Egypt Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Egypt Private Equity Market Overview:

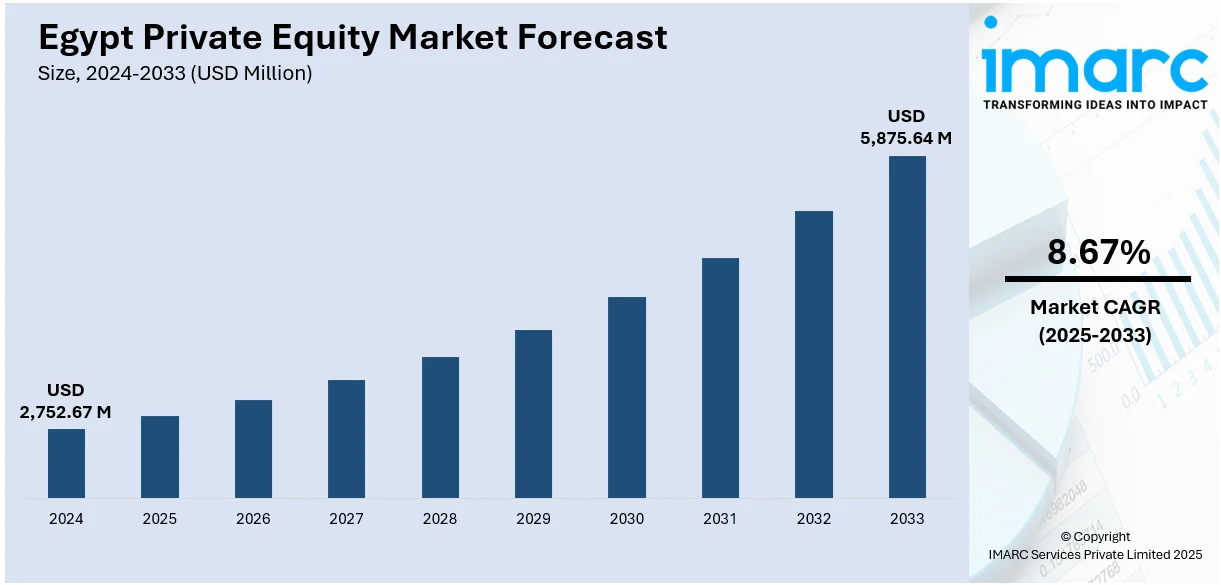

The Egypt private equity market size reached USD 2,752.67 Million in 2024. The market is projected to reach USD 5,875.64 Million by 2033, exhibiting a growth rate (CAGR) of 8.67% during 2025-2033. The sector is driven by regulatory reforms, tech- and export-focused investment mandates, increased FDI, and M&A resurgence. Government incentives, digital transformation policies, and infrastructure projects further increases Egypt private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,752.67 Million |

| Market Forecast in 2033 | USD 5,875.64 Million |

| Market Growth Rate 2025-2033 | 8.67% |

Egypt Private Equity Market Trends:

Focus on Tech, Consumer, and Export Sectors

Egypt’s private equity market growth is being characterised by investments in tech, consumer-facing, and export businesses. Leading PE firm Ezdehar plans to deploy $50–100 Million in 2025 across sectors like higher education, retail, IT services, and consumer goods, capitalising on inflation resilience and export momentum. The firm’s strategy includes majority or influential minority stakes to effect operational influence and support growth. Combined with macro-level reforms, privatization, and foreign investor interest in tourism, fintech, and real estate, these investments reinforce Egypt private equity market growth through diversified sectoral exposure.

To get more information on this market, Request Sample

Privatization, Reform and M&A Revival

Reform-driven M&A activity is lifting Egypt's private equity market. In 2024, deal count surged with 77 transactions including major ones like B Investments’ stake in Orascom Financial and MNT Halan’s $157 Million fintech deal. Regulatory enhancements include Golden Licenses, pre‑merger notification reforms, and tax incentives targeting tech, green energy and manufacturing sectors. Government-led privatizations and foreign sovereign fund participation further support capital flows. These structural improvements enhance predictability and investor confidence, expanding Egypt’s deal-making environment. This momentum underpins Egypt private equity market growth through regulatory clarity, increased FDI, and strategic privatization initiatives.

