Electric Vehicle (EV) Battery Housing Market Size, Share, Trends and Forecast by Cell Format Type, Material, Vehicle Type, and Region, 2025-2033

Electric Vehicle (EV) Battery Housing Market Size:

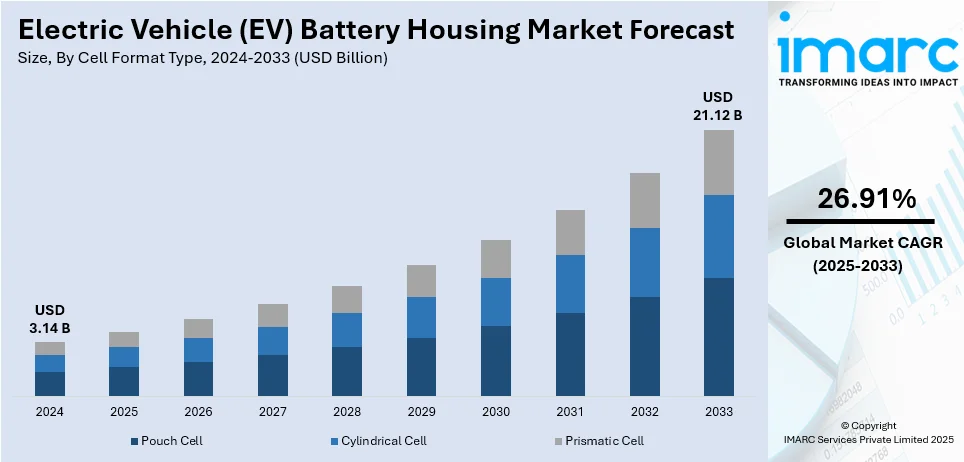

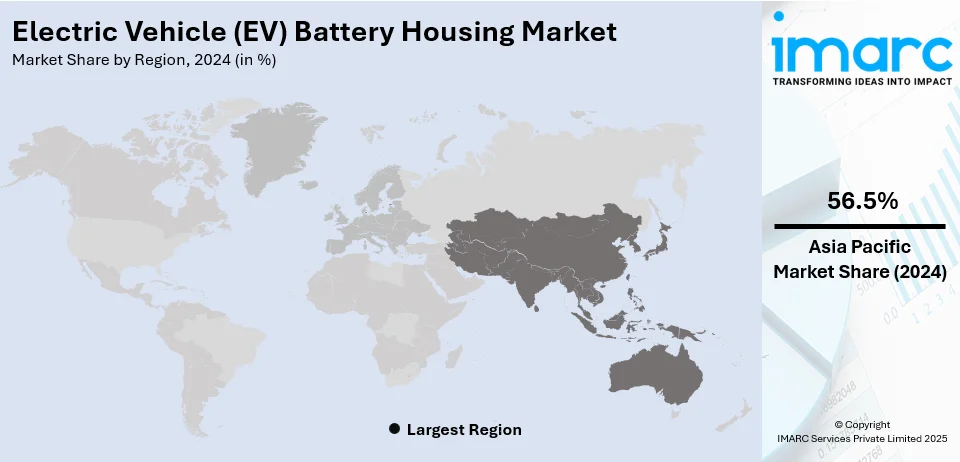

The global electric vehicle (EV) battery housing market size reached USD 3.14 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 21.12 Billion by 2033, exhibiting a growth rate (CAGR) of 26.91% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 56.5% in 2024. The market is propelled by the supportive government policies and incentives, increasing number of electric vehicle (EVs) sales, and the growing investment in electric vehicles (EVs) infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 3.14 Billion |

|

Market Forecast in 2033

|

USD 21.12 Billion |

| Market Growth Rate (2025-2033) | 26.91% |

The EV battery housing market is driven by the widespread adoption of electric vehicles (EVs), fueled by increasing environmental awareness and government policies promoting clean energy. According to industry reports India exhibits notable progress in electric vehicle adoption, with 53.61% of new three-wheelers and 4.97% of two-wheelers sold in 2024 being EVs. Goa leads in EV penetration at 14.20%. Advancements in battery technology demand lightweight, durable, and thermally efficient housing materials to enhance vehicle range and safety. Rising investments in EV infrastructure and the push for reducing vehicle weight to improve efficiency further boost the demand. Additionally, manufacturers are focusing on innovative designs and recyclable materials to meet sustainability goals, supporting the electric vehicle (EV) battery housing market share.

