Europe Automotive Connectors Market Size, Share, Trends and Forecast by Connection Type, Connector Type, System Type, Vehicle Type, Application, and Country, 2025-2033

Europe Automotive Connectors Market Size and Share:

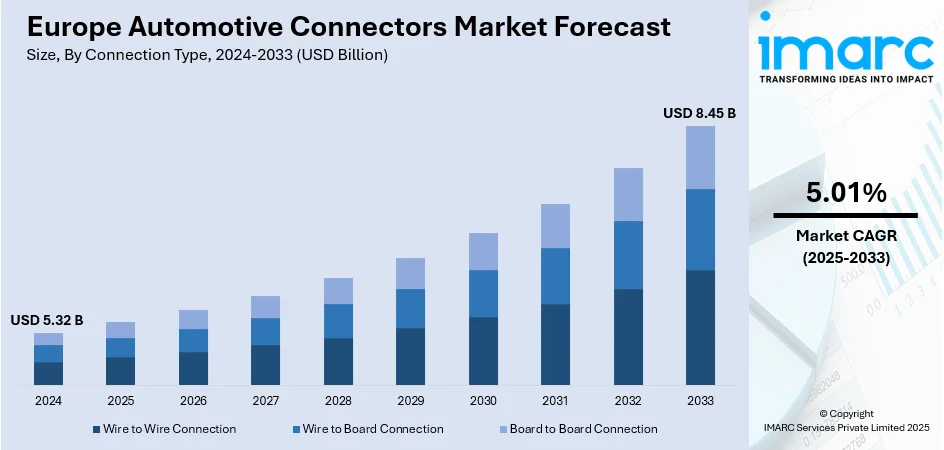

The Europe automotive connectors market size was valued at USD 5.32 Billion in 2024. The market is projected to reach USD 8.45 Billion by 2033, exhibiting a CAGR of 5.01% from 2025-2033. The market is propelled by the greater inclusion of high-end electronics in vehicles, such as infotainment, safety, and engine control systems. Amplified adoption of hybrid and electric cars, combined with aggressive emission standards, drives demand for high-performance, reliable connectors. Ongoing innovations in compact, rugged, and high-speed connectors further boost efficiency, safety, and function in passenger, commercial, and electric vehicles, driving overall growth and expansion of the Europe automotive connectors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.32 Billion |

|

Market Forecast in 2033

|

USD 8.45 Billion |

| Market Growth Rate 2025-2033 | 5.01% |

Modern vehicles increasingly rely on electronic control units, sensors, and communication networks to control engine performance, safety systems, and infotainment applications. High-speed data transmission and signal integrity have become critical, necessitating connectors with specific capabilities to achieve higher bandwidth while sustaining reliability in the presence of vibration, temperature stress, and adverse environmental conditions. As per the sources, in February 2025, Hirose Electric launched the AU1 Series USB 3.2 wire-to-board connectors for automotive applications, offering high-speed data transmission, reinforced durability, USCAR compliance, and enhanced reliability for in-vehicle infotainment systems. Moreover, growing use of connected vehicle technologies, such as telematics, vehicle-to-everything (V2X) communication, and intelligent navigation systems, adds pace to the demand for resilient electrical connections. Automobile connectors facilitate smooth interaction between several electronic modules, making possible improved operational efficiency, safety, and user experience. As OEMs keep pushing the boundaries of vehicle electronics, demand for high-performance, durable, and versatile connectors is likely to propel Europe automotive connectors market growth throughout the region.

