Endoscopy Devices Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

Endoscopy Devices Market 2024, Size and Share:

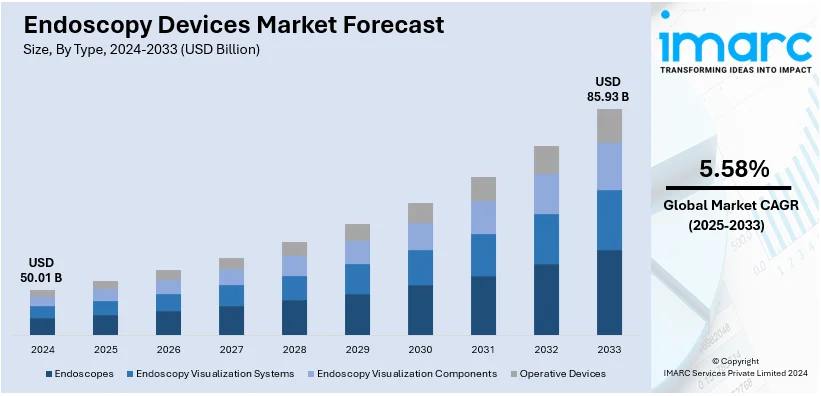

The global endoscopy devices market size was valued at USD 50.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 85.93 Billion by 2033, exhibiting a CAGR of 5.58% during 2025-2033. North America currently dominates the endoscopy devices market share, holding a significant market share of over 38.6% in 2024. The market is experiencing steady growth driven by the growing adoption of minimally invasive surgeries across various medical fields, the rising prevalence of gastrointestinal diseases and cancer necessitating frequent endoscopic procedures for early detection, and continual technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.01 Billion |

|

Market Forecast in 2033

|

USD 85.93 Billion |

| Market Growth Rate (2025-2033) | 5.58% |

The global endoscopy devices market growth is primarily driven by advancements in minimally invasive surgical techniques, growing prevalence of gastrointestinal and chronic diseases, and an aging population requiring diagnostic and therapeutic procedures. Along with this, rising awareness of early disease detection and technological innovations, such as high-definition imaging systems and robot-assisted endoscopy, further propels market growth. On 10th December 2024, The FDA granted EndoQuest Robotics its Investigational Device Exemption for the company's pivotal PARADIGM clinical study to assess the safety and performance of its novel Endoluminal Surgical (ELS) System in robotic endoscopic submucosal dissection (ESD) for colorectal lesion removal. The multicenter trial will enroll 50 patients across top U.S. healthcare institutions in an effort to transform minimally invasive surgery through flexible robotic technology, allowing procedures without leaving scars. Rising healthcare expenditures and improved access to medical facilities in emerging economies are driving demand for endoscopy devices. Additionally, the shift to outpatient settings and the preference for cost-effective procedures further support market growth.

The United States stands out as a key regional market, primarily driven by the increasing prevalence of obesity, colorectal cancer, and other lifestyle-related disorders that require advanced diagnostic tools. Favorable reimbursement policies and strong healthcare infrastructure support widespread adoption of endoscopic procedures. In addition, the rising geriatric population, prone to chronic conditions requiring frequent diagnostic and therapeutic interventions, further fuels demand. Furthermore, ongoing research and development efforts by key players are introducing innovative technologies such as single-use endoscopes and AI-assisted imaging. On 25th January 2025, Boston Scientific initiated a limited market launch of its FDA-cleared VersaVue single-use flexible cystoscope, intended to improve diagnostics and treatments for urinary tract diseases. The compact, portable instrument features high-definition imaging, a single-use sterile design to minimize the risk of infection, and no requirement for reprocessing and maintenance of reusable scopes. Boston Scientific will exclusively distribute VersaVue in the United States, targeting improvements in clinical workflows and patient care. Concurrently, the growing focus on early disease detection and the shift toward value-based care models also stimulate endoscopy devices market demand across the United States.

