Egypt Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Egypt Advertising Market Overview:

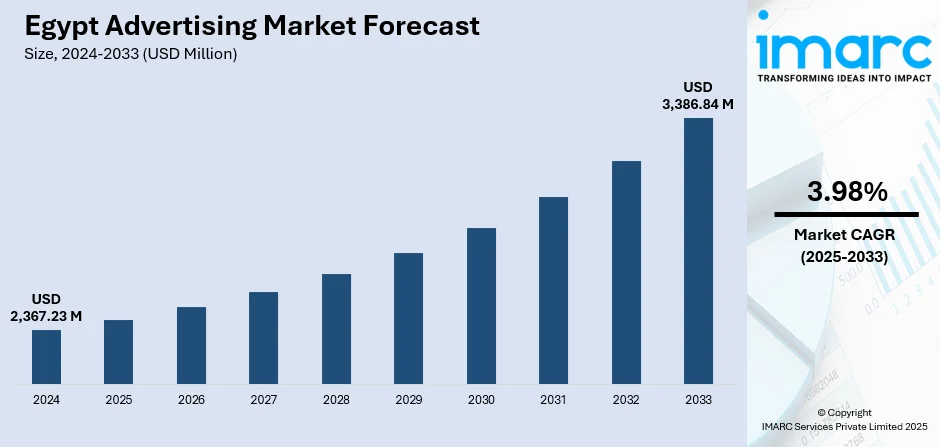

The Egypt advertising market size reached USD 2,367.23 Million in 2024. The market is projected to reach USD 3,386.84 Million by 2033, exhibiting a growth rate (CAGR) of 3.98% during 2025-2033. The market is progressing with digital transformation and enriching consumer engagement across cities. Digital channels, mobile, social media, video, and programmatic formats are driving growth, while traditional media such as TV and outdoor advertising remain relevant in certain regions. Local agencies are increasingly adopting data-informed strategies and creative storytelling to reach diverse audiences more effectively. With regional disparities in media access, advertisers are tailoring campaigns by culture and platform preference. These trends are reshaping the competitive fabric and influencing Egypt advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,367.23 Million |

| Market Forecast in 2033 | USD 3,386.84 Million |

| Market Growth Rate 2025-2033 | 3.98% |

Egypt Advertising Market Trends:

Outdoor Advertising Sees Major Uptick

In January 2025, Egypt’s out-of-home (OOH) advertising sector saw a remarkable surge in activity, based on industry auditing. According to performance metrics, the market expanded sharply in reach and utilization across billboards, urban transit, and digital displays. This growth was driven by accelerated digital out-of-home expansion, which doubled inventory in key metropolitan areas such as Cairo and Alexandria, offering advertisers enhanced opportunities for delivering dynamic and engaging content. Brands are embracing large-scale visuals and interactive placements that engage consumers in high-traffic zones, with new entrants increasing the diversity of ad messaging. The ability to measure impressions more precisely is encouraging media planners to allocate budgets toward OOH formats that deliver tangible exposure metrics. As digital infrastructure improves, these platforms offer seamless integration with mobile and social channels, improving attribution and reach. Advertisers are optimizing creative strategy to balance impactful visuals with measurable metrics. With consumer engagement on the rise, this performance highlights a maturing media mix where outdoor remains central. This momentum underscores robust Egypt advertising market growth as traditional formats strengthen in synergy with digital innovation.

To get more information on this market, Request Sample

Regulatory Reforms Tighten Health & Food Ads

In March 2025, Egypt enacted new advertising regulations targeting health services, medical products, food items, and promotional contests. Under Supreme Council for Media Regulation Decision No. 9 of 2025, all such ads must now secure prior approval from relevant authorities and prominently display registration or license numbers. This shift aims to curb misleading or deceptive messages, requiring strict compliance across press, broadcast, and digital platforms. Advertisers must notify the Consumer Protection Agency before running competitions and ensure full transparency of sponsors. The rules prohibit unverified health claims or therapeutic suggestions in food advertising, reinforcing ethical standards across campaigns. By standardizing disclosures and content approvals, regulators seek to boost consumer trust and protect vulnerable groups. Agencies and media platforms are adapting to pre-screening workflows and documentation requirements to meet new thresholds. The clarity provided by these revisions will influence content strategy, creative planning, and channels selection. Such regulatory evolution is a clear sign of emerging Egypt advertising market trends, reflecting stronger governance over promotional messaging across sectors.

