Embedded Processor Market Size, Share, Trends and Forecast by Type, Number of Bits, Application, and Region, 2025-2033

Embedded Processor Market Size and Share:

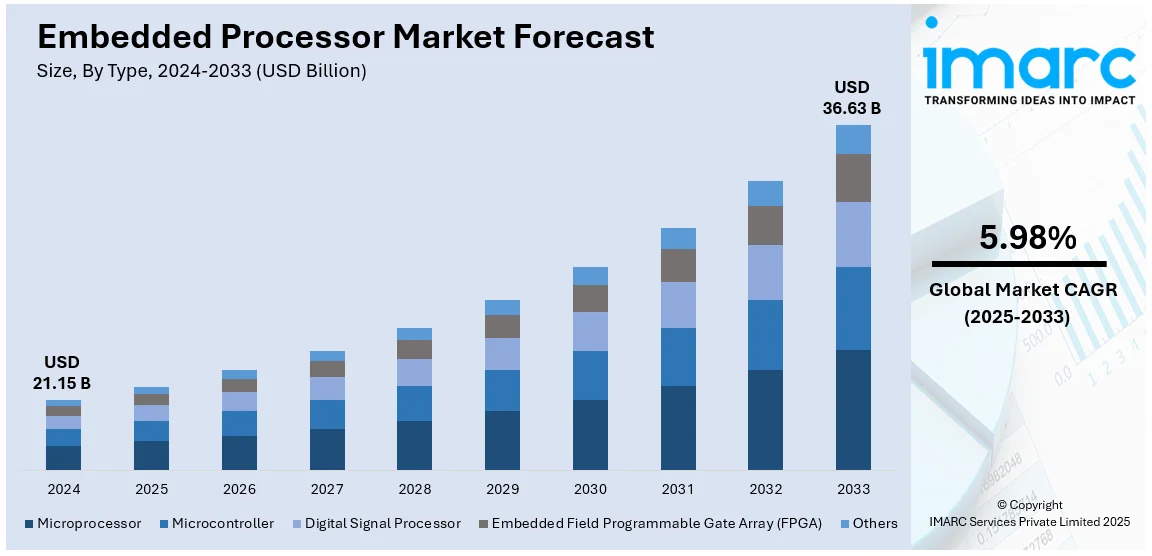

The global embedded processor market size was valued at USD 21.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.63 Billion by 2033, exhibiting a CAGR of 5.98% from 2025-2033. North America currently dominates the market, holding a significant embedded processor market share of over 35.6% in 2024 driven by growing demand for Internet of Things (IoT) devices, advancements in artificial intelligence (AI) and machine learning (ML) applications, and rising adoption of automation across industries. Increasing use in automotive systems, wearable devices, and industrial machinery, coupled with energy-efficient designs and enhanced processing power, further propels market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.15 Billion |

| Market Forecast in 2033 | USD 36.63 Billion |

| Market Growth Rate (2025-2033) | 5.98% |

IoT devices are emerging as a key factor driving growth in the embedded processor market. Healthcare, smart homes, and industrial automation are just a few examples of the various sectors seeing proliferation. Embedded processors power IoT applications, allowing for real-time data processing, connectivity, and efficient resource management. With the rise of connecting all of these devices which is demanding higher functionality with low power consumption, more manufacturers are now integrating specialized embedded processors into IoT systems. Moreover, the surging demand of edge computing solutions to decrease the latency and increase security of data additionally strengthens the requirement of high-performance processors embedded into an IoT environment for which this aspect is considered the most significant driving factor of this market.

The United States plays a significant role in the embedded processor market, driven by advancements in technology and a robust ecosystem of semiconductor manufacturers holing 78.80% of market share. The country’s strong focus on innovation in automotive, aerospace, and defense industries fuels demand for high-performance embedded processors. Moreover, the increasing use of IoT devices, AI-powered applications, and industrial automation is further fueling the expansion of the market. The U.S. government’s investments in semiconductor manufacturing and research and development (R&D) further bolster the sector. Government initiatives, like the CHIPS and Science Act, have provided substantial support to the sector. Since its implementation, companies have revealed investments exceeding $395 billion in semiconductors and electronics, leading to the creation of over 115,000 jobs. Major players headquartered in the region, coupled with an emphasis on energy-efficient and secure embedded solutions, position the U.S. as a leader in driving market expansion and technological breakthroughs.

