Egypt Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

Egypt Commercial Insurance Market Summary:

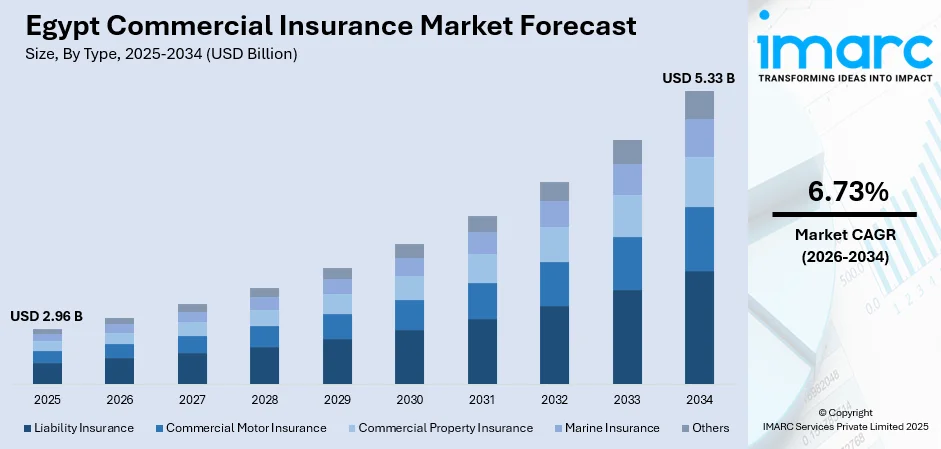

The Egypt commercial insurance market size was valued at USD 2.96 Billion in 2025 and is projected to reach USD 5.33 Billion by 2034, growing at a compound annual growth rate of 6.73% from 2026-2034.

The market is experiencing substantial momentum as Egyptian enterprises increasingly prioritize comprehensive risk mitigation strategies and operational continuity planning. Regulatory modernization through the Unified Insurance Law has enhanced industry transparency while mandatory coverage requirements across professional liability and construction sectors are broadening demand. The accelerating digital transformation of insurance distribution, combined with growing awareness among small and medium enterprises regarding asset protection, continues to strengthen the Egypt commercial insurance market share across manufacturing, logistics, and service industries.

Key Takeaways and Insights:

- By Type: Commercial motor Insurance leads the market with a share of 28% in 2025, driven by the expanding vehicle fleet requirements of logistics and transportation enterprises seeking comprehensive coverage for cargo and passenger operations.

- By Enterprise Size: Large enterprises dominate the market with a share of 62% in 2025, attributable to their complex risk profiles and regulatory compliance requirements across multiple operational domains.

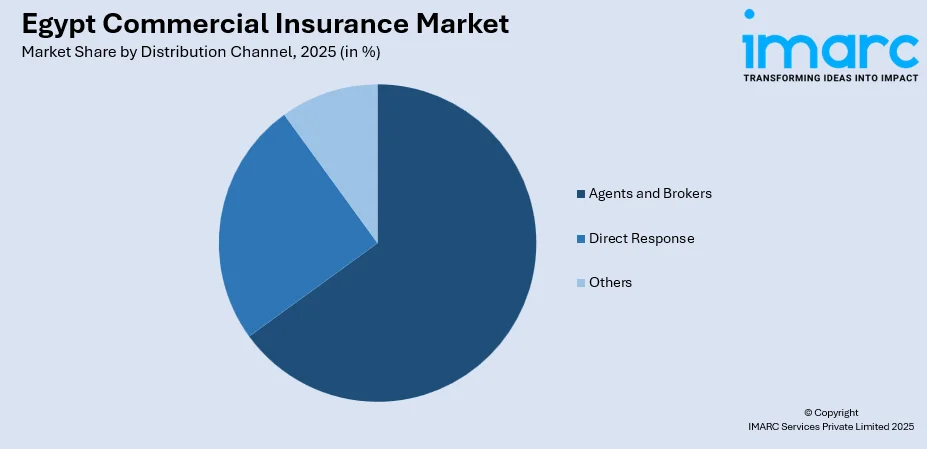

- By Distribution Channel: Agents and Brokers hold the largest market share of 65% in 2025, owing to their established corporate relationships and expertise in customizing complex coverage packages for commercial clients.