To get more information on this market, Request Sample

The move to lightweight vehicle architecture and modular platforms is one of the most important drivers for the Europe automotive connectors industry. Automotive companies are getting more inclined towards modular architecture in order to simplify production, minimize vehicle weight, and enhance energy efficiency, especially in electric and hybrid vehicles. Such architectures need connectors that are lightweight, multi-usage, and have the ability to function at high electrical performance levels in limited spaces. Besides, the increasing demand for fuel efficiency and emissions reduction has spurred the uptake of energy-efficient parts, such as low-resistance, high-current connectors for battery packs and power electronics. According to the reports, in June 2025, BASF launched Ultramid® Advanced N3U42G6, a polyamide 9T for high-voltage automotive connectors, enhancing safety, durability, and color stability in electric vehicles’ inverters, batteries, and DC-DC converters. Furthermore, the modular assembly trend also makes vehicle repair easier and enables quicker electronic subsystem upgrades, further enhancing demand for standardized and high-quality connectors. This emphasis on efficiency, sustainability, and modularity further drives the region's automotive industry growth.

Europe Automotive Connectors Market Trends:

Electrification of Vehicles Propelling Connector Demand

The European automotive connectors market is being driven by vigorous growth because of the extensive adoption of electric and hybrid vehicles throughout the region. Governments are introducing tough environmental regulations to control carbon emissions, and programs such as the European Council's Fit for 55 package strive to cut greenhouse gas emissions by at least 55% by 2030. Such policies are pushing automobile makers to increase their electric vehicle offerings, which, in turn, is generating greater demand for intricate electrical architectures. Plug-in hybrid and full electric vehicles need advanced connector systems to effectively deal with power distribution, battery management, and safety monitoring. With growing consumer demand for more sustainable mobility solutions, the demand for high-performance, reliable connectors in electric drivetrain, charging systems, and auxiliary systems has gained momentum. This Europe Automotive Connectors Market trends identify the growing prospects for connector suppliers to develop innovative products to serve next-generation vehicles in Europe.

Growing Need for Advanced Infotainment and Safety Systems

Another important driver of the Europe automotive connectors market is the integration of advanced infotainment, audio, and driver assistance systems. Contemporary cars increasingly incorporate advanced infotainment interfaces, navigation devices, connectivity modules, and high-definition display systems, which all need specialized connectors to provide smooth signal transmission and power control. Concurrently, the need for advanced safety options like collision alert, lane departure warning, adaptive cruise control, and parking sensors is driving the demand for high-reliability connectors that can function reliably in hostile automotive conditions. These applications require connectors to provide high data transfer rates, robustness against vibration, and endurance over the long term. As consumers focus more on comfort, convenience, and safety, the Europe automotive connectors market for infotainment and advanced driver assistance systems is likely to grow at a tremendous rate. The companies are investing in innovative technology to cater to these increased demands, boosting overall market growth in Europe.

Technological Advancements and Modular Architectures

Advancements in vehicle electronics and modular electrical architectures are playing a major role in shaping the Europe automotive connectors market. Automakers are highly using modular platforms to achieve vehicle lightweighting, enhance assembly efficiency, and ease maintenance. Modular platforms depend on standardized high-performance connectors to integrate several systems, such as power distribution units, sensors, control modules, and communications networks. As the complexity of contemporary vehicles, including electric and hybrid vehicles, continues to increase, connectors with enhanced current-carrying capacity, corrosion resistance, and flexibility in compact sizes are necessary. In addition, advancements like high-speed data connectors, water- and heat-resistant solutions, and automated assembly-ready components are transforming market dynamics. By increasing reliability and facilitating integration with new technologies, these new developments are allowing manufacturers to meet tough environmental specifications and changing consumer expectations, driving the use of advanced automotive connectors even further in Europe.

Europe Automotive Connectors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe automotive connectors market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on connection type, connector type, system type, vehicle type, and application.

Analysis by Connection Type:

- Wire to Wire Connection

- Wire to Board Connection

- Board to Board Connection

The Wire-to-Board is a top product category in the Europe automotive connectors market because of its fundamental function in connecting discrete wiring harnesses to printed circuit boards (PCBs) in vehicles. The connectors provide robust and stable electrical contacts, allowing seamless communication between different electronic modules like infotainment systems, engine control units, and safety modules. Wire-to-board connectors are especially appreciated for their robustness, compact size, and resistance to the severe automotive environments of temperature cycling, vibration, and exposure to moisture or chemicals. Their flexibility also enables integration into advanced vehicle architectures, such as hybrid and electric vehicles, that need optimized power and signal handling across multiple systems. Furthermore, the segment is supported by continuous technological advancements like high-current capability, miniaturization, and enhanced contact reliability that are key enablers of improved overall vehicle performance. Growth in the use of advanced electronics in vehicles is expected to continue driving robust demand for wire-to-board connectors in Europe.

