Egypt Food and Grocery Retail Market Report by Product (Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning and Household, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores and Departmental Stores, Online), and Region 2026-2034

Egypt Food and Grocery Retail Market Overview:

The Egypt food and grocery retail market size reached USD 38.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 56.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.01% during 2026-2034. The market is driven by the growing number of mobile internet users, rapid urbanization, changing individual preferences, rising e-commerce platforms and digitalization, ongoing infrastructure development, and increasing health and wellness trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 38.6 Million |

| Market Forecast in 2034 | USD 56.0 Million |

| Market Growth Rate (2026-2034) | 4.01% |

Access the full market insights report Request Sample

Egypt Food and Grocery Retail Market Trends:

Increasing Number of Mobile Internet Users

As per the Egypt State Information Service website content updated in 2023, the number of mobile internet users in Egypt reached 63.4 million in 2021. The rise of mobile internet users is fueling the growth of e-commerce platforms in Egypt. People can now conveniently browse, order, and pay for groceries through their mobile devices. This is leading to the emergence of online grocery shopping platforms, offering a wide range of products and delivery options. Mobile internet allows individuals to shop for groceries anytime and anywhere, eliminating the need to visit physical stores. This convenience factor is driving more people towards online grocery shopping, especially those with busy schedules or limited access to transportation. Moreover, as mobile internet penetration is rising continuously, more people in even remote or underserved areas can buy groceries. Even in rural areas where physical supermarkets may be scarce, mobile internet users can access online grocery platforms and have products delivered to their doorstep.

In line with this, online grocery platforms use data analytics and artificial intelligence to offer users more than just the purchase history, but unique proposal and personalized product offers. It elevates the shopping experience and increases the likelihood of repeat business. Mobile internet users often get special offers, discounts, and deals through online grocery platforms or mobile apps. These incentives encourage more people to purchase food and grocery items online, thereby aiding in the expansion sales through the online channel and helping in growth of the e-commerce sector in the food and grocery retail segment.

Rapid Urbanization

An article published in 2024 on the website of the Central Intelligence Agency (CIA), the urban population in Egypt was 43.1% of total population in 2023. Urban areas tend to have higher population densities, which translates to a larger customer base for food and grocery retailers. The concentration of people in cities creates a steady demand for essential food items, leading to higher sales volumes for retailers. Urbanization often brings about changes in lifestyles and consumption patterns. They demand a wider variety of products, including imported and specialty items, which is driving retailers to diversify their offerings to meet individual needs.

Besides this, urban lifestyles are often fast-paced, with people having limited time for shopping. As a result, there is a growing demand for convenient shopping options, such as supermarkets, hypermarkets, and convenience stores.

Egypt Food and Grocery Retail Market News:

- February 6, 2024: Kazyon Limited, the UK-based parent company of Egyptian acquired a 50% stake in Saudi grocery chain Dukan.

- April, 2024: Spinneys Egypt, one of the leading supermarket chains announced the opening of its newest store in Alexandria.

Egypt Food and Grocery Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Fresh Food

- Frozen Food

- Food Cupboard

- Beverages

- Cleaning and Household

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes fresh food, frozen food, food cupboard, beverages, cleaning and household, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores and Departmental Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores and departmental stores, and online.

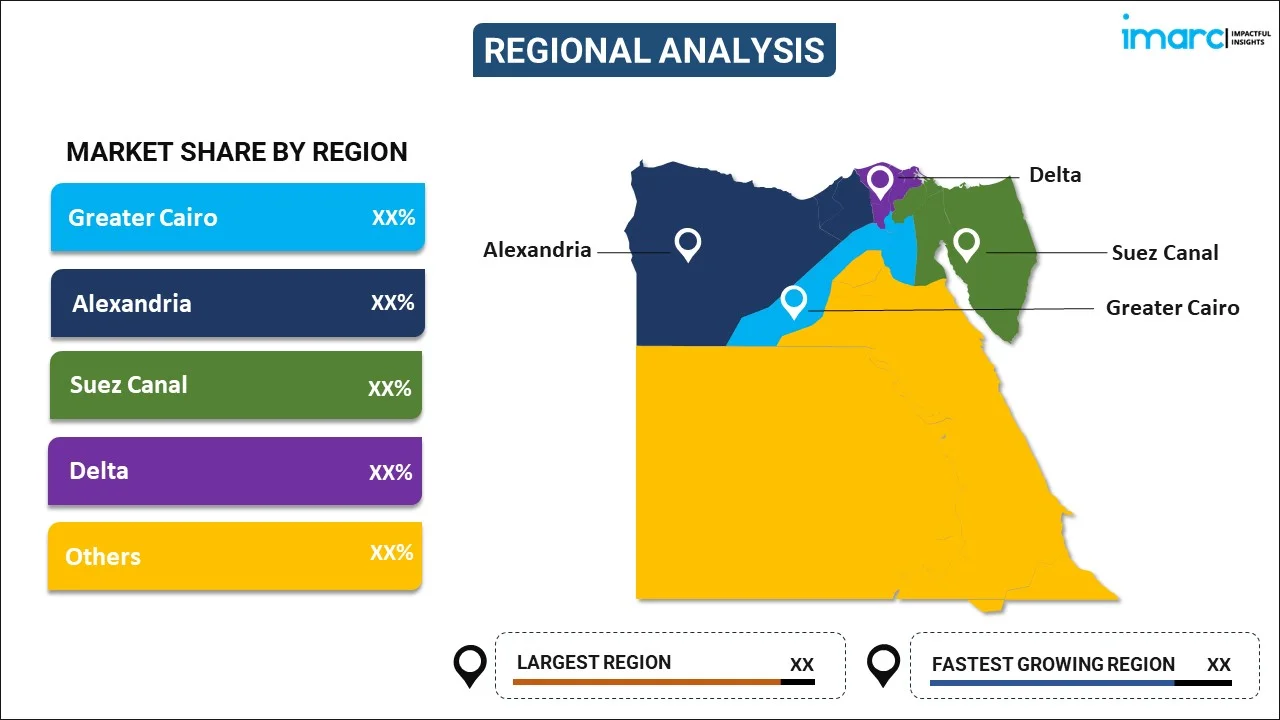

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Food and Grocery Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning and Household, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores and Departmental Stores, Online |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt food and grocery retail market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Egypt food and grocery retail market?

- What is the breakup of the Egypt food and grocery retail market on the basis of product?

- What is the breakup of the Egypt food and grocery retail market on the basis of distribution channel?

- What are the various stages in the value chain of the Egypt food and grocery retail market?

- What are the key driving factors and challenges in the Egypt food and grocery retail?

- What is the structure of the Egypt food and grocery retail market and who are the key players?

- What is the degree of competition in the Egypt food and grocery retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt food and grocery retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt food and grocery retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt food and grocery retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)