Egypt Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Egypt Animal Feed Market Overview:

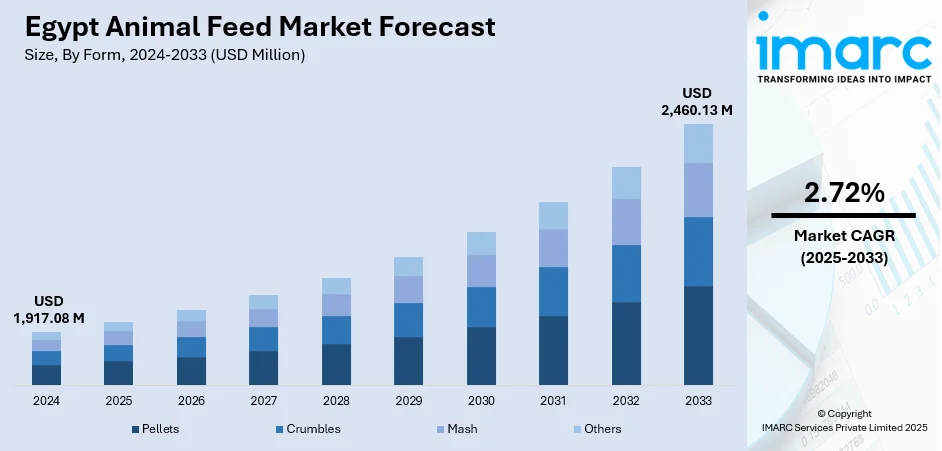

The Egypt animal feed market size reached USD 1,917.08 Million in 2024. The market is projected to reach USD 2,460.13 Million by 2033, exhibiting a growth rate (CAGR) of 2.72% during 2025-2033. The market is growing due to rising demand for quality feed solutions across poultry, livestock, and aquaculture sectors. In addition, increasing investment in local production and feed additives continues to support Egypt animal feed market share across commercial and regional supply networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,917.08 Million |

| Market Forecast in 2033 | USD 2,460.13 Million |

| Market Growth Rate 2025-2033 | 2.72% |

Egypt Animal Feed Market Trends:

Shift Toward Specialized Feed Solutions

The Egypt animal feed market growth is being propelled by rising demand for tailored nutrition across poultry, livestock, and aquaculture sectors. Farmers and feed manufacturers are focusing more on species-specific formulations, which improve animal health and production efficiency. This change comes in response to growing concerns about feed conversion ratios, disease resistance, and antibiotic-free meat production. Companies are investing in research and development to include additives like enzymes, probiotics, and organic acids, which help improve digestion and nutrient absorption. Imports of raw materials such as soybean meal and corn are still key, but there’s also a growing push for local alternatives to reduce costs and supply risks. Large-scale operations are adopting precision feeding systems, improving control over intake and output. These shifts are helping producers manage costs and meet both export and domestic standards. As a result, nutrition-focused feed blends are seeing wider adoption, especially in commercial poultry farms. This trend is also aligning with global standards, allowing Egyptian producers to remain competitive in international markets. Specialized feed is becoming a central driver for long-term gains in animal productivity and market expansion with continuous technological and nutritional improvements.

To get more information on this market, Request Sample

Expansion of Production and Facilities

Ongoing investment in local production capacity is shaping the Egypt animal feed sector. Both multinational and domestic players are opening new plants or upgrading existing ones, aiming to meet the demand for consistent and high-quality supply. One notable example is the recent launch of advanced premix and additive facilities, which aim to support livestock producers with ready-to-use, fortified products. These moves reduce dependency on imports and shorten delivery timelines for vital feed components. Regional demand from North Africa and the Middle East also plays a role in encouraging these expansions, turning Egypt into a possible export hub. Government policies encouraging agribusiness investments and infrastructure development are also playing a part. Tax incentives, easier licensing procedures, and trade agreements are making it easier for firms to scale operations. As capacity increases, economies of scale are expected to bring down production costs, benefitting farmers across the country. In addition, improvements in logistics and storage systems are helping reduce spoilage and ensure the timely delivery of feed. These upgrades in the production chain make the sector more stable and resilient, preparing it for future fluctuations in demand and supply.

Egypt Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

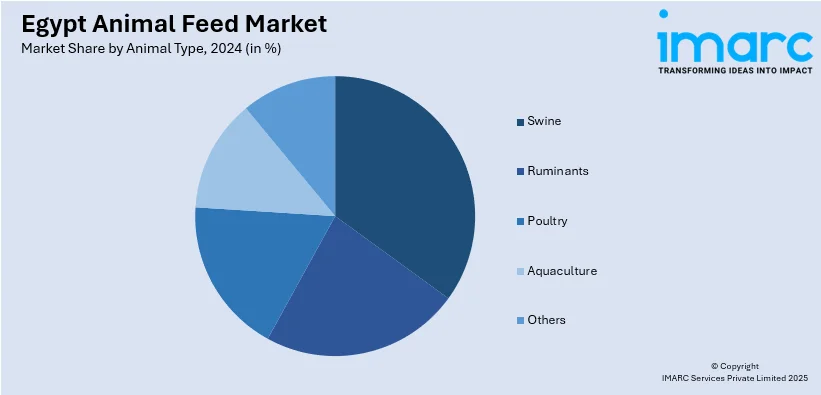

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Animal Feed Market News:

- September 2024: DSM-Firmenich opened a 10,000-Ton annual capacity animal nutrition and health premix plant in Sadat City, Egypt. Serving Egypt, the Middle East, Southern Europe, and Africa, this boosted supply reliability, supported local economic growth, and marked its 50th global production site.

Egypt Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt animal feed market on the basis of form?

- What is the breakup of the Egypt animal feed market on the basis of animal type?

- What is the breakup of the Egypt animal feed market on the basis of ingredient?

- What is the breakup of the Egypt animal feed market on the basis of region?

- What are the various stages in the value chain of the Egypt animal feed market?

- What are the key driving factors and challenges in the Egypt animal feed market?

- What is the structure of the Egypt animal feed market and who are the key players?

- What is the degree of competition in the Egypt animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)