Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033

Electric Truck Market Size and Share:

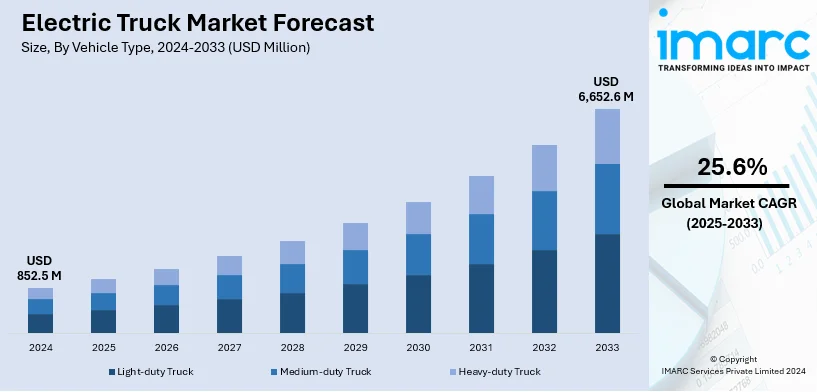

The global electric truck market size was valued at USD 852.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,652.6 Million by 2033, exhibiting a CAGR of 25.6% from 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The market is experiencing steady growth driven by the growing environmental consciousness and the need to reduce greenhouse gas (GHG) emissions, favorable government initiatives to combat air pollution, and increasing demand for cost-effective transportation solutions in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 852.5 Million |

| Market Forecast in 2033 | USD 6,652.6 Million |

| Market Growth Rate (2025-2033) | 25.6% |

The growth of the electric truck market is majorly driven by the increased need for sustainable transportation solutions. Governments worldwide are adopting more stringent emissions regulations that support the adoption of electric trucks and other vehicles in general to reduce carbon footprints. Improved battery technology also enables improved range and efficiency of electric trucks, making them more suitable for long-distance hauls. The increasing fuel price and the need to reduce operational costs are also driving businesses to switch to electric trucks that have lower maintenance costs and savings on fuel. In addition, the growing awareness of environmental issues, along with incentives and subsidies for the purchase of electric vehicles, is accelerating the growth of the market in regions such as North America and Europe.

The U.S. electric truck market is growing rapidly and is driven by supportive government initiatives. In 2023, electric truck sales rose to about 1,200 units, from less than 0.1% of total truck sales. The growth is spurred by tight emission standards and financial incentives. In October 2024, for instance, US nonprofit Climate United said it would invest $250 million in electric semi trucks over three years, in what will be the biggest single order of zero-emissions trucks in the country. Vehicles will be leased to truckers hauling containers to and from California seaports where, as of 2035, 33,000 drayage trucks are required to have zero tailpipe emissions. In addition to this, the Inflation Reduction Act also offers tax credits for the purchase of electric vehicles (EVs), making them more available to consumers and businesses alike. Moreover, improvements in battery technology have increased the range and efficiency of electric trucks, which had been previously a limitation. The increasing demand of logistics companies for sustainable transportation solutions also fuels this market. In addition, the expansion of charging infrastructure and the growing cost of fossil fuels are some of the factors supporting market growth as electric trucks become more cost-effective for most businesses.

Electric Truck Market Trends:

Rising Autonomous Freight Applications

The growing adoption of autonomous driving technology by both established manufacturers and innovative startups is significantly transforming the global electric truck market. By enabling vehicles to operate without the need for human drivers, this technology enhances operational efficiency and reduces labor costs, allowing freight companies to move more goods with fewer drivers. Autonomous trucks can operate for longer hours, improving fleet utilization and reducing delays associated with driver shifts. Additionally, the integration of AI and machine learning in these vehicles leads to optimized routes, better fuel management, and improved safety. This technological evolution is making trucking operations more cost-effective while increasing overall capacity, supporting the rising demand for fast and reliable freight transportation worldwide.

