Electric Commercial Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Application, Battery Type, Battery Capacity, and Region, 2025-2033

Electric Commercial Vehicle Market Size and Share:

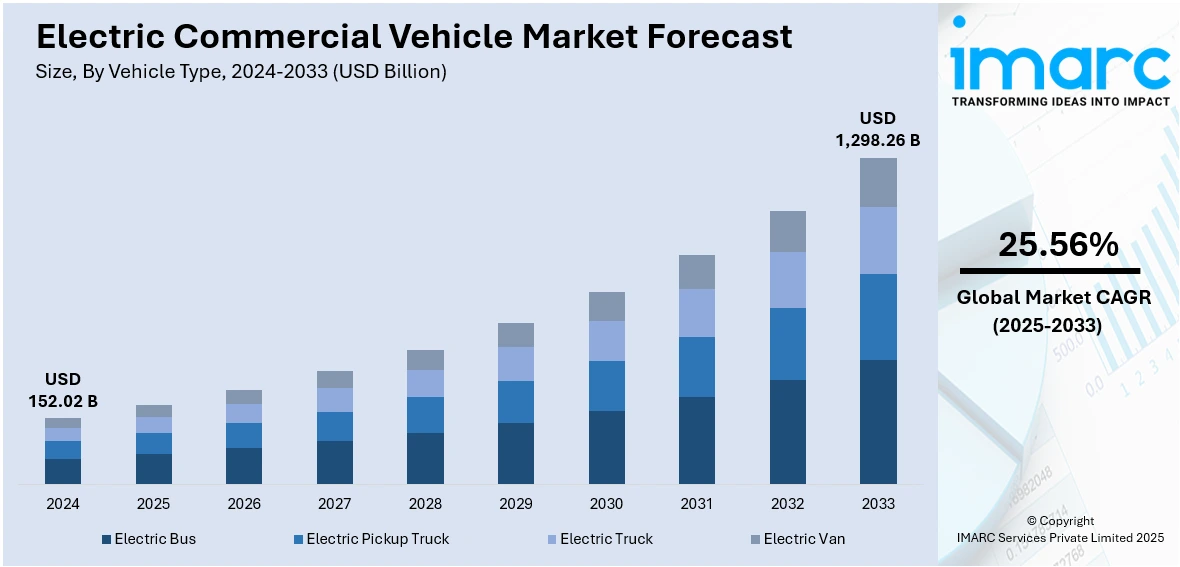

The global electric commercial vehicle market size was valued at USD 152.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,298.26 Billion by 2033, exhibiting a CAGR of 25.56% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 43.7% in 2024. The increasing prices of fossil fuels are significantly driving the demand for electric commercial fleets around the world. Apart from this, governments across the globe are implementing strict emission standards for vehicles, especially in densely populated cities. This trend, along with the rising adoption of electric buses and advances in battery technology, is expanding the electric commercial vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 152.02 Billion |

|

Market Forecast in 2033

|

USD 1,298.26 Billion |

| Market Growth Rate 2025-2033 | 25.56% |

The electric commercial vehicle sector is experiencing robust growth as firms and governments increasingly deploy green transport solutions. Firms are shifting to electric fleets due to the growing demand for eco-friendly solutions and stringent emission controls. It is driven by the imperative to lower carbon footprints and business costs, with electric vehicles (EVs) having lower fuel and maintenance expenses than conventional internal combustion engine vehicles. Technological innovations are also contributing to the market growth. Manufacturers are concentrating on enhancing battery efficiency, increasing driving distances, and lowering charging times, which are some of the biggest challenges facing electric commercial vehicles. Fast-charging infrastructure development is growing, enabling fleets to top up quickly and maintain business operation smoothly.

