Europe Anime Market Size, Share, Trends and Forecast by Revenue Source, and Country, 2026-2034

Europe Anime Market Summary:

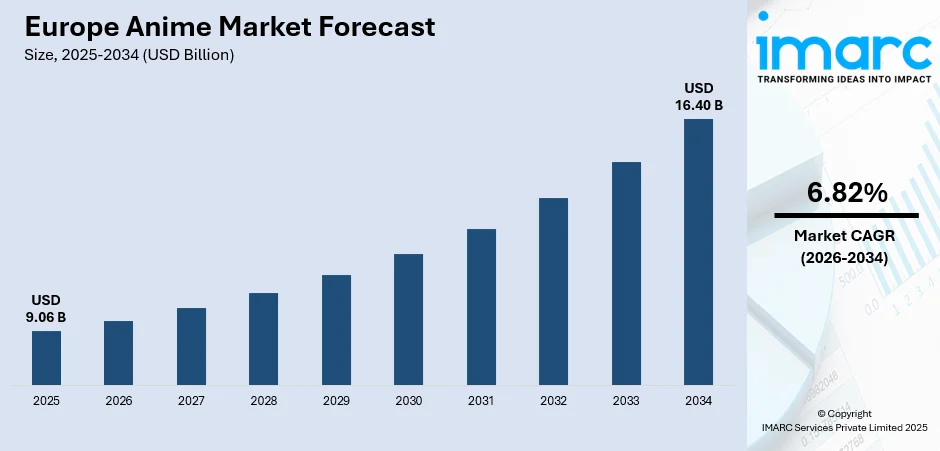

The Europe anime market size was valued at USD 9.06 Billion in 2025 and is projected to reach USD 16.40 Billion by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

The growth of digital streaming services, which have made Japanese animation more accessible to a wider range of demographic groups, is driving the expansion of the European anime business. Mainstream entertainment consumers continue to be drawn to Japanese storytelling traditions because to the growing cultural respect for them and the substantial localization efforts, which include multilingual dubbing and subtitling. The European anime market share is being strengthened by strategic licensing agreements, a thriving convention circuit, and growing merchandise ecosystems.

Key Takeaways and Insights:

-

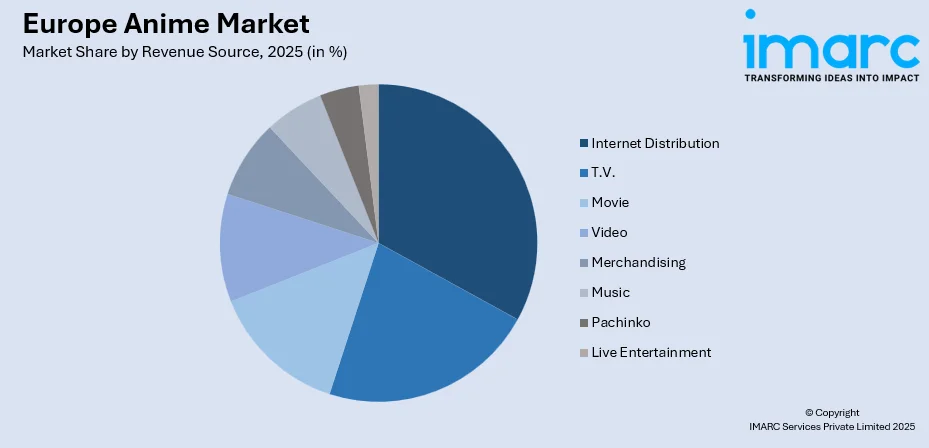

By Revenue Source: Internet distribution dominates the market with a share of 32% in 2025, driven by streaming platforms offering instant access to extensive anime libraries, simulcast releases from Japan, and region-specific localization that has significantly reduced piracy while boosting legal viewership across European audiences.

-

By Country: The United Kingdom leads the market with a share of 24% in 2025, reflecting strong consumer spending on entertainment, a well-established distribution infrastructure, and the presence of major licensing operations that have positioned the country as a strategic hub for anime content distribution throughout Europe.

-

Key Players: Leading companies drive the European anime market through strategic content licensing, platform expansion, and cross-media collaborations. Their investments in localization, theatrical distribution, and merchandise partnerships enhance accessibility and accelerate market penetration across diverse consumer segments.

To get more information on this market Request Sample

The European anime market continues to strengthen its position as one of the fastest-growing entertainment segments, with streaming platforms and fan engagement driving remarkable expansion. The convergence of digital accessibility and passionate fan communities has created a sustainable ecosystem where content consumption directly translates into merchandise purchases, convention attendance, and theatrical experiences. European audiences increasingly embrace anime as mainstream entertainment, with younger demographics particularly engaged through social media platforms and digital communities. The market's maturation is evidenced by growing institutional support and corporate investments in the sector. In July 2024, Crunchyroll expanded its European e-commerce presence by launching localized store operations in English, French, and German, enabling regional fulfillment and enhanced accessibility for fans across multiple territories to purchase official anime merchandise and collectibles.

