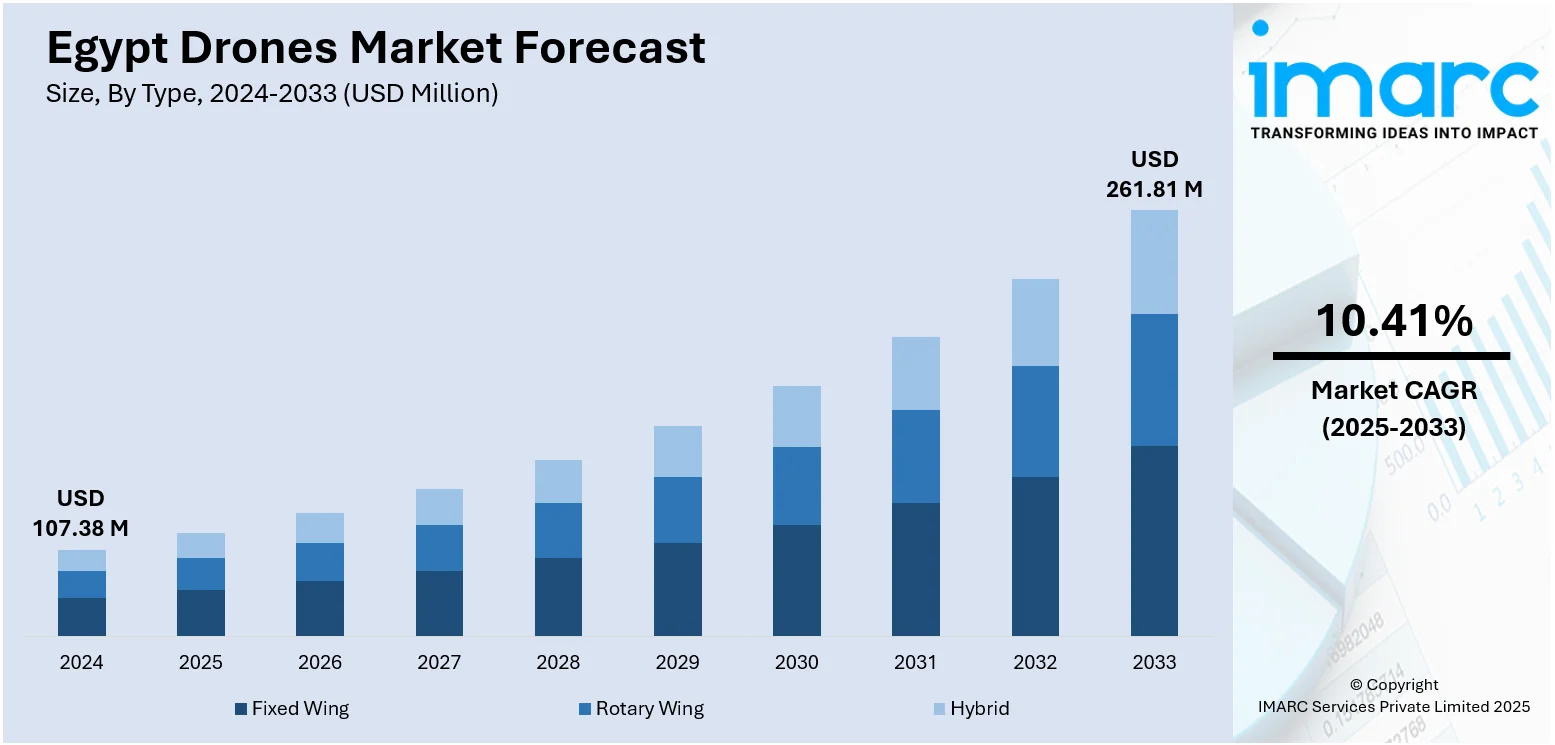

Egypt Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Egypt Drones Market Overview:

The Egypt drones market size reached USD 107.38 Million in 2024. Looking forward, the market is expected to reach USD 261.81 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is fueled by increasing uses in agriculture, infrastructure, security, and environmental monitoring. With expansive desert land and dense agricultural areas along the Nile, drones provide effective solutions for crop monitoring, land surveying, and irrigation control. Government-sponsored infrastructure developments and urban city expansions also drive demand for aerial surveying and monitoring. Rising utilization of drones in border patrol, maritime surveillance, and emergency response missions, further fuel the Egypt drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.38 Million |

| Market Forecast in 2033 | USD 261.81 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Egypt Drones Market Trends:

Agriculture and Environmental usage of Drones in Egypt

In Egypt, drones are increasingly revolutionizing agricultural operations and environmental management by offering customized solutions to the country's unique ecological conditions. With the Nile Delta and Upper Egypt agricultural belts in command, drone technology is central to precision agriculture, for use in crop monitoring for health, irrigation management, and optimal usage of pesticides over rice paddies, wheat fields, and miles of cotton plantations. In areas like the Western Desert oases and Sinai, drones are used in watershed mapping and desert reclamation efforts, in aid of government sustainable land use programs. Environmental authorities also use UAVs to track coastal erosion along the Mediterranean coast, evaluate mangrove well-being in the Red Sea regions, and support conservation activities for threatened species such as some sea turtles. This development of using drone platforms equipped with thermal imaging cameras and multispectral sensors indicates Egypt's increasing interest in using aerial data to conserve natural assets and improve food security under adverse climate conditions, which also contributes to the Egypt drones market growth.

To get more information on this market, Request Sample

Construction, Urban Planning, and Infrastructure Trends

Egypt's urbanization, particularly in mega-projects across the new administrative capital, and in developments that go beyond Greater Cairo, Alexandria and the Nile corridor, has driven the application of drones in urban planning and construction fields to a higher pace. UAVs are used on an everyday basis for aerial surveys, monitoring large-scale construction projects, and observing progress on infrastructure like bridges, roads, and utility installations. Drones generate 3D mapping that underpins the design of new smart city grids, and real-time imagery helps remote project managers oversee projects. When it comes to large-scale hospitality and tourism infrastructure development along the Red Sea Riviera and around Aswan and Luxor, drones provide priceless information that helps ensure structural stability and compliance with safety regulations. This transition toward drone-based surveying and mapping services is a pivotal trend, assisting companies in cutting down the evaluation times, lessening human exposure to risky situations, and providing precise geospatial intelligence for Egypt's changing built environment.

Security, Defense and Disaster Response Integration

Security and disaster response needs are promoting another core trend in Egypt's drone industry as public agencies and private organizations embrace unmanned options for increased situational awareness. In border and sea areas, Egyptian security uses surveillance drones to follow up on unauthorized crossing, smuggling corridors, and sea traffic in the Mediterranean and along the Red Sea coast. During large national occasions such as festivals at Giza or public rallies in Cairo, drone systems are used for crowd management, emergency planning and swift incident response. As increasing danger of sandstorms and flash flooding in arid and rural regions, civil defense units have started using drones with thermal cameras and radio communication for rescue and search operations, particularly in remote and inaccessible terrain. Private security companies and critical infrastructure providers, especially near airports and energy installations, are meanwhile spending in anti-drone technology and perimeter surveillance drones. The overlap of defense-grade deployment of UAVs with commercial necessity highlights a distinctly Egyptian phenomenon merging national security concerns with civilian uses of drones.