- By Industry Vertical: Transportation and Logistics represents the leading segment with a share of 20% in 2025, propelled by Egypt's strategic position as a global trade corridor and expanding port infrastructure requirements.

- Key Players: The Egypt commercial insurance market exhibits a competitive structure with established domestic insurers competing alongside international insurance groups, with market participants focusing on product innovation, digital capabilities, and specialized industry expertise to differentiate their offerings.

To get more information on this market Request Sample

The Egyptian commercial insurance sector is undergoing significant transformation supported by regulatory reforms and increasing corporate risk awareness. The enactment of the Unified Insurance Law No. 155 of 2024 has consolidated previously fragmented regulations into a cohesive framework, enhancing transparency and operational efficiency across the industry. In April 2025, AXA Egypt launched the country's first gold investment fund linked to insurance products, demonstrating the sector's innovation trajectory toward integrated financial solutions. Meanwhile, the Financial Regulatory Authority has implemented new capital requirements and governance standards that are strengthening insurer financial stability. The growing emphasis on digital distribution channels is reshaping how commercial clients access and manage their coverage, with insurtech platforms providing streamlined policy comparison and claims processing capabilities that appeal to modern enterprises.

Egypt Commercial Insurance Market Trends:

Accelerating Digital Transformation of Insurance Distribution

The Egyptian commercial insurance sector is witnessing rapid digitalization as insurers invest substantially in technology platforms to enhance customer accessibility and operational efficiency. Insurance companies are deploying digital policy issuance systems, automated claims processing workflows, and mobile applications that enable corporate clients to manage their coverage portfolios seamlessly. EG Insurtech, which provides technological services to nearly half of the Egyptian insurance market, exemplifies this transformation by connecting insurers with policyholders through AI-powered platforms. Digital insurance transactions increased substantially throughout recent periods as businesses demonstrate growing comfort with online platforms for procurement and policy management.

Emergence of Specialized Industry-Specific Coverage Solutions

Commercial insurance providers are increasingly developing tailored coverage products designed to address unique risk profiles within specific industry verticals. Beyond traditional property, fire, and liability offerings, insurers are introducing policies covering cyber threats, management liability, professional indemnity, and specialized contractual obligations. This trend reflects evolving corporate understanding of insurance as a proactive risk management tool rather than merely post-incident financial protection. In October 2024, five leading Egyptian insurers including Misr Insurance and Orient Insurance partnered with Changelabs to develop and launch SME-focused insurance products with enhanced distribution models, demonstrating the industry's commitment to market-specific solutions.

Regulatory Modernization Enhancing Market Transparency

The implementation of Egypt's Unified Insurance Law No. 155 of 2024 represents a watershed moment for the commercial insurance sector, consolidating previous regulatory frameworks into a comprehensive unified structure. The Financial Regulatory Authority now holds exclusive licensing and supervisory authority over all insurance entities, establishing enhanced governance standards, consumer protection measures, and capital requirements. In February 2025, the FRA issued Decision No. 15 outlining new incorporation and licensing requirements for insurance companies, requiring joint-stock company structures and minimum capital thresholds. This regulatory evolution is boosting corporate confidence in engaging with insurers while attracting international market participants.

Market Outlook 2026-2034:

The Egypt commercial insurance market is positioned for sustained expansion as economic modernization, infrastructure development, and regulatory reforms create favorable conditions for premium growth. The market generated a revenue of USD 2.96 Billion in 2025 and is projected to reach a revenue of USD 5.33 Billion by 2034, growing at a compound annual growth rate of 6.73% from 2026-2034. Ongoing government initiatives to enhance financial inclusion and mandatory coverage requirements across professional sectors are expected to expand the policyholder base. Investment in the Suez Canal Economic Zone and major infrastructure projects will sustain demand for construction, engineering, and liability coverage. Additionally, rising awareness among medium enterprises regarding operational risk protection and the continued expansion of digital distribution channels will support market penetration across previously underserved corporate segments.