Europe Anime Market Trends:

Streaming Platform Expansion with Multi-Language Localization

By making significant investments in localized content distribution, digital streaming services are transforming anime consumption throughout Europe. In addition to providing dubbed video and subtitles in several European languages, platforms are growing their portfolios, thus extending the audience beyond traditional aficionados. Because of its accessibility, anime has become popular entertainment rather than a specialized pastime. In the region, a variety of audience demographics continue to be drawn in and subscriber retention is strengthened by the simplicity of on-demand viewing and simultaneous release techniques that reduce delays between Japanese broadcasts and European availability.

Rise of Live-Based Entertainment and Themed Experiences

European markets are witnessing significant growth in anime-related live entertainment, including concerts, theatrical screenings, and immersive experiences. Theme park operators and entertainment venues are increasingly recognizing anime's commercial potential for creating destination experiences. This trend reflects anime's evolution from passive content consumption to active fan participation. Parc Spirou Provence in France announced the development of a 1.5-hectare Naruto-themed expansion called Konoha Land, scheduled to open in 2026 as Europe's first major anime theme park attraction.

European-Japanese Studio Collaborations and Co-Productions

European and Japanese production studios are increasingly working together in the anime industry, fusing their unique storytelling traditions and animation skills. These collaborations make it possible to expand narrative offers while producing content that appeals to local and international audiences. Japanese companies supply well-known franchises and production techniques, while European studios supply animation talent. As production companies realize the commercial possibilities of fusing Western creative sensibilities with Japanese aesthetic traditions to attract a wider worldwide audience, such cross-cultural endeavors are growing.

Market Outlook 2026-2034:

The European anime market demonstrates strong fundamentals supporting continued expansion through the forecast period. Digital transformation in content delivery, coupled with strategic investments from major entertainment conglomerates, positions the market for sustained growth. The market generated a revenue of USD 9.06 Billion in 2025 and is projected to reach a revenue of USD 16.40 Billion by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034. Increasing mainstream acceptance, expanding distribution networks, and growing merchandise ecosystems will collectively drive market advancement across European territories.

Europe Anime Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Revenue Source |

Internet Distribution |

32% |

|

Country |

United Kingdom |

24% |

Revenue Source Insights:

Access the comprehensive market breakdown Request Sample

- T.V.

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

Internet distribution dominates with a market share of 32% of the total Europe anime market in 2025.

Internet distribution has emerged as the primary revenue channel for the European anime market by eliminating traditional barriers associated with television scheduling and physical media requirements. Streaming platforms provide instant access to extensive content libraries, including simulcast releases that minimize the delay between Japanese broadcasts and European availability. The subscription-based model has proven particularly effective in converting casual viewers into dedicated consumers while reducing piracy through competitive pricing and superior user experiences. Crunchyroll surpassed 15 Million monthly paid subscribers globally in August 2024, demonstrating the substantial consumer appetite for dedicated anime streaming services across international markets.

The internet distribution segment benefits from continuous technological improvements in streaming quality, personalized recommendation algorithms, and enhanced accessibility features. Platforms invest significantly in multi-language dubbing and subtitling to serve diverse European language markets, substantially expanding their addressable audience. The flexibility of on-demand viewing encourages higher engagement levels and repeat watching, while integrated e-commerce capabilities enable seamless merchandise purchases. Netflix's 2025 report revealed that anime viewership exceeded one Billion global views in 2024, with over 50% of its global subscriber base actively engaging with anime content, validating substantial content acquisition investments.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The United Kingdom leads with a share of 24% of the total Europe anime market in 2025.

The United Kingdom has established itself as the dominant market for anime content in Europe, driven by high consumer spending on entertainment, sophisticated distribution infrastructure, and English-language content accessibility. The market benefits from strong licensing operations, well-established retail channels, and growing theatrical distribution for anime films. British audiences have demonstrated particular enthusiasm for both classic franchises and emerging titles, supporting diverse revenue streams across streaming, home video, and merchandise categories. In December 2025, Japanese entertainment giant Toho acquired UK-based distributor Anime Limited and established its European regional headquarters in London, signaling the country's strategic importance.

The British anime market continues to strengthen through strategic corporate investments and expanding distribution networks that serve as gateway operations for broader European market access. Major streaming platforms prioritize the UK market for content launches and localization efforts, recognizing its influence on wider regional trends. The convention circuit, including events attracting thousands of attendees, provides additional revenue opportunities and strengthens fan community engagement.

Market Dynamics:

Growth Drivers:

Why is the Europe Anime Market Growing?

