Ethylene Absorber Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Ethylene Absorber Market Size and Share:

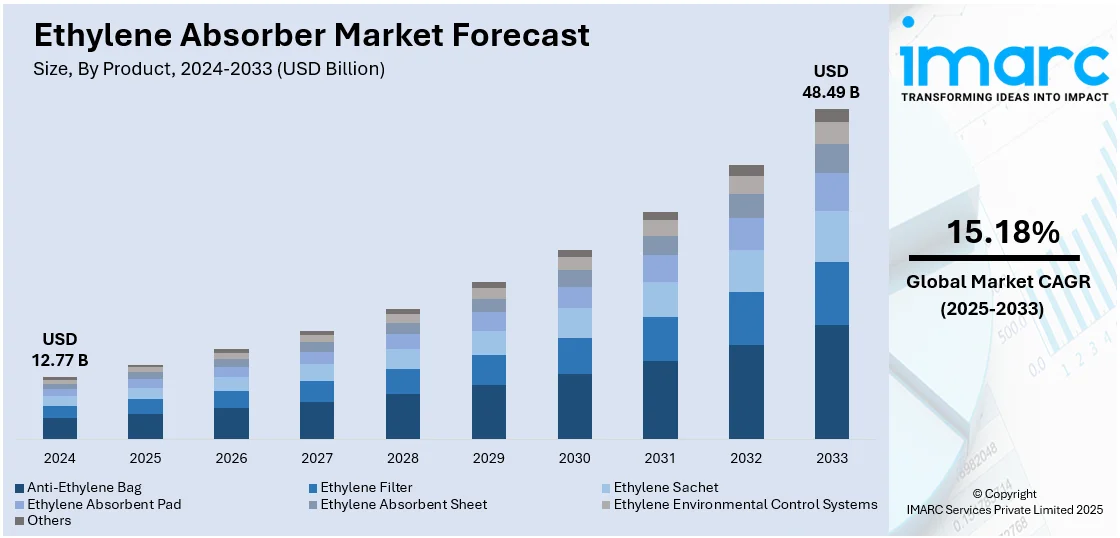

The global ethylene absorber market size was valued at USD 12.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.49 Billion by 2033, exhibiting a CAGR of 15.18% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of over 45.0% in 2024. The growing demand in the residential sector, increasing need to maintain the quality and nutrition of fruits and vegetables during transportation, and thriving packaging industry represent some of the key factors contributing to ethylene absorber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.77 Billion |

|

Market Forecast in 2033

|

USD 48.49 Billion |

| Market Growth Rate 2025-2033 | 15.18% |

The market is primarily driven by the need to extend the shelf life of fresh produce, especially fruits and vegetables. Rising demand for food waste reduction across supply chains has increased the adoption of ethylene absorbers in packaging, cold storage, and transportation. Growth in organized retail, especially supermarkets and hypermarkets, is also boosting demand for ethylene management solutions to maintain product freshness. Additionally, rising global exports of perishable produce necessitate ethylene control during long transits. The increasing popularity of e-commerce grocery delivery is another factor driving the ethylene absorber market growth. Technological innovations in absorber materials, such as potassium permanganate-based or zeolite-based absorbers, are enhancing performance and further supporting adoption. Regulatory encouragement for sustainable packaging and food conservation practices also reinforces market expansion across developed and developing regions.

In the United States, high-end refrigerator models are increasingly incorporating advanced ethylene absorber systems to extend the shelf life of fruits and vegetables. These innovations reflect a growing emphasis on freshness preservation, with built-in ethylene control becoming a key feature in new product designs targeting freshness-conscious consumers. For instance, in May 2024, Thermador, a manufacturer of home appliances based in the US, launched a new range of refrigerators with built-in bottom freezer refrigeration. The new collection features Thermador-exclusive technologies, which include the ThermaFresh Pro Drawers that are equipped with advanced ethylene absorbers to slow down the ripening process and keep produce fresh for a longer duration.

