Electric Vehicle Battery Swapping Market Size, Share, Trends and Forecast by Service Type, Vehicle Type, and Region, 2025-2033

Electric Vehicle Battery Swapping Market Size and Share:

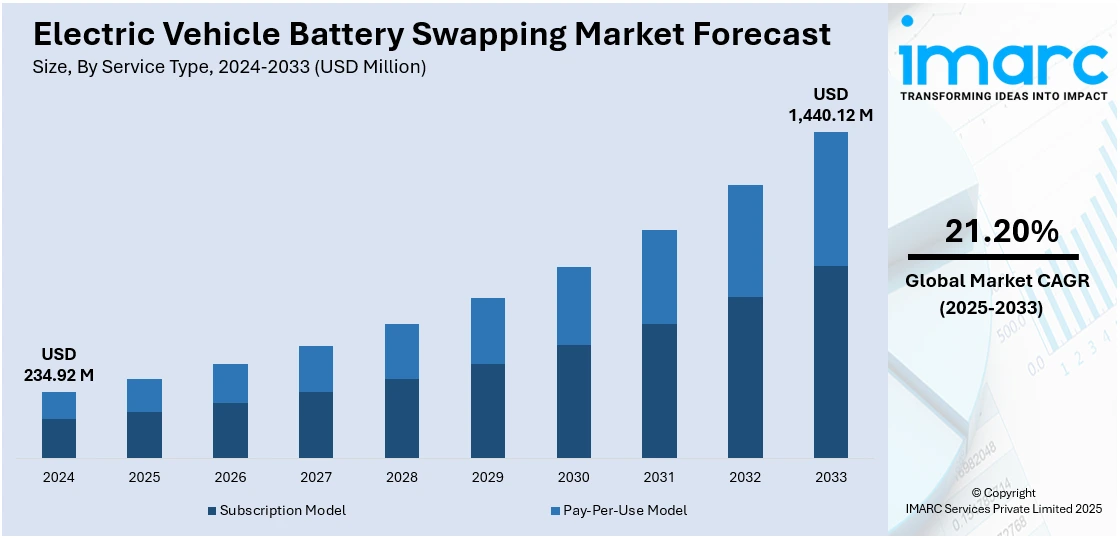

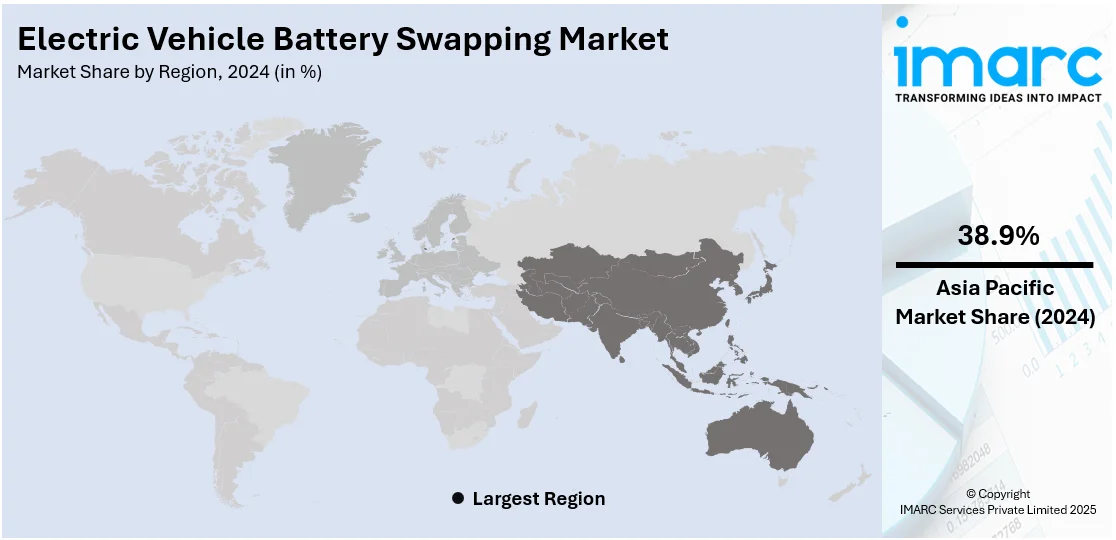

The global electric vehicle battery swapping market size was valued at USD 234.92 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,440.12 Million by 2033, exhibiting a CAGR of 21.20% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 38.9% in 2024. The growing demand for sustainable and environment friendly transportation is positively influencing the market. Besides this, the rising need for hassle-free and time-efficient charging solutions is contributing to the expansion of the electric vehicle battery swapping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 234.92 Million |

| Market Forecast in 2033 | USD 1,440.12 Million |

| Market Growth Rate 2025-2033 | 21.20% |

At present, the rising adoption of electric vehicles (EVs) is creating the need for faster and more efficient charging solutions. Battery swapping offers a quick alternative to slow conventional charging, especially for fleet operators and commercial vehicles. Many companies and individuals prefer battery-as-a-service models to reduce the high upfront cost of EVs. Besides this, government agencies are supporting battery swapping by promoting green mobility and investing in necessary infrastructure. Limited charging stations in crowded urban areas are also driving the demand for swapping networks. Standardized battery designs enhance the practicality and scalability of swapping systems. Moreover, technology improvements help make the swapping process smoother and quicker.

The United States has emerged as a major region in the electric vehicle battery swapping market owing to many factors. The rising need for faster and more efficient charging options is fueling the electric vehicle battery swapping market growth. With more EVs on the road, users seek quicker turnaround times, especially in commercial and ride-sharing segments. According to the International Council on Clean Transportation, the EV sector in the United States achieved 1.56 Million sales and a 10% share of total light-duty vehicle sales in 2024. Battery swapping offers a solution by allowing instant power replenishment without long charging waits. Fleet operators prefer this model to keep vehicles in service longer. The increasing demand for sustainable transportation is also encouraging innovations in battery technologies and infrastructure. Moreover, government incentives and clean energy policies are supporting the employment of advanced solutions.

