Europe Aqua Feed Market Size, Share, Trends and Forecast by Species, Ingredients, Additives, Product Form, and Region, 2025-2033

Europe Aqua Feed Market Size and Share:

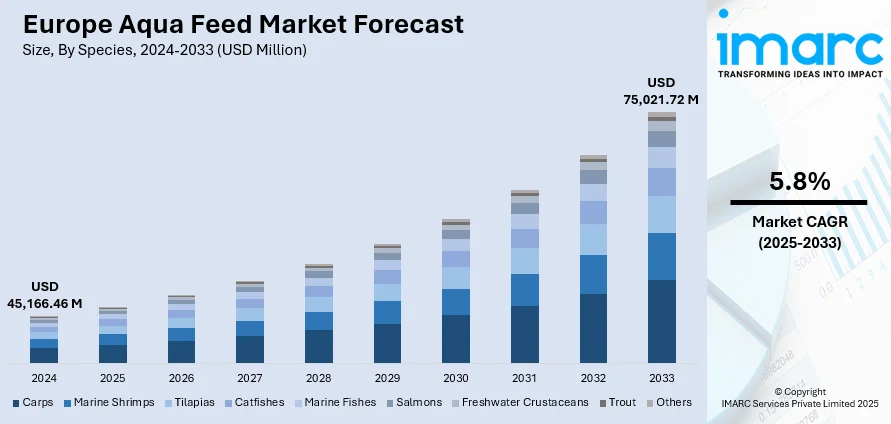

The Europe aqua feed market size was valued at USD 45,166.46 Million in 2024. The market is projected to reach USD 75,021.72 Million by 2033, exhibiting a CAGR of 5.8% from 2025-2033. United Kingdom currently dominates the market, driven by the rapid expansion of aquaculture to meet growing seafood demand, particularly for species like salmon, trout, and seabass. Increasing consumer preference for sustainable, high-quality seafood encourages the adoption of nutritionally balanced and eco-friendly feeds. Moreover, ongoing technological innovations, such as alternative protein sources (insect meal, algae) and precision feeding systems, enhance efficiency and reduce environmental impact. Additionally, stringent EU sustainability regulations push producers to develop traceable, low-pollution feed solutions, fostering continuous innovation and surge in Europe aqua feed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 45,166.46 Million |

|

Market Forecast in 2033

|

USD 75,021.72 Million |

| Market Growth Rate 2025-2033 | 5.8% |

The rising demand for seafood in Europe is a key driver of the aqua feed market, as wild fish stocks continue to decline, and aquaculture becomes vital for meeting consumer needs. Popular species such as salmon, trout, and seabass dominate production, with countries like Norway, Spain, and the UK rapidly expanding fish farming operations. This growth fuels the need for high-quality, nutritionally balanced feed that supports fish health and productivity while adhering to EU sustainability and food safety regulations. In 2024, Europe’s consumption of seafood meals and pellets reached 1.4 million tonnes, generating $2.4 billion, with the UK, Germany, and Norway accounting for 48%—highlighting strong feed demand in these key markets.

To get more information on this market, Request Sample

Technological advancements in feed formulation are significantly driving the Europe aqua feed market growth. The European Commission’s Directorate-General for Agriculture and Rural Development reported that in 2023–24, the EU produced 71 million tonnes of crude protein feed, achieving about 75% self-sufficiency, underscoring the need to reduce reliance on imported proteins. To address this, producers are increasingly adopting alternative proteins such as insect meal, algae, and plant-based ingredients, aligning with environmental goals and cost efficiency. Precision feeding technologies and functional additives like probiotics and enzymes are enhancing nutrient absorption, fish growth, and disease resistance. These innovations, alongside strict EU sustainability regulations, drive the development of traceable, low-pollution feeds, meeting consumer demand for responsibly produced, high-quality aquaculture products.

Europe Aqua Feed Market Trends:

Rising Aquaculture Production & Fish Consumption

One of the prominent Europe aqua feed market trends is the rising demand for seafood and the steady expansion of aquaculture. In 2023, EU aquaculture output reached nearly 1.1 million tonnes, accounting for about 25% of all fisheries production in the region and generating approximately €4.8 billion in value, highlighting its growing economic significance. With wild fish stocks declining and consumers increasingly shifting toward protein-rich diets, aquaculture has emerged as a sustainable solution to meet seafood demand. Countries like Norway, Spain, and the UK are investing heavily in farming species such as salmon, trout, and seabass. This expansion fuels demand for specialized aqua feed designed to enhance growth, improve immunity, and reduce mortality rates. Additionally, the EU’s supportive regulatory framework encourages innovation in sustainable, traceable feed solutions, further bolstering market growth.