The United States EV battery housing market is driven by increasing electric vehicle adoption supported by federal incentives like tax credits and stringent emission regulations. Advancements in lightweight materials and designs to improve vehicle efficiency and range are key factors. Growing investments in EV manufacturing and infrastructure, including charging networks, further boost demand. Additionally, the push for domestic supply chains to reduce reliance on imports and meet sustainability goals strengthens the market, alongside consumer preference for environmentally friendly transportation solutions. For instance, in July 2024, the Biden-Harris Administration announced $1.7 billion to convert 11 auto manufacturing facilities across eight states for electric vehicle production. This investment aims to create and retain thousands of union jobs, bolster American manufacturing and address climate change by enhancing domestic supply chains and promoting environmentally responsible manufacturing practices.

Electric Vehicle (EV) Battery Housing Market Trends:

Government Incentives and Policies

The market for EV battery housings is impacted by the numerous incentives that governments across the globe are implementing to encourage individuals to switch to electric cars (EVs). The main goal of these incentives is to lower the cost barrier for prospective EV purchasers. They consist of subsidies, tax cuts, and refunds. The tax credit of up to USD 7,500 in the US effectively lowers the entry price for customers, making electric cars (EVs) financially competitive with vehicles powered by internal combustion (IC) engines. According to the Internal Revenue Service (IRS), a new qualifying plug-in electric vehicle (EV) purchased before 2023 may be eligible for a clean car tax credit of up to USD 7,500 under Section 30D of the Internal Revenue Code. Besides this, such regulations increase customer demand for electric vehicles, which increases manufacturing levels. There is an increasing need for essential parts such as battery housings as more electric vehicles are produced. Furthermore, by providing financial incentives supported by the government, automakers are incentivized to expand their electric vehicle lineup. This, in turn, stimulates advancements in battery technology and housing solutions, which are critical to the efficiency and safety of vehicles, thus contributing to the electric vehicle (EV) battery housing market share.

Increasing Number of Electric Vehicle (EV) Sales

According to the International Energy Agency (IEA), the international market for new electric cars is expected to develop exponentially, surpassing 14 million units sold by 2023, with the majority of these cars being sold in China, Europe, and the US. There were 40 million electric vehicles on the road overall, following estimates from the 2023 global EV outlook (GEVO-2023) with this increase. Additionally, sales of electric cars increased significantly in the year, accounting for 3.5 million more than in 2022. This is a 35% year-over-year increase and more than a six-fold increase since 2018. In 2023, there were more new registrations per week than there were in 2013, a decade earlier. In 2023, the percentage of cars sold that were electric increased to almost 18% from 14% in 2022. These patterns highlight the industry's sustained strong development, with battery-electric vehicles accounting for 70% of all-electric vehicles by 2023. Hence, this increase is a reflection of consumers' growing preference for cutting-edge, environmentally friendly transportation solutions. Hence, the need for strong, long-lasting EV battery housings is increasing along with EV sales as battery housings are essential for shielding the battery cells from environmental, mechanical, and thermal influences, thus creating a positive electric vehicle (EV) battery market outlook.

