Electric Cargo Bike Market Size, Share, Trends and Forecast by Product Type, Battery Type, End User, and Region, 2025-2033

Electric Cargo Bike Market Size and Share:

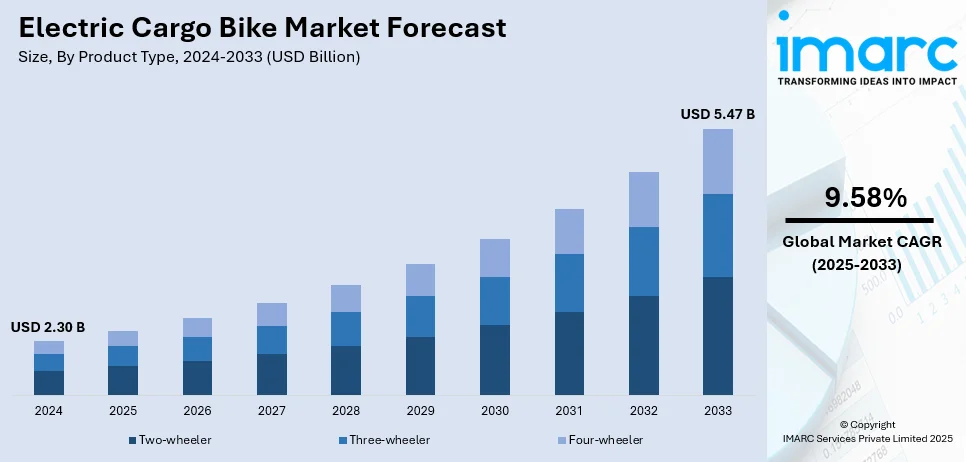

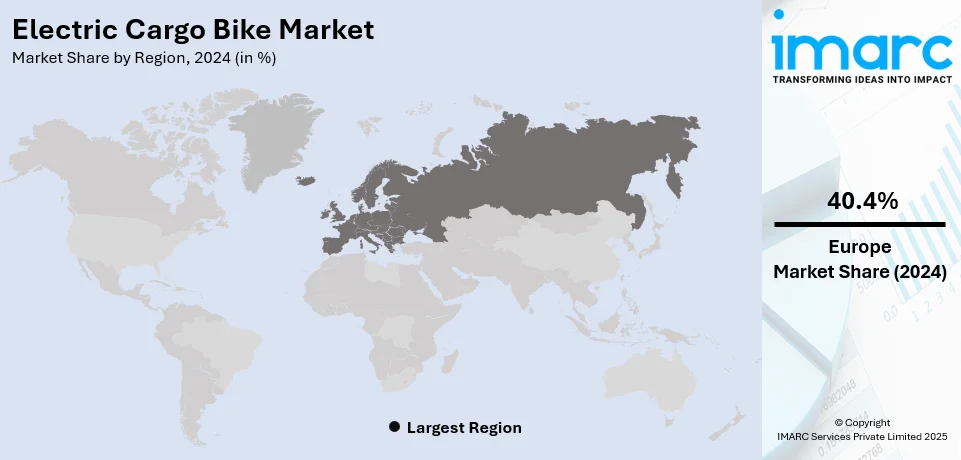

The global electric cargo bike market size was valued at USD 2.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.47 Billion by 2033, exhibiting a CAGR of 9.58% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 40.4% in 2024. The market is driven by increasing urbanization, rising environmental awareness, the growing need for sustainable transportation solutions, introduction of policies aimed at reducing carbon footprints and easing urban traffic congestion. These factors are collectively increasing the electric cargo bike market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.30 Billion |

|

Market Forecast in 2033

|

USD 5.47 Billion |

| Market Growth Rate (2025-2033) | 9.58% |

The key drivers in the electric cargo bike market are the rising demand for ecofriendly urban logistics driven by government incentives and stricter emission regulations. The growth of ecommerce has increased last-mile delivery needs favoring electric cargo bikes for their cost efficiency and ability to navigate congested areas. The widespread adoption of last-mile delivery services is boosting the market growth worldwide. Technological advancements such as improved battery performance enhance range and reliability. For example, in October 2024, Decathlon released a new electric cargo bike called the B'Twin that holds five people in a front-loading design. It is equipped with a powerful Brose S Mag motor, a 630 Wh battery for a 40-80 km range, and it comes fully equipped with GPS tracking for a year. The consumer demand for sustainable transport options and expanding business adoption in urban freight, which is fueling the electric cargo bike market growth.