Egypt Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

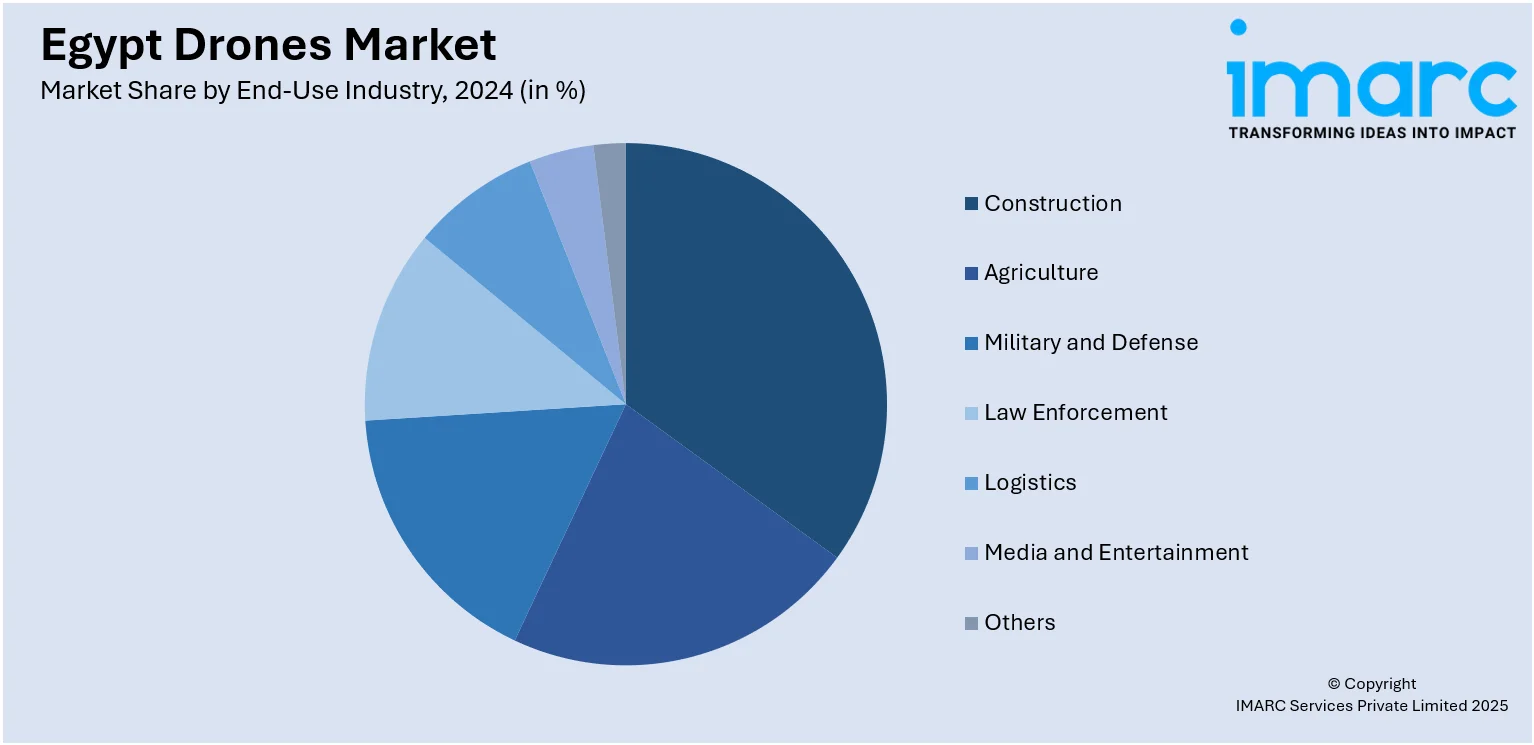

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Drones Market News:

- In September 2024, the Egyptian firm Robotics Engineering Systems (RES) presented its domestically produced drones and advanced munitions during the inaugural Egypt International Airshow (EIAS 2024), taking place at El Alamein International Airport for three days. The company's main product, the "6th of October" drone, was a major draw. It is an unmanned aerial vehicle for multiple missions, completely designed, developed, and produced in Egypt. It was initially presented at the Egypt Defence Expo (EDEX 2023).

Egypt Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt drones market on the basis of type?

- What is the breakup of the Egypt drones market on the basis of component?

- What is the breakup of the Egypt drones market on the basis of payload?

- What is the breakup of the Egypt drones market on the basis of point of sale?

- What is the breakup of the Egypt drones market on the basis of end-use industry?

- What is the breakup of the Egypt drones market on the basis of region?

- What are the various stages in the value chain of the Egypt drones market?

- What are the key driving factors and challenges in the Egypt drones market?

- What is the structure of the Egypt drones market and who are the key players?

- What is the degree of competition in the Egypt drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)