The United States electric commercial vehicle market is driven by pressures of regulatory requirements, advances in technology, and evolving end user attitudes. Businesses are moving their fleets to electric models to suit mounting environmental concerns as well as increasingly stringent emissions standards. The Government is also playing a leading role by implementing policies to foster sustainability, such as tax credits, subsidies, and grants that are intended to spur the use of electric vehicles. These measures are enabling companies to save on operational costs while meeting environmental requirements. In parallel, technological innovation in EV design is constantly enhancing the viability of electric commercial fleets. Manufacturers are pouring significant resources into optimizing battery performance, with advances aimed at boosting energy density and minimizing recharging times. These developments are countering the range anxiety that initially held back the takeup of electric trucks and vans, opening them up to long-distance and urban deliveries. In 2025, Kenworth unveiled two new battery-electric trucks at the latest ACT Expo. The T880E is an electric truck designed for vocational use in the Class 8 sector of the North American trucking market. The Next Generation T680E is engineered for short-distance and regional transport, LTL, and drayage tasks. Both can now be ordered from Kenworth dealers in the US and Canada, with customer deliveries set to start later this year.

Electric Commercial Vehicle Market Trends:

Rising Fossil Fuel Prices

The increasing prices of fossil fuels are significantly driving the demand for electric commercial vehicles. For instance, according to Statista, in May 2024, one gallon of diesel cost an average of USD 3.82 in the United States. Diesel prices climbed dramatically in 2022 and 2023 due to supply limits during the Russia-Ukraine war, as well as transportation challenges caused by low water levels on the Mississippi River. Electric vehicles (EVs), including commercial ones, can offer lower operating costs over their lifetime compared to vehicles powered by fossil fuels. This is primarily due to the lower cost of electricity as that of gasoline or diesel and the reduced maintenance requirements of electric drivetrains. For instance, according to data published by State-owned Convergence Energy Services Ltd, a subsidiary of Energy Efficiency Services Ltd (EESL), around 6,465 electric bus tender prices were found to be 29% less expensive than diesel bus operating costs in December 2023. Similarly, according to an article published by Clean Mobility Shift, the operational costs of electric buses are lower due to their fewer moving parts as compared to traditional buses. Besides this, the growing public awareness of environmental issues and the benefits of electric vehicles is offering a favorable electric commercial vehicle market outlook. Consumers and businesses alike are increasingly willing to consider electric vehicles as viable alternatives to traditional fossil fuel-powered vehicles. These factors are further contributing to the electric commercial vehicle market share.

Stringent Emissions Regulations

Governments around the world are implementing strict emission standards for vehicles, especially in densely populated cities. For instance, in the United States, the Safer Affordable Fuel-Efficient (SAFE) car regulation is expected to be adopted between 2021 and 2026, as recommended by the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA). For passenger cars and light trucks, the regulation may establish corporate average fuel economy criteria and greenhouse gas emissions. Moreover, electric commercial vehicles produce zero tailpipe emissions, making them a favorable choice for meeting these regulations. For instance, according to an article published by the U.S. Department of Energy, all-electric vehicles are zero-emission vehicles as they do not produce any direct exhaust or tailpipe emissions. Besides this, various key players are introducing electric trucks and buses in order to support the government's green drive. For instance, in November 2022, VIA Motors partnered with EAVX, JB Poindexter & Co.'s (JBPCO) newest business segment, to manufacture completely electric Class 2-5 electric work trucks. Similarly, in June 2024, GS Global Corp., a general trade firm based in South Korea, unveiled the T4K Refrigerated Truck, a 1-ton electric truck manufactured by BYD firm Ltd. The T4K refrigerated truck can drive 205 km at room temperature and 164 km at cold temperatures owing to its 82-kWh lithium iron phosphate (LFP) blade battery. These factors are further propelling the electric commercial vehicle market growth.

Growing Adoption of Electric Buses

The increasing adoption of electric buses is impelling the electric commercial vehicle market growth. The development of electric buses pushes advancements in battery technology, electric drivetrains, and charging infrastructures. Advances in battery technology have significantly improved the range and efficiency of electric buses. Modern lithium-ion batteries can now power buses for a full day on a single charge, making them practical for regular transit routes without frequent recharging. For instance, in June 2024, Volkswagen Truck & Bus unveiled a model electric bus in Brazil. It enables ultra-fast charging, allowing the car to achieve its maximum range in just ten minutes. In this case, the prototype created on an 18-ton chassis has an estimated range of 60 kilometers and charges in 10 minutes using a 300-kW pantograph. The electric bus is outfitted with four lithium battery packs with a niobium anode, each with a useful capacity of up to 30 kWh. Besides this, governments of various economies are also taking various initiatives to launch electric buses. For instance, in February 2024, the Government of Delhi launched 350 electric buses. The number of electric buses in the DTC fleet reached around 1,650 in total. Apart from this, governments and private entities are investing in charging infrastructure for electric buses. This infrastructure expansion includes fast-charging stations and depot charging facilities, addressing the range limitations and operational needs of electric bus fleets. For instance, in April 2024, Mapna Group launched Iran's first-ever charging station for e-buses in the northern city of Karaj in Alborz Province. The buses would be entirely charged in two hours and a half so that they could travel as long as 250 kilometers with their coolers on. These factors are driving the adoption of electric commercial vehicles.