To get more information on this market, Request Sample

The main drivers of the United States electric cargo bike market are growth in adoption of sustainable urban mobility solutions to address greenhouse gas (GHG) emission and traffic congestion. Government support through tax credits for e-bikes is also driving both consumer and business adoption. The growth of ecommerce has increased the demand for effective and environmentally friendly last-mile delivery options that are cost-effective. Other contributors to the improvement of electric cargo bikes may be the advancement made in the battery technology thus leading to higher mileage and efficiency improvement with increased health benefits and appreciation of environmental amenity among urbanized commuters. Other contributing factors also includes advances in the technologically made improvement of battery performance in electric cargo bikes, increasing their new ranges and performances with more awareness of health and environmental appreciations of the urban commuter scale. For example, at the end of October 2024, the company Urban Arrow unveiled its next-generation Family Line of electric cargo bikes in the US with a Bosch Smart System. The newly designed models Family Performance and Cargo Line focus on anti-theft features emphasizing safety, connectivity, and performance. They come in customizable forms and can support up to four children, representing an eco-friendly urban mobility offer.

Electric Cargo Bike Market Trends:

Technological Advancements and Integration

Rapid advancement in battery and motor technology represents one of the key electric cargo bike market trends. Improved battery life and motor efficiency have significantly enhanced the performance and reliability of electric cargo bikes making them more suitable for various applications including commercial deliveries and personal transportation. Electric cargo bike manufacturers are integrating smart technology for route optimization, fleet management and real-time tracking which is becoming increasingly common. According to the U.S. Department of Energy, e-bike sales in the United States exceeded one Million in 2022 almost four times the number sold in 2019. This surge indicates a growing acceptance and reliance on e-bikes as a viable mode of transportation driven by technological improvements.

Regulatory Support and Environmental Policies

Another significant trend is the supportive regulatory environment and the introduction of policies aimed at reducing carbon emissions. Cities such as New York are leading the way by authorizing the use of wider pedal-assist cargo bikes which can accommodate larger loads and replace traditional delivery trucks. New York City’s Commercial Cargo Bike pilot program, launched in 2019 saw cargo bikes make over 130,000 trips in 2022 delivering more than five Million packages and reducing CO2 emissions by over 650,000 metric tons. These policies support the adoption of electric cargo bikes and contribute to the broader goals of urban sustainability and reduced traffic congestion.

Funding and Incentive Programs

Funding and incentive programs are playing a crucial role in promoting the adoption of electric cargo bikes. For instance, the Colorado Energy Office’s E-Cargo Bike Grant Program provides funding for businesses and communities to implement e-cargo bike projects. This program aims to shift vehicle trips to e-cargo bikes maximizing air quality benefits and reducing greenhouse gas emissions. For instance, UK-based Fin, a last-mile delivery startup that specializes in electric cargo bikes has raised USD 7 Million in seed funding. Projects can include commercial deliveries, public shared e-cargo bike programs and support for gig economy workers. These initiatives are crucial in lowering the financial barriers to entry and encouraging more widespread use of electric cargo bikes across various sectors and communities.

Electric Cargo Bike Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric cargo bike market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, battery type and end user.

Analysis by Product Type:

- Two-wheeler

- Three-wheeler

- Four-wheeler

Two-wheeler stand as the largest product type in 2024, holding around 44.7% of the market. The two-wheeler segment dominates the electric cargo bike market primarily due to its versatility, affordability and suitability for urban environments. Two-wheeler e-cargo bikes are particularly effective for last-mile deliveries which have surged in demand due to the growth of ecommerce and urban logistics needs. Apart from this, significant trends and regulatory initiatives are further supporting the electric cargo bike market growth. As reported by the U.S. Department of Energy (DOE), in 2022, e-bike sales in the United States exceeded 1.1 Million units reflecting a significant increase and indicating a robust electric cargo bike market demand. Initiatives such as New York City's authorization of larger pedal-assist e-cargo bikes demonstrate their critical role in reducing urban congestion and emissions. These bikes can replace traditional delivery trucks cutting down CO2 emissions by 14 tons per year per replaced truck which equates to the emissions from approximately 30,872 miles driven by a passenger vehicle. This regulatory support and environmental benefit further bolster the prominence of two-wheeler e-cargo bikes in the market.

