Europe Articulated Robot Market Size, Share, Trends and Forecast by Payload, Function, Type, Component, End-Use Industry, and Country, 2025-2033

Europe Articulated Robot Market Size and Share:

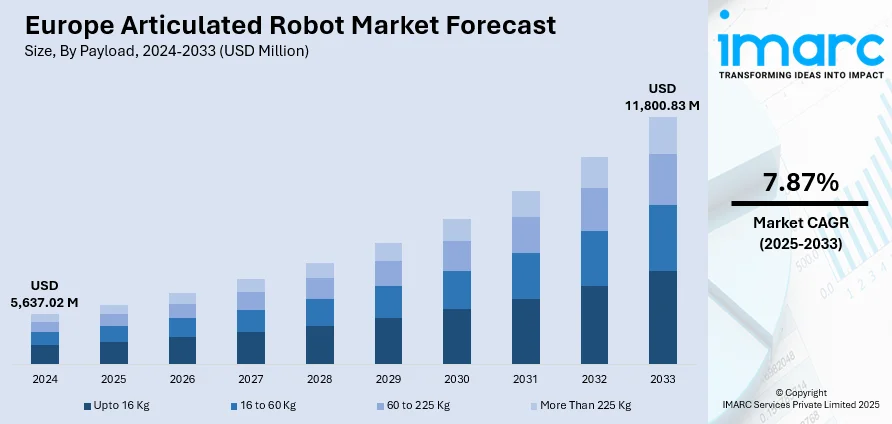

The Europe articulated robot market size was valued at USD 5,637.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 11,800.83 Million by 2033, exhibiting a CAGR of 7.87% during 2025-2033. Germany dominated the market in 2024. Strong automotive and manufacturing industries, driving automation and Industry 4.0 adoption, contribute to the Europe articulated robot market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,637.02 Million |

| Market Forecast in 2033 | USD 11,800.83 Million |

| Market Growth Rate 2025-2033 | 7.87% |

The market is primarily driven by several interconnected factors. Industry 4.0 initiatives across Europe are paramount, emphasizing smart factories, interconnected systems, and data-driven manufacturing. This necessitates advanced automation, where articulated robots play a crucial role in enhancing efficiency, flexibility, and quality control. Furthermore, persistent labor shortages and rising labor costs in many European countries compel industries to invest in automation. Robots offer a reliable solution for repetitive, hazardous, or physically demanding tasks, allowing human workers to focus on higher-value activities. Increased investment and funding from entities like the EU, exemplified by initiatives like InvestAI, are also propelling adoption, particularly in sectors like automotive manufacturing, by supporting the development of AI gigafactories and advanced robotic solutions. Finally, the growing demand for high-quality, precision manufacturing in key sectors such as automotive, electronics, and aerospace, where articulated robots excel in accuracy and repeatability, significantly contributes to market expansion.

To get more information on this market, Request Sample

A major electronics firm is significantly enhancing its robotics capabilities through strategic investment. This move aims to bolster its commercial, industrial, and home robot offerings, with a strong focus on developing advanced, AI-powered, and autonomous articulated robots. This signals a future where intelligent, versatile robotics will play a larger role in diverse applications, including manufacturing automation, assembly, and inspection, impacting the European market. For instance, in January 2025, LG Electronics acquired a 51% stake in Bear Robotics to strengthen its robotics capabilities. This acquisition supports LG's commercial, industrial, and home robot businesses, including the development of its AI-powered "Autonomous Vertical Articulated Robot" for automation, assembly, and inspection tasks.

Europe Articulated Robot Market Trends:

Rapid Cognitive Automation in European Manufacturing

European industrial sectors are witnessing a profound transformation driven by cognitive technologies, shaping the Europe articulated robot market outlook. A significant portion of manufacturers, particularly in the UK, have already integrated machine learning and artificial intelligence into their operations, enhancing efficiency and decision-making. This widespread embrace of advanced analytics underscores a strategic pivot toward intelligent production systems. Furthermore, the almost universal intent to implement generative AI solutions indicates a future where automation extends beyond repetitive tasks to encompass creative and adaptive processes. This accelerating adoption of sophisticated AI applications is fundamentally reshaping the manufacturing landscape across Europe, fostering innovation and boosting operational capabilities within factories, thereby influencing the demand for more advanced articulated robotics. For example, an industry study revealed that 53% of UK manufacturers have already adopted machine learning or AI in their operations, and a remarkable 98% are either utilizing or planning to integrate generative AI.

