Europe Agricultural Robot Market Size, Share, Trends and Forecast by Product Type, Application, Offering, and Country 2025-2033

Europe Agricultural Robot Market Size and Share:

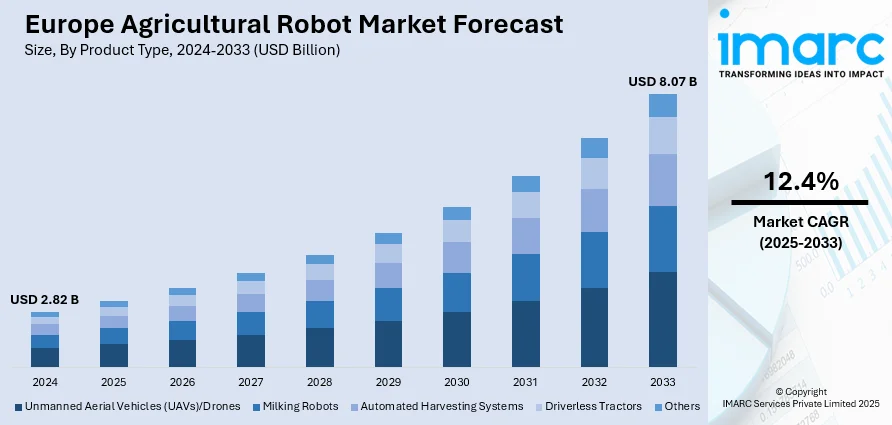

The Europe agricultural robot market size was valued at USD 2.82 Billion in 2024. Looking forward, the market is expected to reach USD 8.07 Billion by 2033, exhibiting a CAGR of 12.4% during 2025-2033. Spain currently dominates the market share in 2024. The market is fueled by rising labor shortages, growing emphasis on sustainable agriculture, and the widespread use of precision agriculture technologies. Environmental laws and consumer pressures for green practices are also driving the adoption of robots that maximize the use of pesticides and water. Developments in machine vision, sensor technology, and AI are facilitating robots to undertake complicated work with better efficiency are further contributing to the rise in the Europe agricultural robot market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.82 Billion |

|

Market Forecast in 2033

|

USD 8.07 Billion |

| Market Growth Rate 2025-2033 | 12.4% |

Among the strongest motivators for agricultural robot uptake in Europe is the chronic labor deficit throughout the agricultural sector in general, and more so in Western and Southern Europe. Most of these nations, including Spain, Italy, and France, have depended traditionally on seasonal migrant workers to perform work such as fruit harvesting, weeding, and harvesting. But recent restriction of immigration policies, increasing cost of labor, and dwindling interest in farming jobs among young generations have opened a widening gap in farm labor supply. Moreover, Europe's farming community has aged significantly, with younger generations showing less interest in inheriting family farms because of the physical labor involved and economic instability associated with conventional farming. This population trend has generated a pressing demand for automation, which has encouraged farmers to invest in robotic technology that can accomplish repetitive and high-labor tasks effectively. Agricultural robots facilitate the relief of manpower challenges and ensure consistency in operations, which is important in sustaining productivity under labor shortages, and fueling the Europe agricultural robot market growth.

To get more information on this market, Request Sample

Europe's strong focus on environmental sustainability is yet another primary force driving agricultural robotics growth. The European Union has enforced stringent controls over pesticide usage, carbon footprints, and water management in farming, which compelled farmers to embrace precision agriculture. Agricultural robots like automated sprayers, weeders, and drone-mounted crop monitors assist these objectives by allowing precision interventions, lowering waste, and lessening environmental footprint. Nations such as Germany and the Netherlands are leading the charge in adopting such technologies, both prompted by government policy and consumer pressure for sustainable food production. The thrust toward sustainable agriculture also comes in line with other EU-wide strategies such as the Green Deal and Farm to Fork, which promote the adoption of smart technology in agriculture. Using robots, farmers can maximize the use of input, reduce operational expenses, and better comply with regulations, thus making automation a strategic instrument for profitability and sustainability throughout the European farming sector.