Growing environmental concerns

The increasing demand for electric trucks on account of the rising environmental consciousness among people worldwide is propelling the growth of the market. In addition to this, growing concerns about climate change and the necessity to decrease greenhouse gas (GHG) emissions are propelling the growth of the market. As indicated by the World Meteorological Organization (WMO), over the past 20 years, the atmospheric concentration of carbon dioxide (CO2) increased by 11.4%, which is considered the leading greenhouse gas responsible for climate change. Furthermore, the population has chosen greener modes of transportation for preserving the environment. People are also now learning to understand the implications of air pollution on their health. Here, electric trucks serve as an alternative to traditional diesel-run trucks. They emit no tailpipe emissions, which is important for reducing air pollution in urban and rural areas. This environmental benefit is aligned with the fight against climate change and improving air quality. In addition, more organizations are embracing electric trucks to stay on course with sustainability goals, build their brand reputation, and reduce their carbon footprint. Further, they can show that they are committed to being environmentally responsible by including electric trucks in their fleets. The electric truck market value is continuously rising because of the advancement of technologies and the growing demand for sustainable transportation solutions.

Favorable government initiatives

Various countries' governing agencies are promoting electric trucks by enforcing stringent emission standards. They are primarily concentrating on reducing air pollution and curbing greenhouse gas (GHG) emissions, which in turn is driving the growth of the market. They are providing many incentives to companies to switch towards cleaner modes of transportation. Those could also range from tax credits, rebates, and subsidies; hence, making electric trucks far more financially appealing to these firms. In addition, governments in many countries are laying targets to ban the sale of internal combustion engine vehicles which encourages the uptake of Electric Vehicle. Electric cars are estimated to have accounted for around 18% of total car sales in 2023, up from 14% in 2022, the International Energy Agency (IEA) stated. Additionally, they are working on charging infrastructure development so that electric trucks can be used effectively in massive transportation networks, which is providing a positive outlook to the electric truck market. Moreover, these developments raise people's awareness of sustainability and clean energy solutions, thus boosting market demand.

Increasing demand for cost-effective transportation solutions

The growing need for low-cost transportation options by the public and various businesses is fueling the market. Electric trucks are also energy-efficient as they consume less electricity to travel the same distance compared to diesel. The International Council on Clean Transportation indicates that battery electric trucks produce 63% fewer GHG emissions than diesel. This helps to reduce fuel costs across the life cycle of the vehicle, particularly since electricity prices tend to be more stable than diesel prices. In addition to this, electric trucks have fewer moving parts than conventional ICE vehicles, hence less maintenance cost. Additionally, there is a lesser probability of mechanical failure, thus reducing downtime and lower maintenance expenditure. These cost advantages make electric trucks economically viable for businesses and individuals interested in proper management of operational expenses. In addition, these benefits of advancement enable the extended operational ability of electric trucks by taking them farther without the need for recharging and enabling a higher load of cargo as well.

Electric Truck Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric truck market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, propulsion, range, and application.

Analysis by Vehicle Type:

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truck

Light-duty trucks are the largest share in 2024, taking up approximately 63.8% of the market. They are designed for relatively smaller cargo and passenger loads. It is usually used for urban and suburban deliveries, last-mile logistics, and plumbing or electrical services. Moreover, it offers a number of benefits, such as zero emissions, lower operating costs, and easy maneuverability in congested urban areas. These vehicles are often preferred when short trips with frequent halts are required. Their growing demand for sustainable solutions for transport and the fast growth of urban infrastructure stimulate their use, making such electric vehicles play a significant role in the reduction of logistics operations' carbon footprint. Advancements in battery technologies further enhance the range and economics of light-duty electric trucks, further driving market growth.

Analysis by Propulsion:

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

Hybrid electric has been the market leader with both an internal combustion engine and an electric propulsion system. These trucks use electric motors in low-speed and stop-and-go driving, minimizing fuel consumption and emissions under urban or congested traffic conditions, and using the ICE when it is required for high speed or heavy loads. It offers better fuel efficiency and reduced emissions compared to traditional diesel trucks, but without sacrificing the range of long-distance travel. Hybrid trucks can switch from the electric motor to the ICE as needed, thus providing excellent performance in various driving conditions. Therefore, hybrid trucks have been viewed as an economical means for fleets looking to improve their environmental profile without having to compromise on operational performance.