Endoscopy Devices Market Trends:

Technological Advancements in Endoscopic Equipment

The global endoscopy devices market share is driven by the increase in surgical procedures and organ-specific cancers. According to the World Health Organization (WHO), colorectal cancer is the third most common cancer globally, with over 1.9 million cases annually, driving demand for high-definition imaging and advanced flexible endoscopes. Advancements in technology such as high-definition imaging, minimal access surgical modalities, and the advent of improved flexible endoscopes with better visualization capabilities are revolutionizing diagnostic and therapeutic aspects. These developments are making the diagnosis or treatment of different medical conditions more accurate and less damaging, which leads to shorter patient recovery times and lower healthcare costs. Moreover, the utilization of artificial intelligence and machine learning in endoscopy improves disease identification accuracy and procedure efficiency. Consequently, the growing acceptance of advanced endoscopy technologies among physicians is propelling endoscopy devices market growth and escalating the demand for ongoing research and development efforts for advanced endoscopy systems.

Rising Prevalence of Gastrointestinal Diseases and Cancer

The increasing prevalence of gastrointestinal diseases and cancer is one of the major factors driving the demand for endoscopy devices. Those with indications for a broad spectrum of endoscopic techniques including colorectal cancer, gastrointestinal hemorrhage, and inflammatory bowel diseases may also be regarded as exemplary clinical populations. In 2020, IARC reported new cases of 19.3 million cancer diagnoses around the globe. GI cancers constituted a great number of the cancers diagnosed, while colorectal cancer alone is responsible for over 935,000 deaths each year. With a survival increase of 40%, early diagnosis by endoscopic techniques has shown improvement in survival from GI cancers. Apart from technological advancements, early diagnosis which is also leading to early treatment of these diseases is crucial for good patient outcomes, thereby aiding the culture of increased endoscopic use. In addition, the increasing aged population, which is more susceptible to these diseases, further drives market growth. Moreover, the increasing emphasis on healthcare and regular monitoring of patients with endoscopes enhances the overall continued demand for endoscopic devices, as they are fundamental in overcoming the rising prevalence of GI and other cancers worldwide.

Expanding Applications of Endoscopy in Various Medical Fields

Applications of endoscopy in diversified medical fields drive the global endoscopy devices market size. In addition to gastroenterology, a wide range of applications within different clinical specialties including urology, gynecology, pulmonology, and orthopedic surgeries in various clinical setups necessitate endoscopy. According to the American Lung Association, bronchoscopy is being increasingly used in the diagnosis of pulmonary conditions including lung cancer that affect 2.2 million individuals each year. These applications are varied and are forcing the development of special endoscopic tools tailored to clinical needs. Along with this, the increasing application of endoscopy for various body system disorders in diagnosis and treatment is also contributing to their demand. Some examples are laparoscopic surgeries in gynecology for endometriosis and minimally invasive urological procedures for kidney stones. This expansion of the utilization of endoscopy strengthens market growth while positively influencing the advancement and development of new types of specialized endoscopic tools for certain branches of medicine.

Endoscopy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global endoscopy devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use.

Analysis by Type:

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

Endoscopy visualization systems lead the market with around 41.5% of market share in 2024. This can be attributed to their importance in increasing the accuracy and precision of diagnostic and therapeutic procedures. These systems include high-definition cameras, video processors, and display monitors that enhance image quality and resolution which is critical for the accurate identification and subsequent treatment of medical conditions. In particular, the inclusion of 4K and 3D imaging technologies acts as one of the major endoscopy devices market trends that leads to improved visualization systems performance through a more advanced level of detail in internal organs and tissue investigation. In addition, the rising adoption rate of minimally invasive procedures that require excellent visualizing systems for better outcomes will drive the demand for these solutions. Meanwhile, the sustained advances in imaging technology and the higher burden of gastrointestinal diseases and cancer ensure that endoscopy visualization systems will remain a lucrative revenue pocket meeting the changing demands from healthcare providers around the globe for best patient care.

