Europe Aerostat Systems Market Size, Share, Trends and Forecast by Payload, Sub-System, Product Type, Propulsion System Class, and Country, 2025-2033

Europe Aerostat Systems Market Size and Share:

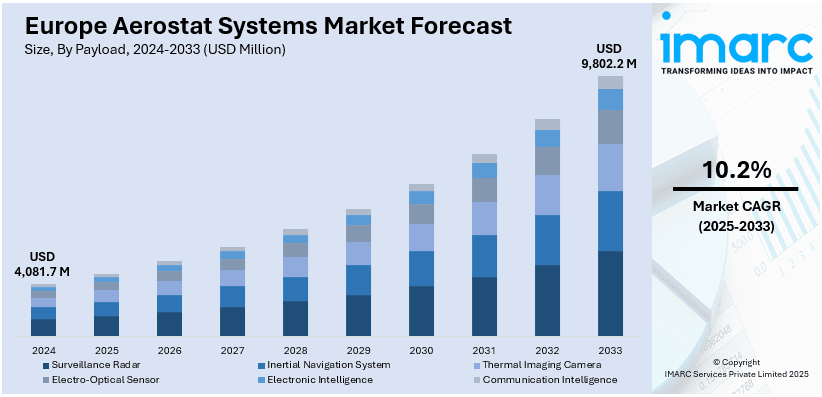

The Europe aerostat systems market size was valued at USD 4,081.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,802.2 Million by 2033, exhibiting a CAGR of 10.2% from 2025-2033. The market is experiencing significant growth driven by an increasing demand for cost-effective, long-duration surveillance in defense, border security and disaster management. Technological advancements in sensors, lightweight materials and communications enhance system efficiency, hence creating a positive outlook for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,081.7 Million |

|

Market Forecast in 2033

|

USD 9,802.2 Million |

| Market Growth Rate (2025-2033) | 10.2% |

The European aerostat systems market is primarily driven by the growing demand for cost-effective surveillance solutions across military, defense, and commercial sectors. For instance, in May 2024, Russia deployed aerostats along its border with Finland in the Republic of Karelia. These long-endurance balloons provide radar and video surveillance to monitor for intruders and prevent illegal immigration. Aerostats offer a unique advantage over traditional aerial platforms by providing long-duration, low-cost monitoring. Their ability to deliver persistent and real-time surveillance over vast areas makes them ideal for border control, national security, and disaster management. As Europe faces increasing security concerns and the need for rapid disaster response, the demand for these systems continues to grow driving market expansion.

Another key driver is technological advancements that improve the functionality and efficiency of aerostat systems. Innovations in lightweight materials, advanced sensors and enhanced communication systems have significantly boosted the capabilities of aerostats. For instance, in July 2024, Russia unveiled the Barrier anti-drone system developed by Pervyy Dirizhabl which employs aerostat technology to capture drones using nets. With a lifting capacity of 30 kg and an altitude of 300 meters it aims to protect strategic sites economically. These technological improvements allow for better surveillance accuracy, longer operational endurance, and greater payload capacity. Additionally, the increasing integration of aerostat systems with other surveillance technologies, such as drones and satellite networks, further enhances their value, making them a versatile tool for both defense and commercial applications in Europe.

Europe Aerostat Systems Market Trends:

Rising Demand for Surveillance and Monitoring

The growing need for effective surveillance across border control, military operations, and disaster management is a key factor driving the demand for aerostat systems in Europe. These systems provide an ideal solution for monitoring large often remote areas with high reliability and minimal operational costs. For instance, in February 2024, the US State Department approved a $1.2 billion military sale to Poland, which includes four aerostat based early warning radar systems. This acquisition aims to enhance Poland's defense against aerial and ground threats contributing to NATO operations amid increased military spending in response to heightened regional tensions. Aerostats are equipped with advanced sensors and communication tools that enable continuous real-time data collection making them invaluable for border security, tracking illegal activities and assisting in military reconnaissance. Additionally, they play a critical role in disaster response offering a stable platform for monitoring natural events like floods, wildfires, and other environmental crises.

Technological Advancements

Technological advancements have significantly enhanced the performance of aerostat systems making them more versatile and efficient for various applications. Innovations in sensor technology such as high-resolution cameras, radar systems and environmental sensors allow for precise monitoring and data collection in real-time. Lightweight materials including advanced composites have improved aerostat stability and payload capacity while reducing operational costs. Additionally, enhanced communication equipment ensures better data transmission enabling seamless connectivity even in remote or challenging environments. For instance, in September 2024, Ukraine introduced the Aero Azimuth, a balloon-based surveillance system that enhances its capabilities to detect and target Russian drone operators. Developed by Kvertus, the system boasts a detection range of up to 60 kilometers enabling effective disruption of enemy drone operations from altitudes between 300 and 700 meters. These technological improvements make aerostats increasingly attractive for both defense sectors, such as surveillance and reconnaissance and commercial applications like telecommunications and environmental monitoring.

