Egypt Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Egypt Steel Tubes Market Overview:

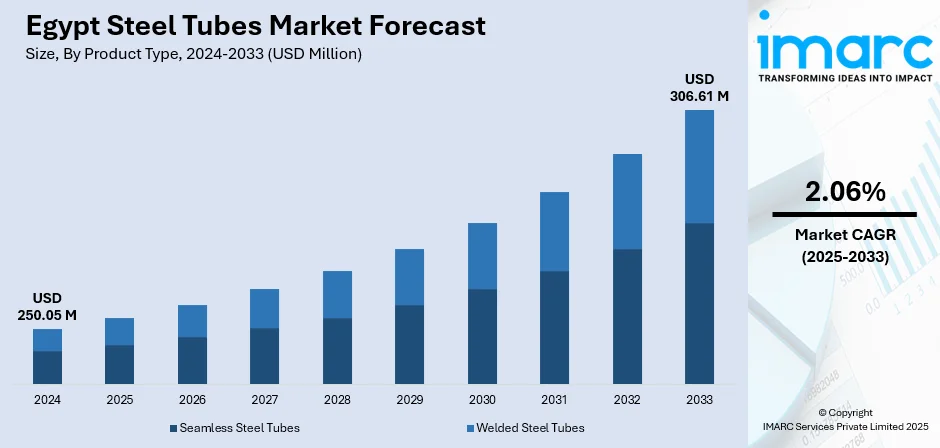

The Egypt steel tubes market size reached USD 250.05 Million in 2024. The market is projected to reach USD 306.61 Million by 2033, exhibiting a growth rate (CAGR) of 2.06% during 2025-2033. The market is evolving steadily, characterized by diverse product types and growing applications across sectors such as energy, infrastructure, and transportation. A rising demand for seamless, welded, and specialized tubing reflects the country’s industrial expansion and modernization efforts. Market momentum is driven by investments in production technologies and the strategic integration of domestic capabilities with international trends. Such developments are shaping a robust and dynamic sector that underscores the importance of Egypt steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.05 Million |

| Market Forecast in 2033 | USD 306.61 Million |

| Market Growth Rate 2025-2033 | 2.06% |

Egypt Steel Tubes Market Trends:

Enhancing Local Production Capabilities

In May 2025, Egypt officially inaugurated a new pelletizing plant and a heavy‑section/rail production facility significantly strengthening its upstream steel capacity and reducing reliance on imports. This development is more than infrastructure it’s a cornerstone for improved supply security for downstream sectors like steel tube manufacturing. With these facilities now part of the local industrial fabric, tube producers can anticipate more predictable raw material flows, helping smooth production schedules and improve delivery consistency. That shift frees manufacturers to focus on refining their operations, optimizing equipment, improving customization capabilities, and meeting demand with greater confidence. Relying less on imported inputs also cuts logistical complexity and pricing volatility, enabling more strategic investment decisions. The optimization of the upstream supply chain creates a foundation for precision, speed, and competitive value in tube production. In practical terms, what used to be a scramble for materials becomes a steady partnership between raw input flow and manufacturing responsiveness. This shift lays a resilient groundwork for sustainable Egypt steel tubes market growth.

To get more information on this market, Request Sample

Trade Shift Spurs Competitive Evolution

In March 2025, Egypt's sources confirmed a notable rise in iron and steel imports in 2024, reaching a substantial value that reflected rising industry requirements. This trend brings a meaningful signal for the tube manufacturing sector. As raw material imports diversify and expand, domestic tube producers are prompted to sharpen their value proposition improving delivery speed, precision, and customization to remain competitive. This environment encourages manufacturers to refine internal processes, align procurement strategies, and explore flexibility in product offerings. Rather than seeing imports as a threat, savvy players are using this shift to drive operational excellence and showcase how locally adapted solutions can outperform broader sourcing options. The result is a more responsive, quality-focused tube manufacturing base that better meets infrastructure and industrial demand. This adaptive stance not only boosts efficiency but also lays the groundwork for a more resilient and dynamic market. It’s a clear sign that the Egypt steel tubes market trends are being shaped by adaptive value strategies and evolving demands.