Stringent Sustainability & Environmental Regulations

Europe’s strong emphasis on sustainability and environmental protection significantly influences Europe aqua feed market outlook. Regulatory bodies like the European Commission have introduced strict guidelines for aquaculture practices, ensuring reduced ecological impact and responsible sourcing of feed ingredients. These policies encourage the use of sustainable raw materials such as plant-based proteins, insect-derived meals, and certified fishmeal, reducing pressure on wild fisheries. Additionally, there is a growing demand for low-pollution feeds that decrease water contamination and improve overall farm efficiency. Certification programs like ASC (Aquaculture Stewardship Council) further push producers toward transparent and eco-conscious feed production. These sustainability initiatives not only ensure compliance but also cater to the rising consumer preference for ethically produced seafood. Consequently, the industry’s focus on eco-friendly, traceable, and high-performance feed solutions continues to propel the growth of the aqua feed market in Europe.

Technological Advancements in Feed Formulation

Technological innovation is a key driver reshaping the European aqua feed market. According to the European Commission’s Directorate‑General for Agriculture & Rural Development, the EU produced 71 million tonnes of crude protein feed in 2023–24, achieving only ~75 % self‑sufficiency, which highlights the region’s reliance on imports and the urgent need to diversify protein sources. Advanced feed formulation techniques are addressing this challenge by incorporating alternative proteins such as insect meal, algae, and plant-based ingredients to reduce dependency on fishmeal, aligning with both environmental goals and cost efficiency. Precision feeding systems and data-driven technologies further optimize feed utilization and monitor fish growth in real time, while increased research and development (R&D) investments are fostering functional feeds enriched with probiotics, enzymes, and immune-boosting additives. Collectively, these innovations enhance sustainability, traceability, and productivity, significantly driving market growth across Europe.

Europe Aqua Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe aqua feed market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on species, ingredients, additives, and product form.

Analysis by Species:

- Carps

- Marine Shrimps

- Tilapias

- Catfishes

- Marine Fishes

- Salmons

- Freshwater Crustaceans

- Trout

- Others

Carps dominate Europe’s freshwater aquaculture, particularly in Central and Eastern regions like Poland and Germany. Their omnivorous nature drives demand for cost-effective feeds with balanced proteins and vitamins. Increasing focus on sustainable, low-impact carp farming encourages the adoption of eco-friendly feed solutions, improving growth performance and farm profitability across the region.

Concurrently, though limited compared to Asia, marine shrimp farming in Southern Europe is growing, particularly in Spain and Italy. This expansion drives demand for high-protein, immune-boosting feed to enhance survival rates and productivity. Sustainable feed solutions with alternative proteins and probiotics support environmentally friendly shrimp farming, meeting rising consumer demand for premium seafood.

In addition to this, the tilapia farming, though smaller in Europe, is gaining traction due to its adaptability, fast growth, and affordability. Demand for cost-effective, nutritionally balanced feed is increasing, especially in countries promoting diversified aquaculture. Fortified formulations enhance growth, disease resistance, and feed efficiency, making tilapia a key species for expanding Europe’s affordable aquaculture segment.

Moreover, the catfish production is notable in Eastern and Central Europe, driven by its popularity as a cost-efficient species. Demand centers on high-protein, floating feeds that improve digestion and growth while minimizing waste. Sustainable, fortified feed solutions help boost productivity, supporting catfish’s role in providing affordable, locally produced seafood for European consumers.

However, the marine fish, especially in Spain, Italy, and Greece, is dominated by marine fish species like seabass, seabream, and turbot. The need for specialist feeds high in proteins, omega-3 fatty acids, and immune-boosting chemicals is fueled by this. Meeting EU environmental requirements and satisfying growing customer demand for premium marine seafood require sustainable, traceable feed options.

Similarly, the salmon farming, concentrated in the UK and Norway (non-EU but significant), heavily influences Europe’s aqua feed market. High-value, export-driven salmon aquaculture demands nutrient-dense, fortified feeds to optimize growth, enhance flesh quality, and prevent diseases. Innovation in alternative proteins and precision feeding supports sustainable, efficient production in this premium aquaculture segment.

Furthermore, the freshwater crustacean farming, though niche, is expanding in Central and Southern Europe. This segment requires specialized feeds tailored to improve growth, survival, and shell development. Rising interest in diversified aquaculture and premium crustacean products drives demand for nutritionally enriched, sustainable feed solutions designed for optimal performance in small-scale and commercial farms.