Electric Vehicle Battery Swapping Market Trends:

Presence of associated benefits

One of the primary factors driving the demand for battery swapping solutions is the convenience and time efficiency they offer. Traditional charging methods often require lengthy charging times, which leads to range anxiety and inconvenience for EV owners. Battery swapping addresses this challenge by providing a rapid battery replacement process, typically taking a few minutes. EV drivers can exchange their depleted batteries with fully charged ones at swapping stations, which eliminates the need to wait for extended charging periods. This ease is particularly appealing for urban dwellers and long-distance travelers, as it enables uninterrupted journeys without compromising on time. Additionally, for commercial EV fleets, battery swapping ensures maximum vehicle uptime, which allows businesses to maintain continuous operations efficiently. Consequently, as worldwide EV sales are rising and individuals are seeking hassle-free and time-efficient charging solutions, the market continues to expand. As per industry reports, total EV sales reached 17.1 Million units, representing a 25% year-over-year (YoY) increase.

Rising demand for sustainable and environment friendly transportation

The increasing focus on sustainable and eco-friendly transportation solutions is offering a favorable electric vehicle battery swapping market outlook. For instance, a February 2024 report by CALSTART stated that the number of full-size transit zero-emission buses (ZEBs) rose by about 12% since 2022, totaling over 6,000 electric buses in the US and nearly 1,000 in Canada. EVs are regarded as an environment friendly alternative to internal combustion engine vehicles, as they produce zero tailpipe emissions. Battery swapping complements this eco-conscious mindset by reducing the overall carbon footprint of electric mobility. Battery swapping systems are contributing to a more sustainable transportation ecosystem by streamlining the charging process and utilizing renewable energy sources at swapping stations. As governments and individuals are prioritizing environmental conservation and seeking to reduce greenhouse gas emissions, the appeal of battery swapping as a green and clean charging option continues to grow.