Security and Defense Applications

Security and defense applications are among the primary drivers of the aerostat systems market in Europe. These systems provide a reliable and cost-effective solution for surveillance, reconnaissance and communication in military and defense operations. Aerostats can remain in the air for extended periods offering persistent monitoring of borders, military bases, and conflict zones. Equipped with high-tech sensors and cameras they provide real-time intelligence and early detection capabilities enhancing national security. For instance, in May 2024, Poland finalized a $960 million deal with the United States to acquire an advanced airspace reconnaissance system enhancing security along its northeastern borders. The agreement includes four tethered radar aerostats capable of monitoring activity up to 300 km away, reflecting Poland's commitment to bolster defense efforts amid regional tensions. Their ability to operate in remote or hostile environments makes them valuable assets for defense forces seeking to improve situational awareness and operational efficiency while reducing reliance on expensive aircraft.

Europe Aerostat Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe aerostat systems market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on payload, sub-system, product type, propulsion system, and class.

Analysis by Payload:

- Surveillance Radar

- Inertial Navigation System

- Thermal Imaging Camera

- Electro-Optical Sensor

- Electronic Intelligence

- Communication Intelligence

Electro-optical sensors hold the largest market share on the basis of payload. These are essential in aerostat systems for high-resolution imaging, which is critical in surveillance, reconnaissance, and intelligence gathering. These sensors capture visible light and infrared radiation allowing for day-and-night observation. Integrated with the aerostat they provide stable and continuous monitoring over large areas with the ability to zoom in on specific targets with remarkable clarity. Electro-optical sensors are particularly effective for border surveillance identifying unauthorized crossings and tracking moving vehicles ensuring that operators receive actionable intelligence without interruption.

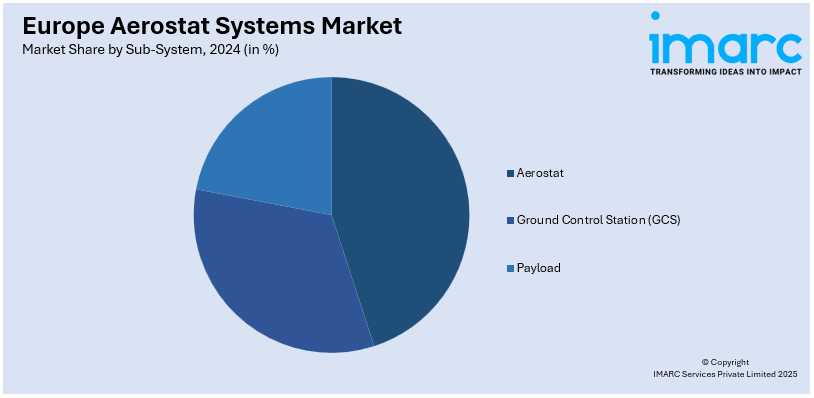

Analysis by Sub-System:

- Aerostat

- Ground Control Station (GCS)

- Payload

Aerostats dominate the market on the basis of sub-system. Aerostats are tethered high-altitude platforms used in surveillance and communication applications. They provide an effective alternative to traditional aircraft and satellites by maintaining a fixed position at great heights allowing for extensive coverage and prolonged operation. These platforms can carry various payloads including surveillance radar and cameras to monitor large geographic areas. Aerostats are utilized in border security, defense, disaster management and environmental monitoring. Their ability to offer persistent surveillance in remote or hard-to-reach locations makes them a valuable asset for continuous monitoring in both military and civilian sectors across Europe.

Analysis by Product Type:

- Balloon

- Airship

- Hybrid

Airships hold the largest share of Europe aerostat market on the basis of product type. Airships are large and lighter-than-air vehicles that combine the functionality of both balloons and aircraft. In the Europe aerostat systems market, airships are valued for their ability to carry heavier payloads and cover larger areas with greater mobility as compared to traditional balloons. Airships are often used for long-duration missions such as surveillance, telecommunications, and environmental monitoring. They can remain airborne for extended periods provide stable monitoring and easily reposition to new areas. Their robust design and ability to handle more advanced equipment make them suitable for military, defense, and commercial applications requiring both flexibility and stability in the air.

Analysis by Propulsion System:

- Powered Aerostats

- Unpowered Aerostats

Powered aerostats are equipped with propulsion systems that allow them to move providing greater flexibility and operational versatility as compared to unpowered systems. These aerostats are often used in missions requiring repositioning or coverage over larger areas. The propulsion system enables them to navigate specific locations maintain a fixed flight path or adjust altitude to optimize the performance of surveillance, communication, and reconnaissance equipment. Powered aerostats are increasingly used in defense, border security, and disaster management, offering both stability and maneuverability for tasks that demand continuous monitoring long-duration flights and the ability to respond to dynamic situations quickly.