Analysis by Range:

- 0-150 Miles

- 151-300 Miles

- Above 300 Miles

The 0-150 miles range category dominates the market as they are usually designed for shorter, intra-city, and regional applications. They are best suited for urban deliveries, short-haul transportation, and services that involve frequent stops and starts. These trucks offer the advantage of zero emissions, making them eco-friendly and compliant with stringent urban emission regulations. Electric trucks in this range category require recharge during the day for extended operations. Their compact dimensions and agility also make them very suitable for navigating through congested urban areas, minimizing delays due to traffic. With the growing need for efficient, low-emission delivery solutions, this range category continues to grow in logistics, retail, and service sectors.

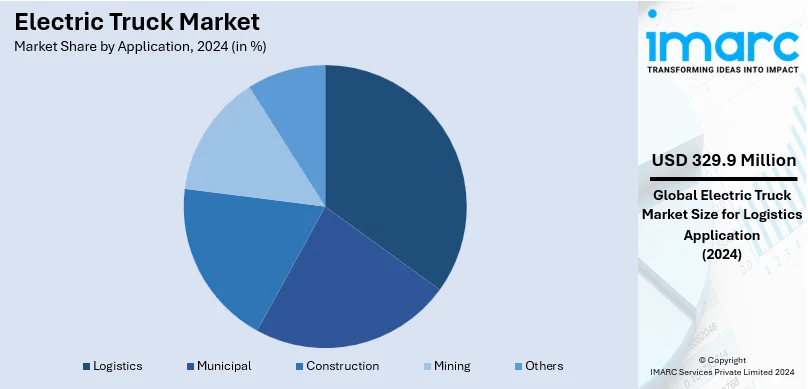

Analysis by Application:

- Logistics

- Municipal

- Construction

- Mining

- Others

Logistics leads the market with around 38.7% of the market share in 2024. Electric trucks are perfect for urban and suburban deliveries, including last-mile logistics. Electric trucks in logistics also reduce emissions in densely populated regions, where air quality and noise pollution are major issues. They are also adopted by courier services, e-commerce companies, and parcel delivery firms for efficient and environment-friendly transport of goods. The growing trend of sustainability in consumers and businesses is yet another driver for the electric trucks in logistics. With the growth of charging infrastructure and government incentives, these are becoming a more feasible solution for fleet operators looking for ways to reduce their carbon footprint and operational costs.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for over 37.8% of the total electric trucks market share. The increasing focus on maintaining the sustainability goals is driving the market's growth. Additionally, North America has an advanced infrastructure for the charging of EVs. significant investment being made by the region's governing agencies in charging networks such as high-power charging stations on major transportation routes are supporting the growth of the market. Moreover, some giant-scale electric truck manufacturers are extending their operations in the region, which further boosts their production capabilities. Apart from this, the region's regulatory environment, which is favorable due to tax incentives and subsidies for EV adoption, also drives the shift to electric trucks.

Key Regional Takeaways:

United States Electric Truck Market Analysis

Several factors are driving the electric truck market in the United States, mainly increasing the emphasis on sustainability and reducing carbon emissions. Environmental regulations are becoming stringent, such as the Biden administration's push for zero-emission vehicles, and federal and state incentives, including tax credits and grants, that reduce the initial cost burden of adopting electric vehicles. The other significant motivators are fuel price inflation and volatility in oil. Electric trucks will thus serve as a more economical alternative to their fossil fuel competitors. Companies are also appreciative of the long-term benefits of the operation, which may include lower maintenance costs and avoiding fluctuations in the prices of fuel. The expanding infrastructure for charging stations, with a 7.7% increase in EV charging ports in Q3 of 2023 according to the U.S. Department of Energy, coupled with advancements in battery technology offering greater range and faster charging, further bolsters market growth. Finally, increasing consumer demand for green logistics solutions and the desire of major fleet operators to enhance their corporate sustainability profiles are accelerating the adoption of electric trucks in the US market.

Europe Electric Truck Market Analysis

The main drivers of the electric truck market in Europe are stringent regulatory frameworks and ambitious climate goals set by the European Union. The Green Deal of the EU is pushing for a 55% reduction in emissions by 2030 and climate neutrality by 2050, which has led to investments in zero-emission transportation solutions, including electric trucks. Strict emissions standards implemented in countries like the UK, Germany, and France are forcing fleet operators there to take on electric trucks if they have to comply. Even Europe's robust charging infrastructure with the advent of technological advancements and improvements in battery performance ensures that electric trucks are capable of operating long-haul and urban transit. Economic factors, of course, include the recent rise in diesel prices and even the volatility of the oil market, which makes electric trucks rather attractive from a cost-efficiency perspective. Furthermore, European consumers and businesses increasingly make demands for sustainable logistics solutions, thus propelling the market forward. The growing focus in corporate strategy on sustainability issues and the availability of wide-ranging incentives for electric vehicles, including grants, subsidies, and tax breaks support the expansion of the market. With Volvo, Daimler, and Scania among the world's leading truck manufacturers, European development and deployment continue to provide the focus point for electric trucks.