Digital Streaming Platform Proliferation and Content Accessibility

The expansion of digital streaming platforms has fundamentally transformed anime consumption patterns across Europe, democratizing access to Japanese animation content. Major streaming services have invested substantially in anime licensing and original productions, recognizing the genre's ability to attract and retain subscribers. These platforms offer extensive content libraries featuring both classic series and simultaneous releases with Japan, creating compelling value propositions for diverse consumer segments. The convenience of on-demand viewing, combined with multi-device accessibility, has significantly expanded the potential audience beyond traditional anime enthusiasts to include mainstream entertainment consumers. Streaming platforms have also pioneered innovative distribution models, including ad-supported tiers that lower entry barriers for price-sensitive viewers.

Growing Fan Convention Culture and Community Engagement

European anime conventions have evolved into major cultural events that strengthen fan communities while generating substantial economic activity. These gatherings provide unique opportunities for fans to engage directly with content creators, voice actors, and fellow enthusiasts, creating memorable experiences that reinforce brand loyalty. Convention programming includes exclusive screenings, merchandise sales, cosplay competitions, and industry panels that offer insights into anime production and distribution. The convention circuit has become an essential marketing channel for content distributors, providing direct consumer feedback and generating excitement for upcoming releases. Fan communities fostered through convention attendance and social media engagement create sustainable demand for anime content and associated products.

Expanding Merchandising Ecosystem and Cross-Media Franchise Development

The European anime merchandising market has experienced remarkable growth as fans increasingly seek tangible connections to their favorite series through collectibles, apparel, and accessories. Popular franchises generate significant revenue through coordinated merchandise releases that span figurines, clothing, home goods, and limited-edition collectibles. Strategic collaborations between anime studios and international retail brands have enhanced product availability while introducing anime merchandise to mainstream shopping channels. E-commerce platforms have further democratized access to official products, enabling fans across Europe to purchase items previously available only through specialized retailers or import channels. The collectible culture among adult fans, particularly the growing kidult demographic, drives demand for premium merchandise categories featuring sophisticated designs and limited availability.

Market Restraints:

What Challenges the Europe Anime Market is Facing?

Content Piracy and Unauthorized Distribution Networks

Digital piracy continues to pose significant challenges for the European anime industry, undermining legitimate revenue streams and discouraging investment in localization efforts. Unauthorized streaming sites and download platforms attract users through free access and often provide content faster than legal alternatives. Despite strengthened enforcement measures and improved legal streaming options, piracy platforms continue operating across European jurisdictions.

High Licensing Costs and Complex Rights Negotiations

The acquisition of anime content rights involves complex negotiations with multiple Japanese stakeholders, including production committees, publishers, and studios. Licensing fees for popular franchises have increased substantially as competition among streaming platforms intensifies. These elevated costs create barriers for smaller distributors while potentially limiting content variety available to European audiences.

Cultural Localization Barriers and Adaptation Challenges

Despite growing mainstream acceptance, anime content occasionally faces resistance when localization efforts fail to preserve authentic Japanese cultural elements. European productions attempting to adapt anime styles without Japanese involvement sometimes receive criticism from established fan communities. Balancing cultural authenticity with accessibility for new audiences requires careful navigation of diverse European market preferences.

Competitive Landscape:

The European anime market features a competitive landscape characterized by strategic positioning among streaming platforms, content distributors, and merchandise providers. Major players differentiate through content library depth, localization quality, and exclusive licensing agreements. Companies increasingly pursue vertical integration strategies, combining streaming services with merchandise operations and theatrical distribution capabilities. Strategic acquisitions and partnerships enable market leaders to expand their content portfolios while strengthening regional distribution networks. Competition extends beyond traditional media companies to include gaming firms and consumer products manufacturers leveraging anime intellectual properties for cross-promotional opportunities.

Recent Developments:

-

In June 2025, Crunchyroll announced its Summer 2025 anime lineup for Europe, featuring premieres including Gachiakuta, Kaiju No. 8 Season 2, DAN DA DAN Season 2, and My Dress-Up Darling Season 2. The announcement expanded content availability with returning series such as Dr. STONE and Toilet-bound Hanako-kun for anime fans across the European region.

Europe Anime Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Revenue Sources Covered | T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment |

| Countries Covered | Germany, France, the United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe anime market size was valued at USD 9.06 Billion in 2025.

The Europe anime market is expected to grow at a compound annual growth rate of 6.82% from 2026-2034 to reach USD 16.40 Billion by 2034.

Internet distribution dominated the market with a share of 32%, driven by streaming platforms offering instant access to extensive anime libraries, simulcast releases, and multi-language localization that has expanded viewership across diverse European audiences.

Key factors driving the Europe anime market include digital streaming platform proliferation, growing fan convention culture and community engagement, expanding merchandising ecosystems, increasing mainstream cultural acceptance, and strategic investments from major entertainment corporations in content licensing and distribution infrastructure.

Major challenges include content piracy and unauthorized distribution networks, high licensing costs and complex rights negotiations, cultural localization barriers, market fragmentation across diverse European language regions, and competition for consumer attention from other entertainment formats.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)