Egypt CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Egypt CCTV Camera Market Overview:

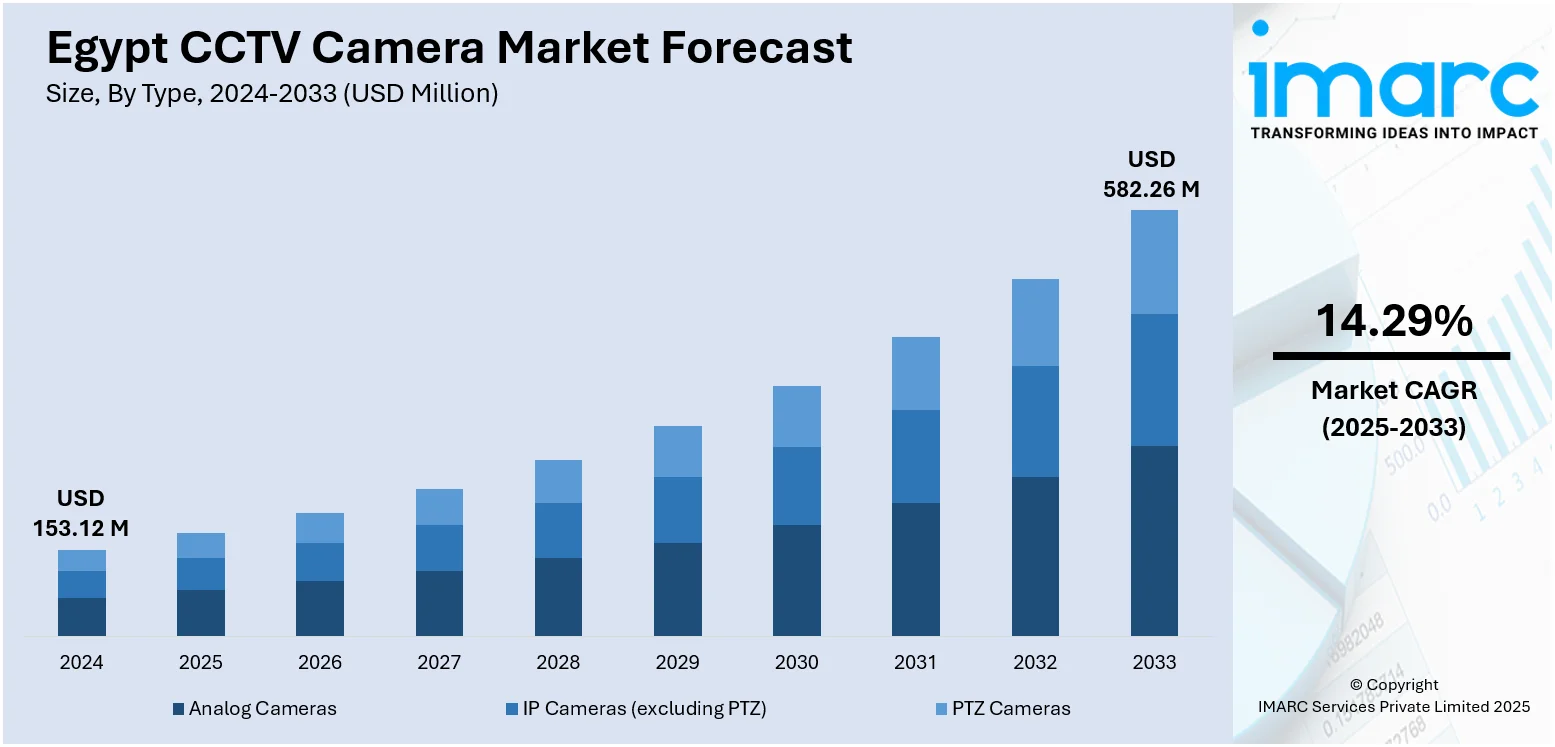

The Egypt CCTV camera market size reached USD 153.12 Million in 2024. Looking forward, the market is projected to reach USD 582.26 Million by 2033, exhibiting a growth rate (CAGR) of 14.29% during 2025-2033. The market is growing steadily, driven by rising security concerns, urban infrastructure development, and increasing adoption of advanced surveillance technologies. Demand is supported by government initiatives for public safety and private sector investments in commercial and residential security systems. The shift toward IP-based and AI-enabled solutions is enhancing market potential, strengthening Egypt CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 153.12 Million |

| Market Forecast in 2033 | USD 582.26 Million |

| Market Growth Rate 2025-2033 | 14.29% |

Egypt CCTV Camera Market Trends:

Growing Adoption of IP-Based and Networked Surveillance Systems

The evolution from analog to IP-based surveillance systems is revolutionizing Egypt's CCTV environment. IP cameras provide enhanced image quality, scalability, and the capacity for integration with various security and building management systems. Their connectivity to networks allows for remote access, real-time monitoring, and simplified system upgrades. Increasingly, businesses, government entities, and residential complexes are opting for these solutions due to their efficiency and flexibility. Furthermore, IP-based systems lower long-term operational costs by optimizing maintenance and utilizing existing network infrastructures. This shift is backed by expanding broadband access and the demand for more intelligent, interconnected security solutions, positioning IP technology as the preferred option for both new installations and system enhancements in Egypt’s growing security market.