Egypt Commercial Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Commercial Motor Insurance | 28% |

| Enterprise Size | Large Enterprises | 62% |

| Distribution Channel | Agents and Brokers | 65% |

| Industry Vertical | Transportation and Logistics | 20% |

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Commercial motor insurance dominates the market with a share of 28% of the total Egypt commercial insurance market in 2025.

The commercial motor insurance segment derives its market leadership from the fundamental requirement for fleet coverage among Egyptian enterprises operating transportation and distribution networks. The Egyptian Compulsory Vehicle Insurance system mandates basic coverage for all commercial vehicles, creating a foundational demand layer that insurers expand through comprehensive policy offerings. Commercial fleet operators increasingly seek coverage extending beyond mandatory third-party liability to include collision damage, theft protection, cargo coverage, and business interruption provisions.

The segment benefits from Egypt's expanding logistics infrastructure and growing commercial vehicle registrations across industrial and service sectors. Insurance providers are enhancing motor offerings with telematics integration, usage-based pricing, and expedited claims processing to attract corporate fleet managers seeking operational efficiency alongside risk protection.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with a share of 62% of the total Egypt commercial insurance market in 2025.

Large enterprises constitute the dominant policyholder segment due to their extensive asset portfolios, complex operational risks, and regulatory compliance obligations that necessitate comprehensive insurance programs. Major corporations operating across manufacturing, energy, telecommunications, and financial services require multi-layered coverage addressing property protection, liability exposures, professional indemnity, and business continuity considerations. These organizations typically maintain relationships with specialized insurance brokers who design integrated risk transfer solutions.

The capital and compliance requirements introduced through the Unified Insurance Law have reinforced large enterprise engagement with commercial insurers seeking demonstrable financial stability and governance standards. In January 2025, the Financial Regulatory Authority raised minimum capital requirements for insurance companies, with specialized insurers serving petroleum, aviation, and energy sectors required to maintain enhanced capital bases. This regulatory framework provides large enterprises with greater confidence in insurer solvency and claims-paying capability.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Agents and Brokers

- Direct Response

- Others

Agents and brokers account for the largest share of 65% of the total Egypt commercial insurance market in 2025.

The agents and brokers distribution channel maintains market dominance through established expertise in navigating complex corporate insurance requirements and longstanding relationships with commercial clients. Insurance brokers provide valuable intermediary services by assessing enterprise risk profiles, comparing coverage options across multiple insurers, and negotiating favorable policy terms on behalf of corporate policyholders. This consultative approach proves particularly valuable for commercial clients requiring customized coverage packages that address industry-specific exposures.

Recent regulatory developments have enhanced broker professionalism and market standing. In May 2025, the Financial Regulatory Authority issued Decree No. 69 of 2025 establishing new rules governing the incorporation of insurance and reinsurance brokerage companies, including minimum capital requirements and professional standards.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics represent the leading segment with a share of 20% of the total Egypt commercial insurance market in 2025.

The transportation and logistics vertical commands the largest industry share owing to Egypt's strategic geographic position as a major international trade corridor and the essential nature of cargo protection across supply chain operations. Companies engaged in shipping, freight forwarding, warehousing, and road transport require comprehensive coverage spanning marine cargo, inland transit, warehouse liability, and fleet insurance to protect goods moving through Egyptian ports and distribution networks.

Egypt's Suez Canal Economic Zone continues to attract significant investment in logistics infrastructure, generating sustained demand for commercial insurance products. DP World recently launched the Sokhna Logistics Park in the Suez Canal Zone, expanding cold storage and distribution capabilities that require substantial property and cargo coverage. Additionally, insurance premiums for vessels transiting the Suez Canal and Red Sea have received attention following regional disruptions, with the Suez Canal Authority implementing incentives in May 2025 including transit fee discounts for container vessels to support shipping companies managing elevated risk exposures.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The Greater Cairo metropolitan region serves as the commercial and financial center of Egypt, concentrating the headquarters of major corporations, financial institutions, and multinational enterprises that constitute the primary commercial insurance policyholder base. The region's dense business infrastructure encompasses manufacturing facilities, corporate offices, retail centers, and service operations that generate substantial demand across all commercial insurance categories. The presence of major insurance company headquarters and brokerage firms in Cairo facilitates direct access to comprehensive coverage solutions for regional enterprises.

