Egypt Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities), and Region 2026-2034

Egypt Construction Market Overview:

The Egypt construction market size reached USD 29,317.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 58,689.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.62% during 2026-2034. The market is experiencing robust growth, driven by urbanization, extensive infrastructure projects, and increased foreign investments. Key trends include sustainable construction practices, technological advancements, and significant government-led initiatives, such as the development of new cities and major transportation projects, thereby enhancing the sector's expansion and modernization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 29,317.5 Million |

|

Market Forecast in 2034

|

USD 58,689.1 Million |

| Market Growth Rate 2026-2034 | 7.62% |

Access the full market insights report Request Sample

Egypt Construction Market Trends:

Adoption of Advanced Construction Technologies and Sustainable Practices

Innovations like building information modeling (BIM), prefabrication, and sophisticated project management tools enhance efficiency, lower expenses, and speed up project schedules. Such technological innovations facilitate greater accuracy, better resource management, and elevated safety standards, resulting in enhanced construction results. Moreover, increasing consciousness regarding environmental effects and energy efficiency is encouraging the adoption of green building standards and sustainable materials. Developers are adopting sustainable designs that reduce carbon emissions and enhance resource efficiency, in line with worldwide sustainability movements and local environmental regulations. This transition not only satisfies the growing demand for ethical building practices but also attracts international investors focused on sustainable development. Through adopting innovation and sustainability, the Egyptian construction industry improves its competitiveness, resilience, and capacity to fulfill changing market demands.

Infrastructure Modernization in Transportation Networks

The modernization and enhancement of Egypt's transportation infrastructure, encompassing roads, bridges, railways, and ports, represent a crucial factor propelling the growth of the market. Effective transportation networks are essential for economic growth, enabling trade, movement, and connections between urban and rural regions. Government actions to enhance current infrastructure and develop new transport routes seek to alleviate congestion, enhance safety, and promote industrial and commercial endeavors. For example, in 2025, Egypt and the French Development Agency (AFD) signed a €70 million credit facility for the Rubeiki–Belbeis railway project, part of a €215 million initiative to connect key industrial zones. The 63.5-kilometer railway aims to enhance logistics, reduce congestion, and support sustainable transport. Such initiatives frequently demand extensive civil engineering knowledge, materials, and project management skills. The creation of multimodal transport centers and logistics hubs further improves supply chain effectiveness. Expenditures on transportation infrastructure also draw regional and global trade, increasing demand for related construction services. This enhancement not only elevates residents' quality of life but also bolsters Egypt’s role as a regional center for trade and transit.

Growing Demand for Healthcare Infrastructure

With population expansion and increasingly intricate healthcare requirements, there is a rise in the need for hospitals, clinics, and specialized medical facilities in both urban and rural areas. Investments from both the government and private sector seek to enhance healthcare access, quality, and capacity, necessitating the development of modern medical facilities equipped with advanced technologies and compliant architectures. For instance, in 2024, Egypt's Minister of Planning, Dr. Hala El-Said, announced that 58 hospitals would be completed in the 2024/2025 development plan with an investment of EGP 2.6 billion. Besides this, the industry's growth also encompasses the establishment of medical research facilities and wellness centers, enhancing public health and medical tourism. This emphasis on healthcare infrastructure promotes enduring social development objectives and strengthens the overall resilience of the national healthcare system. The need for specialized construction skills in the design and construction of health facilities drives innovation and the implementation of global standards.

Egypt Construction Market Growth Drivers:

Expansion of Real Estate Sector and Housing Demand

The growth of Egypt's real estate sector is a key factor influencing the construction market, driven by a rising population and escalating income levels of the urban middle class. The increasing need for both budget-friendly and luxury housing is leading to a strong influx of residential initiatives, ranging from economical apartments to upscale developments. Additionally, government initiatives designed to promote homeownership, like mortgage financing programs and subsidies, are encouraging buyer engagement in the housing market. The expansion of mixed-use projects that integrate residential, commercial, and recreational areas further broadens construction possibilities. For example, in 2025, Just Development, an Egyptian real estate firm, announced plans for a $21 million mixed-use project in the New Administrative Capital. The 12-storey development will feature offices, retail units, and serviced apartments, with construction slated to begin in Q1 2026. This dynamic real estate landscape promotes ongoing need for construction supplies, workforce, and creative building strategies.

Development of Industrial Zones and Economic Cities

The establishment and expansion of industrial zones and economic cities in Egypt are crucial contributors to the construction market growth as they attract investment, drive the demand for specialized infrastructure, and support the country’s broader economic diversification efforts. Construction operations in these areas include production plants, distribution hubs, housing for employees, and business facilities. The establishment of these hubs aids the government's wider strategy for economic diversification, decreasing dependence on conventional sectors and promoting industrial expansion. As a result, the need for customized construction services and personalized infrastructure solutions grows. Such projects frequently entail intricate engineering demands and advanced technologies, fostering innovation in the construction industry. The extent and range of industrial zone development generate substantial job prospects and boost supporting markets, such as material supply and professional services.

Improvement in Regulatory Environment and Project Financing

Mandates designed to streamline the process of obtaining permits, registering land, and licensing construction help eliminate bureaucratic delays and enhance transparency, creating a more appealing environment for investment. Efficient processes promote increased involvement from local and global developers, enabling easier project start-up and finalization. Furthermore, the increase in financing alternatives, comprising long-term loans, mortgage services, and public-private collaborations, offers essential capital to support extensive construction initiatives. The presence of organized financial tools reduces risks and improves the viability of intricate projects. Government-supported assurances and incentives enhance investor support, boosting confidence in the industry. These financial and regulatory enhancements foster market stability, encourage innovation, and advance sustainable growth by facilitating the prompt execution of infrastructure and real estate initiatives, ultimately aiding Egypt's economic modernization objectives.