Europe Agricultural Robot Market Trends:

Increasing Application of Drones and UAVs in Precision Farming

One of the leading trends among Europe's agricultural robots is the quick adoption of drones and unmanned aerial vehicles (UAVs), backed by a number of European Union initiatives for maximizing farm observation and input application. In several countries, pilot schemes prioritize drones for the mapping of fields, analysis of crop health, and precision spraying, led by EU-backed initiatives that optimize precision agriculture and environmental protection. In countries like the Netherlands and France, which boast high-value horticulture and greenhouse production, the use of drones to track plant stress, nutrient deficiencies, and pest invasions is becoming more common. The simplicity of using UAVs to survey extensive acreage and the fact that they can apply variable-rate fertilizer and pesticide application is redesigning crop management. Modern advances make it possible to collect data in real time utilizing thermal and multispectral imaging, empowering farmers to make informed decisions that increase productivity and reduce waste. Recent industry estimates indicated that about one in ten farms in Europe are currently using drones, positioning agriculture as an unexpected leader in technological innovation. Hence, the extensive use of UAVs, underpinned by harmonized European regulation facilitating cross-border testing of drones, is a milestone toward more intelligent, satellite-connected agricultural operations in the region, which will further boost the Europe agricultural robot market demand.

EU-Funded Projects: GRAPE, MARS and Beyond

Another trend redrawing Europe's agri-robotics landscape is the impact of initiatives supported by the European Union, including GRAPE and MARS, aimed at the substitution of manpower-driven operations with sophisticated automated alternatives. GRAPE specializes in precision harvesting systems for sensitive crops such as grapes in Italian, French, and Spanish viticulture areas where seasonal labor shortages are severe. By innovating robotic arms with vision systems that can differentiate between ripeness and selectively picking grape bunches, GRAPE targets to mechanize vineyard work and lower reliance on migrant laborers. On the other hand, MARS focuses on the use of multi-purpose autonomous robots for repeated operations like sowing, weeding, and crop scouting in open-field vegetable and grain fields. These collaborative initiatives engage universities, tech startups, and EU agribusiness companies in co-testing ideas in actual farm environments across several nations. As such, the European Innovation Council (EIC) allocated a EUR 10 Billion budget for the 2021–2027 period to support Europe's leading academics, entrepreneurs, and innovators, helping them transform their ideas from early-stage development to market-ready solutions. Scandinavia to the Mediterranean demonstration sites are proving their worth, speeding up commercialization, and stimulating the next generation of robotics firms. According to the Europe agricultural robot market forecast, these EU initiatives are shifting away from human labor toward system automation throughout Europe's farming industries.

Integration of AI, Big Data, Advanced Sensing, and GPS

Another important trend in the market for agri-robots in Europe is the integration of artificial intelligence, big data analysis, advanced sensing systems, and precision GPS technologies into the next generation of farm robots. Top European producers now outfit autonomous tractors, weed robots, and harvesters with on-board AI able to identify crop types, diseases, and development stages. The robots collect high-res data from cameras, LiDAR, and soil probes that are analyzed by cloud platforms to provide actionable information. GPS navigated systems provide centimeter precision for planting and pesticide application to minimize overlap and operational inefficiency. With aggregation of big data, farmers are now able to monitor performance over time, compare across fields and geography, and adapt farming techniques. Accordingly, in October 2024, Carbon Robotics raised USD 70 Million in Series D funding to expand its LaserWeeder business, introduce new products, and enhance manufacturing. This investment supports growth in North America, Europe, and Asia-Pacific, advancing AI-driven agricultural innovation. This integrated digital strategy is enabling farmers in Germany, Sweden, and Eastern Europe to shift from reactive to predictive management of crops. With increasing intelligence from machine learning and edge computing, systems can increasingly run autonomously with minimal human intervention and maximum productivity. This is fast-tracking the evolution of the Europe agricultural robot market outlook, and further creating a new benchmark for tech-enabled, data-driven sustainable farming.

Europe Agricultural Robot Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe agricultural robot market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, application, and offering.

Analysis by Product Type:

- Unmanned Aerial Vehicles (UAVs)/Drones

- Milking Robots

- Automated Harvesting Systems

- Driverless Tractors

- Others

Automated harvesting systems stand as the largest component in 2024. Automatic harvesting systems are beginning to emerge as the leading product-type segment in the European agricultural robot market, fueled by demands for efficiency and precision in crop management. The systems mechanize the manual labor of harvesting fruits, vegetables, and specialty crops, which have become increasingly difficult to accomplish with labor shortages sweeping the continent of Europe. With sophisticated sensors, computer vision technology, and robotic arms, automatic harvesters can detect ripeness, gently pick crops, and selectively harvest crops by themselves. This accelerates cycle times and shields fragile yields from bruising and damage, leading to enhanced overall quality and lower post-harvest losses. European farmers enjoy the scalability and dependability that automatic systems provide, especially in high-value crops such as berries, apples, and grapes. Additionally, the systems are also enabling sustainability through the targeted harvesting that reduces wastage and maximizes the use of resources. According to the Europe agricultural robot market analysis, as environmental laws become stricter and consumer pressure for fresh premium products increases, these robots provide a useful solution for growers looking for a compromise between productivity, product quality, and sustainability.