The Implementation of Various Government Initiatives On The Expansion Of Charging Infrastructure To Expand The Market Growth

Governments worldwide are supercharging electric mobility with robust incentives and subsidies aimed at accelerating EV adoption. Tax breaks, rebates, and purchase grants are making EVs significantly more affordable for consumers, while subsidies for manufacturers—alongside reduced registration and road taxes—are fueling innovation in affordable models. Simultaneously, authorities are investing heavily in expanding charging infrastructure: highways, urban centers, workplaces, and multi-unit residences are seeing exponential growth in charging stations. Public-private partnerships are playing a pivotal role, with utilities and private firms collaborating seamlessly to build fast-charging networks and smart-grid integration. These dual strategies—financial incentives and infrastructure expansion—not only reduce range anxiety but also bolster confidence among consumers and automakers alike. As this momentum continues, markets are poised for a tipping point: widespread EV adoption, decarbonization of transportation, and a resilient clean-energy ecosystem, reinforcing global climate goals while stimulating local economies.

Electric Commercial Vehicle Market Opportunities:

Innovations and Economic Growth Boost the Market Growth

The drive for EV expansion presents vast opportunities for innovation and economic growth. Governments offering subsidies encourage startups to enter battery recycling, renewable charging solutions, and smart-grid technology sectors, fostering green entrepreneurship. The charging infrastructure boom opens doors for real estate developers, utility providers, and automakers to create integrated EV-friendly communities and commercial hubs. Additionally, widespread EV adoption aligns with clean energy goals, supporting solar and wind energy sector growth via vehicle-to-grid (V2G) technologies. Research into alternative battery materials—like solid-state or sodium-ion batteries—presents potential to reduce costs and dependence on rare minerals. Emerging markets provide untapped potential as infrastructure investment expands beyond urban centers. Overall, the transition creates skilled job opportunities in manufacturing, software development, energy management, and recycling, paving the way for sustainable industrial transformation.

Electric Commercial Vehicle Market Challenges:

High Upfront Cost Impede the Market Growth

High upfront costs of EVs, even with subsidies, deter price-sensitive consumers in many regions. Inadequate rural and semi-urban charging networks create "charging deserts," limiting long-distance travel confidence. Grid capacity strain is another concern as mass EV charging demands surge, necessitating costly grid upgrades and smart load management. Battery material sourcing raises ethical and environmental questions, with geopolitical risks around supply chains. Additionally, inconsistent policies across regions cause market fragmentation, confusing both manufacturers and consumers. Lastly, limited awareness and resistance to change among traditional vehicle users slow the transition. Addressing these barriers requires comprehensive policy harmonization, technological breakthroughs in battery tech, and targeted education campaigns to build trust in EV ecosystems.

Electric Commercial Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric commercial vehicle market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, propulsion type, application, battery type, and battery capacity.

Analysis by Vehicle Type:

- Electric Bus

- Electric Pickup Truck

- Electric Truck

- Electric Van

Electric bus stands as the largest component in 2024, holding 62.0% of the market. Electric buses are a type of public transportation vehicle that runs entirely on electricity, rather than traditional fuels like diesel or gasoline. Electric buses produce minimum tailpipe emissions, which helps to improve urban air quality and reduce greenhouse gas discharges. This makes them an environment friendly alternative to diesel or gasoline-powered buses, particularly important in densely populated areas where air pollution is a concern. Moreover, many governments and local authorities are implementing stringent emission regulations and targets for reducing greenhouse gas emissions. Policies such as low-emission zones and mandates for zero-emission buses in public fleets are driving the adoption of electric buses. For instance, in January 2024, the Assam Chief Minister launched around 200 EV buses for the people of Guwahati.

