Global Education PC Market Expected to Reach USD 47.6 Billion by 2033 - IMARC Group

Global Education PC Market Statistics, Outlook and Regional Analysis 2025-2033

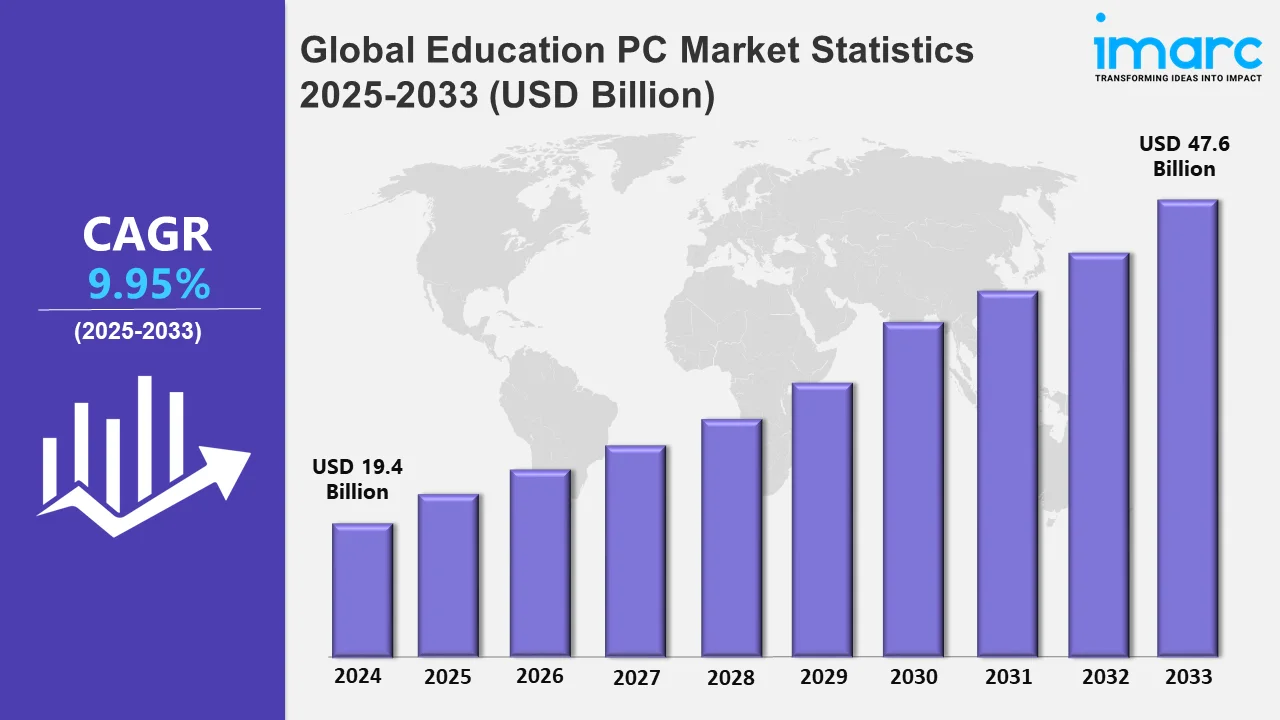

The global education PC market size was valued at USD 19.4 Billion in 2024, and it is expected to reach USD 47.6 Billion by 2033, exhibiting a growth rate (CAGR) of 9.95% from 2025 to 2033.

To get more information on this market, Request Sample

The demand for personalized and interactive learning experiences is majorly driving the global market. The adoption of technology-enhanced pedagogy, at the core of which are PCs, enables customized learning through educational software, e-books, and multimedia content. One of the most important developments was on January 23, 2024, when Lenovo launched the Lenovo 100e Chromebook Gen 4 at Bett UK. The new device is designed to last in rugged student hands and provides security, long-lasting battery life, and MIL-SPEC durability. As part of its broader efforts to help schools in their digital transformation, Lenovo also offers strategic consulting, professional development services, and educational software bundles. The expansion of e-learning platforms and virtual classrooms also pushed the demand for dependable, high-performance PCs to support video conferencing and real-time collaboration. Lenovo innovations target the development of changing needs in education worldwide for quality learning accessibility across all regions.

The market is also driven by the changing educational methodologies, particularly the rise of blended learning models. Combining in-person education with online components, these models demand devices that offer flexibility and connectivity for seamless transitions between physical and virtual learning environments. The increasing emphasis on lifelong learning, with the rise of online courses and certifications, has also supported the demand for PCs to access educational content. Additionally, the rapid integration of technologies such as artificial intelligence (AI) for personalized learning further propels the need for advanced PCs. A recent Wiley survey indicates nearly 60% of college instructors and students are using generative AI in classrooms, with many expecting its growing importance in the coming years. Furthermore, a Washington State University survey reveals that 74% of business professionals believe students should have AI experience before entering the workforce, highlighting the growing relevance of AI education.