Increase in flexibility for EV charging infrastructure deployment

EV battery swapping offers a flexible and adaptable solution for the deployment of EV charging infrastructure. According to the International Energy Association, at the end of 2022, there were 2.7 Million public charging points worldwide, more than 900,000 of which were installed in 2022, about a 55% increase from the 2021 stock. Unlike traditional charging stations that require significant physical infrastructure and may face challenges with zoning and land use, battery swapping stations can be strategically located in areas with high EV traffic and specific user demands. This flexibility allows rapid expansion and scalability of the battery swapping network, which makes it easier for charging infrastructure providers to meet the evolving needs of the electric mobility market. Additionally, battery swapping stations can be installed in a variety of locations, such as parking lots, gas stations, and retail centers, providing multiple access points for EV owners. This decentralized approach to charging infrastructure deployment ensures broader coverage, which enables a more convenient and accessible charging experience for EV users.

Electric Vehicle Battery Swapping Market Challenges:

The electric vehicle battery swapping market is undergoing transformation; however, several key issues still require careful consideration and resolution. One such consideration is standardization of vehicle manufacturers' battery sizes and formats, which at the moment restricts compatibility and convenience. Moreover, although the idea is intended to shorten charging time, the supporting infrastructure for mass battery swapping, such as swap stations and advanced battery logistics is still in nascent stages of development across most parts of the world. Consumers might also be reluctant on account of the longevity and quality of swapped batteries vis-a-vis self-owned and self-maintained devices. In addition, integrating software infrastructure to handle battery usage history and performance monitoring entails technological challenges. Finally, regulatory guidance on battery ownership and energy pricing requires further clarity. These are not insurmountable challenges but necessitate concerted industry cooperation and long-term policy commitment to clear the ground for easy adaptation and long-term market stability.

Electric Vehicle Battery Swapping Market Opportunities:

The market for electric vehicle battery swapping is full of potential for innovation and large-scale impact. Possibly the most lucrative element is in its ability to significantly minimize vehicle downtime by doing away with hours-long charging times. This is particularly useful for fleet operators, ride-sharing services, and delivery carriers that need constant mobility. Battery swapping also facilitates the unbundling of battery ownership from vehicle ownership, potentially reducing up-front costs to consumers and driving EV adoption. The idea fits with circular economy principles, as it allows for centralized monitoring of battery condition, refurbishment, and recycling. Swapping stations in dense urban areas with limited space can also minimize the demand for large charging bays. Furthermore, as technologies for smart grids continue to evolve, swapping stations can help stabilize the grid through role-playing as energy storage facilities. Furthermore, growing interest from automotive and energy players, this model presents a dynamic platform for cross-industry collaboration and ecosystem-wide sustainability benefits.

Electric Vehicle Battery Swapping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric vehicle battery swapping market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type and vehicle type.

Analysis by Service Type:

- Subscription Model

- Pay-Per-Use Model

Subscription model represented the largest market share in 2024. It provides a convenient, cost-effective, and user-friendly solution for EV owners. This model allows users to pay a fixed monthly or annual fee, which covers regular battery swaps, maintenance, and support services. It eliminates the need for users to invest heavily in battery ownership, which is often the most expensive part of an EV. By removing the burden of battery replacement and degradation concerns, it enhances user confidence and encourages wider EV adoption. The subscription model also ensures quick and consistent access to fully charged batteries, saving time compared to traditional charging methods. It supports high usage rates, especially among fleet operators, delivery services, and ride-sharing platforms that depend on fast turnaround. Service providers are benefiting from steady revenue, efficient resource planning, and long-term customer relationships. According to the electric vehicle battery swapping market forecast, with the increasing EV demand, the subscription model will continue to gain popularity due to its simplicity, flexibility, and economic benefits.

