Europe Acetonitrile Market Size, Share, Trends and Forecast by End Use and Country, 2025-2033

Europe Acetonitrile Market Size and Share:

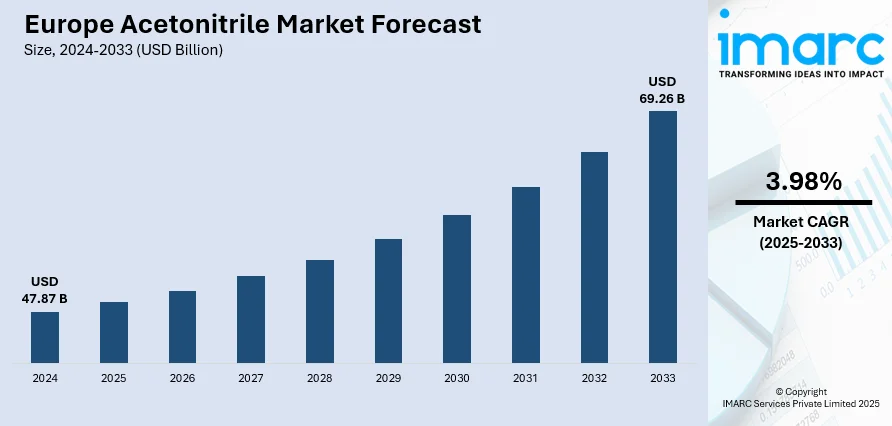

The Europe acetonitrile market size was valued at USD 47.87 Billion in 2024. Looking forward, the market is projected to reach USD 69.26 Billion by 2033, exhibiting a CAGR of 3.98% from 2025-2033. Germany currently dominates the market, holding a market share of 26.6% in 2024. The market is witnessing steady growth, driven by rising demand from pharmaceutical, agrochemical, and analytical industries. Its use as a solvent in drug formulation and chemical synthesis is expanding with advancements in these sectors. Growing research activities, expanding industrial applications, and an increased focus on high-purity solvents and sustainable production processes are collectively driving market momentum, as the Europe acetonitrile market share continues to strengthen across key applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 47.87 Billion |

|

Market Forecast in 2033

|

USD 69.26 Billion |

| Market Growth Rate 2025-2033 | 3.98% |

One of the primary drivers of the Europe acetonitrile market is the robust demand from the pharmaceutical sector, where acetonitrile is extensively utilized as a solvent in drug synthesis and purification processes. The region’s well-established pharmaceutical infrastructure and increasing R&D investments are driving steady consumption. For instance, in April 2024, Merck announced its plans to invest over €300 Million to establish an Advanced Research Center in Darmstadt, Germany, aimed at enhancing biopharmaceutical product development. The initiative, part of a €1.5 Billion investment by 2025, will support around 550 employees and focus on key technologies like antibodies and mRNA applications. Additionally, its use in high-performance liquid chromatography (HPLC) promotes growth in analytical laboratories. As regulatory scrutiny intensifies on drug quality and precision, the need for high-purity solvents like acetonitrile becomes increasingly vital, further boosting its use in both production and testing settings.

To get more information on this market, Request Sample

Another significant factor contributing to Europe acetonitrile market growth is the rising application of acetonitrile in the agrochemical industry. It serves a critical function in the formulation of pesticides and the synthesis of active ingredients. With Europe prioritizing sustainable agriculture and crop protection, the demand for dependable chemical solvents is on the rise. Furthermore, the growing utilization of acetonitrile in battery manufacturing and specialty chemicals is creating new opportunities for industrial use. These varied applications, along with advancements in production technologies and a shift toward environmentally friendly practices, are propelling ongoing growth in the European acetonitrile market.

Europe Acetonitrile Market Trends:

Rising Pharmaceutical Demand

The pharmaceutical sector is a significant user of acetonitrile in Europe, serving as an essential solvent for the synthesis and purification of active pharmaceutical ingredients (APIs). Its superior solubility characteristics and suitability for complex chemical processes make it perfect for drug manufacturing. Furthermore, acetonitrile is extensively utilized in analytical tasks like quality control and stability assessments. As pharmaceutical companies enhance their investments in research and ramp up production to satisfy increasing healthcare needs, the dependence on high-performance solvents such as acetonitrile is anticipated to rise. Backed by strict regulatory frameworks and a strong pharmaceutical infrastructure, the Europe acetonitrile market outlook remains optimistic, with the sector crucially influencing long-term market growth. For instance, in July 2025, the UK government launched a six-point action plan to boost its life sciences sector, aiming for a £41bn growth by 2035. The initiative includes a £520m investment to enhance pharmaceutical manufacturing, streamline regulations, and improve clinical trial efficiency, while also addressing concerns about competitiveness and innovation funding.

Growth in Analytical Applications

Acetonitrile is essential in analytical labs throughout Europe, especially in high-performance liquid chromatography (HPLC) and various separation techniques. Its low viscosity and excellent elution capacity establish it as the preferred solvent for quick and precise analyses. With the rising demand for high-precision testing in pharmaceuticals, environmental studies, and food safety, acetonitrile is becoming increasingly important in scientific exploration. Laboratories are placing more emphasis on using reliable, high-purity solvents to comply with regulatory and quality standards. As research and development activities surge across sectors, the application of acetonitrile in analytical processes is expected to grow consistently. According to Europe acetonitrile market forecast, this trend will substantially enhance the solvent's applications and market presence.

