Egypt Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Egypt Carbon Black Market Overview:

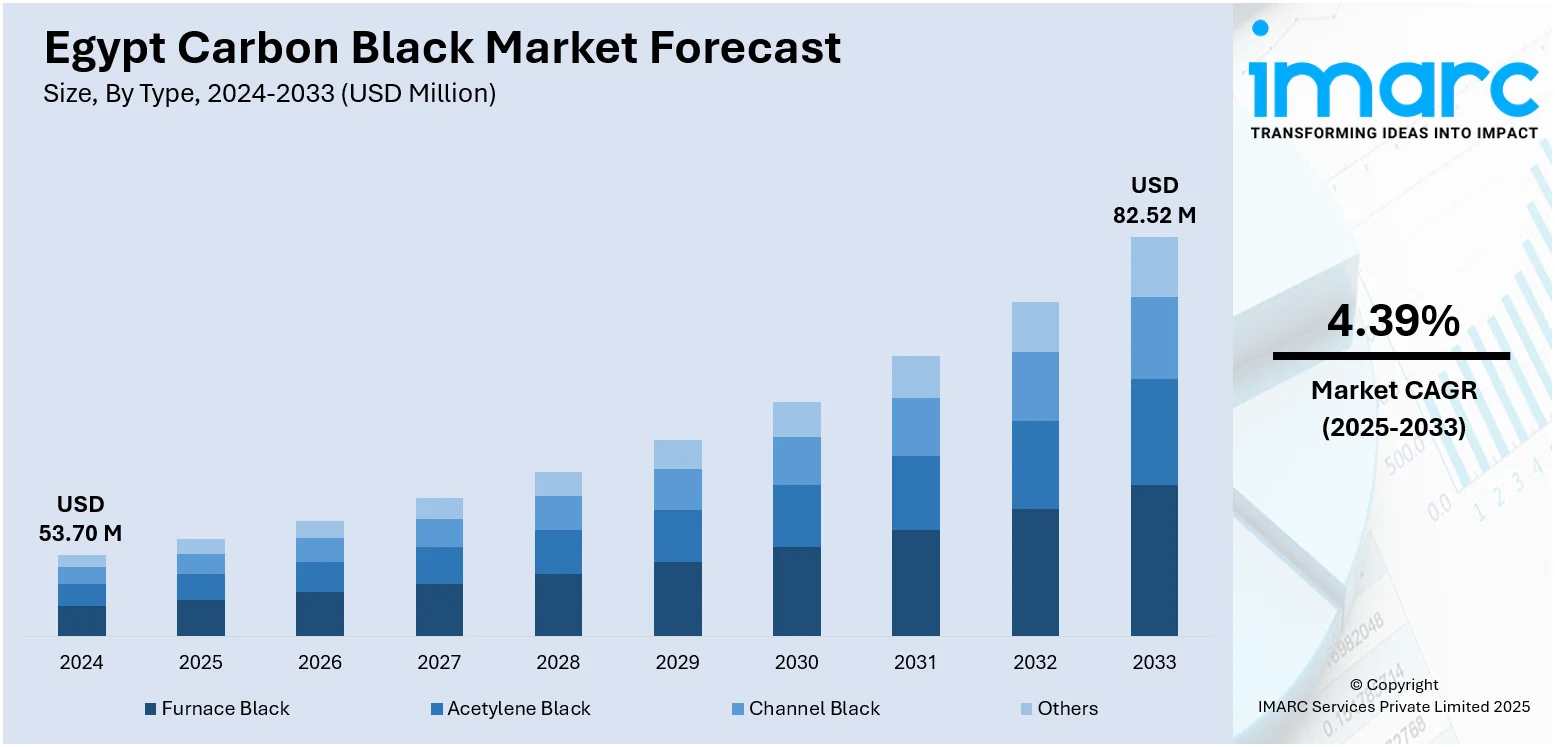

The Egypt carbon black market size reached USD 53.70 Million in 2024. Looking forward, the market is projected to reach USD 82.52 Million by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The market is supported by Egypt’s expanding infrastructure, tire production, and plastic packaging industries. As Egypt diversifies its manufacturing base and strengthens trade ties, demand for carbon black in coatings, cable compounds, and construction materials is expected to rise, further augmenting the Egypt carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53.70 Million |

| Market Forecast in 2033 | USD 82.52 Million |

| Market Growth Rate 2025-2033 | 4.39% |

Egypt Carbon Black Market Trends:

Infrastructure Expansion and Domestic Tire Manufacturing

Egypt's ongoing infrastructure modernization, underpinned by the government’s Vision 2030 plan, is driving significant demand for construction vehicles, passenger cars, and commercial fleets, all of which depend on robust tire supply. Carbon black is a core ingredient in tire treads and sidewalls, providing strength, abrasion resistance, and durability. Local tire production is expanding, with both public and private initiatives supporting new facilities and technological upgrades. While much of Egypt’s carbon black is still imported, the country is steadily building localized compounding and formulation capacity, particularly around Alexandria and the Suez Canal Economic Zone. Government incentives for industrial zones have attracted investments into rubber product manufacturing, spurring demand for stable, high-quality carbon black. Egypt’s carbon black demand is tightly interlinked with its broader development ambitions, where domestic mobility, urban infrastructure, and import substitution are all reinforcing Egypt carbon black market growth.

To get more information on this market, Request Sample

Growth in Plastics Packaging and Black Masterbatch Formulation

Egypt has one of North Africa’s largest plastic processing sectors, particularly in flexible packaging, PET containers, and molded products for FMCG, pharmaceuticals, and agricultural exports. Carbon black plays a vital role in producing UV-stable and opaque plastics, especially for food-safe and logistics-grade packaging. Egyptian converters often rely on masterbatch suppliers in 10th of Ramadan City and Sadat City, where carbon black is blended into carrier resins for black coloration and UV protection. These materials are used in black bottles, caps, agricultural mulch films, drip irrigation components, and garbage bags, all vital in a hot, sun-exposed climate. Increasing environmental awareness is encouraging a shift toward recyclable black plastics and sustainable formulations, where low-PNA and high-dispersion carbon black grades are preferred. In parallel, Egypt’s participation in international trade and free zones has pushed producers to meet EU and GCC standards, further shaping carbon black sourcing and specifications. As local masterbatch manufacturing becomes more sophisticated, value-added use of carbon black is expected to deepen across multiple industries.

Automotive Components, Coatings, and Export Potential

Egypt’s positioning as a strategic manufacturing and re-export hub is enhancing demand for carbon black in automotive parts, industrial goods, and coatings. Local producers of rubber hoses, gaskets, seals, belts, and vibration dampers rely on carbon black to meet performance standards for tensile strength, thermal resistance, and weatherability. Egypt’s automotive component exports to Africa and the Middle East are growing, necessitating consistent rubber compound performance and international certification. In addition, the country’s architectural and industrial coatings sector uses carbon black as both pigment and functional filler, particularly in protective, anti-corrosive, and exterior-grade formulations. Demand is strong from new housing, commercial construction, and energy projects across Egypt’s expanding urban centers and smart city developments. Emerging applications in cable sheathing and polymer composites, especially for oil, gas, and utility infrastructure, further contribute to sustained carbon black consumption. Collectively, these trends highlight how Egypt is integrating carbon black into both its domestic industrialization efforts and its regional export-oriented growth model.