Embedded Processor Market Trends:

Internet of Things and Connected Devices

The proliferation of IoT and connected devices is one of the primary drivers for the embedded processor market. According to reports, there were more than 18 billion IoT devices worldwide in 2024, and that number is expected to rise to over 40 billion by 2030. Applications of such embedded processors in wearables, smart homes, and industrial automation are on the rise. As for example, reports indicate that around 186 million smart home devices were shipped worldwide in the first half of 2023, and an embedded CPU is a critical component of devices such as security systems, smart speakers, and thermostats. Embedded processor integration in industrial IoT promotes operational efficiency and predictive maintenance. There is a growing embedded processor market demand because the automotive industry is embracing connected car solutions.

Advancements in Consumer Electronics

The growth of the embedded processor market is also driven by advancements in consumer electronics. Advances in wearables, gaming consoles, tablets, and smartphones have increased demand in the embedded processor market. According to reports, over 1.2 billion smartphones were shipped worldwide in 2023. High-performance embedded processors were therefore necessary for quicker processing, efficient power management, and better artificial intelligence capabilities. The gaming industry relies heavily on embedded processors in consoles and portable electronics to provide fluid gameplay and excellent graphics. The dependence on embedded processors to offer this sophisticated functionality is increasing due to breakthroughs such as foldable screens and augmented reality (AR) features thus creating a positive embedded processor market outlook.

More Health-Conscious Choices

The requirement for embedded processors has increased with the shift of the automotive industry towards electric cars (EVs) and advanced driver-assistance systems (ADAS). As reported, an average of 70–100 embedded processors are found in modern cars that run a variety of systems such as infotainment, engine control, and autonomous driving. Lane-keeping assistance and adaptive cruise control, two of the ADAS features that rely on embedded computers for real-time data processing and decision-making, were used in more than half of all cars sold around the world in 2023. Embedded processors are also common in the EV market, where over 14 million units were sold worldwide in 2023, according to reports, to operate motor control, battery systems, and connectivity. The need for innovation and compliance will fuel continued growth in embedded processors in automotive applications as the regulatory organisations mandate more stringent safety requirements and sustainability goals.

Embedded Processor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global embedded processor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, number of bits, and application.

Analysis by Type:

- Microprocessor

- Microcontroller

- Digital Signal Processor

- Embedded Field Programmable Gate Array (FPGA)

- Others

Microprocessors holds a significant embedded processor market share due to their versatility and critical role in powering a wide range of electronic devices. Their ability to perform complex computations, enable multitasking, and support advanced applications makes them indispensable across industries such as consumer electronics, automotive, and industrial automation. The rising adoption of IoT devices and AI-driven technologies has further increased demand for microprocessors with higher processing power and energy efficiency. Additionally, their integration into smart devices, home automation systems, and wearable technologies highlights their importance in everyday applications. Advancements in semiconductor manufacturing, such as smaller node sizes and improved architectures, have enhanced microprocessor performance, driving innovation and solidifying their dominance in shaping the future of technology and the embedded processor market growth.

Analysis by Number of Bits:

- 16 Bit

- 32 Bit

- 64 Bit

- Others

16-bit processors are used in cost-sensitive and mid-range applications, offering moderate performance and efficiency. They are commonly found in embedded systems, industrial automation, and automotive applications, where basic data processing and control are required. With their reduced power consumption and cost-effectiveness, 32-bit processors are well-suited for basic computing tasks.

Furthermore, the 32-bit leads in mainstream applications because of their optimal balance between performance and cost. These processors support advanced operations, making them ideal for smartphones, consumer electronics, and IoT devices. With higher data handling capacity and compatibility with modern software, 32-bit processors are versatile for various industrial and commercial uses.