Asia Pacific Electric Truck Market Analysis

The electric truck market in the Asia-Pacific (APAC) region is driven by a combination of environmental policies, urbanization, and advancements in electric vehicle (EV) technology. Countries like China, Japan, and South Korea are at the forefront, with China leading the global market due to its strong government support for electric vehicles, including subsidies and tax incentives. According to IEA, China has also begun to support more sustainable charging behaviour, with the aim that 60% of EV charging occurs off-peak by 2025. Additionally, China has set a target for EV sales to account for 40% of all vehicle sales by 2030. Additionally, stricter emission regulations and air quality concerns in major cities are driving the shift towards electric trucks. Advancements in battery technology, offering longer ranges and shorter charging times, are further enhancing the market’s prospects. Furthermore, the growing focus on reducing logistics costs, coupled with the decreasing cost of EV technology, is making electric trucks more attractive for fleet operators in APAC.

Latin America Electric Truck Market Analysis

In Latin America, the electric truck market is driven by growing environmental concerns and rising fuel costs. Countries like Brazil and Mexico are introducing stricter emissions regulations to accelerate the adoption of electric trucks. In Mexico, the government established a decentralized body, Lithium for Mexico, in August 2022, recognizing lithium as a strategic mineral and nationalizing its value chain. The country aims for 50% of vehicles produced, including trucks, to be zero-emission vehicles (ZEVs) by 2030, according to the IEA. Government incentives, such as tax breaks and subsidies, are helping to offset the high upfront costs of electric trucks. Furthermore, the growing demand for sustainable logistics solutions and the potential for long-term savings in fuel and maintenance costs are driving market growth. However, challenges such as limited charging infrastructure and the higher initial costs of electric trucks remain significant barriers to widespread adoption in the region.

Middle East and Africa Electric Truck Market Analysis

In the Middle East and Africa, the electric truck market is primarily driven by government efforts to diversify the economy and reduce carbon emissions. As part of Saudi Arabia's Vision 2030 and the UAE's National Electric Vehicle Strategy, which targets increasing EVs to 50% of all vehicles on the roads by 2050, both countries are investing heavily in green technologies, including electric vehicles. Rising fuel costs, along with the growing emphasis on environmental sustainability, are also encouraging the adoption of electric trucks. The availability of incentives and supportive policies further aids the transition to electric transportation. However, challenges such as limited charging infrastructure and high initial costs remain impediments to wider adoption in the region.

Competitive Landscape:

The global electric truck market is highly competitive, with several key players striving for dominance as the industry transitions to electric transportation. Major automotive manufacturers are leading the charge, investing heavily in research and development to improve battery technology, vehicle range, and charging infrastructure. New entrants are also gaining attention, focusing on the growing demand for sustainable transportation solutions. Additionally, established logistics companies are partnering with electric truck manufacturers, including Rivian and Daimler, to electrify their fleets. The market is also witnessing strategic collaborations between automakers and tech companies to enhance vehicle performance and address charging challenges. As regulatory pressure increases, these companies are competing not just on vehicle performance but also on environmental sustainability and cost-efficiency.

The report provides a comprehensive analysis of the competitive landscape in the electric truck market with detailed profiles of all major companies, including:

- VolvoGroup

- BYD Company Ltd.

- Mercedes-Benz Group AG

- China FAW Group Co. Ltd.

- Isuzu Motors Ltd.

- Navistar Inc.

- PACCAR Inc.

- Rivian Automotive Inc.

- Volkswagen AG

- Tata Motors Limited

- Tesla Inc.

