Europe Aluminum Extrusion Market Size, Share, Trends, and Forecast by Product Type, Alloy Type, End-Use Industry, and Country, 2025-2033

Europe Aluminum Extrusion Market Size and Share:

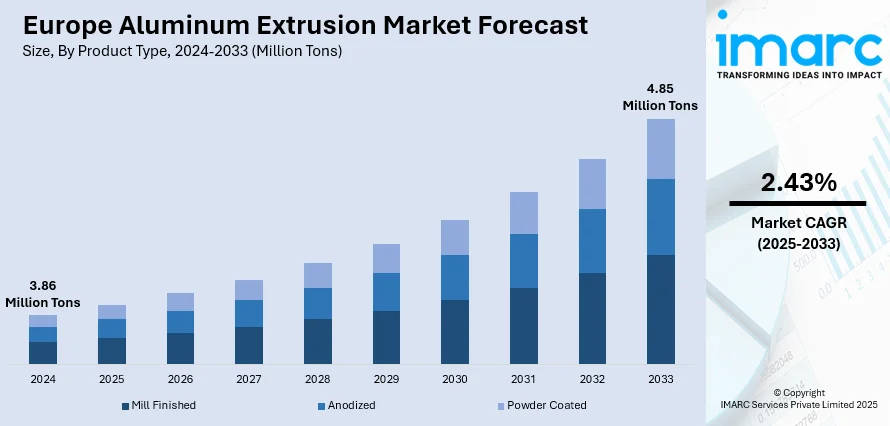

The Europe aluminum extrusion market size was valued at 3.86 Million Metric Tons in 2024. Looking forward, the market is expected to reach 4.85 Million Metric Tons by 2033, exhibiting a CAGR of 2.43% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is experiencing steady growth due to rising demand across the automotive, construction, and renewable energy sectors. Lightweight, durable, and recyclable properties of aluminum make it ideal for energy-efficient and sustainable applications, which is also driving the market. Technological advancements in alloy processing further support adoption, contributing to the expansion of the Europe aluminum extrusion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.86 Million Metric Tons |

|

Market Forecast in 2033

|

4.85 Million Metric Tons |

| Market Growth Rate 2025-2033 | 2.43% |

The demand in the manufacturing industries in the automotive industry, aerospace industry, and building and construction is receiving major boosts due to the increased focus on lightweight and energy-efficient materials. Aluminum extrusions offer high strength-to-weight ratios, resistance against corrosion, and versatility of design, which makes them useful in the construction of electric vehicles, aircraft components, and modular buildings. For instance, in April 2023, ASCONA and D-CUBE formed a strategic alliance to introduce a comprehensive solution for real-time surface inspection of aluminum profiles. This collaboration merges cutting-edge technology with a track record of excellence, already trusted by some of Europe’s largest aluminium extrusion facilities. Backed by extensive industry expertise and a globally established service network, the partnership aims to enhance quality control and operational efficiency across the sector.

To get more information on this market, Request Sample

The Europe aluminum extrusion market growth is also driven by the rapid development of green buildings and smart infrastructure, which is fueling the need for aluminum extrusions in doors, windows, curtain walls, and solar panel frames. This material has a high thermal performance and aesthetic value, making it the ideal building material in contemporary construction. Additionally, there has been an intense concern about environmental sustainability in the area. Aluminum is a very recyclable metal, and well over half of European-produced aluminum now originates as a recycled product. This also endorses EU climate targets and attracts consumers and producers who have an ecological inclination. For instance, in September 2024, Hydro inaugurated a new aluminum recycling facility in Székesfehérvár, Hungary, with an annual processing capacity of 90,000 Tons. The plant is primarily geared toward meeting the demands of the automotive sector, contributing to the growing use of recycled materials in vehicle manufacturing.

Europe Aluminum Extrusion Market Trends:

Rising Demand from Key Industrial Sectors

The market is expanding due to increasing demand from commercial and passenger vehicle manufacturing, aerospace, and infrastructure development. Lightweight yet strong aluminum extrusions are favored in electric vehicles and transport applications. In response to this demand, Hydro announced in March 2025 a NOK 1.65 billion investment in a new wire rod casthouse at Karmøy, Norway. This strategic move aims to strengthen aluminum extrusion supply across Europe, particularly for the growing electric mobility and infrastructure sectors. These industrial developments reflect how extrusion-based aluminum products are becoming essential in meeting the continent’s performance and sustainability targets, contributing significantly to market momentum across various application verticals.