Investment in Electric Vehicle (EV) Infrastructure

The development of EV infrastructure with the increasing use of electric vehicles is influencing the market growth. For instance, by 2030, President Biden intends to have a national network of at least 500,000 public chargers in place. Additionally, to accomplish this goal the Bipartisan Infrastructure Law allots USD 7.5 billion for EV charging infrastructure. Hence, this sum of USD 5 Billion will support the National Electric Vehicle Infrastructure (NEVI) program, which will build a foundational network of high-speed chargers spaced no more than every 50 miles along major American roads, highways, and interstates. Apart from this, the other USD 2.5 Billion will be allocated through the charging and fueling program to competitive grants that will close gaps along charging routes and provide easy, accessible charging alternatives in residential, commercial, and retail locations. This investment makes owning an EV more feasible and lets manufacturers and customers know that the federal government is on board with the move to electric vehicles. Hence, there is a greater need for EVs and for durable, creative battery housings, which are essential to the general operation and durability of electric cars, thus generating a positive electric vehicle (EV) battery housing market outlook.

Electric Vehicle (EV) Battery Housing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on cell format type, material, and vehicle type.

Analysis by Cell Format Type:

- Pouch Cell

- Cylindrical Cell

- Prismatic Cell

Prismatic cell leads the market with around 46.4% of market share in 2024. Prismatic cells lead the EV battery housing market due to their compact design and high energy density. These cells are rectangular and encased in aluminum or steel, making them easier to stack and fit into modular battery housing systems. Their structural efficiency reduces space requirements, allowing for more streamlined battery packs that enhance vehicle range and performance. Prismatic cells also offer superior thermal management and mechanical stability, key for safety and longevity in EV applications. Manufacturers prefer prismatic cells for large-scale production, as their uniform shape simplifies integration into battery packs, supporting scalability and cost-effectiveness in EV manufacturing.

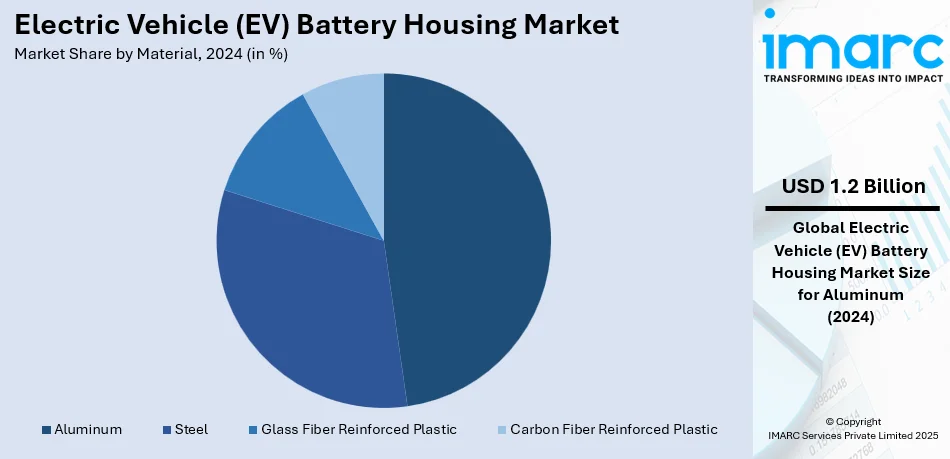

Analysis by Material:

- Steel

- Aluminum

- Glass Fiber Reinforced Plastic

- Carbon Fiber Reinforced Plastic

Aluminum leads the market with around 47.5% of market share in 2024. Aluminum represents the leading market segment. This preference for aluminum stems from its favorable properties, such as its lightweight nature, excellent thermal conductivity, and high recyclability, which enhance the overall efficiency and sustainability of EVs. Moreover, manufacturers opt for aluminum to reduce vehicle weight, thereby extending the driving range per charge. Additionally, aluminum's robustness and resistance to corrosion ensure durability and lower maintenance costs. It is further propelled by innovations in aluminum alloy compositions and manufacturing techniques, aligning with the automotive industry's evolving demands for higher performance and environmentally friendly solutions, thus increasing the electric vehicle (EV) battery housing demand. Moreover, SGL Carbon now supplies these innovative battery enclosures, which provide enhanced thermal insulation, thereby improving battery efficiency and reducing overall energy consumption. This widespread adoption of these highly durable battery casings represents a significant step forward for e-works mobility, delivering advantages in energy efficiency, raw material utilization, and safety features.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two Wheelers and Three Wheelers