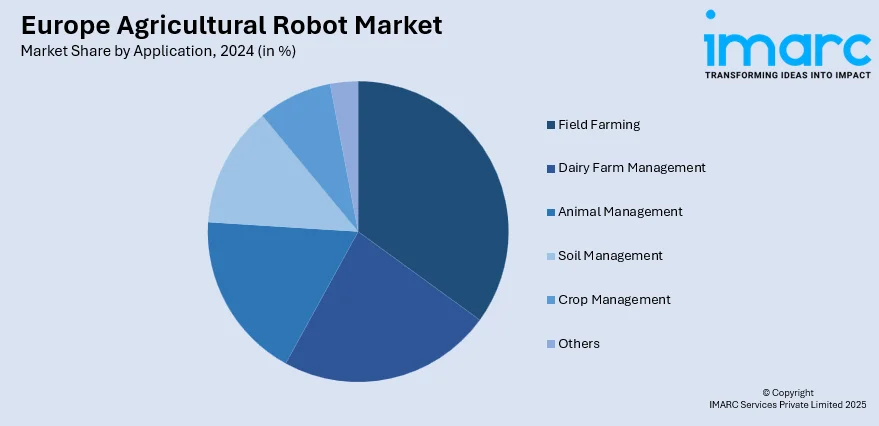

Analysis by Application:

- Field Farming

- Dairy Farm Management

- Animal Management

- Soil Management

- Crop Management

- Others

Field farming leads the market share in 2024. Field farming covers necessary duties over large-acre farms that have a direct effect on yield and efficiency. Robotic solutions targeting plowing, sowing, weeding, and nutrient monitoring are ideal for Europe's extensive arable farms handling cereals, oilseeds, pulses, and other field crops. These robots provide accuracy of performance in land preparation and crop management, taking away repetitive tasks once done with intensive human effort and timing precision. Major European farming zones, like France's grain belt, Germany's diversified farms, and Eastern Europe's extensive fields, are embracing robotic platforms to maximize field-level inputs and lower operating expenses. With cutting-edge sensors and GPS-directed navigation, field robots plant seeds in optimal depths, manage weeds with precision spraying, and assess plant health through the growing season. By providing real-time information and facilitating adaptive management, these systems enhance resource use, encourage eco-friendly farming, and conform to the European environmental objectives. Overall, field farming robots are revolutionizing conventional crop cultivation in Europe by increasing efficiency, sustainability, and scale.

Analysis by Offering:

- Hardware

- Software

- Services

Hardware leads the market with 59.8% of market share in 2024. Hardware constitutes the majority of the European market for agricultural robots, as they are the most essential and embraced offering segment among farms. These comprise autonomous tractors, robotic harvesting arms, weeding machines, drone platforms, and sensor-equipped vehicles performing precision tasks in the field. As observed through Europe agricultural robot market trends, farmers in Europe's agritech-intensive regions like the Netherlands, Germany, and France, are increasingly adopting these hardware solutions to mechanize labor-intensive tasks. These machines combine GPS guidance, computer vision, and real-time control systems to plant, grow, and harvest with incredible precision. European agriculture's focus on sustainability and efficiency gives hardware a special importance that allows for lower soil compaction, optimized input application, and less crop damage. In addition, sophisticated hardware can be modular and upgradeable so growers can tailor systems for various crops, landscapes, and sizes of farms. By making investments in long-lasting equipment with robust software interfaces, European farmers can achieve long-term productivity improvement and evolve with changing regulatory and environmental requirements.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Spain accounted for the largest market share. Spain has become a leading player in Europe's agricultural robot business, benefiting from its multimodal crop production, innovative climate, and distinctive agricultural needs. As one of Europe's leading growers of fruit, vegetables, olives, and wine, Spanish farmers are confronted with labor-intensive harvesting requirements best met by robotics. The patchy availability and increasing expense of seasonal workers have instigated the trend toward automated means in vineyards, olive orchards, and greenhouse crops. Spain's robotics industries and research institutes are creating specialized equipment that can handle hilly landscapes and operate on fragile crops such as grapes and peppers—technology specific to Spanish agronomic requirements. In addition, the national government and regional agricultural programs have assisted pilot ventures and integration among tech startups and cooperatives. This integration speeds up adoption and increases farmer trust. With its combination of greenhouse-dense Murcia region, olive belt, and wine-producing areas in La Rioja and Catalonia, Spain offers rich soil for the employment of farm robots, making it the leader in Europe's farm automation revolution.

