. For insects in the order of Blattodea (termites) and Orthoptera (crickets, grasshoppers, and locusts), protein content varies from 35.3 to 61.3% on a dry matter basis. Campaigning on such facts reduces barriers to insect eating as myths are set right and knowledge is increased. Now, more people understand the health benefits of consuming insects as part of their diet. This growing awareness drives demand for insects-based products in the food and beverage sector and inspires the development of new insects-derived ingredients and snacks. As such, when well-informed consumers seek out these nutrient-rich, sustainable protein sources, the market for edible insects is growing.

Development of insects-based food safety regulations

The development of insects-based food safety regulations has several potentials for the market. As public interest in edible insects grows, the safety and quality of insect-based goods become critical. Establishing clear and thorough food safety laws empowers customers to adopt insect-derived meals. These laws address issues about insects production, processing, and ingestion, ensuring that they fulfill strict safety requirements. The formation of such laws ensures customers of the sanitary and nutritious elements of insects-based goods while also facilitating their inclusion into conventional food supply chains. This, in turn, motivates food makers to invest in insects-based technologies while maintaining safety. Robust rules boost business legitimacy, attracting more customers and spurring the creation of new insects-based food items. The creation of insects-based food safety regulations builds consumer confidence and drives the market by establishing a foundation for sustainable and safe insects consumption. For example, Directive 2002/32/EC48 requires that substrates meet the same regulatory and contamination standards as animal feed, however, EU law does not provide "insects-specific" guidance on microbiological or chemical limitations. This means that the safety of the subsequent insects feed and food chains is greatly influenced by the raising conditions and insects feed substrate. Only 28% of the EU insects feed and food companies are engaged in the rearing process up to the processing of the final product, as revealed by the data from the International Platform for Insects Food and Feed (IPIFF). Most companies purchase whole dried insects which are processed into products to be consumed by the EU consumers.

Edible Insects Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edible insects market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Beetles

- Cricket

- Caterpillars

- Grasshoppers

- Bees

- Ants

- Others

Beetles holds the largest segment, with a market share of 32.8%. The market is growing at a rapid pace due to the growing interest in sustainable food sources and innovative dietary choices. Beetles and crickets are the key drivers of this trend. Beetles are gaining popularity as a source of protein due to their high protein content and rich nutrient profile. These powders are used for the production of protein bars, baked goods, and many more. It leads to diversification in the market for proteins. In addition to this, their lower environmental footprint as compared to livestock-based productions increases their attractiveness. It complements the move of the international community toward making foods greener and healthier.

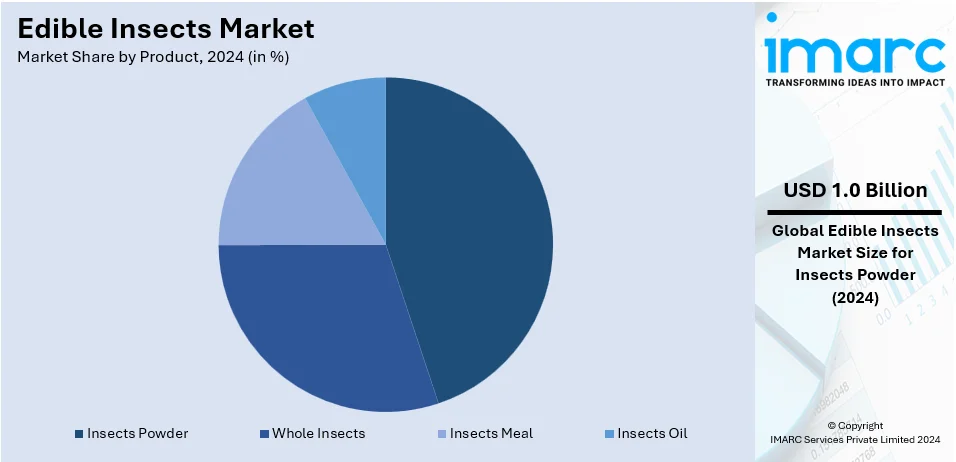

Analysis by Product:

- Whole Insects

- Insects Powder

- Insects Meal

- Insects Oil

Insects powder dominates the market with a share of 44.8%. Market in the transformation phase of growth with the major contributor being the growth in consumption of whole insects and insects powder. The other important driver for the edible insects market growth is insects powder. Insects powder is obtained after processing insects to a fine powdered form. The versatile powder is being used in various food products, such as energy bars, protein shakes, and baked goods. It addresses consumer preferences for sustainable and protein-rich foods and can easily be incorporated into existing food processes. Its long shelf life and neutral flavor make it an ideal ingredient for fortifying everyday meals without altering taste, further increasing its appeal among health-conscious and environmentally aware consumers.

Analysis by Application:

- Food and Beverage

- Bakery

- Pet Food

- Others

Food and beverage holds the largest market share. There is tremendous growth in the edible insects market, and food and beverage and bakery have been crucial players in such growth. Edible insects integrate into various food and beverage industry products, which include protein bars, snacks, savory dishes, and drinks, such as protein shakes and smoothies. This diversifies the source of proteins while providing health-conscious consumers with sustainable alternatives. The high nutritional value of insects, including their rich protein, vitamin, and mineral content, combined with their environmental efficiency, aligns perfectly with the industry's emphasis on health and sustainability, driving further innovation and acceptance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America represents the largest regional market for edible insects with a share of 28.8%. In The shifting consumer preferences and awareness about sustainable food sources have encouraged even greater acceptance of edible insects as a food item. As consumers move toward healthier alternatives of protein ingestion, insects have been integrated into different types of food items like snacks, energy bars, and even drinks. The trend is further supported by increasing interest in sustainability and innovative dietary choices. Expansion of the market is also supported by partnerships between food manufacturers and insects farming companies, aiming to develop new products and improve the supply chain, making insects-based foods more accessible and appealing to a broader audience. Besides this, the facilitative regulatory framework and increasing media attention on the benefits of insects-based food also support the increasing demand for edible insects.

The Asia Pacific region is one of the strongest players in the global edible insects market. Its long history of consuming insects for food explains its dominance in this market. The people of Thailand, Vietnam, and China regularly consume insects, such as crickets, silkworms, and grasshoppers. This cultural acceptance fosters growth in the market. In addition, growing urbanization demands higher-protein alternative foods that do not involve traditional meats and raises environmental concerns against rearing insects as a sustainable alternative. Governments are supporting insects farming practice, and innovative insects-based products including protein powder and snacks could attract more customers, mainly focusing on health-conscious urban areas.

In Europe, growing awareness about environmental issues and the carbon footprint of livestock farming is accelerating the demand for alternative protein sources like edible insects. The European Union's approval of edible insects for human consumption has paved the way for food innovation, leading to products such as insects-based protein bars, burgers, and pasta. Many European consumers are seeking sustainable, healthy alternatives, driven by plant-based and flexitarian diet trends. Insects are mainly recognized for being well nutritionally valued, such as those containing protein, omega-3 fatty acids, and minerals. This market is thus supported by the region's favorable regulatory framework that fuels its growth.

The edible insects market is influenced positively in Latin America by the strong, age-old cultural tradition of consuming insects. Such consumption is found mainly in Mexico with its grasshoppers and ant larvae delicacies. The market is expanding with growing awareness about the nutritional value of insects, including high protein content and essential amino acids. Growing demand for sustainable protein sources to address food security and malnutrition in the region is also propelling the market forward. Insects farming is considered an eco-friendly solution as it requires less land and water compared to traditional livestock, thus making it an attractive alternative for Latin American countries.

The edible insects market in the Middle East and Africa is mainly boosted by food insecurity, malnutrition, and increased interest in sustainable agriculture. For instance, regions within Africa and the Middle East often have some constraints related to accessing traditional animal proteins due to environmental issues, thus, it presents an avenue for other forms of food sources. Insects offer an excellent option to improve nutrition with less detrimental impacts on the environment. Insects consumption is now becoming popular in countries such as Uganda, Kenya, and the Middle East, especially as a cost-effective and environmentally friendly means of food. Governments and international organizations are beginning to support insects farming to enhance food security in these regions.