As Egypt's principal Mediterranean port city, Alexandria hosts significant maritime commerce, manufacturing operations, and trade-oriented businesses requiring specialized commercial coverage. The city's industrial zones and port facilities generate demand for marine cargo insurance, property coverage for manufacturing plants, and liability protection for enterprises engaged in export-oriented production. Alexandria's established manufacturing base in textiles, petrochemicals, and food processing supports sustained commercial insurance activity.

The Suez Canal region has emerged as a strategic commercial hub attracting substantial industrial investment and logistics operations within the Suez Canal Economic Zone. Enterprises establishing manufacturing, assembly, and distribution facilities within designated industrial zones require comprehensive commercial insurance coverage spanning construction, property, liability, and operational risks. The region's role as a global trade transit point generates specialized demand for marine and cargo insurance products protecting goods moving between Mediterranean and Red Sea shipping lanes.

The Nile Delta region encompasses significant agricultural processing, textile manufacturing, and industrial operations distributed across multiple governorates. Commercial insurance demand reflects the region's diverse economic activities including food and beverage production, garment manufacturing, and agricultural enterprises requiring crop and property protection. Medium-sized enterprises operating throughout Delta cities increasingly engage with commercial insurers for coverage addressing facility protection and operational liability.

Remaining Egyptian regions including Upper Egypt, Red Sea tourism zones, and developing industrial corridors contribute to commercial insurance demand through sector-specific activities. Tourism enterprises along the Red Sea coast require hospitality and liability coverage, while emerging industrial projects in Upper Egypt generate construction and property insurance requirements.

Market Dynamics:

Growth Drivers:

Why is the Egypt Commercial Insurance Market Growing?

Expansion of Industrial Manufacturing and Economic Diversification Initiatives

Egypt's strategic focus on industrial development and economic diversification is generating substantial demand for commercial insurance products across manufacturing, processing, and production sectors. The Government's initiatives to position Egypt as a regional manufacturing hub have attracted significant investment in automotive assembly, petrochemicals, textiles, construction materials, and food processing facilities that require comprehensive property, liability, and operational coverage. Industrial zones across the country are experiencing expansion as domestic and international manufacturers establish production capabilities to serve local and export markets. The Suez Canal Economic Zone has emerged as a premier destination for manufacturing investment, with target industries including automotive components, chemicals, and agribusiness operations. Chinese company Jushi previously signed contracts for planned manufacturing expansions in the Ain Sokhna zone with substantial investment allocations, exemplifying the industrial development trajectory supporting insurance demand. These manufacturing facilities require multi-layered coverage addressing machinery breakdown, business interruption, product liability, and worker protection across their operational lifecycles.

Rising Foreign Direct Investment and Multinational Corporate Establishment

The influx of foreign direct investment into Egypt is creating sustained commercial insurance demand as international corporations establish local operations requiring coverage aligned with global risk management standards. Multinational enterprises entering the Egyptian market bring expectations for comprehensive insurance programs comparable to their coverage in other jurisdictions, driving premium growth and product sophistication. International insurers are expanding their Egyptian presence to serve these corporate clients. Foreign companies establishing manufacturing facilities, regional headquarters, distribution centers, and service operations require coverage spanning property protection, professional indemnity, and employee benefits. The government's investment promotion efforts through entities like the General Authority for Investment and agreements with overseas investors are attracting corporations that contribute to commercial insurance market expansion through their systematic approach to risk transfer and protection requirements.