Analysis by Class:

- Compact-Sized Aerostats

- Mid-Sized Aerostats

- Large-Sized Aerostats

Large-sized aerostats lead the market share in Europe. These are designed to carry heavy payloads and provide extended coverage over vast areas making them ideal for high-end surveillance, communications, and defense applications. These systems can support advanced equipment, such as radar, thermal imaging, and high-definition cameras for continuous monitoring. Due to their larger size, they can remain in the air for extended periods offering long-duration observation of wide geographic regions. Large aerostats are often used in military, border security and infrastructure monitoring where extensive coverage, high payload capacity and the ability to operate for long hours are critical for mission success.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany holds the largest market share in Europe with a growing demand for surveillance and security technologies. The country’s strategic location and strong defense sector have driven the adoption of aerostats for military, border security, and infrastructure monitoring applications. Germany’s emphasis on technological advancements and integration of innovative surveillance solutions has led to the development and deployment of both powered and unpowered aerostats. Additionally, Germany's commitment to environmental monitoring and disaster management further supports the use of aerostats for long-duration aerial surveillance in remote or hard-to-reach regions making it a leader in this market segment.

Competitive Landscape:

The European aerostat systems market is highly competitive with numerous players focusing on enhancing technological capabilities and expanding their product portfolios. Companies are investing in research and development to improve aerostat performance such as longer flight durations, better payload capacities and more advanced sensor systems. The market is characterized by a blend of established defense contractors and newer entrants from the aerospace and telecommunications sectors. Additionally, companies are focusing on offering integrated solutions that combine aerostats with other surveillance technologies like drones and satellite systems. Strategic collaborations, government partnerships and technological innovations are key factors driving competition in this growing market.

Latest News and Developments:

- In July 2024, the Russian military intensified the use of aerostats to enhance its communication network deploying systems that range from 15 to 300 cubic meters at altitudes of up to 3 kilometers. Despite past project delays recent developments include the successful testing of the Peresvet aerostat-based communication system.

-

In February 2024, the Ukrainian Armed Forces successfully deployed domestically produced aerostats for reconnaissance and communication on the battlefield. Developed by Aerobavovna these cost-effective systems can be rapidly inflated and launched providing aerial observation capabilities at a fraction of the cost of drones.

Europe Aerostat Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payloads Covered | Surveillance Radar, Inertial Navigation System, Thermal Imaging Camera, Electro-Optical Sensor, Electronic Intelligence, Communication Intelligence. |

| Sub-Systems Covered | Aerostat, Ground Control Station (GCS), Payload |

| Product Types Covered | Balloon, Airship, Hybrid |

| Propulsion Systems Covered | Powered Aerostats, Unpowered Aerostats |

| Classes Covered | Compact-Sized Aerostats, Mid-Sized Aerostats, Large-Sized Aerostats |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe aerostat systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe aerostat systems market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe aerostat systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aerostat systems are tethered, lighter-than-air platforms, such as balloons or airships, used for surveillance, reconnaissance, communication, and monitoring. They provide long-duration, low-cost solutions for tracking activities across large areas, especially in military, defense, border security, and disaster management applications. Aerostats are equipped with sensors, cameras, and communication tools to deliver real-time data.

The Europe aerostat systems market was valued at USD 4,081.7 Million in 2024.

IMARC estimates the Europe aerostat systems market to exhibit a CAGR of 10.2% during 2025-2033.

The key factors driving the Europe aerostat systems market include rising demand for cost-effective, long-duration surveillance, advancements in sensor and communication technologies, and increasing defense and security concerns, particularly for border control, national security, and disaster management applications.

In 2024, electro-optical sensors represented the largest segment by payload, driven by their critical role in high-resolution imaging and continuous surveillance, especially for border security and military reconnaissance.

Aerostats lead the market by sub-system, owing to their ability to provide fixed, high-altitude platforms for surveillance and communication, essential for various applications in defense, border security, and environmental monitoring.

The airship is the leading segment by product type, driven by its ability to carry heavier payloads, provide extended coverage, and offer greater mobility compared to traditional balloons, making it suitable for long-duration surveillance and defense operations.

In 2024, powered aerostats represented the largest segment by propulsion system, driven by their greater flexibility, maneuverability, and ability to cover larger areas for defense, surveillance, and border security applications.

Large-sized aerostats lead the market by class, owing to their ability to carry heavy payloads, provide extended coverage, and operate for longer durations, making them ideal for military, defense, and surveillance operations.

On a country level, the market has been classified into Germany, France, the United Kingdom, Italy, Spain, and others, wherein Germany currently dominates the market, driven by its strong defense sector and demand for surveillance technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)