Passenger cars lead the market with around 72.6% of market share in 2024. Passenger cars constitute the largest segment due to the escalating global demand for personal electric vehicles, as consumers increasingly favor eco-friendly and energy-efficient transportation options. This segment benefits from significant investments in EV technology and infrastructure, which facilitate advancements in battery performance and vehicle design. Hence key players are introducing advanced product variants to meet the numerous needs of individuals. For instance, on 14th September 2023, Toyota Motor Corporation (Toyota) unveiled its advanced battery technology roadmap, highlighting three new liquid electrolyte battery innovations aimed at enhancing power output, extending range, speeding up charging times, and reducing costs. A significant breakthrough in solid-state batteries has accelerated efforts toward mass production. Toyota also emphasized the importance of battery height reduction technology in improving driving range. At the launch of its BEV Factory, Toyota announced that its next-generation battery electric vehicles (BEVs) will commence production in 2026. These BEVs are designed to set new standards in performance and are tailored to meet diverse customer preferences.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 56.5%. Asia-Pacific is leading the market for EV battery housings because of its robust manufacturing sector, increasing adoption of EVs, and pro-EV policies. Thanks to programs like the New Energy Vehicle program, China is in a leading position in the segment of EV sales, with more than 25% of new cars sold there in 2023, as per reports. Relevant materials and designs by major manufacturers, such as BYD and CATL, who are developing lightweight and thermally efficient battery housings. India promises to be a promising market with ambitions to localization of battery manufacture and reach 30% electric vehicle penetration by 2030. Industry giants like Panasonic and LG Chem have headquarters in South Korea and Japan respectively are investing in cutting-edge battery technologies and even housing materials like steel alloys and composites. The demand for rugged and lightweight battery housing solutions is also increasing further because of the increasing use of electric buses and two-wheelers in countries like Indonesia and India.

Key Regional Takeaways:

North America Electric Vehicle (EV) Battery Housing Market Analysis

The North America electric vehicle (EV) battery housing market is driven by the growing adoption of EVs, supported by government policies promoting clean energy and advancements in EV manufacturing. Lightweight materials such as aluminum and composites are gaining traction to enhance vehicle range and efficiency. The increasing focus on domestic production, coupled with investments in innovative battery housing technologies, is reshaping the industry. Automakers are prioritizing thermal management and structural integrity in battery housings to ensure safety and performance in diverse operating conditions. Additionally, supportive measures, including incentives and infrastructure development, are encouraging market growth. Collaborations between manufacturers and material suppliers are fostering the development of cost-effective and scalable battery housing solutions. The push for sustainability, along with evolving consumer preferences for environmentally friendly transportation, continues to position North America as a key player in the global EV battery housing market.

United States Electric Vehicle (EV) Battery Housing Market Analysis

In 2024, the United States captured 88.50% of revenue in the North American market. The growing demand for electric vehicles (EVs), technological developments, and government incentives supporting environmentally friendly transportation are driving the market for EV battery housing in the United States. By 2023, there were more than 3.3 million EVs on the road in the United States, with California accounting for over 35% of all EV sales nationwide, as per reports. In order to increase vehicle range a critical concern for American buyers lightweight battery housing materials such as composites and aluminium are gaining momentum. Companies including Tesla, General Motors, and Ford are expanding their operations due to the Biden administration's goal of 50% EV sales by 2030, which has fueled investments in American battery manufacture. There are further augmentations of EVs by supporting the installation of 500,000 charging stations nationwide by 2030.