Egypt Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

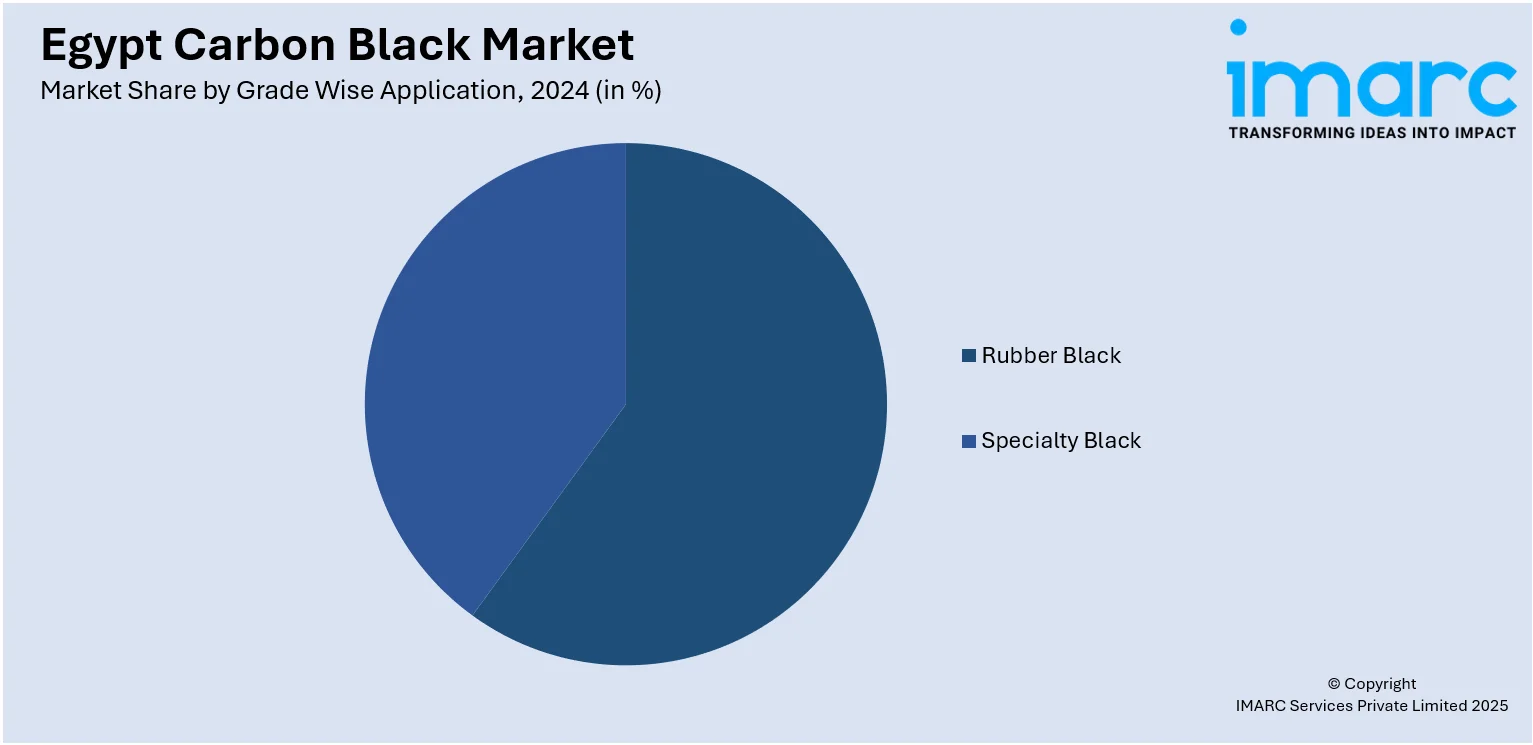

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Carbon Black Market News:

- In June 2024, Birla Carbon announced that its carbon black plant in Egypt (Alexandria) has achieved ISCC PLUS certification, reflecting the company’s commitment to sustainability and traceability in raw materials. This development underscores the growing focus on sustainable and circular practices within the carbon black industry.

- In August 2024, the Egyptian government entered negotiations with a leading Indian carbon black manufacturer to establish a USD 60 Million carbon black production facility in Egypt, according to updates from the Egyptian Commercial Service (ECS). Discussions took place during the India-Africa Business Conference in New Delhi, and a delegation is expected to visit Egypt soon to evaluate potential sites for the plant.

Egypt Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt carbon black market on the basis of type?

- What is the breakup of the Egypt carbon black market on the basis of grade wise application?

- What is the breakup of the Egypt carbon black market on the basis of region?

- What are the various stages in the value chain of the Egypt carbon black market?

- What are the key driving factors and challenges in the Egypt carbon black market?

- What is the structure of the Egypt carbon black market and who are the key players?

- What is the degree of competition in the Egypt carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)