Global Education PC Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced technological infrastructure, high demand for e-learning, and significant investments in educational institutions and digital learning tools.

North America Education PC Market Trends:

The market in North America is primarily driven by the region’s rapid technological adoption, a strong preference for e-learning, and substantial investments from governments and educational institutions. The post-pandemic shift towards remote learning accelerated the integration of digital solutions in classrooms, including PCs, as schools and universities increasingly embrace hybrid and online education models. The growing demand for cloud-based platforms, educational software, and interactive tools further augments the role of PCs in enhancing educational experiences. For instance, PowerSchool's recent launch of MyPowerHub on July 23, 2024, consolidates essential educational tools into a single platform, offering multi-language support, mobile accessibility, and AI-powered features like PowerBuddy. This innovation improves communication between parents, students, and educators, enhancing parental engagement and student support.

Asia-Pacific Education PC Market Trends:

Asia-Pacific is one region leading the charge in terms of growth in the education PC market, driven by growth in the adoption of digital education and improvement in technology. Countries are spending millions of dollars across China, India, Japan, and South Korea alone in modernizing educational infrastructures. Online education platforms and e-learning have mushroomed lately, especially in newer markets. Governments are also initiating propitious schemes to close this digital gap and bring personal computers to more schools and universities across the region, thereby augmenting business growth.

Europe Education PC Market Trends:

Europe's market is characterized by the increasing importance of digital literacy and integration of modern technologies in education. Due to strong government initiatives in all countries, funding for digital classrooms has increased and PCs have become an essential part of the educational infrastructure. The UK, Germany, and France have focused on modernizing their education systems through technological integration. Emerging trend of personalized learning, as well as online education, is further propelling the demand for PCs in the education sector.

Latin America Education PC Market Trends:

In Latin America, the market is changing as governments and educational institutions prioritize digital learning solutions. The region is witnessing a growing adoption of PCs in classrooms as part of initiatives aimed at improving educational outcomes and expanding access to quality education. Although internet connectivity challenges persist, increasing investment in technology infrastructure is helping bridge gaps. Additionally, the rise in mobile learning and government-sponsored programs aimed at digital inclusion are propelling demand for PCs in educational settings.

Middle East and Africa Education PC Market Trends:

The education PC market in the Middle East and Africa is experiencing rapid growth, driven by government-led digital transformation initiatives. Countries in the region are heavily investing in education technology to enhance learning outcomes and promote digital skills. Demand for PCs is high in countries such as the UAE, Saudi Arabia, and South Africa, where modernizing education systems and implementing smart classrooms are priorities. The region is embracing e-learning platforms and digital tools despite the challenges of limited access to technology in rural areas to improve the quality of education.

Top Companies Leading in the Education PC Industry

Some of the leading education PC market companies include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., Elitegroup Computer Systems Co. Ltd., HP Development Company L.P., Lenovo Group Limited, and Samsung Electronics Co. Ltd among many others. On August 21, 2024, 4-H, traditionally known for agricultural and domestic skills, embraced technology through partnerships with Apple. The initiative brings coding, robotics, and creative arts to young people, including rural and underserved communities. With mobile classrooms featuring iPads and Apple tools, 4-H empowers kids to develop skills for future careers, fostering innovation and inclusivity, while keeping its focus on personal growth and education.

Global Education PC Market Segmentation Coverage

- Based on product, the market is classified into laptops, desktop, and tablets. Laptop dominates the market segment due to their portability, versatility, and ability to handle a wide range of educational applications. They offer students and educators flexibility to work from various locations, whether in classrooms, libraries, or at home. Additionally, laptops provide better processing power, multitasking capabilities, and long battery life compared to other devices, making them ideal for both in-person and remote learning environments. Their widespread adoption is further fueled by their user-friendly features and affordability.

- On the basis of application, the market has been categorized into primary, secondary, higher education, and others. Higher education leads the education PC market share due to the increasing demand for digital learning tools and resources. Universities and colleges require advanced computing devices to support research, online courses, and collaborative learning. The integration of technology in curricula, coupled with the emerging trend of remote and hybrid learning, drives higher adoption of PCs, particularly laptops and desktops. Additionally, higher education institutions are investing in cutting-edge technology to enhance the learning experience and improve academic outcomes.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 19.4 Billion |

| Market Forecast in 2033 | USD 47.6 Billion |

| Market Growth Rate 2025-2033 | 9.95% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Laptops, Desktop, Tablets |

| Applications Covered | Primary Education, Secondary Education, Higher Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., Elitegroup Computer Systems Co. Ltd., HP Development Company L.P., Lenovo Group Limited, Samsung Electronics Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)