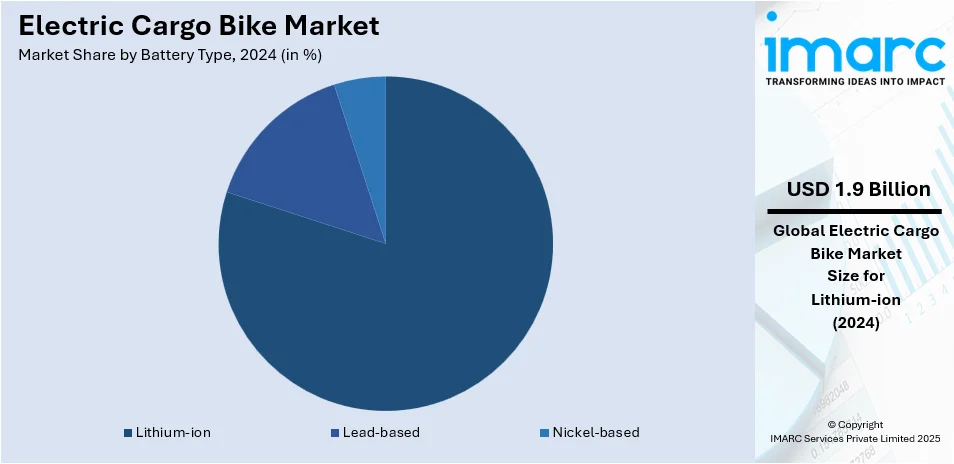

Analysis by Battery Type:

- Lithium-ion

- Lead-based

- Nickel-based

Lithium-ion leads the market with around 83.5% of market share in 2024. Lithium-ion batteries dominate the electric cargo bike market due to their superior energy density, efficiency and long cycle life. These characteristics make them particularly suitable for the electric cargo bikes demand which require reliable and powerful energy sources for extended periods and heavy loads. According to a report by the U.S. Department of Energy (DOE), lithium-ion batteries have been the primary choice for energy storage due to their high energy density and efficiency enabling longer ranges and better performance for electric vehicles including cargo bikes. Advancements in lithium-ion battery technology have driven down costs and improved safety further solidifying their position as the leading battery type in this market. In 2020, the global production capacity for lithium-ion batteries was approximately 500 GWh with projections indicating a significant increase to nearly 2500 GWh by 2030. This growth underscores the widespread adoption and reliance on lithium-ion technology across various electric vehicle applications including electric cargo bikes due to their ability to meet the rigorous demands of urban logistics and last-mile delivery services.

Analysis by End User:

- Courier and Parcel Service Providers

- Service Delivery

- Personal Use

- Large Retail Suppliers

- Waste Municipal Services

- Others

The rise in e-commerce has significantly boosted the need for quick, reliable, and environmentally friendly delivery options, making electric cargo bikes an attractive choice for courier and parcel services. The New York City Department of Transportation (NYC DOT) has recognized the importance of cargo bikes in urban delivery networks, noting that in 2022, cargo bikes in the city made over 130,000 trips, delivering more than five Million packages. This shift has reduced over 650,000 metric tons of CO2 emissions, demonstrating the environmental benefits of using electric cargo bikes for deliveries. Furthermore, the Bureau of Transportation Statistics highlights that smaller, high-value shipments transported by express, parcel, postal, and courier services have grown significantly. This trend aligns with the capabilities of electric cargo bikes, which are ideal for navigating congested urban areas and making frequent stops efficiently. These factors are reinforcing the segment’s prominence and potential growth in urban logistics, thereby contributing positively to the electric cargo bike market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 40.4%. European countries have implemented extensive bike-friendly infrastructure, including dedicated bike lanes and e-bike incentives, which facilitate the growth of this market segment. Moreover, the U.S. Department of Energy's data indicates that European e-bike sales have consistently outpaced those in other regions, demonstrating a robust and growing market. These factors collectively contribute to Europe's leadership in the electric cargo bike market, driven by a combination of supportive policies, advanced infrastructure, and a strong emphasis on sustainable urban mobility.

