Egypt Textiles and Apparel Market Report by Material Type (Natural, Synthetic), Application (Clothing Textiles, Technical Textiles, Fashion Textiles, Home-Decor Textiles, and Others), and Region 2026-2034

Egypt Textiles and Apparel Market Overview:

The Egypt textiles and apparel market size reached USD 24,745.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 37,974.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.73% during 2026-2034. The increasing consumer demand for fashionable and affordable clothing, government initiatives promoting the textile industry, extensive investment in modernizing production facilities, and favorable trade agreements facilitating exports to international markets are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 24,745.8 Million |

|

Market Forecast in 2034

|

USD 37,974.6 Million |

| Market Growth Rate 2026-2034 | 4.73% |

Access the full market insights report Request Sample

Egypt Textiles and Apparel Market Trends:

Increasing consumer demand for fashionable and sustainable clothing

Consumers are growing selective about the clothes they buy as disposable incomes rise and lifestyles change. Moreover, there is a greater demand for clothing made sustainably and ethically as a result of increased awareness of social and environmental issues. These trends have prompted textile manufacturers and apparel brands in Egypt to adopt eco-friendly practices, such as using organic and recycled materials, reducing water and energy consumption, and implementing fair labor practices throughout the supply chain, thereby aiding in market expansion. For instance, the Suez Canal Economic Zone (SCZONE) and Chinese industrial developer TEDA-Egypt have initiated the construction of a textile factory that will specialize in producing high-quality, eco-friendly fabrics and clothing using smart manufacturing techniques.

Adoption of digital technologies in the textile industry

Digitalization is revolutionizing various aspects of textile production, including design, pattern making, cutting, sewing, and quality control. Three-dimensional (3D) printing, computer-aided manufacturing (CAM), and computer-aided design (CAD) are some of the advanced technologies that are making it possible to produce, customize, and prototype clothing more quickly. Automation and robotics are streamlining manufacturing operations, reducing labor costs, and improving productivity. Furthermore, data analytics and artificial intelligence (AI) are being utilized to optimize supply chain management, forecast demand, and enhance customer engagement. Additionally, manufacturers are increasingly integrating digital technologies Digital Production Management (DPM), which utilizes the Internet of Things (IoT) and advanced analytics to enhance transparency on the shop floor, providing production managers with real-time, production-specific key figures, which is further bolstering the market growth.

Growth of e-commerce platforms is reshaping the retail landscape

With the proliferation of smartphones, internet connectivity, and digital payment systems, online shopping has become increasingly popular among Egyptian consumers. E-commerce platforms offer convenience, accessibility, and a wide selection of clothing options to shoppers, driving the shift from traditional brick-and-mortar retail to online channels. Textile manufacturers and apparel brands are leveraging e-commerce platforms to reach a broader audience, expand their market presence, and increase sales. Furthermore, social media platforms are propelling e-commerce sales by means of influencer marketing, focused advertising, and captivating content, thereby creating a positive outlook for market expansion.

Egypt Textiles and Apparel Market News:

- In January 2024, Mahmoud Esmat, Egypt's Minister of Public Business Sector, announced the imminent opening of a textile factory in Mahalla al-Kubra. This initiative, part of Egypt's textile industry development project, aims to increase annual yarn production to 188,000 tonnes and textiles to 198 million meters.

- In August 2023, SCZONE and TEDA-Egypt initiated the construction of a $60 million eco-friendly textile factory, Egypt Cady Textiles, at the Sokhna Integrated Industrial Zone. The foundation stone laying ceremony marked the collaboration between the two entities to establish the factory, which aims to bolster Egypt's textile industry.

Egypt Textiles and Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on material type and application.

Material Type Insights:

To get detailed segment analysis of this market Request Sample

- Natural

- Cotton

- Silk

- Others

- Synthetic

- Nylon

- Polyester

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes natural (cotton, silk, and others) and synthetic (nylon, polyester, and others).

Application Insights:

- Clothing Textiles

- Technical Textiles

- Fashion Textiles

- Home-Decor Textiles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes clothing textiles, technical textiles, fashion textiles, homer-decor textiles, and others.

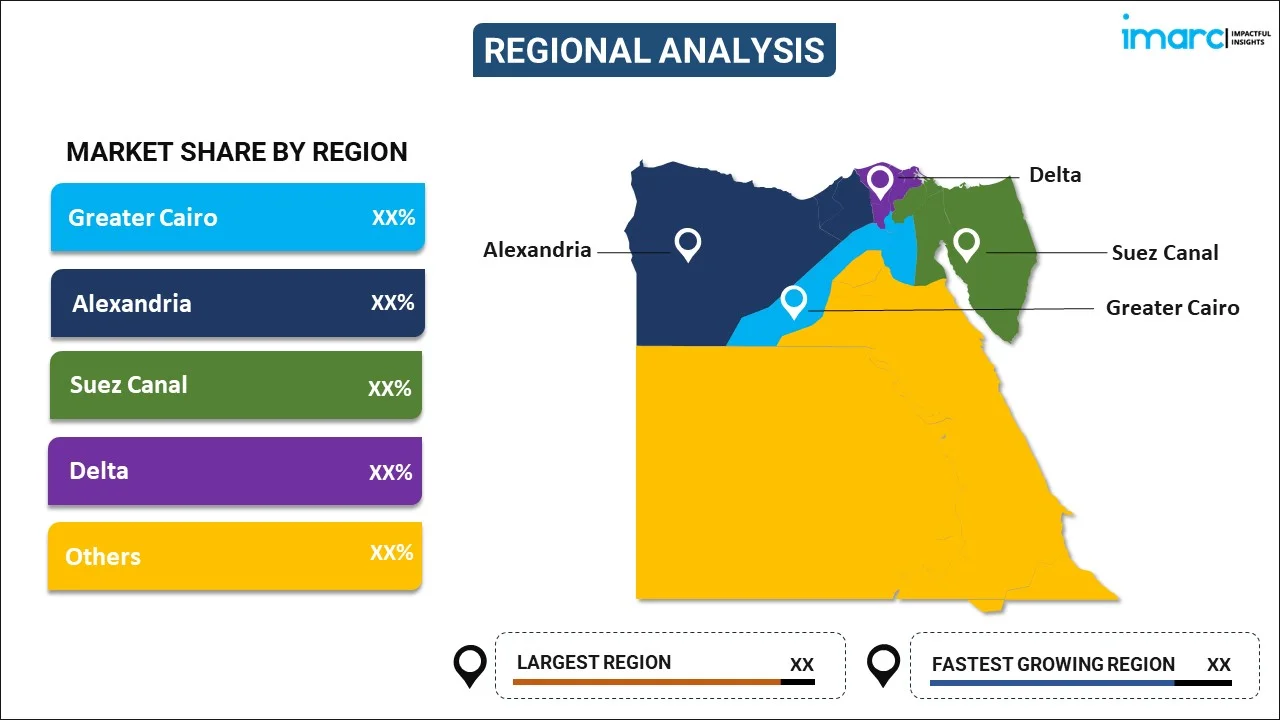

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Textiles and Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Clothing Textiles, Technical Textiles, Fashion Textiles, Homer-Decor Textiles, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt textiles and apparel market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt textiles and apparel market on the basis of material type?

- What is the breakup of the Egypt textiles and apparel market on the basis of application?

- What are the various stages in the value chain of the Egypt textiles and apparel market?

- What are the key driving factors and challenges in the Egypt textiles and apparel?

- What is the structure of the Egypt textiles and apparel market and who are the key players?

- What is the degree of competition in the Egypt textiles and apparel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt textiles and apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt textiles and apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt textiles and apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)