Environmental Sustainability and Recycling Initiatives

Aluminum’s key properties, such as high thermal and electrical conductivity, ductility, and excellent recyclability, are major drivers of market growth. According to the Europe aluminum extrusion market trends, these characteristics align well with Europe’s push toward circular economy practices and green production. An industry report highlighted that over 50% of aluminum produced in Europe now comes from recycled sources, underscoring a strong commitment to environmental sustainability. As climate goals tighten across the region, aluminum extrusion's role in reducing environmental impact becomes more prominent. The use of recycled aluminum not only lowers carbon footprints but also meets the rising demand from eco-conscious manufacturers and consumers, further accelerating the market’s adoption rate.

Growth in Green Construction and Temporary Market Disruptions

The adoption of aluminum extrusions in green building projects is accelerating due to their use in components like doors, windows, and mirrors. These products support energy-efficient designs and are increasingly used in sustainable construction throughout Europe. However, the market has also faced temporary disruptions caused by the COVID-19 pandemic. Lockdowns and production halts across the region led to reduced manufacturing activity and supply chain interruptions. While this impacted short-term growth, the market is expected to rebound as restrictions ease. The long-term outlook remains positive, especially as demand for eco-friendly building materials increases and economic recovery efforts prioritize infrastructure development and climate-resilient construction.

Europe Aluminum Extrusion Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe aluminum extrusion market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, alloy type, and end-use industry.

Analysis by Product Type:

- Mill Finished

- Anodized

- Powder Coated

Mill finished stand as the largest component in 2024, holding 45.3% of the market due to their cost-effectiveness, versatility, and widespread industrial usage. These profiles are delivered without additional surface treatment, making them an economical option for applications where aesthetic appeal is not a primary concern. Industries such as construction, automotive, and machinery manufacturing frequently utilize mill-finished extrusions for structural frameworks, supports, and components, where functionality outweighs appearance. Their immediate availability and shorter lead times further contribute to their popularity. Additionally, mill-finished products serve as a base for further customization, including anodizing or powder coating when needed. According to the Europe aluminum extrusion market forecast, this adaptability, combined with affordability and high utility, makes mill-finished aluminum extrusions a preferred choice across numerous European industrial applications.

Analysis by Alloy Type:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

The 6000 series aluminum alloy holds the largest share in the market due to its excellent balance of strength, corrosion resistance, and workability. Comprising mainly aluminum, magnesium, and silicon, alloys like 6061 and 6063 are highly versatile and widely used across automotive, construction, and transportation sectors. Their superior extrudability allows for the creation of complex shapes, making them ideal for window frames, pipelines, and vehicle components. Additionally, the 6000 series offers excellent surface finish capabilities and is well-suited for both structural and decorative applications. Its compatibility with welding and heat treatment further enhances its utility. The alloy’s strong mechanical properties and broad application potential are creating a positive impact on the Europe aluminum extrusion market outlook.

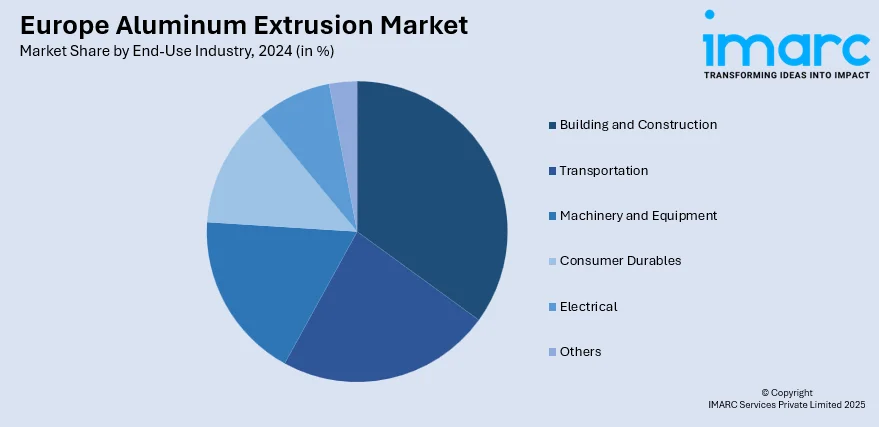

Analysis by End-Use Industry:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