Robust Automation Adoption across Europe

European manufacturing is experiencing a significant acceleration in automation, as evidenced by a consistent rise in the deployment of industrial robots. This substantial increase highlights a strong commitment among European industries to enhance productivity, precision, and competitiveness. The integration of advanced robotic systems is becoming a strategic imperative, allowing businesses to optimize production lines and address challenges such as labor shortages and rising operational costs. This expansion in robot installations is particularly impactful for the articulated robot segment, given their versatility in tasks like handling, welding, and assembly. As per the Europe articulated robot market forecast, the continued upward trajectory indicates a deepening reliance on sophisticated robotic solutions to drive efficiency and maintain a leading position in the global industrial landscape. For instance, the latest World Robotics report showed that industrial robot installations in Europe increased by 9%.

Automotive Sector's Intelligent Manufacturing Evolution

The European automotive industry is undergoing a profound transformation toward highly intelligent manufacturing processes. A significant governmental initiative is propelling the establishment of advanced AI-powered production facilities across the continent. This strategic push is aimed at fundamentally augmenting existing automation and digitalization efforts, driving substantial improvements in production efficiency within smart factories. This represents a concerted effort to leverage artificial intelligence to optimize every facet of vehicle manufacturing, from design to final assembly. This pervasive adoption of cognitive automation is set to redefine the operational landscape, increase competitiveness, and solidify Europe's position at the forefront of advanced industrial production, creating a fertile ground for the deployment of sophisticated articulated robots capable of complex, AI-driven tasks. Europe articulated robot market trends underscore this shift, highlighting the increasing demand and technological advancements within the region's robotics sector. For example, the EU's InvestAI fund, with EUR 200 Billion in investment, aimed to revolutionize automotive manufacturing by establishing AI gigafactories, augmenting automation, digitalization, and production efficiency in smart factories across Europe.

Europe Articulated Robot Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe articulated robot market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on payload, function, type, component, and end-use industry.

Analysis by Payload:

- Upto 16 Kg

- 16 to 60 Kg

- 60 to 225 Kg

- More Than 225 Kg

Upto 16 kg stood as the largest payload in 2024, holding around 38.9% of the market. The pervasive push toward Industry 4.0 and advanced automation across European manufacturing necessitates robots that can seamlessly integrate into smart factories, enhancing efficiency and productivity. Furthermore, persistent labor shortages and rising labor costs incentivize businesses to automate repetitive or hazardous tasks, making these lighter, often collaborative robots, an attractive solution. Additionally, the demand for high precision, speed, and consistent quality in industries like electronics, pharmaceuticals, and consumer goods is perfectly met by the agility of these robots. Finally, the increasing adoption of collaborative robots (cobots) within this payload range significantly contributes to strengthening the Europe articulated robot market growth, as they offer flexibility, ease of integration, and safe human-robot interaction, enabling even SMEs to leverage automation for enhanced competitiveness.

Analysis by Function:

- Handling

- Welding

- Dispensing

- Assembling

- Others

Handling led the market with around 47.5% of market share in 2024 due to its pervasive need across diverse industries. This segment encompasses critical applications like palletizing and depalletizing, pick and place operations, and machine tending, where robots efficiently move and position materials, components, and finished goods. The core impetus stems from European businesses' relentless pursuit of enhanced efficiency and productivity, as robots perform these repetitive tasks with unmatched speed and precision, reducing cycle times and optimizing throughput. Furthermore, persistent labor shortages and rising labor costs in manufacturing and logistics compel companies to automate, freeing human workers for more complex roles and ensuring operational continuity. Finally, the inherent accuracy and repeatability of robots in handling tasks significantly minimize errors, waste, and improve overall product quality, making automation an indispensable investment.

