Electric Vehicle Motor Market Report by Power Rating (Up to 20 kW, 20 kW to 100 kW, 100 kW to 250 kW, Above 250 kW), Application (Two Wheeler, Three Wheeler, Passenger Vehicle, Commercial Vehicle), and Region 2026-2034

Electric Vehicle Motor Market Size:

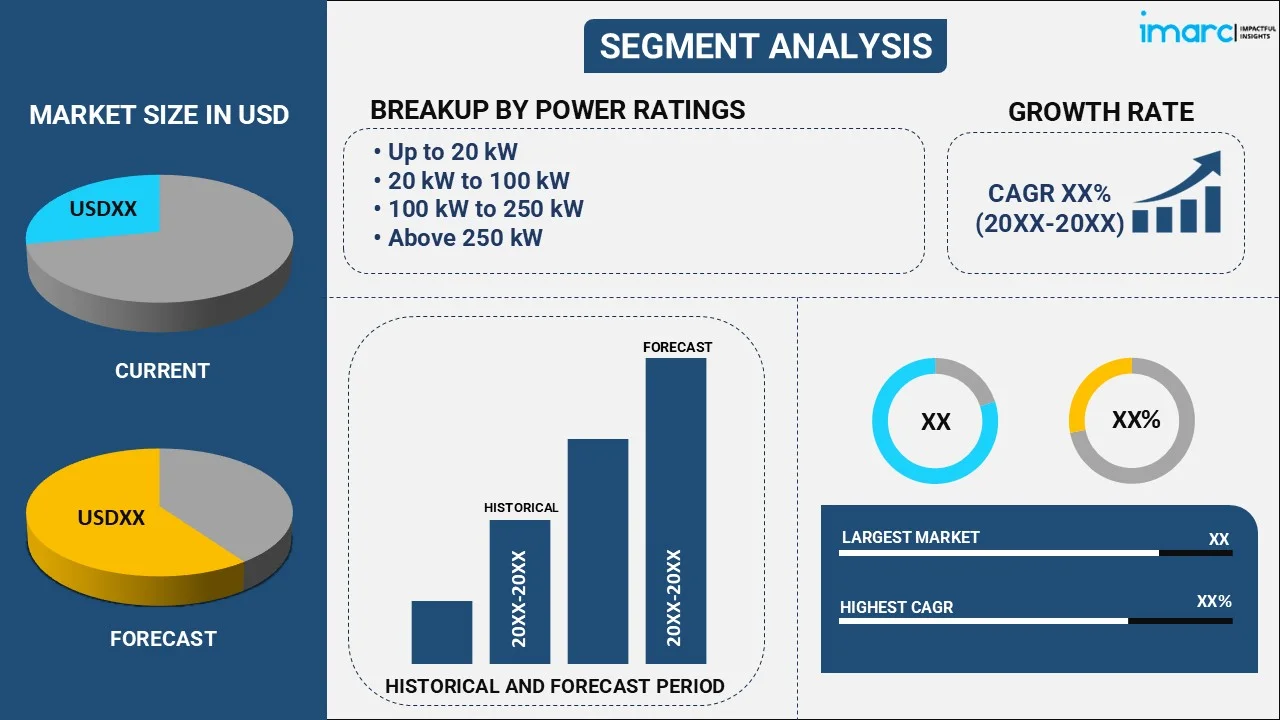

The global electric vehicle motor market size reached USD 54,023.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 211,715.2 Million by 2034, exhibiting a growth rate (CAGR) of 16.39% during 2026-2034. The market is primarily driven by the rising electric vehicle (EV) adoption, significant technological advancements in electric vehicle motors, and favorable government policies and incentives encouraging the use of electric vehicles across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 54,023.1 Million |

|

Market Forecast in 2034

|

USD 211,715.2 Million |

| Market Growth Rate 2026-2034 | 16.39% |

Electric Vehicle Motor Market Analysis:

- Major Market Drivers: The stringent emissions standards globally are pushing automakers to adopt electric vehicles (EVs).Besides, several innovations in motor efficiency and battery technology are driving the development of more powerful and compact electric motors. In addition, the rising consumer interest in electric cars and incentives for EV adoption is increasing awareness regarding environmental problems across the globe.

- Key Market Trends: There is a notable trend toward permanent magnet motors as permanent magnet motors have a better power density and efficiency than induction motors, thus influencing electric vehicle motor demand. Moreover, manufacturers are now merging motor and inverter systems to increase efficiency and decrease the total weight and complexity of vehicles.

- Geographical Trends: The Asia-Pacific region, particularly China, leads in EV production and motor manufacturing, driven by government policies promoting EV adoption and local production. Moreover, North America and Europe are witnessing significant growth in EV motor production, supported by technological advancements and increasing consumer demand for EV motors.

