Egypt IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Egypt IT Training Market Overview:

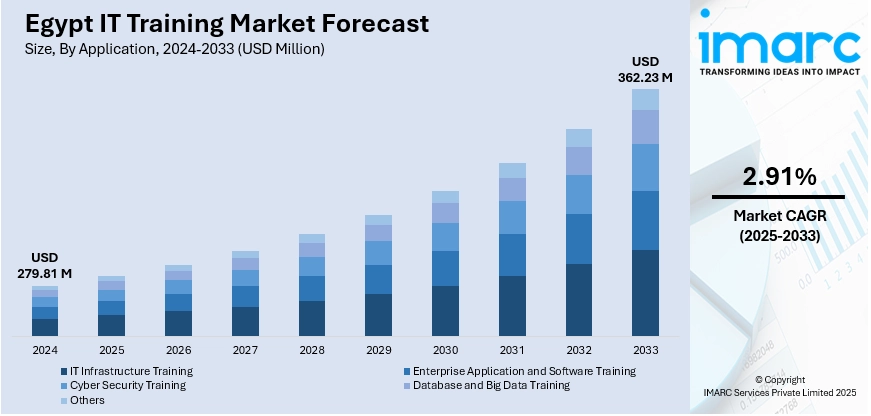

The Egypt IT training market size reached USD 279.81 Million in 2024. The market is projected to reach USD 362.23 Million by 2033, exhibiting a growth rate (CAGR) of 2.91% during 2025-2033. The market is driven by increasing needs for digital transformation across sectors, which heightens the demand for experts in upcoming technologies. Additionally, government incentives and investment in technology infrastructure and education further boost the demand for IT training solutions. In addition, the growth of working from home and the growing technology startup ecosystem in Egypt generates an ongoing demand for reskilling and upskilling the workforce to remain competitive, which is also augmenting the Egypt IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 279.81 Million |

| Market Forecast in 2033 | USD 362.23 Million |

| Market Growth Rate 2025-2033 | 2.91% |

Egypt IT Training Market Trends:

Increasing Demand for Specialized IT Skills

There is a need for specialized IT skills due to the increasing uptake of emerging technologies like artificial intelligence, cloud computing, and cybersecurity. Businesses in different industries are attempting to remain competitive by incorporating such technologies into their operations, thereby creating a need for a workforce that has particular skill sets. IT experts need not only basic technical information but also specialized skills in domains like machine learning, data science, network security, and software development. With companies looking for specialists who can manage sophisticated IT systems, the need for specialized training programs has grown. In addition, academies and training centers are catching up by providing certifications, workshops, and specialized learning modules on these high-priority domains. This trend is further fueled by the desire for organizations to close the skills gap, ensuring their teams can effectively manage and implement cutting-edge technological solutions. Consequently, the need for continuous skill development and professional growth in specialized domains remains a central driver in the Egypt IT training market growth.

To get more information on this market, Request Sample

Growth of Remote Work and Digital Learning Platforms

The transition to remote work, spearheaded by the COVID-19 pandemic, has had a notable impact on the market. Remote work necessitates employees to have a strong knowledge of digital tools and platforms, thus creating a growing demand for remote IT training solutions. Companies are now interested in offering online classes and virtual workshops to educate their workforce on software, cybersecurity, and collaboration tools. Virtual learning platforms have gained acceptance therefore, providing flexible and scalable training solutions to individuals and organizations alike. Virtual learning platforms provide professionals with access to comprehensive sets of training materials from anywhere, at any time, which enables learning on an on-the-go basis without the limitations of classroom settings. In addition, online learning platforms tend to be user-friendly and can cater to various styles of learning by incorporating videos, live sessions, and practical exercises to capture the learners' attention effectively. With companies looking to maintain productivity using remote workforces, they are increasingly making investments in training options that equip their employees adequately for the virtual world.

Government Initiatives and Public-Private Partnerships

Egyptian authorities have made conscious efforts to enhance IT training and education. Various programs, including the "Digital Egypt" initiative and collaborations with global technology behemoths, have been initiated to advance the digital economy of the country and enhance the technological competence of its workforce. These programs emphasize equipping people with training in key fields such as cloud computing, software development, and AI to prepare them for the future workplace. The government also partners with private technology firms to develop programs and certifications that meet industry demands. Public-private partnerships have facilitated the establishment of specialized training centers and technology parks, further solidifying Egypt's place as a competing force in the global IT sector. Apart from this, government-initiated initiatives and collaborations are thus taking center stage in defining the development and construction of the IT training market, thereby facilitating the demand for expert tech personnel.

Egypt IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, data and big data training, and others.

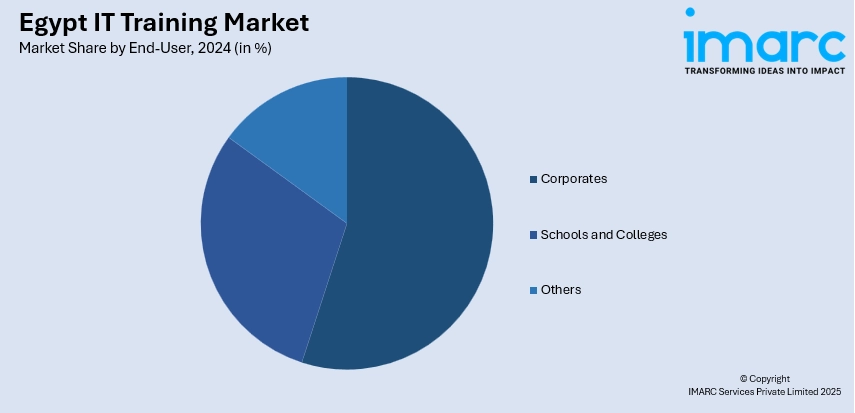

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporate, schools and colleges, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt IT Training Market News:

- On May 22, 2025, The Information Technology Industry Development Agency (ITIDA) in Egypt has unveiled the 47th edition of its Start IT incubation program in partnership with the Technology Innovation and Entrepreneurship Center (TIEC). This new program introduces significantly enhanced benefits aimed at supporting technology startups. The initiative now offers increased financial support of up to EGP 480,000 (about USD 9,600) per startup, up from EGP 180,000 (about USD 3,600), along with USD 10,000 in Amazon Web Services (AWS) cloud credits. The program also introduces AI-driven support services, access to a new Start IT Perks platform offering exclusive partner benefits, specialized AI training, and dedicated recruitment support.

Egypt IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Egypt IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt IT training market on the basis of application?

- What is the breakup of the Egypt IT training market on the basis of end-user?

- What is the breakup of the Egypt IT training market on the basis of region?

- What are the various stages in the value chain of the Egypt IT training market?

- What are the key driving factors and challenges in the Egypt IT training market?

- What is the structure of the Egypt IT training market and who are the key players?

- What is the degree of competition in the Egypt IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)