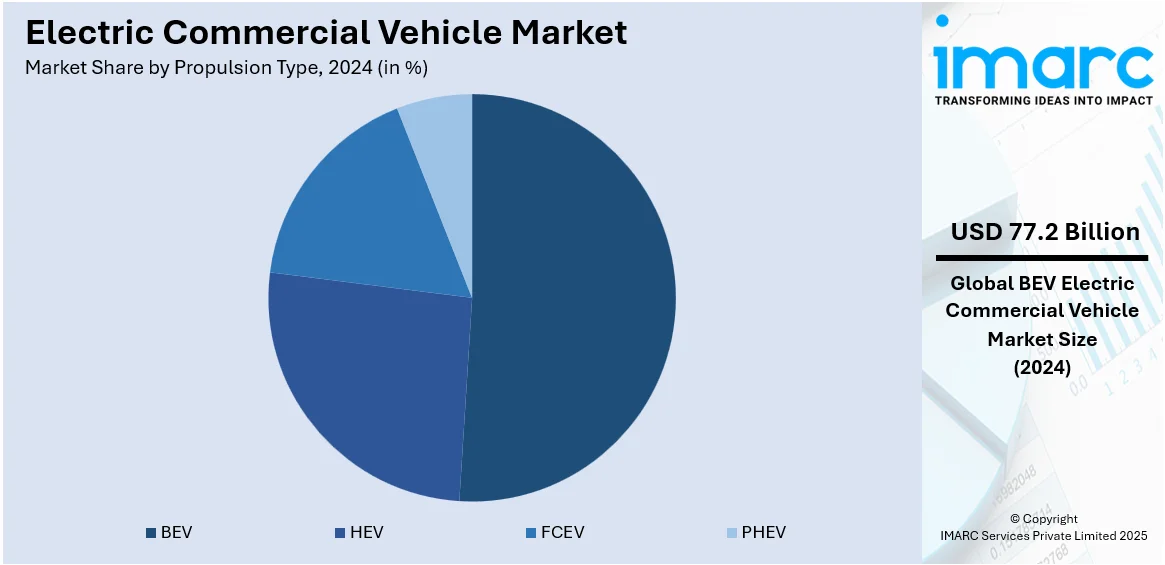

Analysis by Propulsion Type:

- BEV

- HEV

- FCEV

- PHEV

BEV leads the market with 50.8% of market share in 2024. Stringent emission regulations around the world are pushing businesses and governments to adopt zero-emission vehicles. BEVs, which produce zero tailpipe emissions, are a direct solution to meeting these regulatory requirements. This is particularly crucial in urban areas where air quality concerns are high. Moreover, BEVs often have lower operating expenses compared to traditional internal combustion engine vehicles. They have fewer moving parts, which reduces maintenance expenses. In addition, electricity tends to be cheaper than gasoline or diesel in many regions, leading to lower fueling costs over the vehicle's lifetime. For instance, in April 2024, RIZON, the newest electric vehicle brand from Daimler Truck, unveiled its battery-electric Class 4-5 trucks in Canada at the Truck World event in Toronto.

Analysis by Application:

- Cargo

- Passenger

The cargo segment in the market is witnessing steady growth, driven by the heightened demand for sustainable logistics solutions. Electric trucks and vans are being increasingly adopted for freight transportation as businesses look for cost-effective, low-emission alternatives to traditional diesel-powered vehicles. These electric cargo vehicles offer advantages such as lower operational costs, reduced maintenance, and compliance with stringent environmental regulations. As e-commerce platforms continues to expand, the demand for electric delivery trucks and vans, particularly for last-mile delivery, is rising.

The passenger segment of the market is also experiencing growth as transportation companies, including shuttle services, buses, and taxis, are increasingly investing in electric models. These electric passenger vehicles provide an environment friendly alternative to traditional buses and taxis, especially in urban settings where air quality and emissions regulations are a growing concern. Electric buses, in particular, are being adopted by public transport agencies to reduce operational costs, improve sustainability, and comply with emission reduction targets.

