Egypt Takaful Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Egypt Takaful Market Overview:

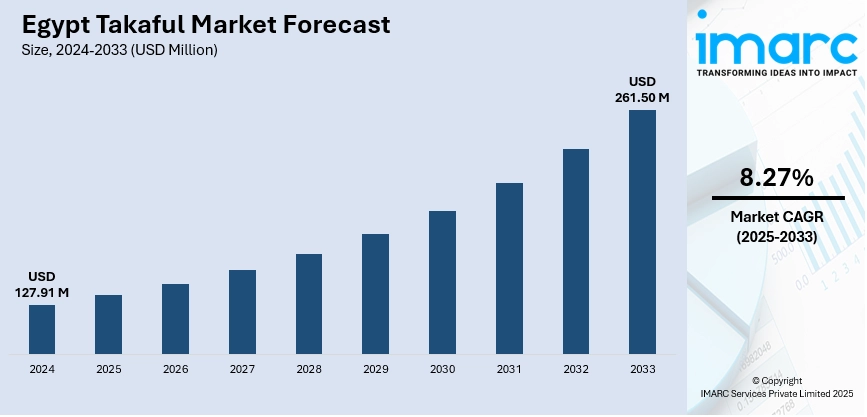

The Egypt takaful market size reached USD 127.91 Million in 2024. Looking forward, the market is projected to reach USD 261.50 Million by 2033, exhibiting a growth rate (CAGR) of 8.27% during 2025-2033. Rising demand for financial services that adhere to Sharia law, expanding knowledge of Islamic insurance, government assistance for the industry, and increased awareness of life and health insurance are some of the elements supporting the expansion of the Egypt takaful market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 127.91 Million |

| Market Forecast in 2033 | USD 261.50 Million |

| Market Growth Rate 2025-2033 | 8.27% |

Egypt Takaful Market Trends:

Government Support and Regulation

The regulatory environment and assistance provided by the Egyptian government have greatly aided in the expansion of the takaful sector. The regulatory landscape for takaful enterprises has improved with the creation of the Egyptian Financial Supervisory Authority (EFSA). By ensuring that takaful providers adhere to certain guidelines, this enhances transparency, safeguards policyholders, and preserves market stability. Additionally, more insurers have been able to enter the market thanks to governmental assistance that has increased customer confidence in takaful products. The environment for takaful businesses has improved as a result of the government's attempts to incorporate Islamic financing into the larger financial system. As a result, the market share of takaful in Egypt has increased steadily in recent years. For instance, in May 2025, Egypt increased its funding for the Takaful and Karama social protection programme to EGP 55bn for FY 2025/2026. This follows the program's expansion, which started with a smaller budget and fewer beneficiaries. The government is committed to supporting vulnerable citizens and ensuring sustainability, including implementing new economic empowerment initiatives.

To get more information on this market, Request Sample

Corporate Sector Adoption

The adoption of takaful solutions by the business sector is another factor propelling the Egypt takaful market growth. Increasing numbers of companies, especially in the private sector, are selecting takaful solutions for their workers, particularly when it comes to health and life insurance. The growing demand for employee benefits and the growing number of businesses searching for Sharia-compliant insurance options are the main drivers of this development. The takaful market in Egypt is expanding as a result of an increasing number of businesses providing takaful plans as a component of their employee welfare initiatives. Takaful helps businesses by giving their employees moral, economical, and all-encompassing coverage. For instance, in May 2025, Egyptian Life Takaful GIG, part of Gulf Insurance Group (GIG), launched a group life and medical product tailored for small and medium-sized enterprises (SMEs). The product offers various plans to meet employees' insurance needs, with a network of over 2,000 medical providers in Egypt. The initiative aims to provide comprehensive protection for employees and their families.

Egypt Takaful Market Segmentation:

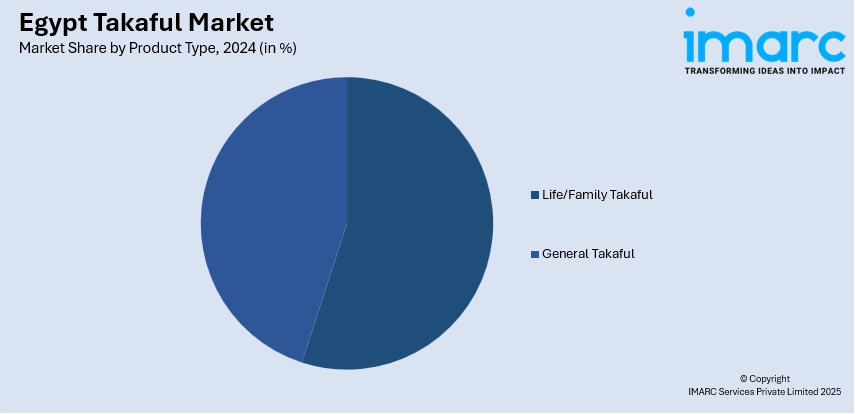

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type.

Product Type Insights:

- Life/Family Takaful

- General Takaful

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life/family takaful and general takaful.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Takaful Market News:

- In March 2025, the Egyptian government provided additional support of 300 pounds to 4.7 million families benefiting from the "Takaful and Karama" program. This initiative, part of social protection efforts, had a total cost of 1.5 Billion pounds. The government also announced a 25% increase in cash support from April 2025 to June 2026.

- In June 2024, AM Best assigned a Financial Strength Rating of B- (Fair) and a Long-Term Issuer Credit Rating of “bb-” (Fair) to Egyptian Takaful Property & Liability Insurance Company (EGTAK). The ratings reflect EGTAK’s strong balance sheet, adequate operating performance, and the challenges posed by Egypt’s economic conditions, especially the concentration of its investments in sovereign bonds.

Egypt Takaful Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life/Family Takaful, General Takaful |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt takaful market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt takaful market on the basis of product type?

- What is the breakup of the Egypt takaful market on the basis of region?

- What are the various stages in the value chain of the Egypt takaful market?

- What are the key driving factors and challenges in the Egypt takaful market?

- What is the structure of The Egypt takaful market and who are the key players?

- What is the degree of competition in The Egypt takaful market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt takaful market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt takaful market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt takaful industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)