Ethylene Absorber Market Trends:

Rising Use of Polyethylene-Based Absorber Materials

The expanding market for low density polyethylene (LDPE) is influencing the development and manufacturing of ethylene absorber products. LDPE’s flexibility, durability, and moisture resistance make it a preferred material in packaging applications, including sachets, filters, and active packaging used for ethylene absorption. As demand for efficient and lightweight materials grows, manufacturers are increasingly adopting LDPE to enhance the product performance and shelf life of fresh produce. This shift supports the scalability of ethylene absorber technologies across storage, transport, and retail environments. The steady growth in LDPE usage is thus shaping material choices in ethylene absorber production, especially in segments requiring food-grade safety, ease of customization, and cost-effective large-scale deployment. For example, the global low density polyethylene market reached USD 47.3 Billion in 2024 and is expected to grow at a CAGR of 3.8% during 2025-2033, as per a report by the IMARC Group.

Growing Focus on Shelf-Life Extension Solutions

Based on the ethylene absorber market outlook, efforts to minimize food loss across the supply chain are driving interest in ethylene absorber technologies. Significant quantities of produce are lost before reaching consumers, with further wastage occurring in homes, stores, and food service settings. To address this, producers and retailers are adopting ethylene control methods to slow down ripening and extend the usability of fresh goods. Ethylene absorbers are increasingly being integrated into storage, packaging, and transport processes to maintain product quality and reduce spoilage. This shift reflects a broader push toward improving food preservation practices, cutting down waste, and enhancing the efficiency of distribution systems. The growing emphasis on sustainability and resource optimization continues to support the adoption of these solutions. According to the United Nations, 13.2% of total food produced in the world is lost between harvest and retail, while approximately 19% is wasted in households, food service, and retail combined.

Push toward Sustainable Ethylene Sourcing

The ethylene absorber market forecast indicates that a growing interest in sustainable production methods is shaping industry dynamics. A new technique now enables the conversion of industrial carbon dioxide emissions into ethylene without relying on purified CO₂, offering a lower-cost and greener alternative to conventional production. This development supports the shift toward eco-conscious sourcing of ethylene, which is a key target for applications focused on preserving produce. With environmental regulations tightening and industry goals moving toward decarbonization, such innovations may indirectly strengthen demand for ethylene control solutions by aligning them with broader sustainability objectives in agriculture, logistics, and packaging systems focused on minimizing waste. For instance, in May 2024, researchers at the National University of Singapore developed a method to convert carbon dioxide from industrial flue gas into ethylene and ethanol without requiring high-purity CO₂. This approach enhances the sustainability of ethylene production by utilizing waste emissions, potentially reducing costs and supporting the ethylene absorber market's growth in eco-friendly applications.

Ethylene Absorber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ethylene absorber market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Anti-Ethylene Bag

- Ethylene Filter

- Ethylene Sachet

- Ethylene Absorbent Pad

- Ethylene Absorbent Sheet

- Ethylene Environmental Control Systems

- Others

Ethylene environmental control systems stood as the largest product in 2024, holding around 35.0% of the market due to its vital role in preserving the freshness and quality of perishable products during storage and transport. These systems regulate ethylene levels in controlled environments such as cold storage units, ripening chambers, and shipping containers. By integrating ethylene absorbers into these systems, producers and distributors can delay ripening and reduce spoilage, ultimately minimizing post-harvest losses. The growing demand for fresh fruits, vegetables, and flowers across extended supply chains has increased the adoption of such systems globally. As awareness around food waste reduction and shelf-life extension rises, ethylene environmental control systems are becoming an essential investment across the agricultural and logistics sectors, directly boosting market growth.

Analysis by Application:

- Controlled Atmosphere Storage

- Ripening Rooms

- Transportation/Shipping

- Residential

As per the ethylene absorber market research report, transportation/shipping led the market with around 39.8% of market share in 2024, as the global movement of perishable goods requires strict control over ripening and spoilage during transit. Ethylene gas, naturally released by fruits and vegetables, can accelerate ripening and lead to quality deterioration if not managed properly. To address this, ethylene absorbers are increasingly being used in shipping containers, refrigerated trucks, and air freight packaging to maintain product freshness throughout long-distance journeys. With the rise of global trade in fresh produce and floriculture, logistics providers are adopting absorber solutions to meet quality assurance standards and reduce post-harvest losses. This growing reliance on cold-chain logistics is propelling demand for ethylene absorbers in the transportation and shipping sector.