Analysis by Type:

- 4-Axis or Less

- 5-Axis

- 6-Axis or More

6‑axis or more led the market with around 52.3% of market share in 2024 due to their superior dexterity and broader range of motion. These advanced robots can mimic human arm movements with exceptional precision, a crucial capability for automating complex and intricate tasks that demand high flexibility and reach. Furthermore, owing to their ability to finely manipulate, reach into confined spaces, and navigate around obstacles, these robots excel in applications like complex assembly, intricate welding, precision machining, and detailed inspection. The increasing adoption of Industry 4.0 principles in Europe, which emphasizes highly flexible and reconfigurable production lines, further fuels demand for these versatile robots. Their capacity to adapt quickly to changing production requirements and perform multiple diverse tasks with high accuracy positions them as indispensable tools for achieving advanced automation and maintaining competitiveness in various European industries.

Analysis by Component:

- Controller

- Arm

- End Effector

- Drive

- Sensor

- Others

The controller led the market in 2024 since manufacturers across industries, especially automotive, electronics, and metalworking, are prioritizing precision, repeatability, and better coordination in multi-axis tasks. Controllers manage robot motion and interaction with other systems, and European companies are investing in more advanced, compact, and AI-integrated control systems to boost productivity and flexibility. As manufacturing gets more digitized, these intelligent controllers help optimize robot behavior in real time, improving process stability and reducing downtime. With Europe’s strong focus on high-tech manufacturing, controller upgrades are no longer optional; they’re part of staying competitive. Regulatory pushes for safer and smarter automation have also pushed demand for controllers that can handle collaborative robotics and safety integration. All of this makes the controller segment a core growth driver in this market.

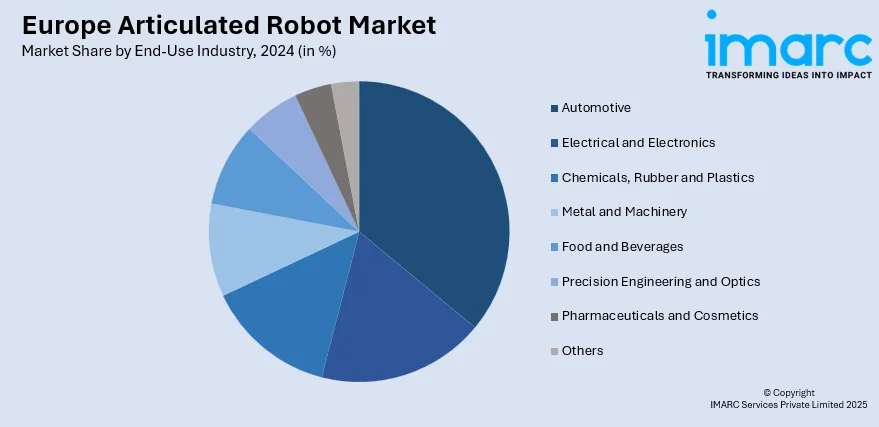

Analysis by End-Use Industry:

- Automotive

- Electrical and Electronics

- Chemicals, Rubber and Plastics

- Metal and Machinery

- Food and Beverages

- Precision Engineering and Optics

- Pharmaceuticals and Cosmetics

- Others

Automotive led the market with around 42.2% of market share in 2024 due to its constant pursuit of efficiency, precision, and cost reduction. Car manufacturers extensively utilize articulated robots for various complex tasks like welding, painting, material handling, and assembly. This high level of automation is driven by factors such as the increasing demand for vehicles, the shift toward electric vehicle (EV) production (which requires new, precise assembly processes), and the need to maintain competitiveness against global markets. The automotive industry's consistent investment in advanced manufacturing technologies, including highly versatile articulated robots, makes it the strongest customer for robotics in Europe, leading to continued market growth.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. Its robust automotive and advanced manufacturing sectors are highly reliant on automation for precision, efficiency, and quality control. German carmakers, for instance, extensively utilize articulated robots for tasks like welding, painting, and assembly. Furthermore, Germany is a pioneer in Industry 4.0, a government-backed initiative promoting the digitalization and interconnectivity of manufacturing. This strategic focus fosters significant investment in robotics, AI, and smart factory technologies. The country also boasts a strong engineering tradition and a dense network of research institutions and universities that fuel continuous innovation and provide a skilled workforce. Coupled with a relatively stable labor cost environment and government incentives, these elements create a highly favorable ecosystem for articulated robot development and adoption.