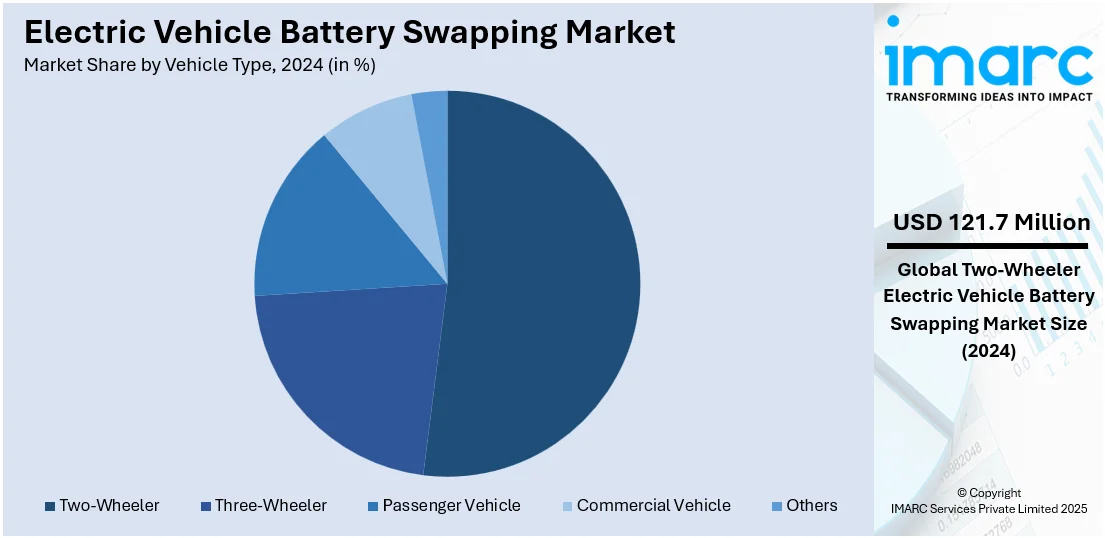

Analysis by Vehicle Type:

- Two-Wheeler

- Three-Wheeler

- Passenger Vehicle

- Commercial Vehicle

- Others

Two-wheeler holds 51.8% of the market share. It offers a practical and cost-effective solution for urban mobility. It consumes less power and uses a smaller battery, which makes the swapping process faster and simpler. A two-wheeler is commonly employed for short-distance travel, deliveries, and personal commutes, especially in congested city areas. Battery swapping allows the rider to avoid long charging times and continue the journey without delay. Many delivery and logistics businesses prefer two-wheelers due to their low maintenance and operational cost, and battery swapping enhances their utility further. The lightweight design and compact size of two-wheeler make it ideal for use with smaller and easy-to-handle battery units. Swap stations also require less space for serving two-wheeler, which supports quick service in crowded locations. As per the electric vehicle battery swapping market report, with more users shifting towards electric options for convenience and sustainability, the demand for two-wheeler battery swapping is growing steadily.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 38.9%, enjoys the leading position in the market. The region is experiencing growth due to its high population density, rising urbanization activities, and strong demand for affordable mobility solutions. Countries like China and India have a large number of two-wheeler and three-wheeler users who prefer cost-effective and time-saving transportation. As per industry reports, in September 2024, the total sales of two-wheelers in India, both domestic and for export, hit 22,79,163 units, showcasing a robust 17.93% year-on-year (YoY) increase from 19,32,606 units in September 2023. Battery swapping fits well into this high demand by offering quick energy refills without waiting for long charging times. Governments in the region are supporting electric mobility through subsidies, policies, and pilot projects, which are encouraging faster adoption. The presence of local manufacturers and technology providers is making battery swapping infrastructure more accessible and scalable. Additionally, many startups and companies in the Asia-Pacific region are investing in setting up swap stations across urban and semi-urban areas.