Key Regional Takeaways:

North America Electric Cargo Bike Market Analysis

The electric cargo bike market in North America is growing fast as there is more emphasis on sustainable urban mobility and the demand for efficient last-mile delivery solutions. Urban centers have started to opt for electric cargo bikes as an efficient way to navigate congested streets considering environmental factors as well. Businesses are embracing these bikes to increase delivery efficiency, reduce operational costs and become more environmentally friendly. Improvements in battery technology and vehicle design have further enhanced the performance and usability of electric cargo bikes making them a popular choice for logistics and urban transportation. Supportive government policies and incentives for low-emission vehicles are also encouraging their adoption. Electric cargo bikes are becoming an integral part of North America's urban logistics ecosystem as consumer expectations for faster and more sustainable deliveries continue to grow. These advancements in battery technology, supportive government policies, growing demand for sustainable last-mile delivery and increasing consumer preference for ecofriendly options are creating a positive electric cargo bike market outlook in North America.

United States Electric Cargo Bike Market Analysis

In 2024, the United States captured 85.20% of revenue in the North American market. The adoption of electric cargo bikes has witnessed a sharp rise in recent years driven by the growing demand for efficient and ecofriendly delivery solutions in logistics. According to reports, the couriers & local delivery services industry was USD 169.6 Billion in 2024 increased by 3.8%. As the need for rapid and sustainable deliveries intensifies particularly from businesses offering courier and parcel services these bikes provide a solution to reduce carbon footprints while navigating congested urban spaces. With logistics providers striving for cost-effective and time-efficient delivery options electric cargo bikes have become a viable alternative to traditional vehicles. Their ability to operate in both urban and rural settings with lower operating costs makes them increasingly attractive. The convenience of avoiding parking restrictions and traffic-related delays has made electric cargo bikes popular in the logistics sector with cities embracing their environmental benefits. The rising trend in sustainability and clean transportation in addition to regulatory incentives promoting low-emission vehicles is fuelling this adoption. With delivery times becoming increasingly crucial electric cargo bikes offer a nimble and efficient alternative.

Asia Pacific Electric Cargo Bike Market Analysis

The rise in electric cargo bike adoption is closely tied to the growth of lithium-ion battery production in the Asia-Pacific region. For instance, China is estimated to remain the prevalent force in the production of lithium-ion batteries by 2030, contributing over 70% of the global capacity. This surge in battery production has led to a decrease in the cost of battery packs making electric cargo bikes more affordable for both manufacturers and consumers. As battery technology advances the range and performance of electric cargo bikes have improved expanding their application across various sectors. The growing demand for energy-efficient and sustainable transport solutions is increasingly met by these bikes with battery manufacturers ramping up production to meet the need. Their capability to deliver higher performance with lighter and longer-lasting batteries has made electric cargo bikes a key player in urban transport. Additionally, governments and organizations in the region are incentivizing green transport solutions further promoting the adoption of electric cargo bikes.

Latin America Electric Cargo Bike Market Analysis

In Latin America, the rise in e-commerce has led to an increased need for efficient last-mile delivery solutions. As more businesses enter the online retail market, there is a growing demand for timely and eco-friendly deliveries, particularly in densely populated urban areas. According to reports, the Latin America market currently boasts over 300 Million digital buyers. With the expansion of the e-commerce sector, the logistics industry has been forced to adapt to meet consumer expectations for fast deliveries. Electric cargo bikes offer a solution, as they can easily manoeuvre through congested city streets, providing faster delivery options while minimizing environmental impact. The growth of e-commerce in Latin America has also led to improved data management systems, allowing companies to track and optimize deliveries in real time.

Middle East and Africa Electric Cargo Bike Market Analysis

Traffic congestion in the Middle East and Africa is prompting many businesses and municipalities to adopt electric cargo bikes as a solution for more efficient urban deliveries. Traffic congestion is costing Dubai more than 3% of its Gross Domestic Product (GDP). In major cities, traffic jams and limited parking spaces make it increasingly difficult for delivery vehicles to reach their destinations on time. Electric cargo bikes, however, are more maneuverable, allowing deliveries to be made more quickly and efficiently. These bikes also offer environmental benefits, as they produce fewer emissions compared to traditional vehicles, contributing to the region's goals for reducing air pollution. In addition to their practicality, electric cargo bikes provide cost savings for businesses by reducing fuel expenses and the need for large vehicles.

Competitive Landscape:

The electric cargo bike market is highly competitive due to the growing demand for sustainable transportation solutions across various sectors. Market players are focusing on innovation introducing models with enhanced battery performance, improved load capacities and advanced features to cater to diverse customer needs. Collaborations with logistics providers and businesses are becoming common to integrate electric cargo bikes into last-mile delivery systems. Regional manufacturers are adding to competitive pressure as they are offering cost-effective solutions that are aligned with local requirements. Companies are also investing in the expansion of their distribution networks and leveraging digital platforms to reach wider customer bases.