Growth of Retail Media in E‑Commerce Landscape

Egypt’s retail media–advertising embedded within e-commerce platforms and digital marketplacess has gained significant traction in 2025. This channel enables brands to place promotional content directly within shopping environments, aligning messages with consumer purchase intent of consideration. Advertisers are increasingly integrating sponsored product listings, in-app display ads, and search placements into the user journey, enhancing relevance and conversion potential. This model supports rich performance data, allowing brands to track ad exposure through to purchase completion. With Egypt's expanding online retail footprint and increasing consumer trust in digital transactions, retail media offers a scalable, targeted way to engage audiences. Marketers are structuring campaigns around contextual relevance, creative alignment, and sales attribution, forming stronger brand-consumer connections. As this format matures, it is reshaping budgets and strategic planning, especially among advertisers keen to link promotional activity directly to measurable outcomes. Such evolution signals promising trends by merging commerce and advertising more seamlessly across digital retail spaces.

Egypt Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

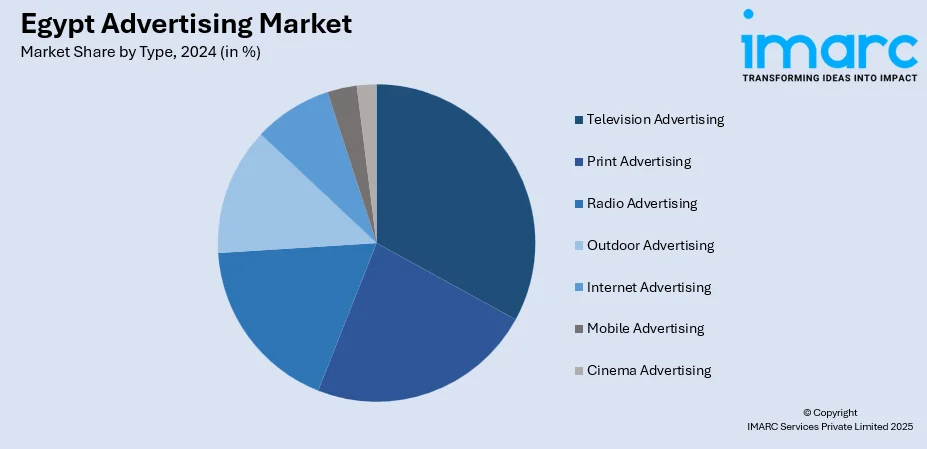

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Advertising Market News:

- January 2025: Egypt’s AdMazad, the company behind the AdMetrics performance analytics platform, has released an update on the country’s out-of-home (OOH) advertising sector. The firm's report highlights a growing demand for outdoor ad placements and the increasing adoption of digital OOH (DOOH) formats. Through detailed audits across major cities including Cairo and Alexandria AdMetrics offers advertisers deeper insights into campaign performance, competitive visibility, and media planning effectiveness. AdMazad continues to position itself at the forefront of data‑driven advertising innovation within Egypt’s evolving media landscape

- February 2025: Egypt’s Etmana, a leading online fashion marketplace active in Egypt and Saudi Arabia, has partnered with AdTech firm GoWit to transform its retail media advertising capabilities. Through this partnership, Etmana will utilize GoWit’s self-service Retail Media Ads platform to deliver personalized ad formats such as sponsored products, brands, displays, and video campaigns across onsite and offsite channels. The collaboration aims to boost customer engagement, enhance brand visibility, and drive performance marketing across the region. It marks a significant step in modernizing Egypt’s e-commerce advertising ecosystem.

Egypt Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt advertising market on the basis of type?

- What is the breakup of the Egypt advertising market on the basis of region?

- What are the various stages in the value chain of the Egypt advertising market?

- What are the key driving factors and challenges in the Egypt advertising market?

- What is the structure of the Egypt advertising market and who are the key players?

- What is the degree of competition in the Egypt advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)