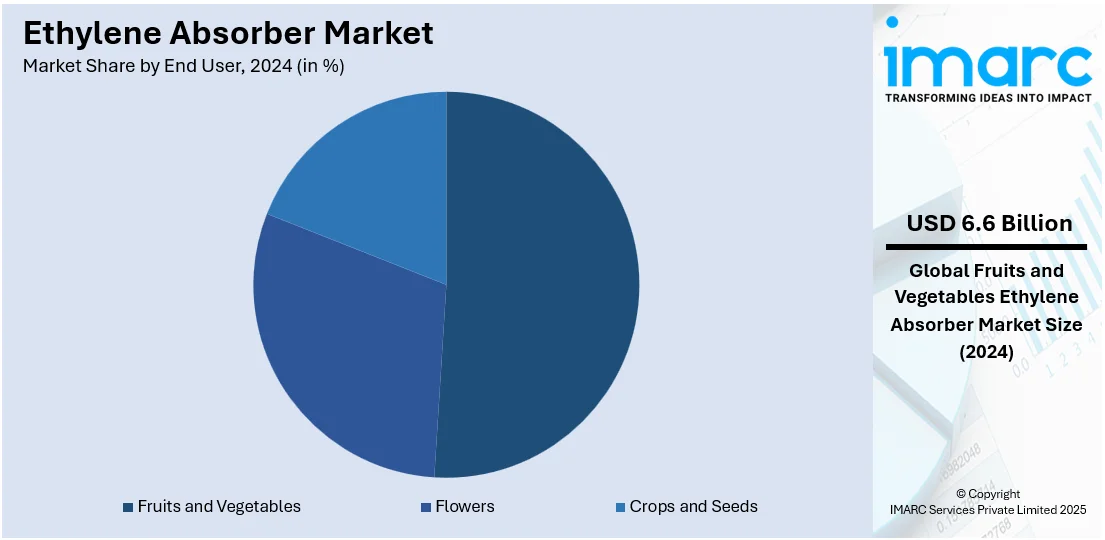

Analysis by End User:

- Fruits and Vegetables

- Flowers

- Crops and Seeds

Fruits and vegetables led the market with around 51.3% of market share in 2024 since these commodities are highly sensitive to ethylene gas, which accelerates ripening and spoilage. During post-harvest handling, storage, and distribution, managing ethylene levels is critical to maintaining freshness, visual appeal, and nutritional value. Ethylene absorbers help extend shelf life by neutralizing excess gas, making them essential in retail storage, cold chains, and packaging. With rising consumer demand for fresh, high-quality produce and the expansion of global supply chains, producers and distributors are increasingly integrating ethylene absorber solutions. The segment's dominance in fresh food trade and the economic impact of waste reduction continue to drive the adoption of ethylene management technologies in this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.0%, owing to its significant agricultural output, particularly in fruits and vegetables, which are highly sensitive to ethylene exposure. Countries like China and India have large-scale horticultural industries that demand effective preservation solutions to reduce post-harvest losses. Rapid urbanization and the expansion of organized retail and e-commerce have further accelerated the need for extended shelf-life products. The region is also witnessing strong growth in cold chain logistics, driven by government investments and rising consumer demand for fresh produce. Additionally, increasing exports of perishables from countries like India have boosted the adoption of ethylene absorbers for improved quality control during long-haul transportation. These combined factors contribute to Asia Pacific’s market dominance.

