Egypt Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, and Seed Treatment, and Region, 2025-2033

Egypt Seeds Market Overview:

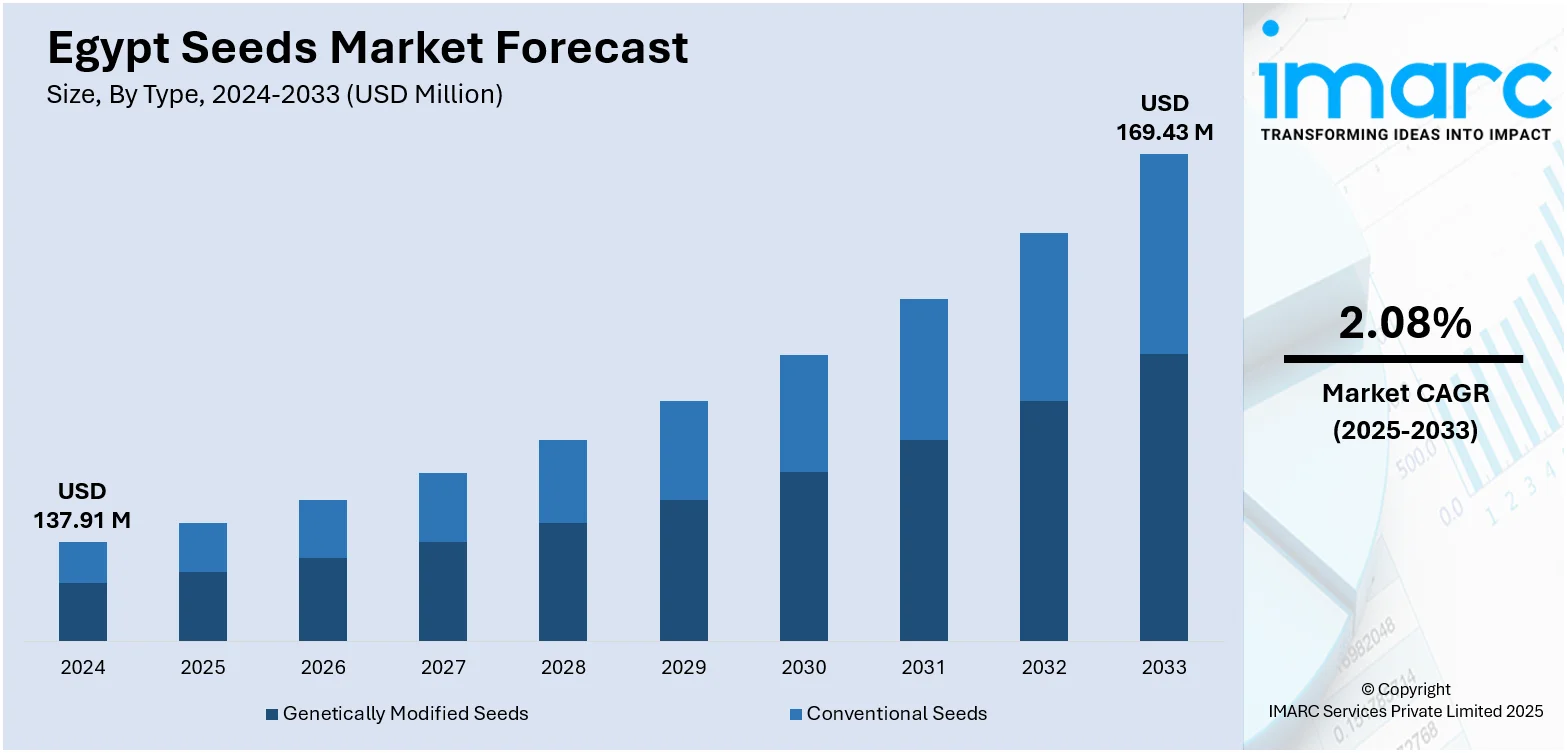

The Egypt seeds market size reached USD 137.91 Million in 2024. The market is projected to reach USD 169.43 Million by 2033, exhibiting a growth rate (CAGR) of 2.08% during 2025-2033. The market is propelled by increasing demand for high-yield and pest-resistant crop varieties, government programs aimed at enhancing agricultural productivity, and technological advancements in seed breeding. Expanding export potential, rising adoption of hybrid seeds, and improved seed distribution networks are further supporting market growth. These factors collectively contribute to strengthening the Egypt seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 137.91 Million |

| Market Forecast in 2033 | USD 169.43 Million |

| Market Growth Rate 2025-2033 | 2.08% |

Egypt Seeds Market Trends:

Growing Support for Local Seed Development

In August 2024, Egypt’s Minister of Agriculture held a meeting with parliamentary members and industry experts to launch a strategic initiative aimed at modernizing the seed sector and boosting local seed production. The focus was on scientific research stations and farm trial plots to advance seed breeding programs for crops suited to conditions like salinity and water scarcity. Awareness campaigns and stricter licensing procedures were introduced to counter counterfeit seed trade, and technical extension services were expanded for farmers. These efforts are enhancing the investment climate and fostering private‑sector involvement in developing high‑quality seeds tailored for Egypt’s environment. With a more regulated trade framework and greater education on seed provenance and benefits, producers currently have access to reliable varieties suited to local agro‑climates. This reflects a foundation being built for long‑term supply stability and agricultural modernization in Egypt’s seed ecosystem. Together, these trends illustrate that Egypt seeds market growth is emerging through modernized regulation, deeper varietal diversity and stronger infrastructure.

To get more information on this market, Request Sample

Expanding Certification and Diversity of Varieties

In April 2024, Egypt’s Central Administration for Seed Inspection and Certification reported notable expansion in the verification and approval of strategic crop seeds such as wheat, beans, rice, cotton, and sweet corn. These efforts are part of a wider national plan to strengthen seed quality, ensure genetic purity, and promote high-performing cultivars. Certified seed varieties now undergo more rigorous inspection and registration, improving standards in germination, resilience, and traceability. This tighter regulatory framework is giving farmers greater access to seeds that are adapted to specific local conditions, particularly those that address water scarcity and soil salinity challenges. Producers are responding with an increased uptake of certified seeds, leading to more consistent crop performance and fewer input losses. The continued introduction of crop-specific guidelines and strengthened field evaluation protocols are improving transparency and long-term reliability across the seed sector. These certification-driven improvements alongside wider variety access form one of the most impactful Egypt seeds market trends, positioning the country’s seed systems for greater consistency, performance, and sustainability.

Strengthening Infrastructure and Future Capacity

In February 2025, Egypt’s Ministry of Agriculture announced a nationwide plan to expand greenhouse cultivation across reclaimed desert lands, linking these zones with strategic seed production and trialing efforts. A central part of the plan includes setting up new seed processing facilities and certified propagation stations that focus on improving seed quality, traceability, and availability. Government-backed demonstration plots and farmer training hubs are being established to build practical knowledge on varietal performance and help match seeds to regional growing conditions. These improvements also include updated inspection stations and modern labs for disease resistance screening and germination testing. Together, these physical and technical upgrades aim to reduce bottlenecks in the seed distribution chain and ensure consistent seed quality across the country. By directly investing in local infrastructure, Egypt is creating a scalable model for improving seed access and building farmer confidence. This long-term capacity building will play a key role in supporting food security goals, especially in areas where traditional seed access has been limited or unreliable.