Key Regional Takeaways:

United States Edible Insects Market Analysis

In 2024, the United States holds 74.5% of the edible insects market in North America. The increasing demand in the US for high-protein alternatives, and awareness about sustainable methods from food sources have fueled the edible insects industry in the country. In a study by the University of Michigan, one field cricket contains 58% protein, thus opening a promising alternative among a range of customers due to its nutritious value. Products that are supportive of environmental sustainability and health benefits have always been particularly attractive to Gen Z and Millennials, who form more than half of the U.S. population and are health conscious. Cricket farming produces 80% less methane than the usual cattle, so edible insects have also been branded as a solution in the growing focus of the food industry on reducing carbon footprints. According to an industrial report, insects-based protein powders and energy bars have also been popular products within the USD 1.8 Trillion US wellness economy. Market growth is further supported through regulatory innovation like FDA approval for insects-based products. Edible bug products are now widely available through the retail industry, primarily through e-commerce sites like Amazon and Walmart.

Europe Edible Insects Market Analysis

The edible insects industry is moving at the forefront of the Europe market due to very stringent ecological regulations and increasing demands for alternative proteins. Increasingly, the demand for insects-based foods has arisen due to the European Union's Farm to Fork strategy, which focuses on decreasing resource-intensive food production. The age group of 25-44 is the most likely to consume the product, six out of ten Europeans who sampled insects-enriched products evaluated the flavor as "very good," the International Platform of Insects for Food and Feed or IPIFF reported during the EU Consumer Acceptance Survey on Edible Insects. Regulatory approvals have hastened growth, including the European Food Safety Authority's licensing of some insects for human consumption. Additionally, the fact that insects can grow well on organic waste aligns with consumer demand to reduce food waste. Furthermore, food innovations, such as baked goods and snack foods, that are made from insects have become extremely popular, especially in cities where over 80% of the population lives. Educational programs on the nutritional value of insects have helped to strengthen market acceptance even further.

Asia Pacific Edible Insects Market Analysis

Due to a long history of consuming insects, Asia-Pacific is one of the major market for edible insects as, over 60% of the world's population resides in this region. Asia is the continent with the highest number of edible insects, which stands at 932 species, as per industry report. The Asian countries that consume the most insects is Thailand (272 species), India (262 species), China (235 species), and Japan (123 species). Insects are a staple in both rural and urban diets due to their high protein content and low cost. An estimated 20,000 edible insects farms exist in Thailand. More than 1 billion health-conscious middle-class customers in the region are increasing the demand for packaged snacks and supplements that make use of insects. Governments and new companies are encouraging insects farming as a sustainable route to food security, especially in high population-density countries such as India. The pet food industry contributes to the tune of billions within the Asia-Pacific and uses insects protein as a green alternative to traditional animal by-products, whereas products derived from edible insects have become more accessible due to e-commerce websites and applications associated with food delivery services that lead toward the higher expansion of the market.

Latin America Edible Insects Market Analysis

The market for edible insects in Latin America is driven by growing awareness about the sustainability benefits of eating insects as well as cultural familiarity with doing so. A study reports that Latin America has some of the highest rates of insects consumption, with Brazil swallowing 140 species and Mexico consuming 450. This can be attributed to its long-standing culinary use of insects like chapulines. Innovative insects-based snacks and protein powders, healthier alternatives, are taken by the region's booming middle class, which takes the biggest share of its population, while the promotion of insects farming is facilitated as a viable sector also through government programs oriented on sustainability and food security. The cattle business pushed the shift to alternative proteins. This includes insects-based solutions due to current problems such as deforestation and water consumption experienced by the same business. Latin American companies offer processed products of insects available in North America and Europe, respectively.

Middle East and Africa Edible Insects Market Analysis

Food security and sustainable sources of protein are driving the edible insects market in the Middle East and Africa. A study revealed that over 1,000 species of insects, which include locusts and mopane worms, are consumed across Africa, and their consumption has a long history. Alternative proteins, for example, insects, will alleviate the demand that the Middle East has for importing meat, based on the fact that there is an increase in environmental awareness and urbanization. Insects farming is highly supported by governments and non-governmental organizations to curb malnutrition as well as reap economic benefits in the rural setting. Gas and oil-exporting nations of the Middle East are finding investment opportunities within sustainable food industries such as insects farming.