Key Regional Takeaways:

United States Ethylene Absorber Market Analysis

In 2024, the United States accounted for 83.8% of the market share in North America. The United States ethylene absorber market is primarily driven by the presence of leading chemical companies in the country, which are offering innovative ethylene absorbers designed to improve the shelf life of fruits and vegetables by controlling the ethylene gas levels that expedite ripening. These companies are also investing heavily in research and development (R&D) to meet the increasing demand for efficient and eco-friendly solutions, aligning with sustainability goals. Furthermore, logistics companies involved in cold chain management are increasingly adopting ethylene absorbers to ensure produce arrives in peak condition, influencing both the demand for the product and its applications in the supply chain. Retailers such as Walmart and Costco, who require long-lasting shelf life for fresh produce due to consumer demand for fruits and vegetables, are also significantly influencing the market through partnerships with suppliers of ethylene absorbers and increasing adoption of these in their supply chains. According to the United Health Foundation, in 2021, 7.4% of adults in the United States consumed three or more vegetables and two or more fruits every day, highlighting the robust demand for fresh produce in the country. As consumer demand for fresh produce with extended shelf life rises, the market is increasingly witnessing innovation and expansion, ensuring the safe, widespread use of ethylene absorbers across various industries.

Asia Pacific Ethylene Absorber Market Analysis

The Asia Pacific ethylene absorber market is expanding due to the region's growing agricultural sector, advancements in post-harvest technology, and evolving consumer expectations. For instance, the agricultural sector in India accounted for 18.2% of the GDP of country in 2024, as per the Press Information Bureau (PIB). As demand for fresh produce rises, particularly in urban areas, agricultural producers are increasingly adopting ethylene absorbers to preserve the quality and extend the shelf life of fruits and vegetables. Packaging specialists are also contributing to industry expansion by integrating ethylene-absorbing materials into innovative packaging designs that improve product freshness during distribution. Additionally, the growing focus on sustainability is propelling stakeholders to explore more environmentally friendly and cost-effective alternatives. Consumer preferences for longer-lasting, chemical-free produce further fuel demand, as buyers seek fresh options with minimal environmental impact. Besides this, research and development (R&D) initiatives within the region, focusing on enhancing absorber efficiency and safety, are significantly influencing the market landscape, ensuring that the region stays at the forefront of agricultural preservation technologies.

Europe Ethylene Absorber Market Analysis

The European ethylene absorber market is significantly influenced by the rising focus on agricultural sustainability, food security, and supply chain efficiency. The European Commission’s initiatives, including the Farm to Fork Strategy, are increasingly promoting the use of technologies that enhance food preservation and minimize waste, thereby driving the demand for ethylene absorbers. Numerous national governments, particularly in countries such as France, Germany, and the Netherlands, are also supporting policies that encourage the adoption of these solutions within the agricultural and food sectors. Additionally, prominent agricultural trade associations, such as the European Federation of Fruit and Vegetable Processors (FFP), are working to promote post-harvest technologies, including ethylene absorbers, to extend the shelf life of fresh produce and reduce food waste. According to the European Commission, in 2022, approximately 132 kg of food waste per inhabitant was generated across the European Union. Of this, the food supply chain accounted for 46% of food waste, while the remaining 54% was generated by households. Other than this, research institutions and industry collaborations, such as the European Food Information Council (EUFIC), are working on ongoing studies and technological advancements that are contributing substantially to market expansion, ensuring that ethylene absorbers are optimized for both efficiency and minimal environmental impact.

Latin America Ethylene Absorber Market Analysis

The Latin America ethylene absorber market is experiencing robust growth, primarily fueled by the expanding retail and agricultural sectors in the region, along with evolving consumer demands for fresh, sustainable produce. For instance, Argentina is the third largest exporter of food in the world, with its agricultural sector accounting for 15.7% of the GDP of the country in 2021. As a result, agricultural producers are increasingly adopting ethylene absorbers to combat post-harvest losses, which are a significant issue in the region due to varying climate conditions and supply chain inefficiencies. This trend is further supported by distributors and logistics providers, who are increasingly employing ethylene absorbers to enhance the shelf life and quality of perishable goods during transportation.

Middle East and Africa Ethylene Absorber Market Analysis

The Middle East and Africa ethylene absorber market is being propelled by growing concerns about food security and the preservation of fresh produce. Due to this, farmers and growers in the region are increasingly adopting ethylene absorbers to combat the high levels of post-harvest wastage, particularly in countries with harsh climates. Additionally, the logistics and transportation sector is also contributing substantially to industry expansion, as the region's vast distances and challenging conditions require effective solutions to preserve the freshness of fruits and vegetables during transit. Overall, the logistics market in the Middle East was forecasted to grow at a CAGR of 5.80% during 2024-2032, according to a report by the IMARC Group. As the region’s food supply chain continues to modernize and expand, the adoption of ethylene absorbers is becoming vital for maintaining product quality and reducing waste throughout the distribution process.