Another strong support comes in the way of sustainability adopted by the U.S. automobile industry through lithium-ion battery housing with structural integrity and thermal control. The customers for EV also enjoy federal tax credits of up to USD 7,500 that fuels growth in this market.

Europe Electric Vehicle (EV) Battery Housing Market Analysis

Europe is leading the EV revolution due to strict pollution standards, strong government support, and customer desire for environmentally friendly automobiles. The EU wants all new car sales to be carbon neutral by 2035, which will spur EV manufacturing. According to an industry report, more than 22% of new cars registered in Europe in 2023 were electric vehicles (EVs), with Norway and Germany leading the way in adoption. Lightweight carbon composites and magnesium alloys will be recommended to meet emission regulation and increase the efficiency of the vehicles. Investments in advanced battery housing solutions have increased through the European Battery Alliance's strategy of domestic production and recycling. In addition, the presence of significant EV producers such as BMW, Volkswagen, and Renault encourages innovations in battery housing. Along with government subsidies and tax breaks for EV sales, the vast infrastructure of EVs in Europe more than 400,000 public charging stations is helping expand the industry.

Latin America Electric Vehicle (EV) Battery Housing Market Analysis

Government initiatives towards greener transportation, increased urbanization, and reduction of greenhouse gases are propelling the EV battery housing market in Latin America. Thanks to the tax benefits and subsidies, Brazil and Mexico remain the most prolific adopters in the region. According to the International Energy Agency, there are already over 90,000 registered electric vehicles in the area by 2023 and more is in line to shoot upwards exponentially. For satisfying market demand, there's a preference toward two relatively low-cost, light-weight materials namely aluminum and hybrid composites to encase batteries. This need for reliable battery housing solutions is further driven by urban electrification projects, for example, the introduction of electric buses in Santiago and Bogotá.

Middle East and Africa Electric Vehicle (EV) Battery Housing Market Analysis

The area of MEA is embracing electric vehicles rapidly, mainly owing to government initiatives and sustainability aims. For instance, the UAE and Saudi Arabia are investing heavily in EV infrastructure as part of their strategies to reach net-zero emissions by 2060. The NEOM city project in Saudi Arabia plans to implement a fully electric public transit system, which will raise demand for cutting-edge battery technology, including housing solutions. South Africa and many African countries are adopting early-days EVs due to incentives to lower import taxes. In this region, lightweight and long-lasting battery housings are essential due to harsh weather. The expanded markets also become possible due to the growth of renewable energy sources for EV charging.

Competitive Landscape:

At present, key players in the electric vehicle (EV) battery housing market are employing strategic initiatives to bolster their growth. They focus on innovation in lightweight and thermally efficient materials to enhance battery performance and vehicle range. Additionally, partnerships with automotive manufacturers and investments in advanced manufacturing technologies are influencing the market growth. These companies are expanding their global presence through mergers and acquisitions and increasing their production capacities to meet the surging demand for EVs. Hence key players are introducing advanced product variants to meet these needs. For instance, in July 2023, Magna invested over USD 790 Million in constructing the first two supplier facilities at Ford’s BlueOval City supplier park in Stanton, Additionally, Magna established a stamping and assembly facility in Lawrenceburg, Tennessee. Ford’s on-site supplier park at BlueOval City will facilitate vertical integration to streamline production, supporting the assembly of up to 500,000 electric trucks annually at full capacity. Magna’s contributions to BlueOval City will include supplying battery enclosures, truck frames, and seats for Ford’s next-generation electric trucks. Along with this, the battery enclosures facility is anticipated to employ approximately 750 workers, with an additional 300 employees at the seating plant scheduled to commence in 2025.

The report provides a comprehensive analysis of the competitive landscape in the electric vehicle (EV) battery housing market with detailed profiles of all major companies, including:

- Constellium SE

- Gestamp Automoción, S.A.

- GF Casting Solutions

- Minth Group Ltd.