Analysis by Application:

- Gastrointestinal Endoscopy

- Urology Endoscopy

- Laparoscopy

- Gynecology Endoscopy

- Arthroscopy

- Others

Gastrointestinal endoscopy leads the market with around 55.4% of market share in 2024 due to the escalating number of gastrointestinal diseases and disorders across the globe. This segment includes procedures such as colonoscopy, gastroscopy, and endoscopic retrograde cholangiopancreatography (ERCP) needed for accurate treatment of diseases including colorectal cancer, gastrointestinal bleeding, and inflammatory bowel disease. Along with this, the increasing awareness among patients to undergo diagnosis in the early stage and rising trend of preventive healthcare, are two key drivers facilitating the growth of gastrointestinal endoscopy. These procedures benefit from improved equipment and advanced technologies such as smoother imaging, and enhanced capabilities paired with the convenience of less invasive procedures. The segment is further experiencing market growth as prevalence in the geriatric population with gastrointestinal disorders has been increasing.

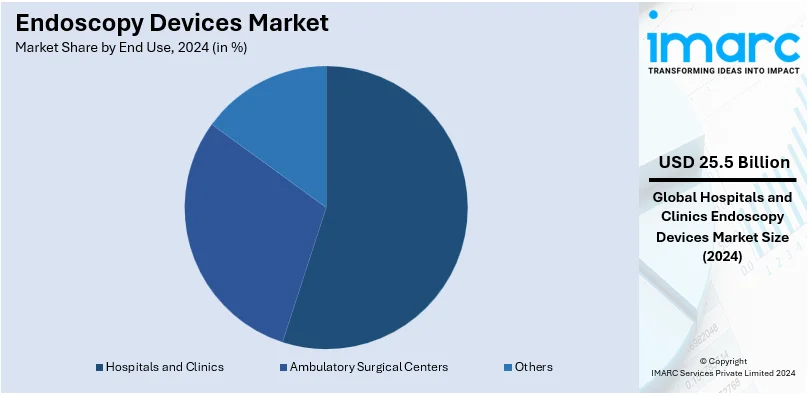

Analysis by End Use:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Hospitals and clinics lead the market with around 51.0% of market share in 2024. They provide a broad spectrum of diagnostic and therapeutic applications. These endoscopy centers have state-of-the-art endoscopy equipment and resources, so they are capable of delivering a full range of endoscopic procedures needed to diagnose and treat various disorders. Additionally, centers and clinics with specialist medical professionals provide access to research-backed treatments for a fraction of patients. In addition, the large number of patient flow and the urgency of receiving accurate diagnoses on time in these areas present a significant requirement for endoscopy devices. Endoscopy also becomes more enhanced as a whole with high-end technological improvements, helping hospitals and clinics hold the largest endoscopy devices market share. Moreover, the growing burden of chronic diseases and the growing demand for minimally invasive procedures accentuate the adoption of endoscopy devices by hospitals and clinics, solidifying their dominance in the endoscopy devices market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.6%. North America has the highest market share in the market, driven by high per capita income and intense R&D activities that foster innovation for high-quality miniature endoscopes for diagnostic applications. Extra sales growth stems from the region using new diagnostic imaging, high-definition video, and robotics endoscopy technologies first. In addition to this, the rising incidence of lifestyle-related chronic disorders such as cancer and gastrointestinal disorders necessitates more endoscopy procedures. Accessibility to advanced endoscopy equipment opportunities is made easily progressively due to the high presence of top medical device manufacturers and their research and development activities. Along with this, government support and a favorable reimbursement climate are essential facilitators for advanced endoscopic services. Concurrently, the increasing burden of diseases has a positive impact on the endoscopy devices market, along with the growing awareness of early disease detection and preventive healthcare. Moreover, North America leads the way in the adoption of state-of-the-art endoscopy steering healthcare performances and patient outcomes across the globe which is creating a positive endoscopy devices market outlook.

Key Regional Takeaways:

United States Endoscopy Devices Market Analysis

In 2024, the US accounted for around 82.90% of the total North America endoscopy devices market. High expenditure on health, technological progress, and elevated gastrointestinal diseases prevails the U.S. endoscopy devices market. According to the Centers for Medicare & Medicaid Services, expenditures in the health care sector rose to USD 4.5 trillion in 2022 alone. Much funding has been placed for high-quality equipment such as endoscopy devices. Minimally invasive treatments have always gained a position among the world's aging populations. Further technologies such as an AI-powered endoscope are considered more accurate while making a diagnosis. Boston Scientific and Medtronic, for example, are significant players in the market, targeting hospitals and out-of-hospital facilities. The domestic production of devices stabilizes the supply chain and reduces import dependency. Federal initiatives that encourage early disease detection contribute further to demand stimulation. Increasing R&D investments in innovative products help U.S. manufacturers expand their business worldwide, further consolidating their position in the endoscopy devices market.