Key Regional Takeaways:

United States Electric Vehicle Battery Swapping Market Analysis

The United States holds around 80.00% of the market share in North America. The United States is witnessing market expansion due to increasing expenditure on automobile manufacturing. For instance, since the start of 2021, auto manufacturers announced investments of more than USD 75 Billion in the US. Automakers and energy infrastructure developers are allocating resources to battery technologies and swapping stations, enhancing the scalability of EV ecosystems. This trend is supported by a strategic shift in manufacturing capabilities towards electrified mobility. As spending on automobile manufacturing is accelerating, more standardized and modular battery platforms are being introduced, improving compatibility for swapping. Government incentives, tax credits, and private partnerships are further supporting the expansion of battery swapping infrastructure. Additionally, rising user interest in faster energy replenishment is motivating automakers to integrate battery swapping options. With investments in automobile manufacturing becoming a central growth driver, the United States is positioned to increase its reliance on efficient modular battery exchange systems.

Europe Electric Vehicle Battery Swapping Market Analysis

Europe is experiencing market expansion, driven by the rising demand for sustainable and environment friendly transportation. For instance, by 2023, more than 42% of newly registered city buses in Europe were zero-emission vehicles, a significant increase from 15% in 2020. Individuals and businesses are prioritizing clean mobility solutions that align with climate goals, encouraging innovations in EV charging alternatives. Battery swapping offers a solution to long charging times and range anxiety while promoting the circular use of resources. As sustainable and environment friendly transportation are gaining popularity, automakers and mobility providers are integrating swappable battery systems into fleets to reduce carbon emissions. Supportive regulations and green mobility initiatives are further enhancing the viability of such models. Public awareness about environmental impacts and commitments to carbon neutrality are influencing adoption. By aligning EV infrastructure with the demand for sustainable and eco-friendly transportation, Europe is paving the way for battery swapping integration at scale.

Asia-Pacific Electric Vehicle Battery Swapping Market Analysis

The market in the Asia-Pacific region is growing due to the rising inflow of foreign direct investment (FDI) in the automobile sector. According to the India Brand Equity Foundation, the automotive industry experienced a total equity FDI inflow of approximately USD 36.21 Billion from April 2000 to September 2024. Increased FDI in the automobile sector is leading to the establishment of advanced production facilities and innovation hubs focused on electrification. These financial inflows are supporting the development of swappable battery ecosystems, enabling quicker vehicle turnaround and minimizing downtime. As worldwide automotive brands are partnering with regional firms, the demand for modular battery designs suited for battery swapping is rising. The growing FDI in the automobile sector is contributing to the localized manufacturing of battery packs and standardized components, encouraging market scalability.

Latin America Electric Vehicle Battery Swapping Market Analysis

Latin America is showing an upward trend in EV battery swapping adoption due to increasing sales of EVs. According to the data released by the National Sustainable Mobility Association, ANDEMOS, in 2021, a sum of 118,191 hybrid and electric vehicles (HEVs) were registered in Latin America, exceeding 100% compared to 2020, when 57,078 units were logged. The surge in EV adoption is creating a need for efficient and time-saving charging alternatives. Battery swapping addresses this by enabling instant energy replenishment, enhancing overall vehicle utilization. As sales of EVs continue to increase across the region, infrastructure development for battery exchange is becoming an attractive solution to support user convenience and operational efficiency.

Middle East and Africa Electric Vehicle Battery Swapping Market Analysis

The Middle East and Africa region is witnessing market expansion owing to the growing flexibility for EV charging infrastructure deployment. As of 2024, the UAE had over 620 charging stations. According to the International Trade Administration, the Dubai Electricity and Water Authority set up 382 green charging stations in Dubai and plans to reach 1,000 by 2025. Battery swapping provides a modular and space-efficient solution suitable for regions facing grid constraints and limited real estate for traditional charging stations. With an increase in flexibility for EV charging infrastructure deployment, battery exchange networks are emerging as a key approach to electrification. Stakeholders are leveraging this flexibility to design scalable solutions adaptable to diverse geographical and infrastructural conditions.