Egypt Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

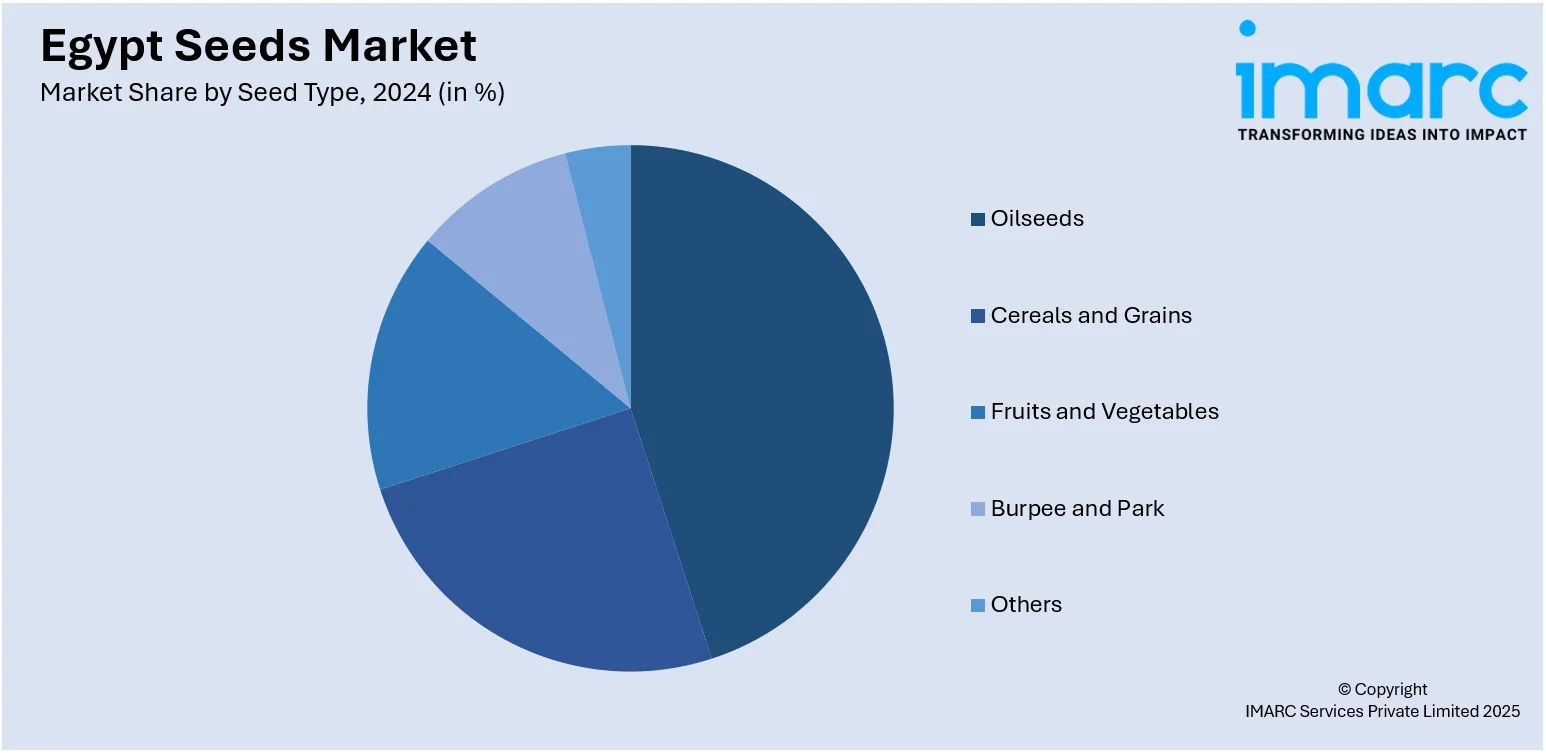

Seed Type Insights:

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Seeds Market News:

- May 2025: BASF Agricultural Solutions Egypt has commenced commercial operations under its internationally recognized Nunhems vegetable seed brand. Launched at a symbolic event near the Pyramids of Giza, this initiative introduces a fully localized model delivering tailored, high-performance vegetable seed varieties to meet Egyptian growers’ needs. Drawing on decades of global breeding expertise and supported by a network of R&D centers, BASF aims to enhance sustainability, crop quality, and access to innovation while advancing Egypt’s agricultural development goals.

- June 2025: Egyptian fintech startup AgriCash has received new funding to expand its platform and extend its support to more smallholder farmers. Dr. Diaa Youssef and Dr. Mostafa El-Sehli started the company, which combines technology and farming by providing farmers access to tools such as AI-based advice, crop insurance, and flexible payments. With this capital, AgriCash aims to expand nationwide in Egypt, enhance its digital platform, and forge additional partnerships with banks and insurance companies to make agriculture more accessible and financially safe for people in local communities.

Egypt Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt seeds market on the basis of type?

- What is the breakup of the Egypt seeds market on the basis of seed type?

- What is the breakup of the Egypt seeds market on the basis of traits?

- What is the breakup of the Egypt seeds market on the basis of availability?

- What is the breakup of the Egypt seeds market on the basis of seed treatment?

- What is the breakup of the Egypt seeds market on the basis of region?

- What are the various stages in the value chain of the Egypt seeds market?

- What are the key driving factors and challenges in the Egypt seeds market?

- What is the structure of the Egypt seeds market and who are the key players?

- What is the degree of competition in the Egypt seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt seeds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)