Europe Endoscopy Devices Market Analysis

The growth of the European endoscopy devices market is driven by rising healthcare investments, a growing incidence of chronic diseases, and early diagnostics. As per the European Commission, in 2022, Germany had allocated EUR 489 billion, which is approximately USD 522 billion, for healthcare purposes, including medical technologies like endoscopy devices. The demand for robotic-assisted endoscopy is rising in countries like the UK and France, driven by technological advancements and the growing preference for minimally invasive solutions. Furthermore, diagnostic endoscopy devices are also expected to be sought out with the increase in colorectal cancer screening programs that are reported by the European Society of Gastrointestinal Endoscopy. Olympus and Karl Storz are among the key players with the most recent technological advancements. Strict EU regulations ensure product quality and safety. Public healthcare systems collaborate with manufacturers to support R&D, thus making Europe the hub for innovation in endoscopy.

Asia Pacific Endoscopy Devices Market Analysis

Rapidly increasing healthcare spending, awareness of preventive health care, and the growth in the middle class are factors improving the Asia Pacific endoscopy devices market. As per the data provided by China's National Bureau of Statistics, health care expenditure in China stood at USD 1,268.603 billion during 2022, focusing more on advanced diagnostic tools such as endoscopy devices. India's National Health Mission focuses on early disease detection, and in its 2023-2024 budget, the Ministry of Health and Family Welfare has allocated USD 8 billion to healthcare. The outpatient endoscopic procedures in the region are rapidly increasing as these procedures are inexpensive and have very short recovery periods. Innovation in the sector is led by companies such as Fujifilm and Pentax Medical, while the R&D for next-generation endoscopic systems is being supported by initiatives such as Japan's AMED. The partnerships between global and local players enhance technology transfer, making Asia Pacific a key market for endoscopy devices.

Latin America Endoscopy Devices Market Analysis

Growth drivers for Latin America's endoscopy devices market include increasing budgets for healthcare and access to the same, besides a growing number of gastrointestinal diseases. ITA states that in 2022, Brazil spent around USD 161 billion on its healthcare budget. The investments under this budget in diagnostic technologies continue to grow, with public-private partnerships in places including Mexico and Chile working toward improving endoscopic diagnostic capabilities across more rural and less privileged areas. The growing medical tourism in Costa Rica and Colombia enhances the demand for advanced endoscopic devices for minimally invasive procedures. Companies such as Hoya Group are now expanding their operations in the region to cater to this growing demand. Government-sponsored training programs for healthcare professionals help improve the adoption of endoscopic techniques, thus further enhancing the market. Growing healthcare infrastructure in Latin America makes it an emerging player in the global endoscopy devices industry.

Middle East and Africa Endoscopy Devices Market Analysis

Increasing healthcare infrastructure investments along with the escalating prevalence of chronic diseases are currently driving the market for endoscopy devices in the Middle East and Africa. According to International Trade Administration, Saudi Arabia allotted USD 36.8 billion to healthcare during 2022, which targeted the modernization of hospitals as well as the diagnostics sector. In South Africa, there is a developing demand for diagnostic services through less invasive procedures among both public as well as private systems, which tend to prefer advanced endoscopy devices. Regional manufacturers, such as United Surgical, offer competitive, locally sensitive products. Emphasis on developing health care facilities by the government of the UAE under Vision 2030 along with diagnostic technology promotes the acceptance of endoscopic equipment. Awareness among individuals through tie-ups with global players creates more demand. In the Middle East and Africa, the advancement of health care and strategic investment have made the region a great place for endoscopic equipment.

Competitive Landscape:

The key players operating in the endoscopy devices market forecast are investing in R&D to find new technologies and update their products. Olympus Corporation, Karl Storz, and Stryker are focusing on these areas, with new imaging technologies, AI & machine learning solutions for better detection, and more flexible or adaptable endoscopes built. In addition, they pursue various primary strategies such as partnerships and global acquisitions to expand their product portfolio on a global level. Moreover, endoscopy devices companies are concentrating on manufacturing minimally invasive surgical tools, as the demand for this surgery is significantly increasing. Sustained training and education programs for healthcare professionals also bolster the utilization of advanced endoscopy devices in clinical applications.

