Egypt Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Egypt Real Estate Market Overview:

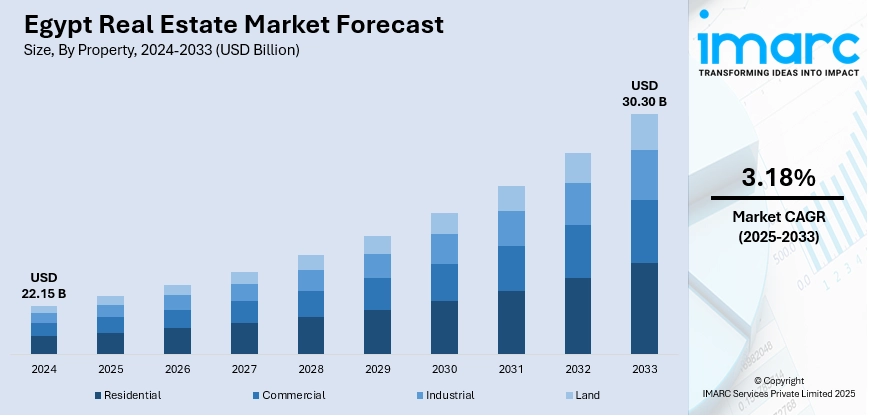

The Egypt real estate market size reached USD 22.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.30 Billion by 2033, exhibiting a growth rate (CAGR) of 3.18% during 2025-2033. The market is experiencing steady growth, driven by urban expansion, population increase, and government-backed infrastructure projects such as the New Administrative Capital. Demand remains strong across residential, commercial, and industrial segments, with increased interest in gated communities and mixed-use developments. Foreign investment and public-private partnerships are further boosting development momentum. Additionally, rising construction activities and affordable housing initiatives are shaping market dynamics are contributing to the Egypt real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.15 Billion |

| Market Forecast in 2033 | USD 30.30 Billion |

| Market Growth Rate 2025-2033 | 3.18% |

Egypt Real Estate Market Trends:

Expansion of New Administrative and Satellite Cities

Egypt’s real estate landscape is experiencing rapid transformation through the government’s strategic development of the New Administrative Capital and multiple satellite cities. Overseen by the Ministry of Housing, Utilities, and Urban Communities and the New Urban Communities Authority (NUCA), these urban expansions aim to reduce congestion in Cairo and promote balanced urban growth. These developments integrate residential, commercial, governmental, and recreational zones, underpinned by major infrastructure such as highways, railways, and utilities. The national urban plan aligns with Egypt Vision 2030 to distribute population density and create modern, sustainable living environments. Featuring modern public services, green spaces, and smart technologies, they attract residents, investors, and businesses seeking long-term opportunities. Through these comprehensive efforts, the Egypt real estate market growth is supported by diversified housing supply, improved infrastructure, and urban decentralization, fostering social and economic stability across various regions.

To get more information on this market, Request Sample

Coastal and Resort Property Expansion

Egypt’s coastal real estate market is undergoing strategic expansion through government-directed development along both the Red Sea and Mediterranean coasts. The Ministry of Tourism and Antiquities, together with the New Urban Communities Authority (NUCA), supervises these large-scale master plans. They integrate residential, hospitality, recreational, and commercial zones into cohesive resort communities. This development supports national goals to diversify tourism offerings while also expanding permanent residential opportunities in scenic coastal regions. New infrastructure projects—such as highways, international airports, and upgraded utility networks—are being built in parallel to ensure full accessibility and service delivery. The Ministry of Water Resources and Irrigation also implements coastal protection programs to safeguard these zones against erosion and environmental risks. These well-planned coastal developments attract domestic buyers, international investors, and second-home seekers. As coastal real estate evolves into vibrant lifestyle destinations, it drives Egypt real estate market trends, contributing to diversified sectoral growth and long-term economic stability.

Rise of Integrated Mixed‑Use Urban Communities

Drawing upon the goals of Egypt Vision 2030, the creation of sustainable mixed-use urban communities has been given new energy in 2024, most notably through the incorporation of clean-tech infrastructure. A high-profile example is the disclosure by Magnom Properties, a Rawabi Holding subsidiary of Saudi Arabia, that it is to build the Forbes International Tower in the New Administrative Capital. This 50-story clean hydrogen skyscraper office building is set to run on net-zero emissions using a combination of solar and clean hydrogen power to greatly minimize its footprint. The project highlights how sustainable architecture integrated with residential, commercial, healthcare, and recreational elements is reshaping Egypt’s emerging urban landscape. Supported by land allocations and policy incentives from the New Urban Communities Authority (NUCA), these self-contained, walkable districts meet the growing demands of Egypt’s expanding middle class and younger demographic. By aligning with global sustainability standards, such developments not only improve environmental performance but also enhance the resilience and attractiveness of the Egypt real estate market to international investors.

Egypt Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

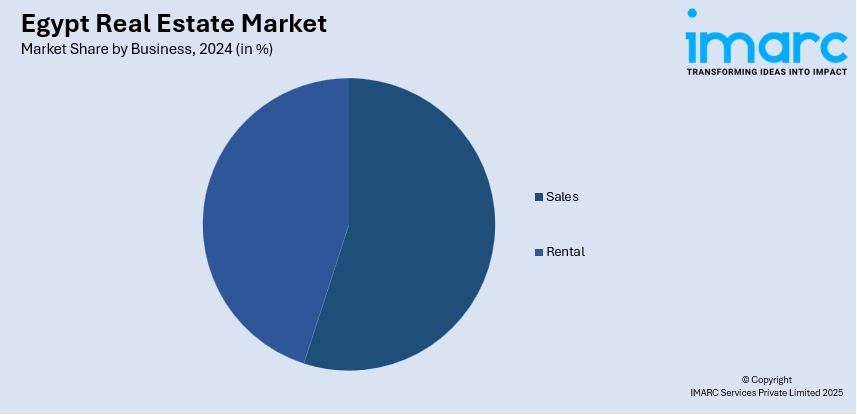

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Real Estate Market News:

- February 2025: Cairo House Egypt consortium has entered a partnership with Marriott International to develop a major hospitality project in Cairo’s Tahrir Square. The project aims to transform the area into a vibrant destination, blending luxury accommodations with cultural and commercial spaces. Marriott will manage the hotel operations, bringing its global expertise to development.

- December 2024: Emtalak has launched in Egypt through a strategic partnership with Uptown 6 October, introducing fractional ownership for commercial, administrative, and residential properties. This model allows individual investors to buy shares in high-quality real estate, lowering entry barriers and offering options like buy-to-rent and gradual purchase.

Egypt Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt real estate market on the basis of property?

- What is the breakup of the Egypt real estate market on the basis of business?

- What is the breakup of the Egypt real estate market on the basis of mode?

- What is the breakup of the Egypt real estate market on the basis of region?

- What are the various stages in the value chain of the Egypt real estate market?

- What are the key driving factors and challenges in the Egypt real estate?

- What is the structure of the Egypt real estate market and who are the key players?

- What is the degree of competition in the Egypt real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)