Egypt Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Egypt Pallet Market Overview:

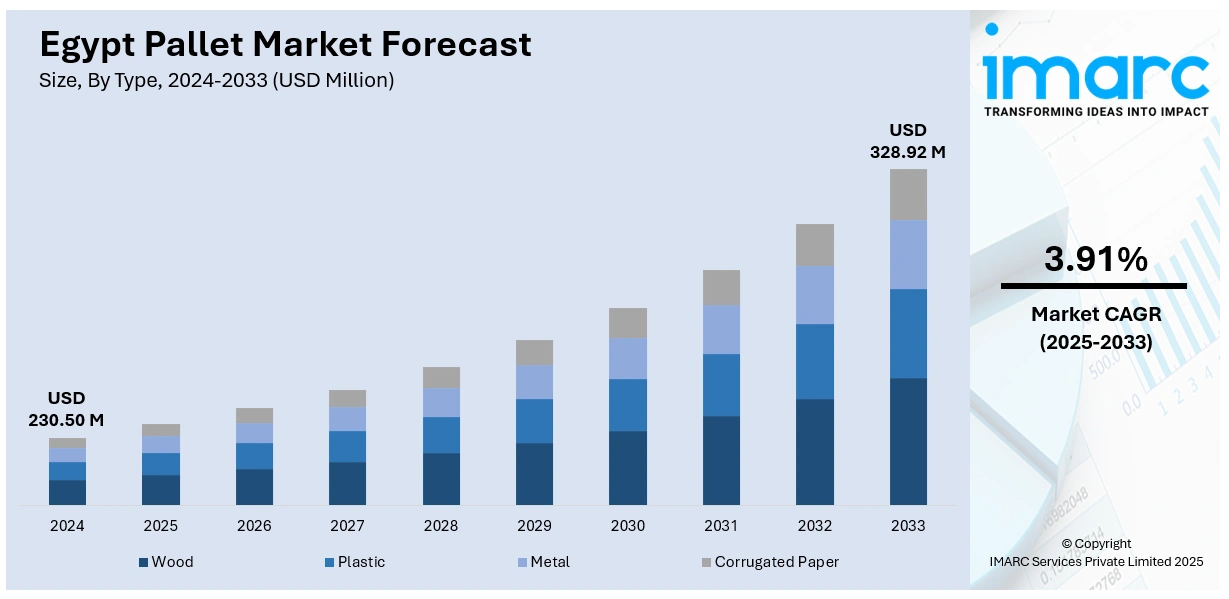

The Egypt pallet market size reached USD 230.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 328.92 Million by 2033, exhibiting a growth rate (CAGR) of 3.91% during 2025-2033. The market is driven by stringent international export regulations, particularly ISPM 15, which necessitate compliant pallet solutions. Government import substitution policies and a devalued local currency are also incentivizing domestic production and investment. Furthermore, the expansion of key export sectors, including pharmaceuticals and food processing, continues to fuel demand, further augmenting the Egypt pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 230.50 Million |

| Market Forecast in 2033 | USD 328.92 Million |

| Market Growth Rate 2025-2033 | 3.91% |

Egypt Pallet Market Trends:

The Strategic Shift Towards Plastic and Presswood Pallets

A significant trend in the market is the accelerating shift from traditional wooden pallets to those made from alternative materials, primarily plastic and presswood. This transition is driven by the stringent phytosanitary (ISPM 15) regulations required for international exports, which mandate costly heat treatment and fumigation for wooden pallets. Plastic pallets, being inherently compliant, offer a hassle-free solution for exporters, particularly in the pharmaceutical, food, and beverage industries where hygiene and contamination prevention are paramount. Furthermore, plastic pallets provide superior durability, weather resistance, and a longer lifespan, justifying their higher initial investment through reduced replacement costs and better product protection. As Egyptian businesses increasingly integrate into global supply chains, investing in ISPM 15-compliant pallets is no longer a luxury but a strategic necessity to avoid shipping delays and rejections at foreign ports, solidifying this material shift as a dominant market trend.