Competitive Landscape:

The Europe articulated robot market is experiencing significant growth, driven by increasing automation demands, labor shortages, and rising labor costs. Recent developments include continuous product innovation, particularly integrating AI and ML for enhanced capabilities and adaptability. Partnerships and collaborations between robotics companies, research institutions, and industry players are common, often spurred by government initiatives like Horizon Europe, which funds robotics R&D. Raised funding for startups and established firms is also prevalent, indicating strong investor confidence. A common practice at present is the strategic collaboration between technology providers and end users, alongside robust government funding and R&D support to push the boundaries of AI-driven robotics and smart factory solutions.

The report provides a comprehensive analysis of the competitive landscape in the Europe articulated robot market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Circus SE and REWE Region West announced an exclusive pilot partnership to integrate the CA-1 articulated robot for autonomous meal preparation in REWE supermarkets. The pilot, starting in Fall 2025, will include three CA-1 robots and Circus Software, aiming to enhance food production and customer experience.

- November 2024: Inovance launched its articulated and SCARA industrial robots at the SPS Nuremberg show in Europe. The company also introduced the eco-friendly MV33 AC motor and MD630 AC drive, designed to meet European environmental standards, alongside its new IntelliPulse design philosophy for enhanced product identification.

- November 2024: Serve Robotics announced its acquisition of Vebu, the maker of the Autocado avocado-processing robot. This acquisition expands Serve's automation offerings, addressing labor shortages in the restaurant industry. The integration enhances Serve’s European footprint and back-of-house robotic capabilities, complementing their delivery robot solutions.

- October 2024: Automated Industrial Robotics Inc. acquired Robotics & Drives (RDS), a leading Irish robotics solutions provider. The acquisition expands AIR’s capabilities in Europe, enhancing its automation offerings with advanced articulated robots and robotic software, strengthening its presence in the commercial and industrial markets.

- July 2024: Bobcat announced plans to merge with Doosan Robotics, forming a new entity focused on autonomous and AI-driven machines. The merger aims to leverage Bobcat’s dealer network and financial resources to accelerate innovation in autonomous vehicles, including articulated robots, enhancing product testing and development.

Europe Articulated Robot Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payloads Covered | Upto 16 Kg, 16 to 60 Kg, 60 to 225 Kg, More Than 225 Kg |

| Functions Covered | Handling, Welding, Dispensing, Assembling, Others |

| Types Covered | 4-Axis or Less, 5-Axis, 6-Axis or More |

| Components Covered | Controller, Arm, End Effector, Drive, Sensor, Others |

| End-Use Industries Covered | Automotive, Electrical and Electronics, Chemicals, Rubber and Plastics, Metal and Machinery, Food and Beverages, Precision Engineering and Optics, Pharmaceuticals and Cosmetics, Others |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe articulated robot market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe articulated robot market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe articulated robot industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The articulated robot market in the Europe was valued at USD 5,637.02 Million in 2024.

The Europe articulated robot market is projected to exhibit a CAGR of 7.87% during 2025-2033, reaching a value of USD 11,800.83 Million by 2033.

The Europe articulated robot market is primarily driven by the escalating demand for industrial automation and efficiency across various sectors, especially automotive and electronics. Additionally, labor shortages, advancements in AI and machine learning, and the rising focus on Industry 4.0 initiatives are key contributing factors.

Germany accounted for the largest share of the market in 2024 due to its robust automotive and manufacturing industries, high automation demand, strong R&D, and supportive government initiatives like Industry 4.0, fostering innovation and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)