Also, the trout farming is well-established in countries like France, Italy, and Germany, fueling consistent demand for high-protein, energy-rich feeds. Fortified feeds with probiotics and immune-boosting additives enhance growth rates and resilience, ensuring compliance with strict EU sustainability and water-quality standards. This makes trout a key contributor to Europe’s aquaculture feed demand.

Besides this, the other species, including eels, sturgeon, and mollusks, collectively contribute to Europe’s aquaculture diversity. These niche markets require highly specialized feed formulations to meet species-specific nutritional needs and improve productivity. Growing consumer demand for exotic, high-value seafood fosters innovation in functional feeds, supporting sustainable farming of lesser-known species across the continent.

Analysis by Ingredients:

- Soybean

- Corn

- Fish Meal

- Fish Oil

- Additives

- Others

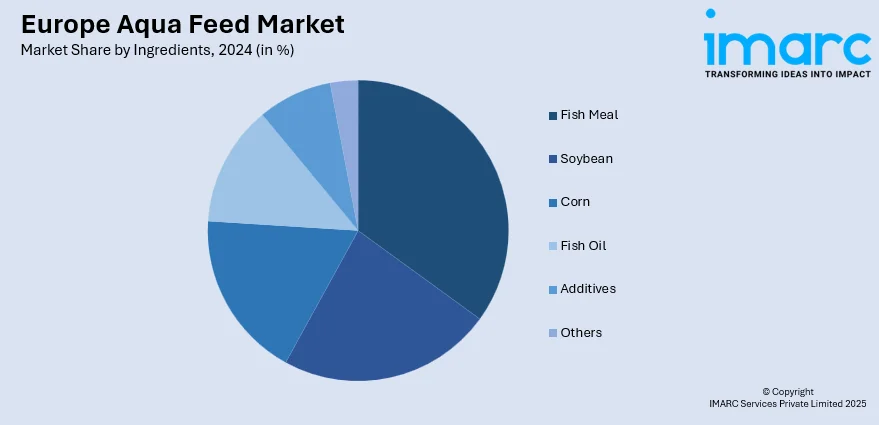

Based on the Europe aqua feed market forecast, the fish meal dominates due to its exceptional nutritional profile, making it a preferred protein source for aquaculture. Rich in essential amino acids, fatty acids, vitamins, and minerals, fish meal supports optimal growth, immunity, and overall health of farmed species like salmon, trout, and seabass. Its high digestibility enhances feed conversion ratios, improving production efficiency and reducing waste. Despite the rising use of alternative proteins, fish meal remains indispensable in premium and starter feeds where nutrient density is crucial. Additionally, Europe’s focus on sustainable and responsibly sourced fish meal ensures compliance with strict regulatory standards, further reinforcing its role as a key component driving aqua feed market growth across the region.

Analysis by Additives:

- Vitamins and Minerals

- Antioxidants

- Feed Enzymes

- Others

Vitamins and minerals share 30.1% of Europe aqua feed market size because of their vital contribution towards fish health, growth, and productivity. These additives enhance critical physiological functions such as bone formation, immune function, reproduction, and metabolism, making them a necessity in aquaculture diets. Incorporation of well-balanced vitamins and minerals contributes to lowering disease susceptibility, which increases survival rates and improves feed efficiency. Thanks to Europe's stringent rules regarding the welfare of animals and food quality, fortified feed keeps them in line with the requirement while satisfying customers for safe, quality seafood. Moreover, the trend towards functional feed that enhances resistance and performance in intensive farming systems further propels the extensive use of vitamins and minerals in aqua feed formulations throughout the region.

Analysis by Product Form:

- Pellets

- Extruded

- Powdered

- Liquid

Pellets represent 43.2% of the largest market share in Europe aqua feed because they are more efficient, easy to handle, and convenient for most aquaculture species. Pellet feed provides improved water stability, with fewer nutrients lost and less environmental impact, which complies with Europe's rigorous sustainability laws. The same size and shape make them better for intake, digestion, and growth rates of fish, leading to improved production efficiency. Moreover, pellets are inexpensive to manufacture, and stock than other types of feed, so they are the preferred option for aqua farmers. The increasing emphasis on precision feeding and demand for nutritionally superior, eco-friendly feed also fuel the regional market for aqua feed dominated by pellets.