The report provides a comprehensive analysis of the competitive landscape in the endoscopy devices market with detailed profiles of all major companies, including:

- Boston Scientific Corporation

- Johnson & Johnson

- FUJIFILM Holdings Corporation

- HOYA Corporation

- Karl Storz SE & Co. KG

- Machida Endoscope Co. Ltd

- Medtronic Plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

Latest News and Developments:

- December 2024: PENTAX Medical won US FDA 510(k) clearance for its new i20c Video Endoscope Series models and the Right/Left Wheel Extender. These innovations focus on imaging, ergonomics, maneuverability, and clinical workflow.

- October 2024: Olympus Europa SE & Co. KG announced that they received MDR CE-mark approval for Odin Vision's cloud-AI endoscopy devices, enhancing clinical outcomes and operational efficiency in Europe by offering CADDIE, CADU, and SMARTIBD.

- June 2024: Johnson & Johnson MedTech revealed Polyphonic, which it describes as an open and secure digital surgical ecosystem. Data source agnostic software applications provided by the ecosystem, focus on insights at the point of surgery.

- June 2024: Silk Road Medical, Inc., a leading medical technology company focused on reducing the risk of stroke and its devastating impact, announced that it has entered into a definitive agreement to be acquired by Boston Scientific Corporation.

- May 2024: FUJIFILM India announced that they have launched the most advanced endoscopic ultrasound machine ALOKA ARIETTA 850 in India.

- March 2024: Boston Scientific and Scivita Medical have expanded a strategic partnership focused on co-developing and selling endoscopic devices, among them single-use endoscopes, worldwide. This partnership backs Scivita's globalization plan and Boston Scientific's focus on the growth in China's medtech market.

Endoscopy Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, Operative Devices |

| Applications Covered | Gastrointestinal Endoscopy, Urology Endoscopy, Laparoscopy, Gynecology Endoscopy, Arthroscopy, Others |

| End Uses Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boston Scientific Corporation, Johnson & Johnson, FUJIFILM Holdings Corporation, HOYA Corporation, Karl Storz SE & Co. KG, Machida Endoscope Co. Ltd, Medtronic Plc, Olympus Corporation, Richard Wolf GmbH, Smith & Nephew plc, Stryker Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the endoscopy devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global endoscopy devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the endoscopy devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Endoscopy devices are medical instruments designed to visualize and examine internal organs and tissues. They are primarily used in minimally invasive diagnostic and therapeutic procedures, enabling physicians to diagnose diseases early and perform surgeries with minimal incisions.

The endoscopy devices market was valued at USD 50.01 Billion in 2024.

IMARC estimates the global endoscopy devices market to exhibit a CAGR of 5.58% during 2025-2033.

The market is driven by advancements in minimally invasive surgical techniques, the rising prevalence of gastrointestinal and chronic diseases, technological innovations such as AI-assisted imaging, and the growing geriatric population requiring diagnostic and therapeutic interventions.

Endoscopy visualization systems represented the largest segment by type, driven by their importance in improving the accuracy and precision of diagnostic and therapeutic procedures.

Gastrointestinal endoscopy leads the market by application due to the high prevalence of gastrointestinal diseases and increased awareness about early-stage diagnosis.

Hospitals and clinics are the leading segment by end use, driven by their state-of-the-art endoscopy equipment and resources catering to a high patient volume.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global endoscopy devices market include Boston Scientific Corporation, Johnson & Johnson, FUJIFILM Holdings Corporation, HOYA Corporation, Karl Storz SE & Co. KG, Machida Endoscope Co. Ltd, Medtronic Plc, Olympus Corporation, Richard Wolf GmbH, Smith & Nephew plc, and Stryker Corporation, among others.

In 2024, endoscopes held a dominant 41.1% share of the endoscopy devices market, primarily due to heightened awareness and their increasing utilization in diverse diagnostic and therapeutic applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)