Egypt Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Egypt Electric Two-Wheeler Market Overview:

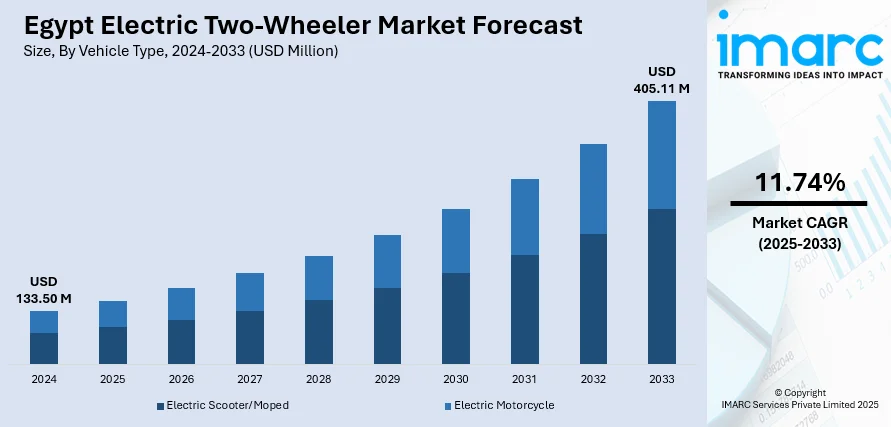

The Egypt electric two-wheeler market size reached USD 133.50 Million in 2024. The market is projected to reach USD 405.11 Million by 2033, exhibiting a growth rate (CAGR) of 11.74% during 2025-2033. The market is driven by strong government support through subsidies and infrastructure expansion to combat pollution and reduce fuel dependence. Urban congestion and rising fuel prices increase demand for affordable, compact electric two-wheelers, ideal for daily commuting. Technological advances in battery efficiency have lowered costs and extended range, enhancing electric vehicles’ practicality and reliability. Together, these factors create a favorable environment, encouraging consumers to switch to electric two-wheelers for economical, eco-friendly, and convenient transportation thus surging the Egypt electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 133.50 Million |

| Market Forecast in 2033 | USD 405.11 Million |

| Market Growth Rate 2025-2033 | 11.74% |

Egypt Electric Two-Wheeler Market Trends:

Government Incentives and Policy Support

One of the significant Egypt electric two-wheeler market trend is the Egyptian government pivotal role in advancing the electric two-wheeler market through comprehensive policies and incentives. To reduce greenhouse gas emissions and reduce dependence on imported fossil fuels, the government actively promotes electric mobility as a sustainability priority. It offers subsidies of up to EGP 50,000 for the first 100,000 electric vehicle buyers, significantly lowering upfront costs and making EVs more affordable. Simultaneously, efforts to expand charging infrastructure across urban areas enhance convenience for users. The government also encourages local manufacturing and assembly of electric vehicles through tax exemptions and support, boosting the domestic industry and creating jobs. By implementing regulations and financial incentives, these initiatives reduce barriers for producers and consumers alike. Together, they create a favorable environment for innovation and market growth, accelerating electric two-wheeler adoption in Egypt’s congested cities and promoting cleaner, more sustainable transportation nationwide.

To get more information on this market, Request Sample

Technological Advancements in Electric Vehicles

Rapid technological advancements in electric vehicle (EV) components, particularly batteries, significantly boost the appeal of electric two-wheelers in Egypt. Improvements in lithium-ion battery technology have increased energy density and extended range, addressing range anxiety—a major concern among users. Meanwhile, production innovations have reduced battery costs, making electric two-wheelers more affordable. Enhanced battery life and faster charging capabilities improve user convenience and reliability, essential for daily commuters and commercial users. Moreover, the integration of smart technologies, such as IoT-enabled monitoring and mobile apps, enhances the overall user experience. These innovations mitigate previous limitations like limited range, long charging times, and high upfront costs. As a result, technological progress directly supports wider EV adoption in Egypt, making electric two-wheelers a competitive alternative to traditional fuel-powered vehicles in both performance and price.

Urban Congestion and Affordability

Egypt’s densely populated cities, like Cairo and Alexandria, face severe traffic congestion, with Cairo’s Traffic Congestion Index reaching 13.53 in November 2023, reflecting significant delays. Rising fuel prices and the high cost of traditional vehicles strain many residents’ budgets, making daily commuting challenging. Electric two-wheelers offer an affordable, efficient alternative ideal for urban lifestyles. Their compact size allows easier navigation through congested streets, reducing commute times. Lower operating and maintenance costs compared to gasoline motorcycles appeal to cost-conscious users, including delivery workers and young professionals. Producing zero tailpipe emissions, electric two-wheelers help address critical air pollution issues in crowded cities. This blend of economic and practical benefits fuels strong demand, positioning electric two-wheelers as a smart, sustainable solution to Egypt’s urban mobility and environmental challenges thus aiding the Egypt electric two-wheeler market growth.

Egypt Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

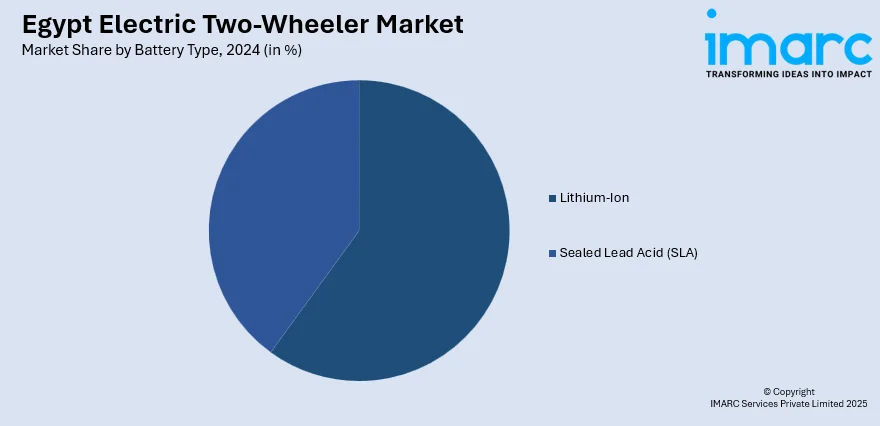

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Electric Two-Wheeler Market News:

- In January 2025, Ezz LCV, TVS Motor’s authorized distributor in Egypt, has launched a new assembly line in Giza with a USD 6.5 million investment. The facility can produce up to 100,000 units annually, assembling popular models like the TVS Apache RTR, HLX Series, and XL 100. This move aims to boost local manufacturing, improve delivery times, support the dealer network, and create job opportunities in Egypt’s growing electric two-wheeler market.

Egypt Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Egypt electric two-wheeler market on the basis of battery type?

- What is the breakup of the Egypt electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Egypt electric two-wheeler market on the basis of peak power?

- What is the breakup of the Egypt electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Egypt electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Egypt electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Egypt electric two-wheeler market?

- What are the key driving factors and challenges in the Egypt electric two-wheeler market?

- What is the structure of the Egypt electric two-wheeler market and who are the key players?

- What is the degree of competition in the Egypt electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)