Breakup by Country:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

United Kingdom is the leading region in European aqua feed market, fueled by its strong aquaculture industry and increasing consumer demand for sustainable seafood. The nation's emphasis on cultivating value-added species like salmon and trout strongly drives demand for nutritionally evolved feed formulations that increase growth rates, boost immunity, and decrease mortality rates. Furthermore, the UK's robust regulatory environment supports sustainable and traceable aquaculture production, pushing for alternatives such as insect meal, algal meal, and plant-based ingredients to diminish fishmeal dependency. Heavy investments in research and development, as well as the implementation of precision feeding technologies, further consolidate the UK's position as an industry leader driving innovation and growth in the European aqua feed market.

Competitive Landscape:

The Europe aqua feed market's competitive scene is defined by high innovation, regulatory adherence, and sustainability-focused strategies. Manufacturers concentrate on creating nutritionally superior and eco-friendly feeds in accordance with EU regulations to improve fish health and farm efficiency. Competition revolves around embracing alternative protein sources, optimizing feed conversion ratios, and incorporating precision feeding technologies for improving efficiency. Firms are also focusing on traceability and eco-certifications to match consumer calls for responsibly produced seafood. Exorbitant R&D activities, industry collaborations through the aquaculture value chain, and investments in sustainable raw materials fuel differentiation. Overall, the market is vibrant with rivalry on innovation, cost efficiency, and sustainable production patterns.

The report provides a comprehensive analysis of the competitive landscape in the Europe aqua feed market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Alltech became the majority owner of Alltech Fennoaqua, Finland’s only fish feed production facility. The acquisition strengthened its position in aqua feed solutions for cold-water species and recirculating aquaculture systems.

- June 2025: BioMar Norway achieved ASC Feed Certification, reinforcing its commitment to responsible aqua feed production. The company had previously secured the certification in Ecuador, Chile, the United Kingdom, and Costa Rica.

- May 2025: Volare secured approximately USD 28 Million to build its Volare 01 insect factory in Finland, which was designed for maximum resource efficiency. The plant was set to produce 5,000 tons of protein annually and aimed to support sustainable aqua feed solutions through insect-based ingredients.

- May 2025: BioMar partnered with local manufacturer Fóðurblandan to launch the first aqua feed produced in Iceland. The move made BioMar the only global manufacturer with aqua feed production in the country, strengthening its regional footprint.

- March 2025: Skretting Spain became the first ASC-certified aqua feed mill in the EU, marking a significant milestone in sustainable feed production. The company gained global traction with ASC certifications, reinforcing its leadership in responsible aqua feed manufacturing.

Europe Aqua Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | Carps, Marine Shrimps, Tilapias, Catfishes, Marine Fishes, Salmons, Freshwater Crustaceans, Trout, Others |

| Ingredients Covered | Soybean, Corn, Fish Meal, Fish Oil, Additives, Others |

| Additives Covered | Vitamins and Minerals, Antioxidants, Feed Enzymes, Others |

| Product Forms Covered | Pellets, Extruded, Powdered, Liquid |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe aqua feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe aqua feed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe aqua feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Aqua Feed market in the Europe was valued at USD 45,166.46 Million in 2024.

The Europe aqua feed market is projected to exhibit a CAGR of 5.8% during 2025-2033, reaching a value of USD 75,021.72 Million by 2033.

The Europe aqua feed market is driven by rising seafood demand, declining wild fish stocks, and the rapid expansion of aquaculture, particularly for high-value species like salmon and trout. Additionally, sustainability-focused regulations, innovations in feed formulations using alternative proteins, and increasing consumer preference for traceable, eco-friendly seafood significantly boost market growth.

Fish meal dominates the Europe aqua feed market growth due to its high protein content, excellent digestibility, and rich profile of essential amino acids and omega-3 fatty acids. These qualities make it vital for promoting rapid growth, improved immunity, and superior flesh quality in farmed species like salmon, trout, and seabass.

Vitamins and minerals hold the largest market with a share of 30.1% of the Europe aqua feed market share due to their crucial role in enhancing fish health, immunity, and growth performance. These additives help prevent nutritional deficiencies, improve feed efficiency, and support overall aquaculture productivity, making them essential components in modern, nutritionally balanced aqua feed formulations.

Pellets account for the largest share of 43.2% in the Europe aqua feed market due to their superior water stability, ease of storage, and efficient nutrient delivery. They reduce feed wastage, enhance digestion, and support consistent fish growth, making them the preferred choice for large-scale aquaculture operations across the region.

The United Kingdom currently dominates market growth owing to its advanced aquaculture industry, particularly in salmon and trout farming, which drives high demand for specialized aqua feed. Strong sustainability regulations, adoption of alternative proteins, and investments in precision feeding technologies further enhance feed efficiency and support the country’s leading position in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)