- Tevva Motors Limited

Latest News and Developments:

- May 2025: Mercedes-Benz Trucks announced the expansion of its battery-electric truck portfolio based on the eActros 600, a long-haul flagship model featuring advanced technologies like an electric drive axle, lithium iron phosphate (LFP) batteries, and the Multimedia Cockpit Interactive 2. New variants include semitrailer tractors, platform chassis with varied wheelbases, battery packages, and long cab designs. The eActros 600 offers a 500 km range with a 621 kWh battery capacity and supports up to 44 tons gross combination mass. Production of first-generation eActros 300/400 ends in 2025. New models will be orderable from autumn 2025, supporting Mercedes-Benz’s goal to accelerate decarbonization in transport.

- April 2025: Windrose Technology launched the first all-electric long-haul sleeper truck in the U.S., with a 420-mile range. JoyRide Logistics, based in Phoenix, is the first U.S. regional trucking company to operate these trucks, which will be powered by EO Charging. The initial rollout will be in Arizona, California, and Nevada, with plans for nationwide expansion. Windrose trucks have been tested in Asia, Europe, Oceania, and North America, including a 2,800-mile cross-country trip using public charging stations.

- February 2025: Renault Trucks and Schwing-Stetter developed an innovative, fully electric concrete transport solution: the Renault Trucks E-Tech C 10x4, a five-axle truck with a fully electric mixer capable of carrying up to 10 m³ of concrete. This design overcomes battery weight challenges by repositioning batteries and adding an axle, maintaining payload and maneuverability. With a range of up to 140 km and fast charging, it supports typical construction routes with zero CO₂ emissions. This cost-competitive, decarbonised vehicle targets markets with favorable regulations and will debut at Bauma 2025.

- February 2025: DHL Group and Scania jointly developed an Extended Range Electric Vehicle (EREV), an electric truck with a fuel-powered generator to bridge the gap before full charging infrastructure is available. Starting February 2025, the EREV will be tested for parcel transport between Berlin and Hamburg, enabling 80-90% renewable electricity use and reducing CO2 emissions by over 80%. The truck offers a range of 650-800 km, can refuel at conventional stations, and serves as a pragmatic interim solution to accelerate sustainable freight transport while infrastructure scales up.

Electric Truck Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-Duty Truck, Medium-Duty Truck, Heavy-Duty Truck |

| Propulsions Covered | Battery Electric Truck, Hybrid Electric Truck, Plug-In Hybrid Electric Truck, Fuel Cell Electric Truck |

| Ranges Covered | 0-150 Miles, 151-300 Miles, Above 300 Miles |

| Applications Covered | Logistics, Municipal, Construction, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | VolvoGroup, BYD Company Ltd., Mercedes-Benz Group AG, China FAW Group Co. Ltd., Isuzu Motors Ltd, Navistar Inc., PACCAR Inc., Rivian Automotive Inc., Volkswagen AG, Tata Motors Limited, Tesla Inc., Tevva Motors Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric truck market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric truck market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An electric truck is a vehicle that uses electricity as its primary power source, powered by batteries or fuel cells. These trucks are designed to reduce emissions and reliance on fossil fuels, offering an eco-friendly alternative to traditional diesel-powered trucks, with applications in urban delivery, logistics, and heavy-duty transport.

The electric truck market was valued at USD 852.5 Million in 2024.

IMARC estimates the global electric truck market to exhibit a CAGR of 25.6% during 2025-2033.

The key factors driving the global electric truck market include stringent emissions regulations, government incentives, advancements in battery technology, rising fuel costs, and increasing demand for sustainable, cost-effective transportation solutions in urban and logistics sectors.

In 2024, light-duty trucks represented the largest segment by vehicle type, driven by their suitability for urban deliveries, zero emissions, and lower operating costs.

Hybrid electric trucks lead the market by propulsion, owing to their combination of electric motors for city driving and internal combustion engines for long-distance travel, providing flexibility and fuel efficiency.

The 0-150 miles range is the leading segment by range, driven by demand for urban deliveries, short-haul logistics, and frequent stops in congested areas.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global electric truck market include VolvoGroup, BYD Company Ltd., Mercedes-Benz Group AG, China FAW Group Co. Ltd., Isuzu Motors Ltd, Navistar Inc., PACCAR Inc., Rivian Automotive Inc., Volkswagen AG, Tata Motors Limited, Tesla Inc., Tevva Motors Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)