Analysis by Battery Type:

- Lithium-Nickel-Manganese-Cobalt Oxide Batteries

- Lithium-Iron-Phosphate Batteries

- Others

Lithium-nickel-manganese-cobalt oxide batteries segment is picking up strong momentum in the market for electric commercial vehicles because of the high energy density, long life, and efficiency of the batteries. NMC batteries are most popular for their capacity to provide more energy output, which makes them suitable for long-distance running EVs like long-haul trucks and large freight carriers. These batteries ensure a great balance between power, capacity, and safety and hence are increasingly being used by vehicle manufacturers.

The lithium-iron-phosphate battery segment is also experiencing significant growth in the electric commercial vehicle segment because of its intrinsic safety attributes, affordability, and sustainability. LFP batteries have the best thermal stability and greater cycle life and are thus a consistent option for EVs, particularly urban applications such as public buses and last-mile vans. LFP batteries tend to be cheaper than NMC batteries, which is appealing to companies wanting to save on the initial investment but deliver acceptable performance.

Analysis by Battery Capacity:

- Less Than 50 kWh

- 50-250 kWh

- Above 250 kWh

The less than 50 kWh battery capacity segment is primarily focused on electric commercial vehicles designed for short-range applications, such as urban delivery vans, small trucks, and shuttle buses. These vehicles are typically used for last-mile deliveries, short-distance passenger transportation, and other localized operations where long driving ranges are not required. The key advantage of vehicles in this category is their lower cost, making them an attractive option for businesses looking to invest in electric fleets without significant upfront expenditure.

The 50-250 kWh battery capacity segment caters to medium-duty electric commercial vehicles, such as regional trucks, larger delivery vans, and buses used in public transportation. Vehicles in this category are designed to handle longer distances and more demanding tasks than those with smaller batteries, while still maintaining a relatively efficient energy profile.

The above 250 kWh battery capacity segment is tailored for heavy-duty electric commercial vehicles that require high energy storage for long-haul transport and large-scale operations. This includes electric trucks, freight vehicles, and buses that need substantial range and power to handle extended journeys without frequent recharging. Vehicles in this segment are equipped with advanced battery technology to ensure long-lasting performance even under demanding conditions, such as carrying heavy loads over long distances.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

In 2024, Asia-Pacific accounted for the largest market share of 43.7%. Numerous nations in the Asia Pacific, such as China, Japan, South Korea, and India, are adopting robust governmental strategies and incentives to encourage electric vehicle use. These measures consist of financial support, tax breaks, and rules promoting the use of electric vehicles in business fleets. In November 2022, Japan's Ministry of Land, Infrastructure, Transport, and Tourism enhanced its assistance for commercial vehicles featuring green number plates. The Ministry incorporated JPY 2.12 Billion into the second supplementary budget for the fiscal year concluding in March 2023. Additionally, this area houses some of the world's largest and rapidly expanding economies, creating considerable demand for various types of commercial vehicles. With the urbanization and innovation of these economies, the demand for addressing air pollution and decreasing reliance on fossil fuels is growing, making electric commercial vehicles a compelling option.

Key Regional Takeaways:

United States Electric Commercial Vehicle Market Analysis

The United States holds 87.80% share in North America. The United States is witnessing a significant surge in electric commercial vehicle adoption due to the growing adoption of electric buses. For instance, with the third round of Clean School Bus Program awards announced in May 2024, more electric school buses are expected to be introduced across the U.S., through the next two years. The opening of the fourth round of applications in January 2025, provided an additional USD 1 Billion for electric school buses. This shift supports a broader electrification strategy across various commercial vehicle segments, including delivery vans and heavy-duty trucks. Increased awareness among fleet managers and the enhanced performance of electric buses have also fueled this transition. Infrastructure improvements, such as expanded charging networks and grid readiness, further support electric bus implementation. The preference for clean transportation alternatives among logistics and transit firms aligns with ongoing efforts to reduce urban pollution and improve public health. As electric buses become more cost-competitive, the momentum continues to push forward electric commercial vehicle adoption across multiple industries and applications.