To get more information on this market, Request Sample

Integration of AI Features such as Facial Recognition and Behavior Analytics

Artificial Intelligence is significantly enhancing the functionality of CCTV systems in Egypt. Contemporary surveillance solutions are incorporating AI-driven features such as facial recognition, object detection, and behavior analytics to facilitate proactive threat detection and quicker response times. These innovations assist security personnel in distinguishing critical alerts from routine footage thereby boosting operational efficiency. AI-driven analytics also aid in crowd management, traffic observation, and access control proving beneficial for both public and private sector applications. This progress aligns with the country’s smart city projects and an increasing focus on intelligent security infrastructure driving the Egypt CCTV camera market growth through improved accuracy, automation, and real-time decision-making capabilities.

Rising Demand for High-Definition and 4K Resolution Cameras

The necessity for clearer and more detailed surveillance footage is escalating the demand for high-definition and 4K resolution CCTV cameras in Egypt. These advanced cameras deliver exceptional image clarity, enabling more effective identification of individuals, vehicles, and incidents even under challenging lighting conditions. High-resolution footage is crucial for evidence collection in law enforcement, significantly enhancing the accuracy and reliability of investigations. Commercial establishments, retail spaces, and public facilities favor such solutions to minimize blind spots and bolster monitoring effectiveness. Moreover, advancements in compression technologies are making high-resolution systems more economically accessible and storage efficient. This trend underscores a growing focus on precision and quality in surveillance solutions, ensuring optimal performance in security operations.

Egypt CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

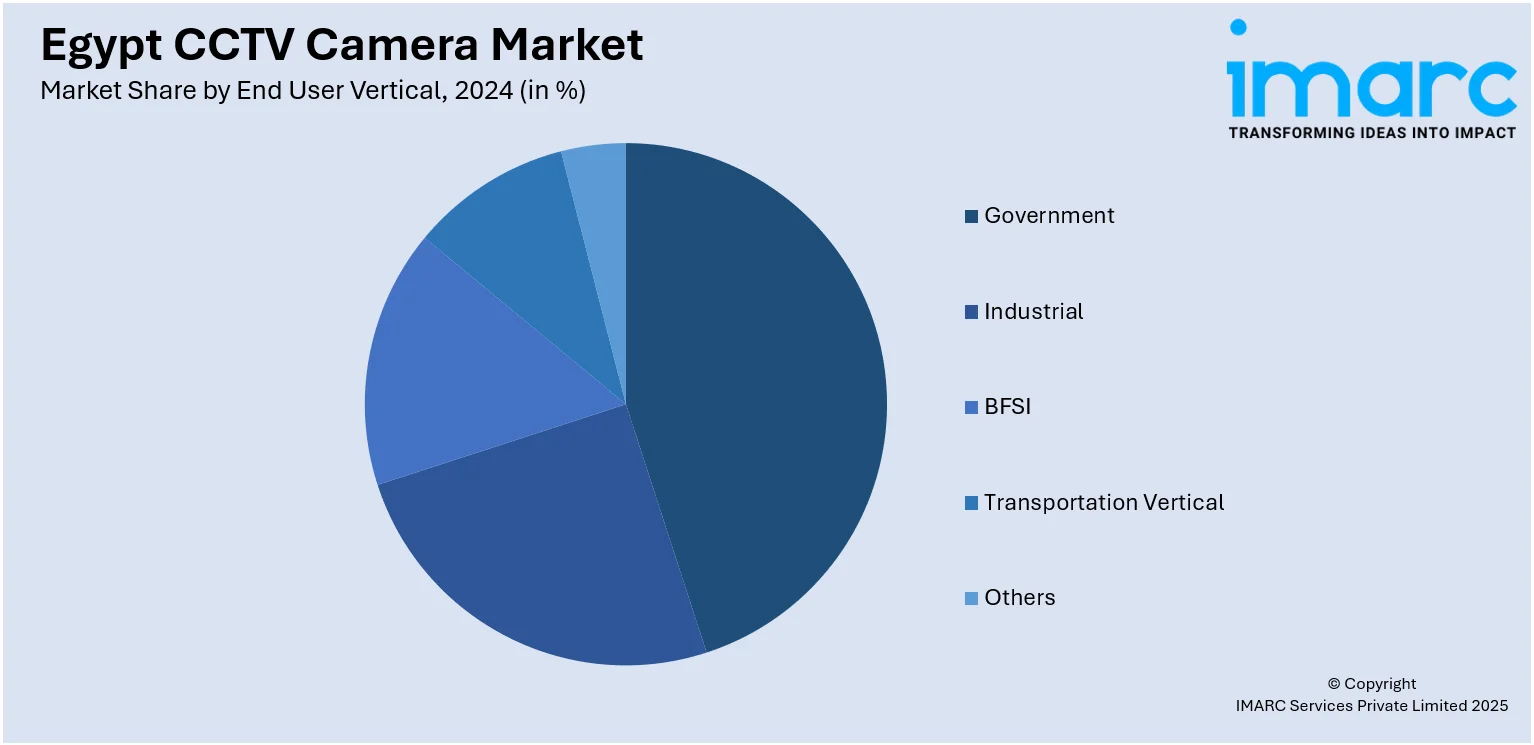

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt CCTV Camera Market News:

- In January 2024, Egypt's new capital featured over 6,000 surveillance cameras aimed at enhancing safety and monitoring public spaces. However, digital rights experts warn that this poses a threat to freedoms amidst ongoing repression under President Sisi's regime. Critics argue the project prioritizes surveillance over personal privacy and civil liberties.

Egypt CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt CCTV camera market on the basis of type?

- What is the breakup of the Egypt CCTV camera market on the basis of end user vertical?

- What is the breakup of the Egypt CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Egypt CCTV camera market?

- What are the key driving factors and challenges in the Egypt CCTV camera market?

- What is the structure of the Egypt CCTV camera market and who are the key players?

- What is the degree of competition in the Egypt CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)