Competitive Landscape:

Major players in the Europe agricultural robot market are aggressively pushing innovation and installation through strategic alliances, technology innovation, and geographic expansion. Autonomous tractors, robotic harvesters, and drone technologies are being heavily invested on by companies to cope with labor issues and enhance farm operational efficiency. Several top companies are partnering with research institutions and universities across nations such as France, Germany, and the Netherlands to create AI-based robots that can carry out precise operations such as planting, weeding, and crop inspection. Traditional players and startups are concentrating on the incorporation of machine learning and computer vision to make robots more adaptable in dynamic field conditions. In addition, producers are also creating modular and scalable robot systems to serve both small- and large-scale agricultural farms. In line with Europe's stringent environmental regulations, businesses are also focusing on sustainable agriculture by creating robots that minimize the use of chemicals and optimize resource inputs. Certain companies are entering into joint ventures or acquiring niche startups to supplement their product offerings and further enhance their market presence. Pilot schemes, state-backed trials, and demo farms are further driving adoption by enabling farmers to see for themselves the productivity and sustainability advantages of robotic technology. These initiatives are collectively shifting classical European farming into a high-tech sector.

The report provides a comprehensive analysis of the competitive landscape in the Europe agricultural robot market with detailed profiles of all major companies, including:

Latest News and Developments:

- June 2025: Arugga AI Farming launched its first autonomous plant lowering robot, "Louie," for greenhouse-grown tomatoes and cucumbers. The robot can manage 300 plants per hour, reducing labor and ensuring consistent growth. Deployments are underway in the Netherlands, Belgium, and France, with live demos at GreenTech Amsterdam 2025.

- May 2025: Manitou Group acquired the robotics division of Sitia, a French engineering company. This acquisition, part of Manitou’s LIFT strategic roadmap, strengthens its focus on robotics, particularly in agriculture. The move includes a team of experts and aims to accelerate product development in the agricultural and semi-industrial sectors.

- April 2025: The EU-funded AgRibot project, with a EUR 4.97 Million grant, aims to enhance European agriculture through robotics, AR/XR, and 5G technologies. It will test six robotic systems across Europe, focusing on tasks like weed management, precision spraying, and harvesting, improving sustainability, productivity, and farmer training.

- April 2025: Taylor Farms acquired agri-tech company FarmWise, specializing in agricultural robotics and precision weeding. The acquisition strengthens Taylor Farms' focus on sustainable farming and robotics, with the Vulcan machine using machine learning for efficient weed removal. The move also expands Taylor Farms' presence in the European market.

- October 2024: To alleviate labor shortages and improve food security, DENSO and Certhon introduced a completely automated harvesting robot for cherry truss tomatoes in Europe. This innovative solution leverages DENSO's automotive expertise to revolutionize agricultural practices, making crop production more efficient and overcoming climate challenges.

Europe Agricultural Robot Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Unmanned Aerial Vehicles (UAVs)/Drones, Milking Robots, Automated Harvesting Systems, Driverless Tractors, Others |

| Applications Covered | Field Farming, Dairy Farm Management, Animal Management, Soil Management, Crop Management, Others |

| Offerings Covered | Hardware, Software, Services |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe agricultural robot market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe agricultural robot market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe agricultural robot industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural robot market in Europe was valued at USD 2.82 Billion in 2024.

The Europe agricultural robot market is projected to exhibit a CAGR of 12.4% during 2025-2033, reaching a value of USD 8.07 Billion by 2033.

The Europe agricultural robot market is driven by labor shortages, rising demand for precision farming, and strict environmental regulations. Technological advancements in AI, sensors, and automation enhance productivity and sustainability. Government support and subsidies for smart farming also encourage adoption, particularly in countries like Germany, France, and the Netherlands.

Spain accounts for the largest share in the Europe agricultural robot market, driven by labor shortages in rural regions, strong demand for precision viticulture and olive cultivation, and strict environmental regulations. Advancements in AI, sensor technology, and automation boost efficiency. Government initiatives and EU funding for smart agriculture further accelerate adoption across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)