Egypt Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Egypt Agribusiness Market Overview:

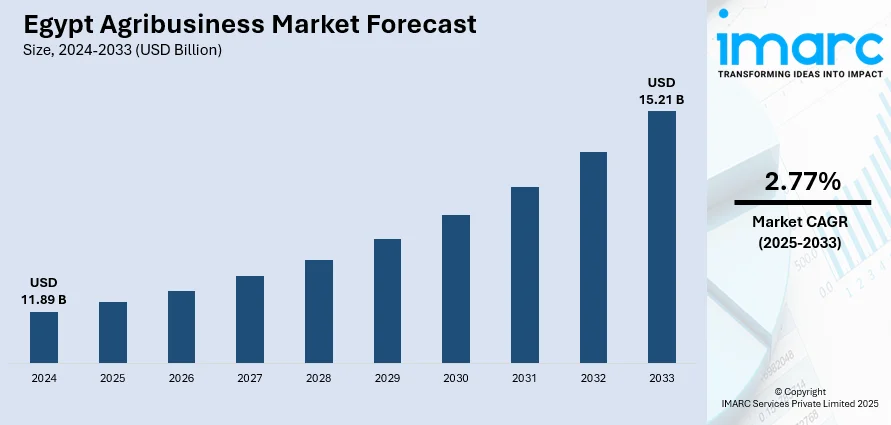

The Egypt agribusiness market size reached USD 11.89 Billion in 2024. The market is projected to reach USD 15.21 Billion by 2033, exhibiting a growth rate (CAGR) of 2.77% during 2025-2033. The government is encouraging contemporary agricultural practices by providing subsidies for high-quality seeds, fertilizers, and equipment, while ensuring farmers and agribusinesses can access low-interest loans. Besides this, increasing export activity is encouraging farmers and agribusiness companies to adopt better farming techniques, thus fueling the Egypt agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.89 Billion |

| Market Forecast in 2033 | USD 15.21 Billion |

| Market Growth Rate 2025-2033 | 2.77% |

Egypt Agribusiness Market Trends:

Increasing government support

Rising government support is positively influencing the market in Egypt. The government is actively promoting modern farming techniques, offering subsidies for quality seeds, fertilizers, and machinery, and facilitating access to low-interest loans for farmers and agribusiness enterprises. It is also investing in infrastructure, such as rural roads, cold storage, and irrigation networks, to improve supply chain efficiency and reduce post-harvest losses. Efforts to modernize agricultural education and training programs help farmers adopt advanced practices, while favorable trade policies and export promotion initiatives are expanding market access for Egyptian products. Public-private partnerships are being encouraged to stimulate agribusiness innovations and processing capabilities. Government initiatives for agricultural water resources focus on efficient irrigation systems, desalination projects, and water-saving technologies to address scarcity and ensure sustainable farming. In October 2024, the Ministry of Water Resources and Irrigation of Egypt (MWRI) joined forces with ICARDA to enhance collaboration in agricultural water resources research and human capacity development and optimize water use in agriculture in Egypt. In order to support advancements in sustainable farming and water management that could assist Egyptian farmers and the wider agricultural industry, the MoU would be valid for three years, automatically renewing for an identical period. Additionally, targeted programs for land reclamation and greenhouse farming are boosting crop yields and diversifying production.

To get more information on this market, Request Sample

Growing exports of agri-food items

Rising exports of agri-food items are impelling the Egypt agribusiness market growth by boosting production, investments, and competitiveness in the sector. As per the data provided by the Ministry of Agriculture and Land Reclamation, Egypt's agricultural exports exceeded 6.9 Million Tons between January 1st to October 16, 2024, totaling USD 4.37 Billion. Egypt’s agricultural products, such as fruits, vegetables, grains, and processed foods, are increasingly in demand in international markets, particularly in Europe, Africa, and the Middle East. This increasing export activity is encouraging farmers and agribusiness companies to adopt better farming techniques, improve quality standards, and wager on modern processing and packaging facilities to meet global requirements. Export revenues provide capital for expanding operations, upgrading infrastructure, and enhancing supply chain efficiency. Moreover, participation in international trade is fostering innovations and compliance with certifications, which also benefits the domestic market. The rising global visibility of Egyptian agri-food products is strengthening the country’s reputation as a reliable supplier, attracting foreign partnerships and technology transfers.

Egypt Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

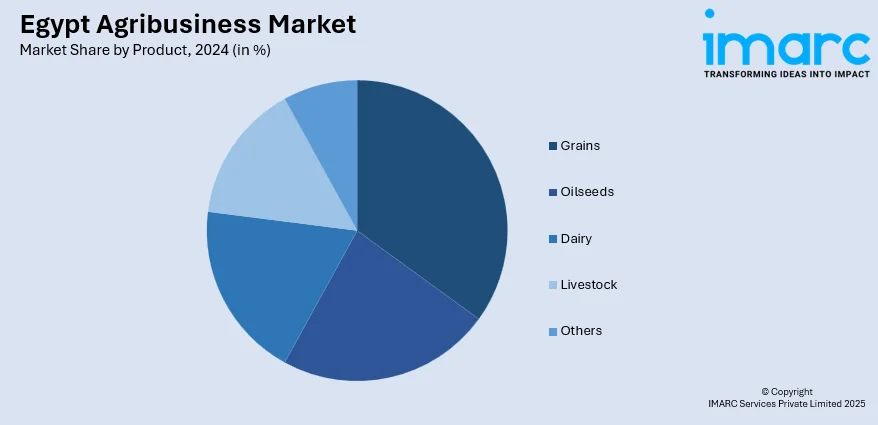

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Agribusiness Market News:

- In July 2025, Mr. Abdel Wahab, Chairperson and Managing Director of the Egyptian Countryside Development Company, welcomed Michał Murkociński, the Polish Ambassador, along with his accompanying delegation, at the company’s headquarters in Cairo, Egypt. The discussion examined opportunities for collaboration between Poland and Egypt's 1.5 Million Feddan Project, one of the largest sustainable agriculture initiatives in the area. Conversations focused on collaborations with leading Polish firms and organizations in agricultural mechanization, smart farming, and food processing.

- In February 2025, SEKEM, a prominent Egyptian social enterprise focused on regenerative development, established a partnership with the Ministry of Petroleum and Mineral Resources, Matrouh Governorate, Egyptian General Petroleum Corporation (EGPC), and IEOC Production B.V to implement the ‘Towards Organic Agriculture’ initiative in Egypt. The project sought to improve organic farming methods in Egypt, especially in Matrouh, by assisting 700 farmers in shifting to organic agriculture.

Egypt Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt agribusiness market on the basis of product?

- What is the breakup of the Egypt agribusiness market on the basis of region?

- What are the various stages in the value chain of the Egypt agribusiness market?

- What are the key driving factors and challenges in the Egypt agribusiness market?

- What is the structure of the Egypt agribusiness market and who are the key players?

- What is the degree of competition in the Egypt agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)