Agrochemical Sector Expansion

The agrochemical industry in Europe is progressively utilizing acetonitrile as a primary solvent in the formulation of pesticides and the synthesis of herbicides and insecticides. Its capability to dissolve a variety of organic compounds renders it effective in producing stable and efficient crop protection products. With the region's focus on sustainable agricultural practices and innovative crop management solutions, advancements in chemicals are crucial. Acetonitrile aids in developing high-quality agrochemicals that align with changing regulatory requirements. Moreover, ongoing research and development in agricultural chemistry is broadening its range of applications. The growing demand from agrochemical producers highlights a significant Europe acetonitrile market trend, as the industry seeks dependable and high-performance solvents to enhance modern farming techniques.

Europe Acetonitrile Industry Segmentation:

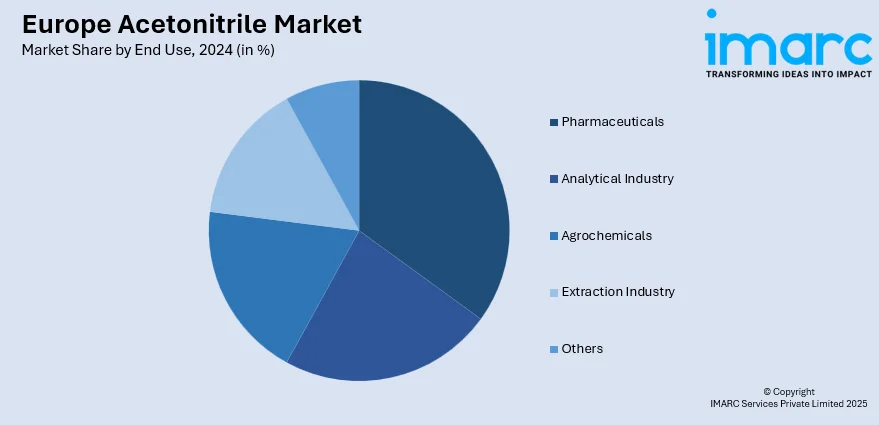

IMARC Group provides an analysis of the key trends in each segment of the Europe acetonitrile market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on end use.

Analysis by End Use:

- Pharmaceuticals

- Analytical Industry

- Agrochemicals

- Extraction Industry

- Others

Pharmaceuticals stand as the largest end use in 2024, holding 40.4% of the market, driven by its essential function as a solvent in drug development, purification, and analytical testing. Its exceptional solvency power and compatibility with various organic compounds make it a crucial component in formulating active pharmaceutical ingredients (APIs). Acetonitrile is also extensively utilized in chromatographic techniques like HPLC, which are vital for quality assurance and meeting regulatory requirements. As the pharmaceutical industry continues to grow due to increasing healthcare demands and innovations in drug creation, the requirement for high-purity acetonitrile is projected to stay robust throughout the region.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share of over 26.6%, bolstered by its robust pharmaceutical, chemical, and research sectors. The country's advanced manufacturing capabilities and commitment to high-quality production methods have led to a steady consumption of acetonitrile across numerous applications. Additionally, Germany's well-established laboratory infrastructure and focus on innovation further enhance its solvent usage. As sustainability and efficiency become key priorities in industrial practices, Europe acetonitrile market demand is expected to remain particularly strong in Germany, further solidifying its role as a significant contributor to regional growth.

Competitive Landscape:

The competitive environment of the Europe acetonitrile market consists of a combination of established chemical producers and niche solvent manufacturers. Companies are concentrating on enhancing production efficiency, ensuring consistent purity levels, and adhering to rigorous environmental and safety standards. Innovations in manufacturing technologies and waste minimization efforts are becoming vital differentiators. Market participants are also prioritizing supply chain resilience to guarantee timely delivery across regions. As demand rises from pharmaceuticals, agrochemicals, and laboratories, firms are making investments in capacity expansion and product diversification. Strategies such as strategic partnerships, long-term agreements, and customer-centric service models are being employed to enhance market reach. With sustainability gaining importance, businesses are exploring greener alternatives and more responsible sourcing techniques to remain competitive in the dynamic European market.

The report provides a comprehensive analysis of the competitive landscape in the Europe acetonitrile market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Indaver disclosed plans to build a solvent recycling plant on the Huddersfield industrial complex of Syngenta UK. The facility’s construction is scheduled to begin in 2026, with commercial operations starting by 2028. The plant will have the capacity to treat and recycle 15,000 Tonnes of industrial waste per year. This facility will allow Indaver to obtain acetonitrile through recycling processes for agricultural product manufacturing.

- June 2024: The Green Lake Facility of Switzerland-based INEOS Nitriles was selected by Trillium Renewable Chemicals for the establishment of the first experimental facility worldwide for the conversion of plant-based glycerol into acrylonitrile. The selection of INEOS highlights Trillium's goal to advance its technology by scaling it up in an industrial setting.

- April 2024: INEOS Nitriles announced the first global sales of INVIREO, a novel bio-based acetonitrile utilized in the manufacturing of numerous medications. INVIREO Acetonitrile is manufactured through a controlled and certified (ISCC+) mass balance process. With this production procedure, INEOS Nitriles is able to provide clients with products that function similarly to conventionally manufactured acetonitrile, but with a 90% lower carbon footprint.

Europe Acetonitrile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Pharmaceuticals, Analytical Industry, Agrochemicals, Extraction Industry, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe acetonitrile market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe acetonitrile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe acetonitrile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetonitrile market in Europe was valued at USD 47.87 Billion in 2024.

The Europe acetonitrile market is projected to exhibit a (CAGR) of 3.98% during 2025-2033, reaching a value of USD 69.26 Billion by 2033.

The market is driven by rising demand from the pharmaceutical and analytical sectors, increasing use in agrochemical formulations, and growing focus on high-purity solvents. Technological advancements and stricter quality standards across industries are further accelerating the adoption of acetonitrile in Europe.

Germany accounts for the largest share in the Europe acetonitrile market, supported by its strong pharmaceutical manufacturing base, advanced chemical industry, and high investment in research and laboratory infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)