To get more information on this market, Request Sample

The Rise of Local Manufacturing and Import Substitution

The strengthening of local manufacturing capabilities, a movement heavily influenced by government-led import substitution policies and recent economic pressures, is propelling the Egypt pallet market growth. The devaluation of the Egyptian pound has made imported pallets, especially plastic ones, significantly more expensive, creating a substantial opportunity for domestic manufacturers to capture market share. This is further bolstered by national initiatives such as "Made in Egypt," which encourage local production to conserve foreign currency and create jobs. Egypt’s GDP reached USD 396 Billion in 2023 (38th globally), with exports at USD 51.1 Billion (58th) and imports at USD 90.8 Billion (42nd); key “Made in Egypt” exports included refined petroleum (USD 4.34 Billion), fertilizers (USD 2.59 Billion), and gold (USD 2 Billion), shipped mainly to Saudi Arabia, Turkey, and Italy. Imports were dominated by refined petroleum (USD 8.52 Billion), wheat (USD 4 Billion – making Egypt the world’s largest wheat importer), and cars (USD 2.49 Billion), sourced from China, Saudi Arabia, Russia, the U.S., and Germany. With exports down 12.5% YoY (-USD7.3 Billion) and palletized logistics essential for petroleum, fertilizers, and wheat trade, Egypt’s pallet sector is central to sustaining competitiveness as export per capita remains low at USD 446 vs imports USD 792. Consequently, there is a rise in investment in local pallet manufacturing plants, which are now expanding their production lines to include higher-quality plastic and presswood pallets that were previously imported. This trend not only enhances the resilience and self-sufficiency of the local logistics ecosystem but also leads to more competitive pricing and customized pallet solutions tailored to the specific needs of the Egyptian market.

Egypt Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

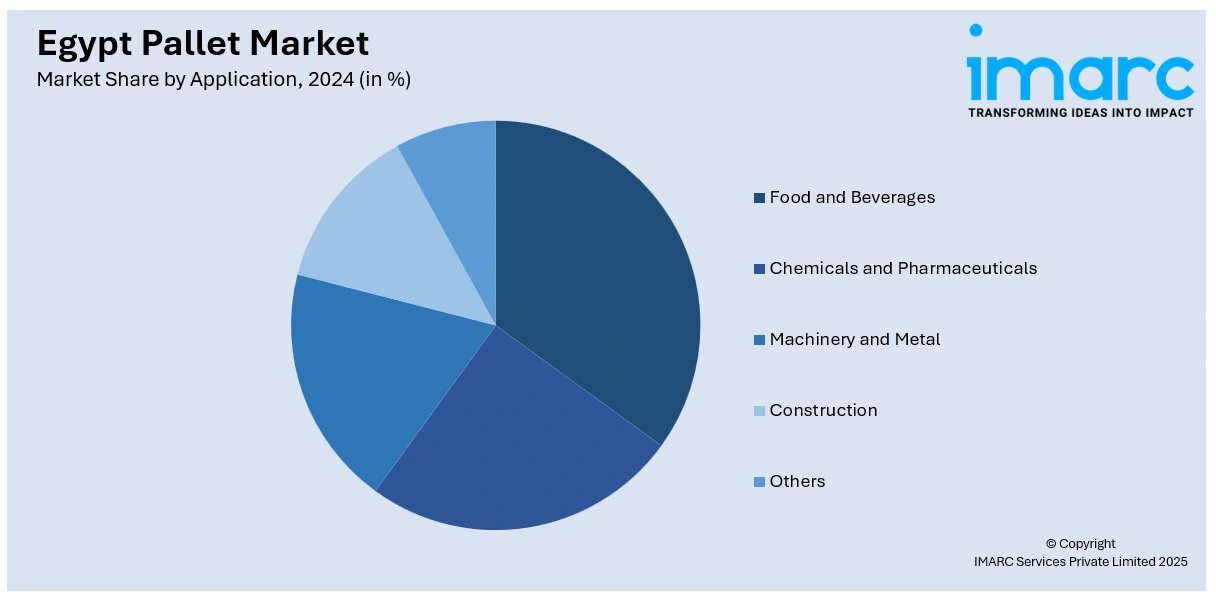

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt pallet market on the basis of type?

- What is the breakup of the Egypt pallet market on the basis of application?

- What is the breakup of the Egypt pallet market on the basis of structural design?

- What is the breakup of the Egypt pallet market on the basis of region?

- What are the various stages in the value chain of the Egypt pallet market?

- What are the key driving factors and challenges in the Egypt pallet market?

- What is the structure of the Egypt pallet market and who are the key players?

- What is the degree of competition in the Egypt pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)