The building and construction sector holds the largest share in the market due to the material’s lightweight, strength, and corrosion-resistant properties, making it ideal for structural and architectural applications. Aluminum extrusions are widely used in window frames, curtain walls, roofing systems, and façade structures, particularly in energy-efficient and green buildings. The EU’s focus on sustainable urban development and stringent energy efficiency regulations has further accelerated the adoption of aluminum-based solutions. Additionally, aluminum's recyclability aligns with Europe’s circular economy goals, boosting its demand in modern construction projects. With the rise in residential, commercial, and infrastructure developments across the region, aluminum extrusions continue to be a preferred choice for builders and architects, driving consistent Europe aluminum extrusion market demand.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a key driver of the Europe aluminum extrusion market due to its strong industrial base, particularly in the automotive, construction, and machinery sectors. The country's emphasis on lightweight and fuel-efficient vehicle production has led to increased use of aluminum extrusions in EV components, chassis, and structural parts. In the construction sector, rising investments in energy-efficient buildings and infrastructure modernizations boost the demand for aluminum profiles due to their durability and thermal performance. Furthermore, Germany’s commitment to sustainability and recycling supports aluminum use, as it is highly recyclable and reduces carbon footprints. The presence of advanced manufacturing facilities and R&D capabilities also positions Germany as a hub for innovation in extrusion technologies, further enhancing market growth in the region.

Competitive Landscape:

The Europe aluminum extrusion market features a competitive landscape dominated by key players such as Hydro Extrusions, Constellium SE, SAPA Group, and Exlabesa. These companies leverage advanced technologies, wide distribution networks, and strategic investments to strengthen their market positions. For instance, Hydro’s NOK 1.65 billion investment in a new wire rod casthouse in Norway reflects its commitment to expanding capacity and meeting rising regional demand. Many players focus on product innovation, sustainability, and customized extrusion solutions to cater to evolving end-user needs across automotive, construction, and electrical sectors. Furthermore, partnerships, mergers, and acquisitions remain common strategies to gain market share. Local and niche manufacturers also contribute to the market by offering specialized services and flexible production capabilities.

The report provides a comprehensive analysis of the competitive landscape in the Europe aluminum extrusion market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Novelis unveiled the world’s first aluminum coil made entirely from 100% recycled end-of-life automotive scrap, developed for the European market. This breakthrough supports circularity in the automotive industry, significantly reducing carbon emissions and energy use while maintaining performance standards for outer car body applications.

- November 2024: Mengtai Group completed its acquisition of Alu Menziken Extrusion AG, strengthening its presence in Europe’s aluminum industry. The integration creates a network of seven production sites, offering end-to-end aluminum solutions for automotive, construction, and industrial sectors, with a focus on innovation and sustainability.

- October 2024: Ball Corporation acquired Alucan, a leading European producer of extruded aluminum aerosols and bottles, with facilities in Spain and Belgium. The acquisition expands Ball’s sustainable packaging capabilities in Europe, supporting growth in personal care and home products while enhancing innovation, customer proximity, and environmental performance.

- September 2024: Fastmarkets proposed launching two weekly price assessments for 6063 aluminum extrusion scrap, clean production and 95/5 post-consumer, delivered to European consumers.

- September 2024: Hydro inaugurated a new aluminum recycling plant in Székesfehérvár, Hungary, with a 90,000-tonne annual capacity. Adjacent to its extrusion plant, the facility supports closed-loop recycling for the automotive sector, strengthening Hydro’s European presence and commitment to low-carbon, post-consumer aluminum solutions ahead of its 2030 sustainability goals.

- August 2024: Hammerer Aluminium Industries (HAI) inaugurated its P61 extrusion press line and logistics center in Ranshofen, Austria. Part of a EUR 125 Million investment, the new line boosts capacity for complex automotive profiles, raising HAI's total extrusion output to 125,000 tons annually across 13 European lines.

Europe Aluminum Extrusion Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe aluminum extrusion market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe aluminum extrusion market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe aluminum extrusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminum extrusion market in Europe reached 3.86 Million Metric Tons in 2024.

The Europe aluminum extrusion market is projected to exhibit a (CAGR) of 2.43% during 2025-2033, reaching a volume of 4.85 Million Metric Tons by 2033.

The Europe aluminum extrusion market is driven by rising demand from the automotive, construction, and aerospace sectors, coupled with a strong shift toward lightweight, recyclable materials. Advancements in green building practices and increased use of recycled aluminum further boost market growth across various industrial applications.

Germany currently dominates the Europe aluminum extrusion market due to Germany’s strong automotive, construction, and renewable energy sectors. The country’s focus on lightweight materials, sustainability, and high-performance infrastructure further accelerates adoption, reinforcing its leadership in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)