Egypt Construction Market News:

- In June 2025, Egypt launched a $200-million solar manufacturing project in Ain Sokhna with China’s Sunrev Solar. The facility will boost local solar production, with a first phase focused on solar cells and modules, followed by a second phase for essential raw materials. The complex is expected to generate $300 million annually, enhancing Egypt's position as a solar manufacturing hub in the MENA region.

- In May 2025, Voya Development launched its $40 million COY residential project in Sheikh Zayed City, West Cairo. The 42-acre development will feature 80% green coverage and is expected to be completed in four years. The project will incorporate smart technology through a partnership with Vodafone and will contribute to Voya's expansion plans in the region.

- In April 2025, UK-based Innovo Group, formerly Al Shafar Group, announced plans to launch two real estate projects in Egypt. The first, Park Street Edition, a mixed-use development in New Cairo, will focus on wellness and sustainability with a construction cost of EGP 7bn. This marks Innovo's debut in Egypt’s real estate sector, part of its broader expansion strategy.

- In June 2024, Egis, a global architecture and consulting group, has been awarded a major contract to lead the transformation of Alexandria's metro line in Egypt. Egis will provide crucial services for the project, including Project Implementation Unit support, contract management, and construction supervision. The project, named Abou Qir Metro, aims to modernize the existing diesel train service into an efficient electric metro system, spanning 22 kilometers and featuring new, sustainable metro stations along the route.

- In May 2024, Siemens Mobility achieved major milestones by advancing the construction and delivery of high-speed rail infrastructure and rolling stock in Egypt. The project encompasses the development of electrified lines spanning 2,000 km that are designed to run at speeds of up to 250 km/h. Siemens is also tasked with supplying essential railway systems and management tools. The upcoming network will function autonomously from the current main lines of Egyptian National Railways.

Egypt Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on sector.

Sector Insights:

To get detailed segment analysis of this market Request Sample

- Residential

- Commercial

- Industrial

- Infrastructure (Transportation)

- Energy and Utilities

The report has provided a detailed breakup and analysis of the market based on the sector. This includes residential, commercial, industrial, infrastructure (transportation), and energy and utilities.

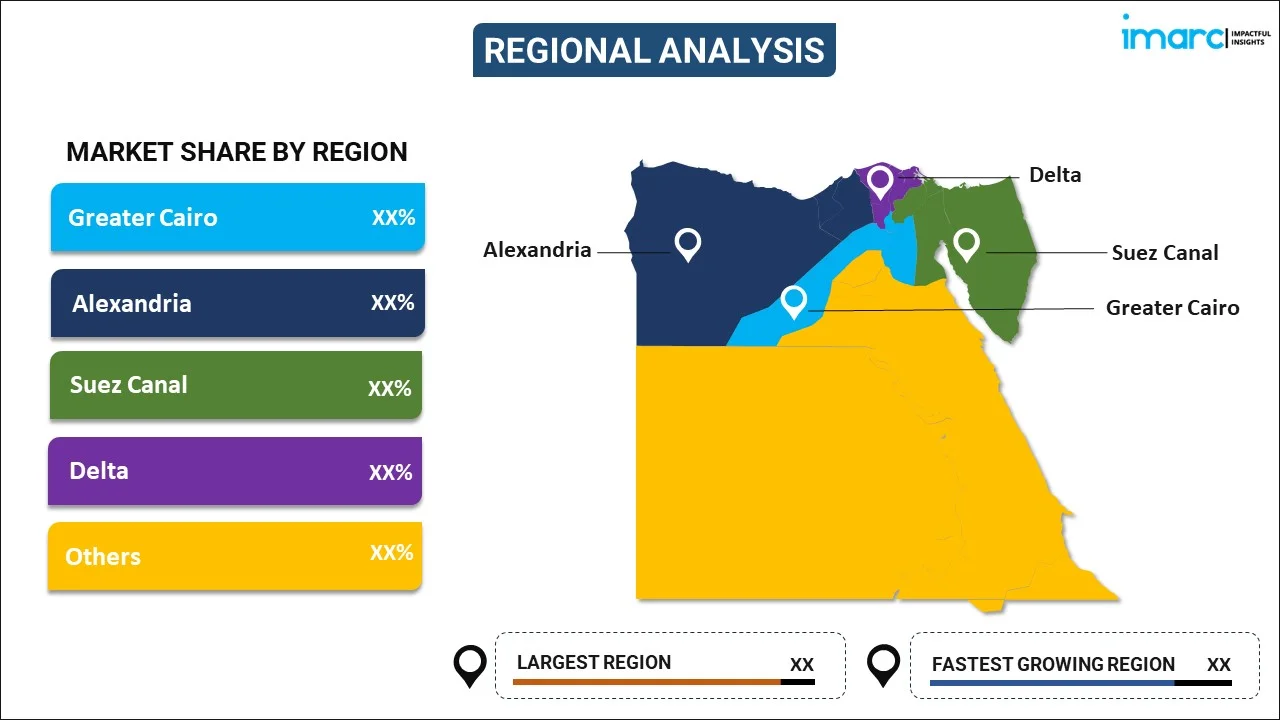

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction market in Egypt was valued at USD 29,317.5 Million in 2025.

The Egypt construction market is projected to exhibit a CAGR of 7.62% during 2026-2034, reaching a value of USD 58,689.1 Million by 2034.

The Egypt construction market is driven by robust government infrastructure investments, urbanization, and increasing demand for residential and commercial developments. Economic growth, favorable regulatory reforms, and rising foreign direct investment further influence the market. Additionally, advancements in construction technology and a growing focus on sustainable building practices offer a positive market outlook.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)