Industrial Sovereignty Sparks Upstream Momentum

In May 2025, national media confirmed the inauguration of two new steel-processing facilities an iron ore pelletizing plant and a heavy‑section production complex designed to bolster Egypt’s industrial self-reliance. These strategic additions are more than volume gains they’re a signal that tube manufacturers can increasingly rely on a fortified domestic backbone. With enhanced access to core materials like railway rails and structural sections, producers can better anticipate supply streams and optimize planning cycles. That internal predictability ushers in smoother procurement, shorter lead times, and stronger consistency for end users across infrastructure, utilities, and industrial development. Rather than scrambling to secure imports, the market can shift toward process improvement and precision execution. In effect, this industrial momentum strengthens not just production capacity, but market resilience and growth potential. These developments are forging a sturdier foundation for long‑term Egypt steel tubes market enabling the sector to support national ambitions with confidence rooted in domestic strength.

Egypt Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

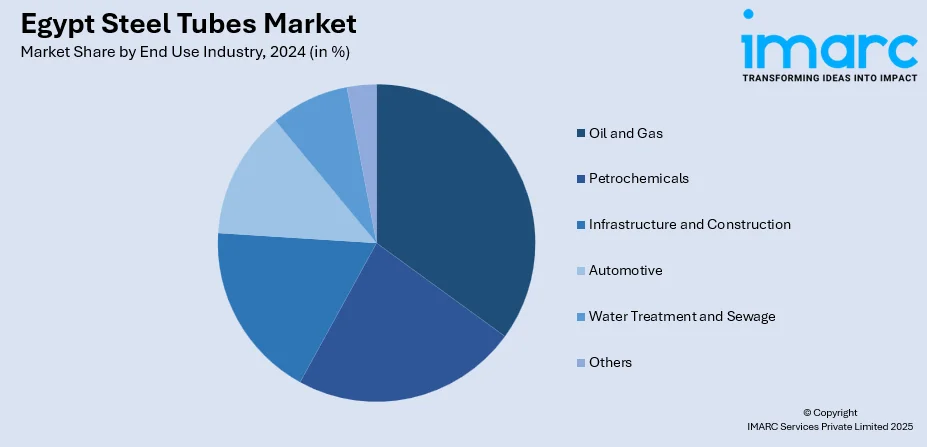

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Steel Tubes Market News:

- June 2025: Egypt’s Ashry Steel Group has announced plans to build a new stainless steel pipe plant, following governmental approval and certification. Chairman Ayman El‑Ashry revealed the initiative aims to strengthen domestic steel production by delivering seamless stainless-steel pipes. The company intends to commence site preparations soon and launch the facility within two years. This project supports Egypt’s industrial expansion and reinforces its regional standing as a developer of advanced steel manufacturing capabilities.

- December 2024: Egypt’s industrial landscape is set to gain momentum as Chinese steelmaker Hebei Xinfeng Steel advances with plans to build a major industrial complex in the Ain Sokhna region, within the Suez Canal Economic Zone. In collaboration with Egyptian authorities, the project will unfold in two phases and encompass facilities for producing automotive and household appliance components, fasteners, hot-rolled and cold-rolled steel. This initiative aims to enhance Egypt’s manufacturing base and further strengthen industrial ties between the two nations.

Egypt Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt steel tubes market on the basis of product type?

- What is the breakup of the Egypt steel tubes market on the basis of material type?

- What is the breakup of the Egypt steel tubes market on the basis of end use industry?

- What is the breakup of the Egypt steel tubes market on the basis of region?

- What are the various stages in the value chain of the Egypt steel tubes market?

- What are the key driving factors and challenges in the Egypt steel tubes market?

- What is the structure of the Egypt steel tubes market and who are the key players?

- What is the degree of competition in the Egypt steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)