Asia Pacific Electric Commercial Vehicle Market Analysis

Asia-Pacific is experiencing accelerated electric commercial vehicle adoption due to growing government support and initiative. For instance, schemes promoting electric mobility (e-mobility) in India received a renewed impetus in the Union Budget 2025-26 with a funding increase of over 20% compared to last year. Regional authorities are implementing targeted policies, offering subsidies, and initiating public-private partnerships to promote clean transportation. Dedicated programs focus on manufacturing incentives and procurement schemes that encourage fleet owners to transition toward electric alternatives. Regulations mandating reduced emissions, combined with tax relief and other financial benefits, make electric commercial vehicles increasingly attractive. Urban areas are prioritized for electrification, given their high traffic density and pollution levels, resulting in stronger demand for electric delivery vans, trucks, and buses. Public infrastructure investments in charging stations and energy management systems reinforce this growth.

Europe Electric Commercial Vehicle Market Analysis

Europe is undergoing rising electric commercial vehicle adoption due to a growing focus to reduce greenhouse gas emissions and stringent emissions regulations. For instance, In the third quarter of 2024, greenhouse gas emissions from the EU economy were estimated at 767 million tons of CO2-equivalents (CO2-eq), representing a 0.6% reduction compared to the same quarter in 2023 (772 million tons of CO2-eq). Transport emissions remain a significant contributor to environmental concerns, prompting authorities to enact strict carbon-reduction policies. Legislations require fleet operators to adhere to defined emission thresholds, with penalties for non-compliance. This regulatory pressure pushes businesses to switch to electric commercial vehicles to meet sustainability benchmarks and avoid fiscal repercussions. Awareness of climate change and long-term energy goals further reinforces this transformation. Low-emission zones and green logistics mandates also encourage the shift to electric-powered fleets in urban centers. As regulations tighten, commercial vehicle manufacturers invest more in electric mobility solutions to stay competitive.

Latin America Electric Commercial Vehicle Market Analysis

Latin America is seeing a growing adoption of electric commercial vehicles primarily due to rising fossil fuel prices. For instance, Brazil's Petrobras hiked jet fuel prices by 0.3% in May 2025. Increasing fuel costs make electric alternatives more economically attractive for commercial fleet operators aiming to reduce operational expenses. This shift is particularly significant in logistics and urban delivery sectors, where fuel efficiency and cost savings are critical. The volatility in fossil fuel markets encourages stakeholders to seek stable and sustainable energy sources, boosting demand for electric commercial vehicles.

Middle East and Africa Electric Commercial Vehicle Market Analysis

The Middle East and Africa see growing electric commercial vehicle adoption driven by expanding electric vehicle charging infrastructure. For instance, in February 2025, UAE's Under-Secretary for Energy and Petroleum Affairs at the Ministry of Energy and Infrastructure announced that the country will install more than 500 electric vehicle (EV) charging stations by the end of 2025. Investments in charging networks are enhancing vehicle accessibility and operational convenience. Improved infrastructure reduces range anxiety and supports broader fleet electrification. This development encourages businesses to adopt electric commercial vehicles, aligning with sustainability goals and operational efficiency improvements.

Competitive Landscape:

Market players in the electric commercial vehicle sector are actively engaged in a range of activities aimed at expanding their product offerings and improving vehicle performance. Leading manufacturers are focusing on advancing battery technology, such as enhancing energy density and charging speeds, to increase the range and efficiency of electric commercial vehicles. They are also investing in building robust charging infrastructure to support widespread adoption. Additionally, market players are collaborating with government entities to take advantage of incentives and meet stringent environmental regulations. Some companies are exploring new business models, including vehicle leasing and fleet management services, while others are enhancing after-sales services to strengthen customer relationships and ensure long-term market success. As per electric commercial vehicle market forecast, these efforts are expected to reflect the competitive nature of the ECV market.

The report provides a comprehensive analysis of the competitive landscape in the electric commercial vehicle market with detailed profiles of all major companies, including:

- AB Volvo

- Anhui Ankai Automobile Co. Ltd.

- BYD Company Ltd.

- Construcciones y Auxiliar de Ferrocarriles S.A.