- Nemak S.A.B. de C.V.

- Norsk Hydro ASA

- Novelis Inc. (Hindalco Industries Limited)

- Proterial, Ltd.

- Teijin Automotive Technologies

- thyssenkrupp AG

- TRB Lightweight

- UACJ Corporation,

Latest News and Developments:

- January 2025: An innovative EV battery system with improved energy density, safety, and lifespan has been launched by LG Energy Solution (LGES). This idea fits with sustainable transportation trends and attempts to promote high-performance electric automobiles. The innovative technology meets the needs of global manufacturers for dependable and efficient energy solutions, demonstrating LGES's dedication to leading advancements in the EV sector.

- October 2024: Honeywell has unveiled fresh ideas to improve the manufacturing efficiency and safety of EV batteries. These developments seek to improve manufacturing procedures and solve safety issues related to lithium-ion batteries. The technologies' main goals are to enable scalable manufacturing, lower the risk of fire, and improve thermal management.

- November 2023: SGL Carbon achieved second place in the Products and Applications category at the AVK Innovation Awards 2023. It was held during the JEC DACH Forum in Salzburg, Austria. Additionally, their entry, titled Electric car battery housing components based on innovative continuous fiber-reinforced phenolic resin composites”, demonstrated their expertise in fiber composites and surpassed numerous other cutting-edge technologies in the competition.

- February 2023: AURORA, Ontario, Magna revealed that it has been awarded a new contract by General Motors (GM) to supply battery enclosures for the 2024 Chevrolet Silverado EV. These enclosures will be manufactured at Magna's electric vehicle structures facility located in St. Clair, Michigan, which currently produces enclosures for the GMC HUMMER EV. Magna has recently outlined substantial investment initiatives for the St. Clair facility to bolster its capabilities in response to the rapidly expanding electric vehicle sector, and the production is slated to commence later in 2023.

Electric Vehicle (EV) Battery Housing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cell Format Types Covered | Pouch Cell, Cylindrical Cell, Prismatic Cell |

| Materials Covered | Steel, Aluminum, Glass Fiber Reinforced Plastic, Carbon Fiber Reinforced Plastic |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two Wheelers and Three Wheelers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Constellium SE, Gestamp Automoción, S.A., GF Casting Solutions, Minth Group Ltd., Nemak S.A.B. de C.V., Norsk Hydro ASA, Novelis Inc. (Hindalco Industries Limited), Proterial, Ltd., Teijin Automotive Technologies, thyssenkrupp AG, TRB Lightweight, UACJ Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, electric vehicle (EV) battery housing market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle (EV) battery housing market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the electric vehicle (EV) battery housing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle (EV) battery housing market size reached USD 3.14 Billion in 2025.

The electric vehicle (EV) battery housing market is projected to reach a value of USD 21.12 Billion by 2033, exhibiting a robust CAGR of 26.91% during the forecast period from 2025-2033.

The market is majorly driven by increasing EV adoption, supported by government incentives, rising investments in EV infrastructure, and advancements in battery technology. Lightweight, durable, and thermally efficient materials enhance safety and efficiency. Sustainability goals and innovative designs further bolster market growth, alongside growing consumer preference for eco-friendly transportation.

Asia Pacific dominates the electric vehicle (EV) battery housing market in 2024, accounting for a share exceeding 56.5%. This dominance is fueled by robust manufacturing capabilities, supportive government policies, high EV adoption rates, significant investments in EV infrastructure, and advancements in battery housing technologies from leading regional players.

Some of the major players in the electric vehicle (EV) battery housing market include Constellium SE, Gestamp Automoción, S.A., GF Casting Solutions, Minth Group Ltd., Nemak S.A.B. de C.V., Norsk Hydro ASA, Novelis Inc. (Hindalco Industries Limited), Proterial, Ltd., Teijin Automotive Technologies, thyssenkrupp AG, TRB Lightweight, and UACJ Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)