The report provides a comprehensive analysis of the competitive landscape in the electric cargo bike market with detailed profiles of all major companies, including:

- Accell Group N.V.

- Amsterdam Bicycle Company

- Butchers & Bicycles

- Cycle Derby

- Douze Cycles

- Giant Bicycles

- Rad Power Bikes Inc.

- Riese & Müller GmbH

- Smart Urban Mobiity BV.

- Worksman Cycles

- Xtracycle Cargo Bikes

- Yubabikes Inc.

Latest News and Developments:

- January 2025: Okaya EV has rebranded as OPG Mobility, introducing two sub-brands: Ferrato for premium electric motorcycles and scooters, and OTTOPG for passenger and cargo three-wheelers. This rebranding aligns with the company’s expansion into electric mobility solutions. OPG Mobility will showcase its new products at the Bharat Mobility Global Expo 2025.

- January 2025: ENGWE has delivered popular e-bike models like the M20.2.0 moped-style, Engine Pro 2.0, and commuter-friendly P275 and P20 city e-bikes. The ENGWE LE20 cargo electric bike, designed for carrying goods and children, further solidifies the brand’s reputation for versatile, user-focused designs.

- December 2024: Car.los has launched the V1 foldable electric cargo bike in Europe, featuring two versions: the V1 Basic and V1 Full. The V1 Full includes a collapsible front basket capable of carrying up to 65 kg. Powered by a Brose Drive T motor and a 552Wh battery, the bike offers a top speed of 25 kph and includes features like a stepless transmission, hydraulic disc brakes, and a color display.

- December 2024: Wardwizard recently launched two electric cargo three-wheelers under its Joy-e-rik brand. These new models are designed for efficient cargo transport, enhancing eco-friendly solutions in the delivery sector. The electric cargo bikes aim to reduce emissions and operational costs. The launch marks a significant step in Wardwizard's expansion of electric mobility options.

- December 2024: BAXY Mobility has launched a new range of electric three-wheelers in India, including both passenger and cargo models. The vehicles feature advanced battery technology, offering sustainable and cost-effective transportation solutions. Aimed at both urban and rural markets, this initiative supports eco-friendly mobility options. The cargo models promise enhanced efficiency for logistics and goods transportation.

Electric Cargo Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Two-Wheeler, Three-Wheeler, Four-Wheeler |

| Battery Types Covered | Lithium-Ion, Lead-Based, Nickel-Based |

| End Users Covered | Courier and Parcel Service Providers, Service Delivery, Personal Use, Large Retail Suppliers, Waste Municipal Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accell Group N.V., Amsterdam Bicycle Company, Butchers & Bicycles, Cycle Derby, Douze Cycles, Giant Bicycles, Rad Power Bikes Inc., Riese & Müller GmbH, Smart Urban Mobiity BV., Worksman Cycles, Xtracycle Cargo Bikes, Yubabikes Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric cargo bike market from 2019-2033.

- The electric cargo bike market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric cargo bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric cargo bike market was valued at USD 2.30 Billion in 2024.

The electric cargo bike market is projected to exhibit a CAGR of 9.58% during 2025-2033, reaching a value of USD 5.47 Billion by 2033.

Key drivers include an increasing demand for sustainable urban logistics, growth in e-commerce for last-mile delivery, advancements in battery technology enhancing range and efficiency, and supportive government policies promoting low-emission transportation.

Europe currently dominates the electric cargo bike market, accounting for a share of 40.4%. The implementation of bike-friendly infrastructure, including dedicated bike lanes and e-bike incentives, along with rising e-bike are primarily driving the market for electric cargo bike in the region. Other factors, such as favorable governmental policies and an enhanced focus sustainable urban mobility, are creating a positive electric cargo bike market outlook across the region.

Some of the major players in the electric cargo bike market include Accell Group N.V., Amsterdam Bicycle Company, Butchers & Bicycles, Cycle Derby, Douze Cycles, Giant Bicycles, Rad Power Bikes Inc., Riese & Müller GmbH, Smart Urban Mobiity BV., Worksman Cycles, Xtracycle Cargo Bikes, Yubabikes Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)