Egypt Paints and Coatings Market Report by Product (Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, and Others), Material (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), Application (Architectural and Decorative, Non-Architectural), and Region 2026-2034

Egypt Paints and Coatings Market Overview:

The Egypt paints and coatings market size reached USD 22.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 62.2 Million by 2034, exhibiting a growth rate (CAGR) of 11.56% during 2026-2034. The market is driven by urbanization, infrastructure development, and a growing automotive sector. Rising disposable incomes, technological advancements, and an increasing preference for eco-friendly products further propel market growth, supported by expanding retail and DIY trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22.1 Million |

| Market Forecast in 2034 | USD 62.2 Million |

| Market Growth Rate (2026-2034) | 11.56% |

Access the full market insights report Request Sample

Egypt Paints and Coatings Market Trends:

Rising Demand from Architectural Segment

The rising demand for architectural coating in Egypt is mainly driven by the growing construction industry which encompasses residential, commercial and institutional buildings. According to an article published by the International Trade Administration, Egypt has announced the construction of high-speed train to connect entire country through various phases. The project has been contracted to Siemens as the main contractor with value of $8.7 billion. In line with this, Egypt plans to build 14 new smart cities across the nation and has completed infrastructure projects worth about LE 1.7 trillion (approximately US 106.25 billion) in less than two years. The New Urban Communities Authority (NUCA) is responsible for developing these new cities. Architectural coatings are important for protecting and decorating these structures. The rapid growth in Egypt’s construction sector is fueled by numerous high profile development projects such as Green Cities Program and Noor City Project in East Cairo. These initiatives aim to promote sustainable urban development and include construction of modern and ecofriendly buildings. Furthermore, projects like the skyscrapers at New Alamein City further boost the need for high quality architectural coatings. This rise in construction activity along with the rising urbanization and the growing focus on sustainability is significantly driving the demand for architectural coatings in the Egyptian market.

Growth in Automotive Sector

The automotive sector in Egypt is experiencing significant growth, which is driving the demand for automotive paints and coatings. This expansion encompasses both original equipment manufacturer coatings that are used in production of new vehicles and refinished coatings applied in vehicle repair and maintenance. In November 2023, Global Auto Group, GAFI, The Environmentally Friendly Automotive Industry Fund, and the Automotive Industry Unit signed an agreement to manufacture cars locally, witnessed by Prime Minister Madbouly. The agreement aligns with Egypt's strategy to develop the automobile industry, especially eco-friendly cars. The Automotive Industry Development Program aims to establish Egypt as a hub for emerging vehicle markets in Africa. Similarly, an agreement with Germany's Volkswagen aims to establish the East Port Said Automotive Zone, attracting investments of $240 million and creating over 6,000 job opportunities. The rising vehicle production and sales in Egypt fueled by rising consumer income and urbanization stimulates the demand for high quality, durable coatings. In line with this, the country’s growing focus on automotive exports necessitates advanced coating solutions that enhance vehicle aesthetics and protection. Technological advancements in coatings such as eco friendly and high performance products further cater to the evolving needs of automotive industry. This sectoral growth is further complemented by investments in automotive manufacturing facilities and supportive government policies collectively driving the paints and coatings market in Egypt.

Egypt Paints and Coatings Market News:

- In July 2023, Delta Coatings International expanded its operations in Oman, Egypt, and Saudi Arabia, unveiling a three-year strategic growth plan for the Middle East. The company aims to enhance its turnkey project delivery services and launch a new range of self-applied products. Delta Coatings will focus on providing waterproofing and protective coating solutions for various projects, reinforcing its position as a leading player in the region.

- In July 2023, Jazeera Paints introduced a new line of exterior products, including Marotex, Newtex Pro, and Texture, designed to enhance building facades. Marotex offers durability and elegance, while Newtex Pro provides professional performance. Texture adds depth and visual appeal with its range of textured coatings. These products are engineered to exceed industry standards and are formulated to withstand harsh weather conditions while delivering outstanding results for homeowners, architects, and contractors.

Egypt Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, material, and application.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others.

Material Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

Application Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, protective, and others).

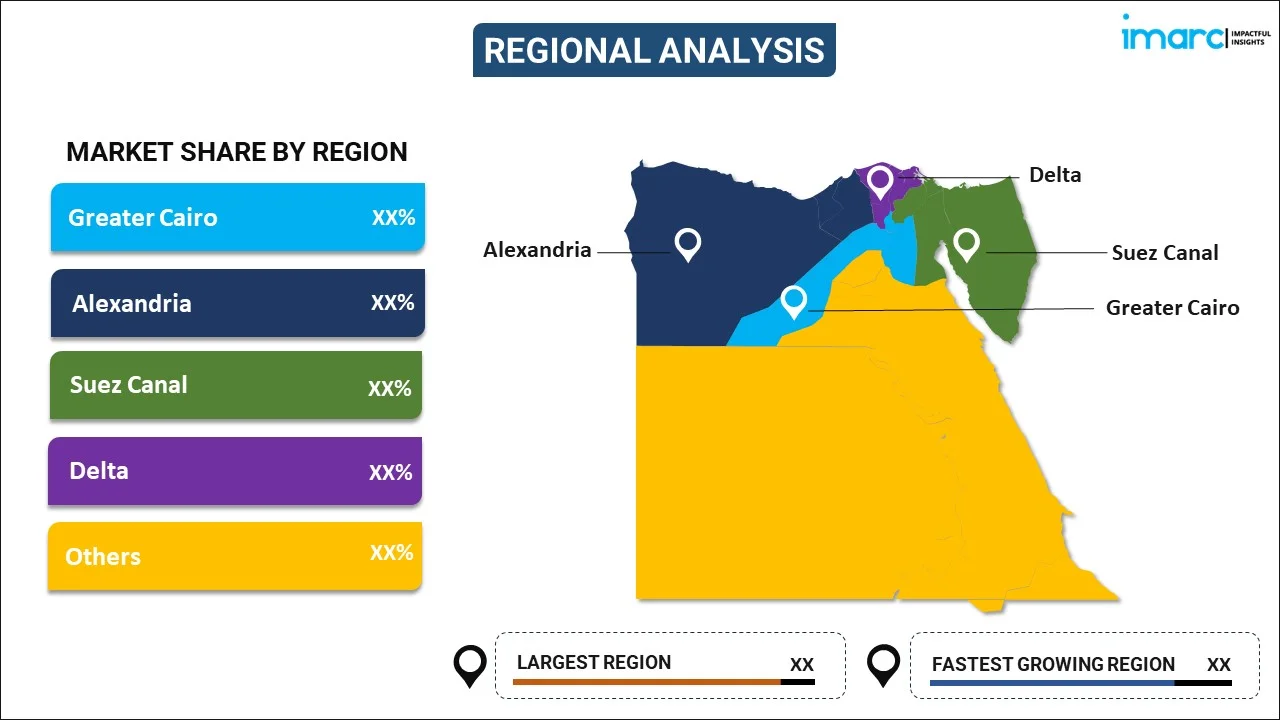

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt paints and coatings market on the basis of product?

- What is the breakup of the Egypt paints and coatings market on the basis of material?

- What is the breakup of the Egypt Paints and Coatings market on the basis of application?

- What are the various stages in the value chain of the Egypt paints and coatings market?

- What are the key driving factors and challenges in the Egypt paints and coatings?

- What is the structure of the Egypt paints and coatings market and who are the key players?

- What is the degree of competition in the Egypt paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt paints and coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)