Growth of Small and Medium Enterprise Ecosystem and Entrepreneurship Support

The expanding small and medium enterprise sector represents a significant growth frontier for commercial insurance as government initiatives and financial inclusion efforts bring previously uninsured businesses into the formal coverage market. Egypt's SME ecosystem encompasses millions of enterprises across retail, services, light manufacturing, and professional sectors that increasingly recognize the protective value of commercial insurance for business continuity. The Financial Regulatory Authority has implemented measures supporting SME access to insurance, including raising micro-insurance coverage limits to EGP 312,500 in early 2025 and establishing frameworks for specialized microinsurance companies with reduced capital requirements of EGP 40 million.

Market Restraints:

What Challenges the Egypt Commercial Insurance Market is Facing?

Low Insurance Penetration and Limited Market Awareness

Despite regulatory progress and economic growth, Egypt's commercial insurance penetration rate remains significantly below global and regional averages, reflecting substantial unexplored market potential alongside awareness challenges. Many small and medium enterprises lack sufficient understanding of insurance benefits and the protective value of coverage against operational risks. Limited insurance literacy among business owners, combined with prioritization of immediate operational expenditures over risk protection investments, constrains market expansion into underserved corporate segments.

Economic Volatility and Currency Fluctuations

Macroeconomic challenges including inflation pressures and currency volatility present ongoing obstacles for commercial insurers and their corporate policyholders. Currency depreciation impacts insurer operational viability and complicates pricing for policies with long-term liability exposures. Enterprises facing economic uncertainty may reduce insurance expenditures or defer coverage expansion, constraining premium growth during periods of macroeconomic instability that affect business profitability and investment capacity.

Fragmented Distribution Infrastructure Outside Major Urban Centers

Commercial insurance distribution remains concentrated within major metropolitan areas, with limited broker and agent presence in secondary cities and regional industrial zones. Enterprises operating outside Greater Cairo and Alexandria may face challenges accessing specialized commercial coverage products and expert advisory services. The distribution gap constrains market penetration among medium-sized enterprises in emerging industrial regions that lack convenient access to insurance expertise.

Competitive Landscape:

The Egypt commercial insurance market features a moderately competitive structure with established domestic insurers, regional players, and international insurance groups operating across multiple product categories. Major domestic participants leverage extensive branch networks and longstanding corporate relationships to maintain market positions, while international insurers contribute specialized expertise and product innovation capabilities. Competition increasingly centers on digital transformation, with market participants investing in technology platforms to enhance customer accessibility, streamline policy administration, and improve claims processing efficiency. Insurers are differentiating through industry-specific coverage solutions, risk advisory services, and integrated financial products that address evolving corporate requirements. The regulatory modernization through the Unified Insurance Law has established enhanced capital and governance standards that may accelerate market consolidation while raising entry barriers for smaller participants.

Recent Developments:

- In September 2024, UAE-based Orient Insurance confirmed plans to expand commercial and life insurance operations in Egypt, building upon its existing Orient Takaful subsidiary presence. Orient Insurance, which holds the highest credit ratings in Africa and the Middle East from AM Best and S&P, is targeting growth across commercial insurance lines including fire, property, motor vehicles, and marine cargo coverage.

Egypt Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Egypt Commercial Insurance market size was valued at USD 2.96 Billion in 2025.

The Egypt Commercial Insurance market is expected to grow at a compound annual growth rate of 6.73% from 2026-2034 to reach USD 5.33 Billion by 2034.

Commercial Motor Insurance held the largest type segment share with 28% of the market in 2025, driven by mandatory vehicle coverage requirements and the expanding fleet protection needs of logistics and transportation enterprises operating across Egyptian commercial networks.

Key factors driving the Egypt Commercial Insurance market include regulatory modernization through the Unified Insurance Law enhancing market transparency, strategic infrastructure development generating sustained coverage demand, and growing corporate adoption of formal risk management practices across industrial and service sectors.

Major challenges include low insurance penetration and limited awareness among small and medium enterprises, macroeconomic volatility affecting business investment in coverage, fragmented distribution infrastructure outside major metropolitan areas, and the ongoing need for skilled insurance professionals to serve expanding market requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)