Egypt Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Egypt Confectionery Market Overview:

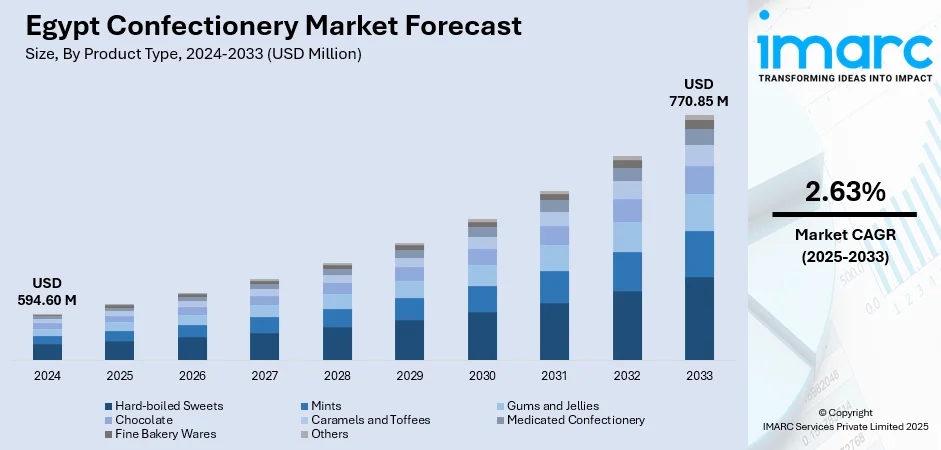

The Egypt confectionery market size reached USD 594.60 Million in 2024. The market is projected to reach USD 770.85 Million by 2033, exhibiting a growth rate (CAGR) of 2.63% during 2025-2033. The market is driven by rising disposable incomes, a growing youth population, and increasing demand for affordable indulgence. Urbanization and the expansion of modern retail outlets have improved product accessibility. Additionally, health-conscious innovations like sugar-free and organic sweets are gaining popularity. Local and international brands are intensifying competition through new product launches and aggressive marketing, contributing to the rising Egypt confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 594.60 Million |

| Market Forecast in 2033 | USD 770.85 Million |

| Market Growth Rate 2025-2033 | 2.63% |

Egypt Confectionery Market Trends:

Trend Towards Health-Focused and Functional Confectionery

Egypt's confectionery market is witnessing a significant change as consumers start to become more health-focused. Growing awareness about lifestyle conditions, including diabetes and obesity, is promoting the demand for low-sugar, organic, and functional confectionery products. These are foods enriched with vitamins, minerals, or plant-based ingredients meant to aid digestion or enhance energy. The trend is especially dominant among urban middle-class shoppers who want indulgence without sacrificing their well-being aspirations. Brands therefore reformulate classical products by cutting back on artificial additives and substituting synthetic sweeteners with natural sweeteners such as stevia or date sugar. Additionally, the increased popularity of transparent product labeling and allergen-free products is a sign of a consumer trend toward quality and transparency. This shift in consumer behavior is driving Egypt confectionery market growth as brands realign their portfolios to cater to contemporary dietary choices and lifestyles centered on wellness.

To get more information on this market, Request Sample

Growth of Modern Retail and E-commerce Channels

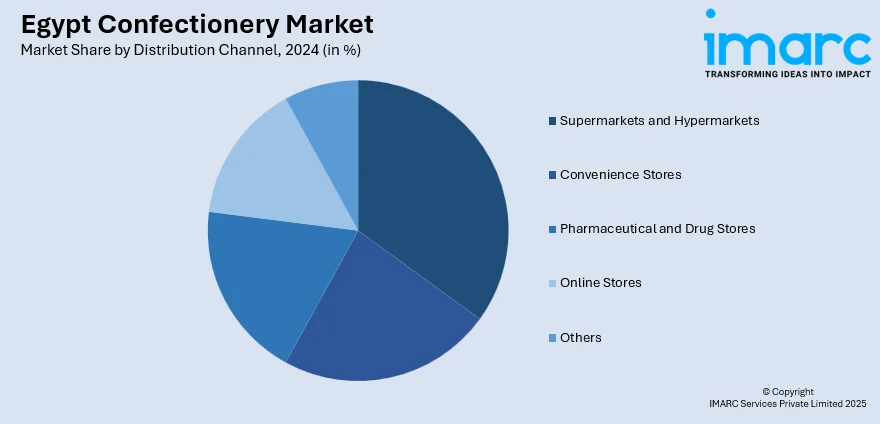

The expansion of digital platforms and modern retail formats is transforming the Egypt confectionery market's distribution map. Supermarkets, hypermarkets, and convenience stores have emerged as first points of purchase, which sell a variety of confectionery items under one umbrella. These stores offer a source through which visibility of products is enhanced, placement is optimized, and promotional campaigns are carried out to increase consumer interaction. At the same time, the growth of e-commerce and mobile shopping apps is increasing market access, particularly among younger, technologically advanced consumers in urban centers. Online channels provide the convenience of home delivery, wider selection of products, and digital promotions, additionally shaping purchasing behavior. Such an omnichannel strategy is enhancing market penetration and building brand loyalty in both premium and mass-market segments. The diversified retail environment not only facilitates quicker product turnover but also allows for more specific marketing strategies, finally increasing consumer reach and adding to Egypt confectionery market share.

Preference for Local Taste and Tailored Products

Egyptian consumers are increasingly turning to confectionery products that are aligned with local taste and cultural preferences. Local flavors like dates, rosewater, cardamom, and tahini are being innovatively blended into newer forms like chocolate bars, candies, and filled biscuits. The localization approach builds higher emotional bonds with consumers through the combination of nostalgia and novelty. Concurrently, there is increasing demand for personalized offerings, such as limited-edition products for religious and celebration periods like Ramadan and Eid. Seasonal flavor launches and custom packaging drive impulse buys and repeat purchase. Younger generations also value products that blend international confectionery formats with Egyptian culinary traditions. Reflecting broader export ambitions and innovation, in June 2024, M.O. Group announced its participation in the Fancy Food Show in New York, showcasing Egyptian confectionery and chocolate brands aiming to boost exports from an already 80% year‑on‑year growth in 2023. This trend is not only creating product differentiation but also expanding the confectionery appeal to cross-cultural consumer segments. With continued alignment of innovation with cultural needs, firms enhance brand loyalty and long-term engagement, which further drives Egypt confectionery market growth.

Egypt Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Confectionery Market News:

- In March 2024: Nestlé inaugurated its first confectionery manufacturing facility in Egypt, situated in 6th of October City, with an investment of approximately EGP 65 million (around US$9 million), according to Food Processing Technology and Egypt Foods Group. The plant is dedicated to producing Crunch chocolate snacks, primarily for the domestic market and eventually for export across North Africa. This launch marks a key step toward localized production and signals a strategic expansion within Egypt’s confectionery industry.

- In April 2024: Covertina invested US$6.5 million to build a new confectionery factory in Egypt, aiming to boost exports and launch new products tailored for local and African markets.

Egypt Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt confectionery market on the basis of product type?

- What is the breakup of the Egypt confectionery market on the basis of age group?

- What is the breakup of the Egypt confectionery market on the basis of price point?

- What is the breakup of the Egypt confectionery market on the basis of distribution channel?

- What is the breakup of the Egypt confectionery market on the basis of region?

- What are the various stages in the value chain of the Egypt confectionery market?

- What are the key driving factors and challenges in the Egypt confectionery market?

- What is the structure of the Egypt confectionery market and who are the key players?

- What is the degree of competition in the Egypt confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)