Competitive Landscape:

Key players are working to develop innovative solutions to meet the high demand. They are building and operating swapping stations that allow users to replace depleted batteries quickly, reducing downtime. These companies also focus on manufacturing standardized battery systems to ensure compatibility across different vehicle models. By collaborating with automakers and government bodies, they are supporting the creation of a seamless ecosystem. Key players are promoting awareness about the benefits of battery swapping and offering subscription-based services to make the model more accessible. They are also investing in research and development (R&D) activities to improve battery life, safety, and swapping efficiency. Through innovations and market expansion, these companies are increasing adoption and trust among users, fleet operators, and logistics providers, making battery swapping a reliable and scalable solution in the electric mobility space. For instance, in January 2025, U Power introduced its EV battery-swapping technology in Peru, collaborating with Treep Mobility to promote sustainable transportation. The partnership started with an effective pilot initiative, launching two battery-swapping stations and multiple EVs. Due to favorable outcomes, Treep Mobility pledged to transition its fleet to the new model, with total orders anticipated to surpass USD 1 Million.

The report provides a comprehensive analysis of the competitive landscape in the electric vehicle battery swapping market with detailed profiles of all major companies, including:

- Ample Inc.

- ChargeMyGaadi (CMG)

- Echargeup Solutions Pvt. Ltd.

- Esmito Solutions Pvt Ltd

- Gogoro Inc.

- Kwang Yang Motor Co. Ltd.

- Lithion Power Private Limited

- NIO Inc.

- Numocity

- Oyika Pte. Ltd.

- SUN Mobility

Latest News and Developments:

- April 2025: The Indian government announced initiatives to provide subsidies for setting up battery swapping stations, with a focus on electric buses, trucks, and two- and three-wheeled vehicles. This effort sought to reduce lengthy charging durations and improve the practicality of long-distance EV journeys.

- April 2025: Sinopec teamed up with CATL to establish 10,000 battery exchange stations throughout China. The collaboration was intended to set up 500 stations by 2025, with aspirations for future expansion.

- March 2025: NIO and CATL established a strategic alliance in Ningde, China, to grow a battery swapping network for passenger cars. The collaboration sought to standardize technical guidelines and improve financial and business cooperation.

- March 2025: Ample revealed intentions to establish a network of battery swapping stations in Tokyo, with an initial emphasis on assisting commercial fleets in the logistics industry. Every station was expected to accommodate more than 100 vehicles, with a goal of offering quick and expandable solutions for electrifying fleets.

Electric Vehicle Battery Swapping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Subscription Model, Pay-Per-Use Model |

| Vehicle Types Covered | Two-Wheeler, Three-Wheeler, Passenger Vehicle, Commercial Vehicle, Others |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Ample Inc., ChargeMyGaadi (CMG), Echargeup Solutions Pvt. Ltd., Esmito Solutions Pvt Ltd, Gogoro Inc., Kwang Yang Motor Co. Ltd., Lithion Power Private Limited, NIO Inc., Numocity, Oyika Pte. Ltd., SUN Mobility, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle battery swapping market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle battery swapping market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle battery swapping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle battery swapping market was valued at USD 234.92 Million in 2024.

The electric vehicle battery swapping market is projected to exhibit a CAGR of 21.20% during 2025-2033, reaching a value of USD 1,440.12 Million by 2033.

The rising adoption of EVs is creating the need for quick and convenient charging alternatives, and battery swapping offers a fast solution compared to traditional charging. Besides this, government agencies are supporting the market through policies promoting clean mobility and infrastructure development. Additionally, technological advancements improve battery standardization and automation, making the swapping process more efficient and user-friendly.

Asia-Pacific currently dominates the electric vehicle battery swapping market, accounting for a share of 38.9% in 2024, driven by rising demand for affordable and time-saving transportation, government support, and a large number of two-wheeler users. The region's infrastructure development, along with eco-friendly initiatives, is encouraging the rapid adoption of battery swapping.

Some of the major players in the electric vehicle battery swapping market include Ample Inc., ChargeMyGaadi (CMG), Echargeup Solutions Pvt. Ltd., Esmito Solutions Pvt Ltd, Gogoro Inc., Kwang Yang Motor Co. Ltd., Lithion Power Private Limited, NIO Inc., Numocity, Oyika Pte. Ltd., SUN Mobility, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)