Moreover, 64-bit processors are preferred for high-performance applications requiring advanced computing power. They are integral to servers, gaming systems, and AI-driven technologies. Their ability to handle larger memory addresses and execute intensive workloads positions them as critical components in industries demanding superior performance and computational efficiency.

Also, the other processors include 8-bit and niche architectures catering to specialized applications. 8-bit processors, though less common, are used in legacy systems and simple embedded devices. Meanwhile, application-specific processors like DSPs (Digital Signal Processors) address unique requirements in audio, video, and signal processing, ensuring tailored performance for distinct tasks.

Analysis by Application:

- Automotive/Transportation

- Industrial Automation

- Information and Communication Technology

- Healthcare

- Utilities

- Others

Embedded processors in automotive systems enable advanced functionalities such as engine control, autonomous driving, and in-vehicle infotainment. They support safety features, real-time navigation, and connectivity, driving efficiency and innovation. The growing demand for electric vehicles and autonomous technologies is driving the increased use of embedded processors in the automotive industry.

Also, the embedded processors play a vital role in industrial automation by powering robotics, process control systems, and smart manufacturing solutions. They ensure precision, energy efficiency, and real-time monitoring in factory operations. The shift toward Industry 4.0 and increased reliance on IoT-driven smart factories propel their demand in this application area.

Moreover, in ICT, embedded processors are crucial for powering networking equipment, data centers, and communication devices. They enable seamless connectivity, data processing, and cloud integration. With the rise of fifth generation (5G) networks, AI, and edge computing, embedded processors are becoming indispensable in advancing information and communication infrastructure.

Also, the embedded processors drive innovation in healthcare by powering medical devices, diagnostic tools, and wearable technologies. They support real-time patient monitoring, imaging systems, and telemedicine applications. The growing demand for portable healthcare devices and advanced diagnostic solutions underpins the significance of embedded processors in modern healthcare.

Additionally, in the utilities sector, embedded processors play a crucial role in managing smart grids, energy distribution, and integrating renewable energy. They enable real-time monitoring, predictive maintenance, and the efficient use of resources. The transition to smart energy systems and sustainable solutions drives the adoption of embedded processors in energy management and utility operations.

Furthermore, other applications include aerospace, defense, and consumer electronicsIn the aerospace and defense sectors, embedded processors are essential for ensuring accuracy and reliability in navigation and control systems. In consumer electronics, they power devices like smart TVs, gaming consoles, and home automation systems, highlighting their versatility across a broad spectrum of industries.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the embedded processor market forecast, North America leads the market with 35.5% shares due to its robust manufacturing ecosystem, technological advancements, and high consumer demand. The region hosts key semiconductor manufacturing hubs, which benefit from cost-efficient production and a skilled workforce. Rapid industrialization, urbanization, and the widespread use of IoT devices are driving the demand for embedded processors in sectors such as automotive, consumer electronics, and industrial automation. Additionally, the increasing adoption of 5G, AI, and smart city initiatives enhances market growth. Countries such as China, Japan, South Korea, and India make substantial contributions through investments in research and development, as well as in advanced infrastructure. The region’s strong electronics export base, coupled with government support for digital transformation, reinforces its dominance in the global embedded processor market.

Key Regional Takeaways:

United States Embedded Processor Market Analysis

Strong growth in the consumer electronics, automotive, and IoT markets is driving the embedded processor market in the United States. The rapid growth of the Internet of Things, which is expected to have more than 40 billion linked devices by 2030, is driving demand for embedded processors in smart home, industrial automation, and healthcare applications, as per reports. The automotive sector is the leading contributor, with approximately 17 million cars sold annually. Many of them have embedded processor-powered advanced driver-assistance systems. Contributing equally important contributions are also the U.S. defense and aerospace industries because of increasing investments in unmanned aerial vehicles and communications systems that demand high-performance embedded processors.