- Competitive Landscape: Some of the major market players in the electric vehicle motor companies include ABB Ltd., BorgWarner Inc., Continental AG, Hitachi Astemo Ltd. (Hitachi Ltd.), Mitsubishi Electric Corporation, Robert Bosch GmbH, etc., among many others.

- Challenges and Opportunities: Challenges include dependence on rare earth materials for magnets and semiconductors and achieving cost parity with internal combustion engines. On the other hand, opportunities exist in developing next-generation motor technologies, such as advanced materials and manufacturing processes for improving performance and minimizing costs.

To get more information on this market, Request Sample

Electric Vehicle Motor Market Trends:

Increasing electric vehicle (EV) Sales

Presently, stringent regulations are compelling manufacturers and consumers to choose more environmentally friendly car alternatives, which is influencing the electric vehicle (EV) motor market growth. According to World Metrics, in 2021 Europe accounted for 25% of the world's electric motor market. Moreover, in 2021 sales of electric cars increased to 6.6 million units, over 9% of the worldwide auto industry, more than doubling their market share from only two years earlier, according to the International Energy Agency (IEA). This sharp rise reflects the growing EV technology, which increases the competitiveness and desirability of these vehicles, and the rising customer demand for environmentally friendly automobiles. Besides, the increasing investment in research and development (R&D) for strong and efficient EV motors is due to the increasing sales, which further propel technological advancements. As a result, the increasing trend in EV sales shows that the industry is expanding robustly and that there is a bright future for the development of EV motors, encouraging manufacturers to keep coming up with new ideas to satisfy the growing demand and global regulatory standards.

Technological Advancements

Significant breakthroughs in the electric vehicle (EV) motor sector are accelerated by technological advancements in EV motor technology. For instance, researchers at Oak Ridge National Laboratory have achieved a significant achievement using polyphase electromagnetic coupling coils to create a 100-kW wireless power transmission system. This ground-breaking solution boosts efficiency and offers great power density, paving the way for a whole new method of EV charging. This technology enables quick and efficient wireless charging and eliminates the need for plug-in infrastructure, minimizing physical hurdles to EV adoption. Moreover, wireless charging is convenient and meets the growing need for cutting-edge, user-friendly technical solutions, which enhance customer interest in electric vehicles and advanced technological solutions. These technologies have the potential to impact the development trajectory of the EV industry as they are widely included in mainstream EV models by increasing the attractiveness and accessibility of electric vehicle motors.

Government Incentives and Policies

The EV market is shaped by government policies and incentives and financial tools such as tax breaks and subsidies. For instance, the Internal Revenue Service (IRS) reports that when a person buys a new qualifying plug-in electric car (EV) or fuel cell electric vehicle (FCV), the government grants individuals a tax credit under Internal Revenue Code Section 30D of up to $7,500. This credit's regulations for cars purchased between 2023 and 2032 were updated by the 2022 Inflation Reduction Act. Additionally, EVs become more appealing to a wider range of consumers, by offering financial incentives, thus contributing to the market growth. Moreover, the ambitious goal set by the European Union to have at least 30 million zero-emission cars by 2030 highlights the strong legislative support for EVs. These measures let manufacturers and investors know that the government is fully supporting the industry by lowering the initial costs of EVs. These incentives therefore promote greater output and investment in EV technology, which impact the expansion of the EV motor market by escalating the demand and increasing the rate of technical advancement, thus creating a positive electric vehicle motor market outlook.

Electric Vehicle Motor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on power rating and application.

Breakup by Power Rating:

To get detailed segment analysis of this market, Request Sample

- Up to 20 kW

- 20 kW to 100 kW

- 100 kW to 250 kW

- Above 250 kW

100 kW to 250 kW accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes up to 20 kW, 20 kW to 100 kW, 100 kW to 250 kW, and above 250 kW. According to the report, 100 kW to 250 kW represented the largest segment.

The 100 kW to 250 kW range represents the leading segment. It generally serves light commercial vehicles and passenger cars with moderate to high power needs for optimal performance. For mainstream consumers looking for cars with greater speeds and a longer range, motors in this power range provide an excellent mix of performance and energy economy. Moreover, the increasing demand for electric cars that deliver strong performance on par with internal combustion counterparts is supporting the appeal of this category and propelling notable breakthroughs in motor technology and adoption rates. Hence key players are introducing advanced product variants to meet these needs. For instance, in March 2024, Dodge unveiled the 2024 Dodge Charger Daytona, now fully electric, with an astounding 670 horsepower predicted to reach 60 mph in just 3.3 seconds, keeping its position as the world's fastest and most powerful muscle car. In addition, the 2024 Dodge Charger Daytona is anticipated to dominate all muscle cars in quarter-mile elapsed time (ET) with a predicted timing of 11.5 seconds.