- Daimler AG

- Ebusco B.V.

- King Long United Automotive Industry Co. Ltd

- NFI Group Inc.

- Proterra Inc.

- VDL Groep B.V.

- Zhengzhou Yutong Bus Co. Ltd.

- Zhongtong Bus Holding Co. Ltd.

Latest News and Developments:

- April 2025: Isuzu unveiled the D-Max EV, marking its entry into electric commercial vehicles. This fully electric pickup offers a 263 km WLTP range, 3.5-tonne towing capacity, and over 1-tonne payload. Equipped with a 66.9 kWh battery and dual motors delivering 140 kW, it features full-time 4×4 and advanced driver assistance systems, catering to professionals seeking sustainable yet robust transport solutions.

- March 2025: Jupiter Electric launched its Tez LCV, an electric commercial vehicle priced at approximately USD 12,500 and inaugurated a new manufacturing facility in Indore. The move aims to strengthen the company’s presence in the electric commercial vehicle market.

- January 2025: Montra Electric, a subsidiary of TI Clean Mobility, unveiled two electric commercial vehicles at BMGE 2025: the EVIATOR e-SCV (3.5-tonne GVW) and the Super Cargo e-3W. The company also signed an MoU to supply 600–800 EVIATOR units over the next year. Additionally, Montra showcased the RHINO, a 55-ton electric heavy commercial truck.

- January 2025: EKA Mobility announced the launch of its electric commercial vehicle range, including heavy electric trucks and an 18-meter electric bus carrying 125 passengers, at Bharat Mobility Auto Expo 2025. The company also showcased over 11 platforms covering buses, trucks, and small commercial EVs for diverse transport needs. It also introduced EKA Connect, a fleet management system to improve performance and efficiency.

- January 2025: SWITCH Mobility unveiled the 7.2-ton IeV8 electric light commercial vehicle at the Bharat Mobility Expo 2025, targeting mid-mile logistics. The IeV8 offers a 250 km range, 830 cubic feet of cargo space, and integrates the SWITCH iON telematics system for real-time fleet management.

Electric Commercial Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Electric Bus, Electric Pickup Truck, Electric Truck, Electric Van |

| Propulsion Types Covered | BEV, HEV, FCEV, PHEV |

| Applications Covered | Cargo, Passenger |

| Battery Types Covered | Lithium-Nickel-Manganese-Cobalt Oxide Batteries, Lithium-Iron-Phosphate Batteries, Others |

| Battery Capacities Covered | Less Than 50 kWh, 50-250 kWh, Above 250 kWh |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | AB Volvo, Anhui Ankai Automobile Co. Ltd., BYD Company Ltd., Construcciones y Auxiliar de Ferrocarriles S.A., Daimler AG, Ebusco B.V., King Long United Automotive Industry Co. Ltd, NFI Group Inc., Proterra Inc., VDL Groep B.V., Zhengzhou Yutong Bus Co. Ltd., Zhongtong Bus Holding Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric commercial vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electric commercial vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric commercial vehicle industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric commercial vehicle market was valued at USD 152.02 Billion in 2024.

The electric commercial vehicle market is projected to exhibit a CAGR of 25.56% during 2025-2033, reaching a value of USD 1,298.26 Billion by 2033.

Key drivers of the electric commercial vehicle market include rising fossil fuel prices, stringent emissions regulations, advancements in battery technology, and increasing government support through subsidies and incentives. Additionally, growing environmental concerns and demand for sustainable logistics solutions are pushing the shift towards electric fleets.

Asia Pacific currently dominates the electric commercial vehicle market, accounting for a share of 43.7%. Government policies, subsidies, and infrastructure investments are driving this dominance.

Some of the major players in the electric commercial vehicle market include AB Volvo, Anhui Ankai Automobile Co. Ltd., BYD Company Ltd., Construcciones y Auxiliar de Ferrocarriles S.A., Daimler AG, Ebusco B.V., King Long United Automotive Industry Co. Ltd, NFI Group Inc., Proterra Inc., VDL Groep B.V., Zhengzhou Yutong Bus Co. Ltd., Zhongtong Bus Holding Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)