Consumer electronics too finds support in a healthy demand for wearables and smart appliances with 80 million smartwatch users in the United States according to reports. Additionally, strengthened demand for embedded processors is also found in the nation through the leadership it holds in semiconductor R&D. It is further supported by initiatives by federal financing in CHIPS Act which promotes innovation and growth through manufacturing.

Europe Embedded Processor Market Analysis

Developments in industrial automation, automotive innovation, and renewable energy systems are driving the embedded processor market in Europe. Due to the region's focus on Industry 4.0 technology, embedded processors are now widely used in factory automation and robotics. For instance, the demand for processors has increased due to the significant yearly growth in the industrial robotics market in Germany. Another significant driver is the European automotive sector, which produces more than 13 million cars a year as per the data by European Automobile Manufacturer’s Association. Embedded processors are essential to ADAS and electric vehicles (EVs). According to the data by European Council, in 2022, renewable sources accounted for around 40% of Europe's electricity. Renewable energy projects, such as wind and solar farms, are increasingly relying on embedded processors for effective energy management and grid connectivity. Additionally, the increased application of embedded processors in smart city initiatives aligns with the European Union's strategy on sustainability and digital transformation, which increases connectivity and efficiency in resource utilization across the continent.

Asia Pacific Embedded Processor Market Analysis

The Asia-Pacific region is the most prominent in the embedded processor market, given its increased digitization, automobile production, and manufacturing of consumer electronics. Global leaders in semiconductor manufacturing are China, Japan, and South Korea; in fact, China produces more than 30% of all electronics produced in the world, as per reports. With 1.4 billion 5G connections in the region by 2030 as reported, the rising need for smart phones dramatically increases the adoption of embedded CPUs. Asia-Pacific produces roughly half of the automobiles in the world, and most of them have embedded CPUs for safety and infotainment systems. The automotive industry also contributes to this. The region's expanding IoT market further drives processor demand and will be used in applications ranging from industrial automation to smart cities. Based on estimates, the region is expected to spend over USD 270 Billion on the Internet of Things (IoT) in 2023, an 11% increase from 2022. Government initiatives like China's "Made in China 2025" and India's "Make in India" are fostering increased regional manufacturing and innovation in embedded systems.

Latin America Embedded Processor Market Analysis

The rising adoption of IoT, automotive, and industrial automation technologies is driving the growth of the embedded processor market in Latin America. Smart sensors and embedded systems are also optimizing resource usage in countries like Argentina and Brazil, which have growing IoT deployments in agriculture, including precision farming. Media reports state that more than 2 million vehicles were produced in 2022, of which most were equipped with embedded processors, thereby leading the way in the automobile sector expansion. The demand for embedded processors in energy management systems is also fuelled by the region's growing renewable energy sector, with wind and solar capacity rising significantly each year. Additionally, the need for embedded systems in supply chain and logistics applications is increased by the growth of e-commerce, which is expected to increase by 20% yearly in important regions, as per reports.

Middle East and Africa Embedded Processor Market Analysis

The growth of the automotive sector, digitalization, and increasing expenses in smart infrastructure are driving the embedded processor market in the MEA region. The individual countries within the GCC, led by Saudi Arabia and the UAE, are heavily investing in the smart city initiatives such as NEOM, which require embedded processors for connectivity and Internet of Things applications. This makes the automotive market grow, given that countries such as South Africa are emerging as production hubs, producing over 500,000 vehicles a year according to the World Economic Forum, many of which have embedded CPUs. Demand for embedded system-powered energy management solutions is driven by the region's focus on renewable energy initiatives, such as Saudi Arabia's goal of generating 50% of its electricity from renewable sources by 2030, according to data from Saudi and Middle East Initiatives.

Competitive Landscape:

The embedded processor market's competitive landscape is very innovative, but the industry highlights rapid technological growth. It is highly competitive in nature as the companies develop processors that can have higher performance, energy efficiency, and enhanced functionalities in order to fulfill various applications like IoT, automotive, industrial automation, and consumer electronics. Frequent launches of products along with strategic collaborations form a part of the market's offerings to satisfy the customer's evolving requirements, especially for AI and machine learning applications. Companies are increasingly focusing on growing their portfolios in niche markets of specialized processors and edge computing/5G infrastructure. Competition has also been boosted by the growth of advanced manufacturing technologies and inclusion of security features. Regional players and startups are rising, making the competition for share in this sector even more vigorous and dynamic.