Breakup by Application:

- Two Wheeler

- Three Wheeler

- Passenger Vehicle

- BEV

- Hybrid

- Commercial Vehicle

- BEV

- Hybrid

Passenger vehicle holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes two-wheelers, three-wheelers, passenger vehicles (BEV and hybrid), and commercial vehicles (BEV and hybrid). According to the report, passenger vehicles accounted for the largest market share.

Passenger vehicles represent the largest segment due to the rising consumer demand for environmentally friendly transportation options combined with supportive government policies promoting EV adoption. Moreover, the expansion of the passenger vehicle segment is further propelled by technological advancements in battery technology and motor efficiency, making EVs more accessible and affordable. Additionally, the integration of high-performance motors that enhance vehicle range and efficiency is enabling electric vehicle motor manufacturers to appeal to a broader consumer base. For instance, on 26th October 2023, GKN Automotive unveiled a new plug-and-play eDrive concept aimed at meeting the increasing demand among niche electric vehicle manufacturers and conversion companies for modular electric drive technology. This concept introduces a range of options, including a 113kW 2-in-1 combination system and a fully integrated 3-in-1 system with choices of 113kW or 185kW outputs. These systems cater to diverse applications from small to large cars and light commercial vehicles, supporting series production and retro-conversion projects which are scheduled for potential availability starting in 2025.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest electric vehicle motor market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest regional market for electric vehicle motors.

According to the electric vehicle motor market forecast, Asia Pacific is dominating the market. This dominance is fueled by significant investments in EV infrastructure and favorable government policies across major economies such as China, Japan, and South Korea. The region's market leadership is further bolstered by its strong base of EV manufacturers and suppliers, coupled with a growing consumer demand for sustainable transportation solutions. Additionally, the Asia Pacific market benefits from advancements in battery technology and cost reductions, making EVs more accessible and appealing. This regional market is expected to maintain its lead due to ongoing innovations and the increasing economic scale of EV production, which is generating electric vehicle motor market revenue. Hence key players are introducing advanced product variants to meet the changing needs of individuals across the globe. For instance, in October 2023, Toyota announced that the company is targeting solid-state battery electric vehicles (EVs) capable of achieving up to 750 miles of range by 2027, with Lexus potentially being the first to adopt this technology. The company aims to introduce solid-state batteries commercially by 2027, representing a significant advancement in EV technology. Toyota's efforts focus on enhancing the current lithium-ion liquid electrolyte technology, aiming to reduce manufacturing costs, shorten recharging times, and significantly increase single-charge driving distances.

Competitive Landscape:

- The electric vehicle motor market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the electric vehicle motor industry include ABB Ltd., BorgWarner Inc., Continental AG, Hitachi Astemo Ltd. (Hitachi Ltd.), Mitsubishi Electric Corporation, Robert Bosch GmbH, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- At present, key players in the market are actively pursuing strategies to bolster market growth through innovation, partnerships, and global expansion. Additionally, companies like Tesla, Nidec, and Bosch are focusing on advancing motor efficiency and reducing costs by innovating in materials and production techniques. Moreover, partnerships between automakers and tech companies are becoming more common to leverage shared expertise in software and hardware development. Furthermore, expansion into emerging markets with growing demand for EVs is a strategic move by firms to increase their global footprint, thus strengthening their market presence and boosting growth. For instance, in May 2023, Nidec Corporations revealed the opening of two new facilities in Novi Sad, Republic of Serbia, in response to the rising demand for electric vehicle (EV) components across Europe. The newly established Nidec Electric Motor Serbia is set to commence large-scale production of automotive motors, while Nidec Elesys Europe will focus on mass-producing automotive inverters and ECUs.

Electric Vehicle Motor Market News:

- 20 November 2023: Advanced Electric Machines, a prominent manufacturer of sustainable motors for the automotive sector, reinforces its commitment to sustainability in EV motors with a £23 Million new investment. This funding will support the expansion of production capacity at its North East facility, facilitate the realization of ambitious growth objectives to establish a global sales presence and enhance research and development capabilities.

Electric Vehicle Motor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | Up to 20 kW, 20 kW to 100 kW, 100 kW to 250 kW, Above 250 kW |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., BorgWarner Inc., Continental AG, Hitachi Astemo Ltd. (Hitachi Ltd.), Mitsubishi Electric Corporation, Robert Bosch GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global electric vehicle motor market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global electric vehicle motor market?

- What is the impact of each driver, restraint, and opportunity on the global electric vehicle motor market?

- What are the key regional markets?

- Which countries represent the most attractive electric vehicle motor market?

- What is the breakup of the market based on the power rating?

- Which is the most attractive power rating in the electric vehicle motor market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the electric vehicle motor market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global electric vehicle motor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric vehicle motor market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electric vehicle motor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle motor industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)