Egypt Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

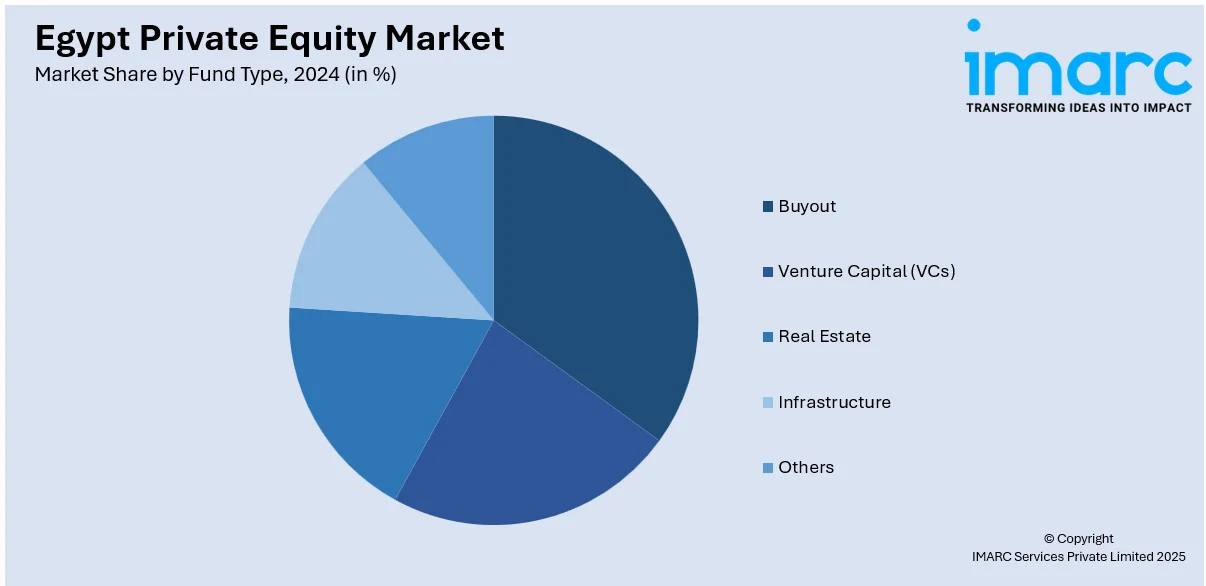

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Private Equity Market News:

- In May 2025, Morpho Investments launched its inaugural $55 Million private equity fund, marking a new phase in Egypt’s investment landscape. Co-founded by former leaders of Egypt’s sovereign wealth fund, the firm made its first investments in Agriventures—granted exclusive rights to grow and distribute berries in Saudi Arabia and Oman using precision farming in arid conditions. Morpho also backed Jinet Agriculture, a large-scale farming project along the Nile in partnership with Hassan Allam Holding, aimed at enhancing food security and boosting agricultural exports.

- In May 2025, Bluewater, a private equity firm, agreed to sell Apex International Energy to United Energy Group Limited, following Apex’s rapid growth in Egypt’s upstream oil and gas sector. Since Bluewater’s initial investment, Apex has made significant strides, including oil discoveries, natural gas production, and acquisitions, becoming one of Egypt’s top ten producers.

Egypt Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt private equity market on the basis of fund type?

- What is the breakup of the Egypt private equity market on the basis of region?

- What are the various stages in the value chain of the Egypt private equity market?

- What are the key driving factors and challenges in the Egypt private equity market?

- What is the structure of the Egypt private equity market and who are the key players?

- What is the degree of competition in the Egypt private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)