The report provides a comprehensive analysis of the competitive landscape in the embedded processor market with detailed profiles of all major companies, including:

- Analog Devices Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Intel Corporation

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated.

Latest News and Developments:

- October 2024: AMD launched its fourth-generation Epyc Embedded 8004 Series processors, designed for compute-intensive embedded systems. These processors deliver up to 30% better performance-per-watt and support high-speed I/O and expansive memory bandwidth. The Epyc 8004 Series is optimized for networking, storage, and industrial edge applications, with a long lifecycle support of 7 years.

- July 2024: Intel launched its 14th Gen Raptor Lake Refresh CPUs, focusing on embedded solutions with a unique E-coreless design. The flagship Core i9-14901KE is overclockable, marking a first for Intel's embedded processors. The lineup includes Core i9, i7, and i5 variants, targeting power-efficient and high-performance applications.

- April 2024: Synaptics launched the Astra AI-native IoT platform, featuring the SL-Series of embedded processors and the Astra Machina Foundation Series development kit. These processors enable high-performance AI at the edge, with applications across smart home, industrial, and enterprise IoT. The platform integrates scalable hardware, open-source AI frameworks, and robust wireless connectivity for rapid deployment.

- October 2024: In order to meet the increasing demand for effective AI infrastructure as industries embrace AI solutions more and more, Untether AI has introduced new AI chips with the goal of improving energy efficiency and performance for AI workloads. These chips are intended for data centre applications and are focused on providing high computational throughput while minimising power consumption.

- April 2024: A new product from Concurrent Technologies broadens the company's offering of cutting-edge computing technologies.It has introduced 'Rhea,' a new embedded processor board in its VME line. Customers in demanding industries like industrial applications, aerospace, and defence are expected to benefit from this development's increased performance and adaptability. The device is in line with the business's plan to develop cutting-edge embedded computing technology to satisfy intricate operational needs.

- February 2024: AMD introduced its Embedded+ Architecture, which integrates embedded processors with adaptive System-on-Chips (SoCs). The invention addresses complicated workloads and real-time processing requirements in a variety of industries, including automotive, industrial, healthcare, and more. It is a flexible option for contemporary embedded systems since it combines low latency, enhanced power management, and sophisticated processing capabilities.

Embedded Processor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Microprocessor, Microcontroller, Digital Signal Processor, Embedded Field Programmable Gate Array (FPGA), Others |

| Number of Bits Covered | 16 Bit, 32 Bit, 64 Bit and Others |

| Applications Covered | Automotive/Transportation, Industrial Automation, Information and Communication Technology, Healthcare, Utilities and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Broadcom Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology Inc, NXP Semiconductors N.V., ON Semiconductor Corporation, Renesas Electronics Corporation, STMicroelectronics N.V. and Texas Instruments Incorporated |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the embedded processor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global embedded processor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the embedded processor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The embedded processor market was valued at USD 21.15 Billion in 2024.

IMARC Group estimates the market to reach USD 36.63 Billion by 2033, exhibiting a CAGR of 5.98% from 2025-2033.

Key factors driving the embedded processor market include the increasing adoption of IoT devices, demand for automation across industries, advancements in AI and machine learning, the shift toward energy-efficient and high-performance computing, and the growing need for real-time data processing in sectors like automotive, healthcare, and industrial automation.

North America currently dominates the market, driven by its increased digitization, automobile production, and manufacturing of consumer electronics.

Some of the major players in the embedded processor market include Analog Devices Inc., Broadcom Inc., Infineon Technologies AG, Intel Corporation, Microchip Technology Inc, NXP Semiconductors N.V., ON Semiconductor Corporation, Renesas Electronics Corporation, STMicroelectronics N.V. and Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)