Competitive Landscape:

Companies engaged in insects farming, processing, and distribution are at the forefront of the industry, as they often innovate to improve the efficiency and sustainability of production. Insects farming operations breed crickets, mealworms, and black soldier flies, which they raise in controlled environments to maximize their growth. These insects are then processed into various products such as protein powders, snacks, and ingredient additives in food and animal feed. Besides the producers, researchers and other activities of product development have contributed to the growth of the industry. Market players are currently investing in studies to enhance insects farming techniques and explore new ways of incorporating insects into popular diets, amongst other activities. The companies partnered with food companies mainly within the plant-based and alternative protein sectors. Companies developed insects-based products such as protein bars, burgers, and even pasta. Business organizations have also taken part in educational processes to remind people and eliminate stigma related to the eating of insects. Various government agencies and non-governmental organizations now promote and endorse the company's quest for the sustainability of the food system.

The report provides a comprehensive analysis of the competitive landscape in the edible insects market with detailed profiles of all major companies, including:

- All Things Bugs LLC

- Bugsolutely Ltd.

- Chapul LLC

- DeliBugs

- Eat Grub Ltd.

- Entomo Farms

- EnviroFlight LLC

- EXO Protein (Aspire Food Group)

- Fluker's Cricket Farm Inc.

- Jr Unique Foods Ltd.

- Nutribug Ltd.

- Thailand Unique

Latest News and Developments:

- July 2024: Singapore state food agency gave approval to 16 edible insects for sale and consumption in the country. They include locusts, grasshoppers, mealworms, and many species of beetles. Insects and their products can be used as food for humans or as animal feed for food-producing animals.

- January 2024: Entocycle and EnviroFlight announced a collaboration to commercialize and test Entosight Neo, Entocycle's proprietary black soldier fly breeding technology solution that allows for neonate counting and dosing. The partnership is designed to enhance production efficiency in the insects-based ingredients industry.

Edible Insects Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Beetles, Cricket, Caterpillars, Grasshoppers, Bees, Ants, Others |

| Products Covered | Whole Insects, Insect Powder, Insect Meal, Insect Oil |

| Applications Covered | Food and Beverage, Bakery, Pet Food, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | All Things Bugs LLC, Bugsolutely Ltd., Chapul LLC, DeliBugs, Eat Grub Ltd., Entomo Farms, EnviroFlight LLC, EXO Protein (Aspire Food Group), Fluker's Cricket Farm Inc., Jr Unique Foods Ltd., Nutribug Ltd., Thailand Unique., etc.. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edible insects market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global edible insects market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edible insects industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Edible insects refer to insects species that are taken as food for human consumption. These insects have been found to be rich in protein, healthy fats, vitamins, and minerals. They represent a sustainable, nutritious alternative for livestock. Popular edible insects are crickets, mealworms, grasshoppers, and ants, which are increasingly being consumed worldwide.

The edible insects market was valued at USD 1.9 Billion in 2024.

IMARC estimates the edible insects market to exhibit a CAGR of 15.51% during 2025-2033

The emergence of insects-based protein powders and supplements, an increase in investments into insects farming startups and ventures, a rise in the acceptance of insects as ingredients for processed foods, and a growing adoption of products as pet food ingredients are some factors driving the market.

In 2024, beetles represented the largest segment by type due to the growing interest in sustainable food sources and innovative dietary choices.

Insects powder leads the market by product due to increased consumption of whole insects and insects powder.

The food and beverage is the leading segment by application, driven by their role in integration into various food and beverage products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global edible insects market include All Things Bugs LLC, Bugsolutely Ltd., Chapul LLC, DeliBugs, Eat Grub Ltd., Entomo Farms, EnviroFlight LLC, EXO Protein (Aspire Food Group), Fluker's Cricket Farm Inc., Jr Unique Foods Ltd., Nutribug Ltd., Thailand Unique., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)