Competitive Landscape:

The market is witnessing active developments through new product launches, strategic partnerships, and collaborations, particularly aimed at enhancing food preservation technologies. Research and development efforts are also gaining momentum, focusing on improving absorber efficiency and sustainability. While funding rounds and government initiatives are less frequently highlighted, industry players are consistently engaging in innovation-driven tie-ups and joint ventures to expand their capabilities. Among these, collaborations and partnerships remain the most common practice, enabling knowledge exchange and faster market adaptation in response to rising demand for extended shelf-life solutions in fresh produce supply chains.

The report provides a comprehensive analysis of the competitive landscape in the ethylene absorber market with detailed profiles of all major companies, including:

- Bee Chems

- Bioconservacion SA

- BioXTEND Inc.

- DeltaTrak Inc.

- Ethylene Control Inc.

- Greenkeeper Iberia S.L.

- Keep-It-Fresh

- Lipmen Co. Ltd.

- Secco International Group

- Sercalia SL

- Symphony Environmental Ltd. (Symphony Environmental Technologies Plc)

Latest News and Developments:

- February 2025: Keep It Fresh launched KIF Cassettes, ethylene-absorbing devices that help extend the freshness of fruits, vegetables, and flowers across the supply chain. By capturing ethylene gas, these cassettes slow ripening, inhibit bacterial growth, and minimize odors. Their use in cold storage, transport, and retail supports reduced food waste, lowers spoilage-related costs, and promotes longer shelf life.

- January 2025: Wisesorbent Technology officially launched its French website, www.wisesorbent.fr, to strengthen its presence in the European market. The new platform offers detailed insights into Wisesorbent’s moisture and oxygen control solutions tailored for pharmaceuticals, healthcare, food, and industrial sectors. The company has an ethylene absorber in its products as well.

Ethylene Absorber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Anti-Ethylene Bag, Ethylene Filter, Ethylene Sachet, Ethylene Absorbent Pad, Ethylene Absorbent Sheet, Ethylene Environmental Control Systems, Others |

| Applications Covered | Controlled Atmosphere Storage, Ripening Rooms, Transportation/Shipping, Residential |

| End Users Covered | Fruits and Vegetables, Flowers, Crops and Seeds |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bee Chems, Bioconservacion SA, BioXTEND Inc., DeltaTrak Inc., Ethylene Control Inc., Greenkeeper Iberia S.L., Keep-It-Fresh, Lipmen Co. Ltd., Secco International Group, Sercalia SL, Symphony Environmental Ltd. (Symphony Environmental Technologies Plc), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ethylene absorber market from 2019-2033.

- The ethylene absorber market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ethylene absorber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ethylene absorber market was valued at USD 12.77 Billion in 2024.

The ethylene absorber market is projected to exhibit a CAGR of 15.18% during 2025-2033, reaching a value of USD 48.49 Billion by 2033.

The ethylene absorber market is driven by rising demand for extended shelf-life of fruits and vegetables, growth in global fresh produce trade, increasing use in retail and storage applications, consumer preference for less chemical preservation, and adoption in packaging innovations across food logistics, supermarkets, and cold chain infrastructure.

Asia Pacific dominated the ethylene absorber market in 2024, accounting for a share of 45.0%, due to high fruit and vegetable production, expanding cold storage infrastructure, rising exports, and growing demand for shelf-life extension in retail and logistics.

Some of the major players in the ethylene absorber market include Bee Chems, Bioconservacion SA, BioXTEND Inc., DeltaTrak Inc., Ethylene Control Inc., Greenkeeper Iberia S.L., Keep-It-Fresh, Lipmen Co. Ltd., Secco International Group, Sercalia SL, Symphony Environmental Ltd. (Symphony Environmental Technologies Plc), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)