Analysis by Connector Type:

- PCB Connectors

- IC Connectors

- RF Connectors

- Fiber Optic Connectors

- Others

PCB connectors offer stable interfaces for printed circuit boards, allowing efficient data and power transfer. They are essential in engine control, safety systems, and infotainment modules, facilitating integration of advanced electronics in contemporary vehicles. Developed to withstand vibrations, thermal variations, and contaminants, PCB connectors ensure reliable performance and endurance in automotive applications.

IC connectors combine semiconductor modules into electronic systems, facilitating smooth data and power flow. IC connectors are applied to engine management, safety systems, infotainment, and advanced vehicle electronics. IC connectors enable compact, multi-function designs through high-density applications, thermal stability, and robust performance, allowing seamless integration and increased functionality within automotive electronic architectures.

RF connectors carry high-frequency signals for communication, infotainment, and telematics functions in the vehicle. They preserve signal quality, withstand vibration and temperature variation, and offer connectivity between different modules. RF connectors play a critical role for navigation, wireless communication, and complex electronics, delivering robust data transmission and facilitating advanced, connected automotive systems in Europe.

Fiber optic connectors provide high-speed, interference-free data transfer between vehicle electronic modules. Critical to advanced infotainment, driver assistance, and communication systems, fiber optic connectors are lightweight, dependable, and vibration- and temperature-resistant. They accommodate high-bandwidth applications, providing precise, efficient signal transfer, and improving the performance of contemporary European cars.

Other connectors provide specialized automotive requirements, such as high-current applications, hostile environments, and special electronic architectures. They cater to various systems like battery management, telematics, and auxiliary electronics. Engineered for reliability, robustness, and efficiency, the connectors provide seamless integration and performance in current cars, addressing changing technological and environmental demands.

Analysis by System Type:

- Sealed Connector System

- Unsealed Connector System

Sealed connector systems safeguard against moisture, dust, and contaminants, guaranteeing long-lasting reliability. They are applied in engine compartments, safety modules, and exterior electronics and hold electrical integrity in rugged conditions. Through guaranteed secure and durable connections, sealed systems promote vehicle safety, performance, and regulatory compliance, making them mandatory in current automobile applications.

Unsealed connector systems offer conventional electrical connections in controlled conditions where moisture or contamination exposure is restricted. They offer economical solutions for electronics inside, infotainment, and lighting modules. Though without any extra protection features, unsealed connectors ensure stable power and signal transfer, accomodating flexible integration and efficient assembly in contemporary automobiles.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

Passenger cars propel demand for miniaturized, multifunctional connectors that serve to support electronics, infotainment, and safety systems. Connectors need to be able to withstand normal operating stresses while allowing integration of advanced technologies. Lightweight, robust, and reliable connectors in passenger cars guarantee efficient performance, comfort increase, and smooth operation of intensely complex automotive electronic systems in Europe.

Commercial vehicles, such as light commercial vehicles, need heavy-duty, high-load connectors. Heavy commercial vehicles need connectors withstanding extreme currents, vibration, and environmental stresses for supporting safety, reliability, and operational efficiency. Connectors in these vehicles provide stable power distribution, communication, and electronic system performance in stressful transportation conditions.

Electric vehicles need high-current, long-life connectors for battery systems, power electronics, and drivetrains. Such connectors are developed for thermal stability, vibration tolerance, and secure energy transfer. Facilitating charging systems, motor controllers, and electronic modules, EV connectors allow safe, efficient, and high-performance operation, which is a symbol of the continued expansion of electrified mobility in Europe.

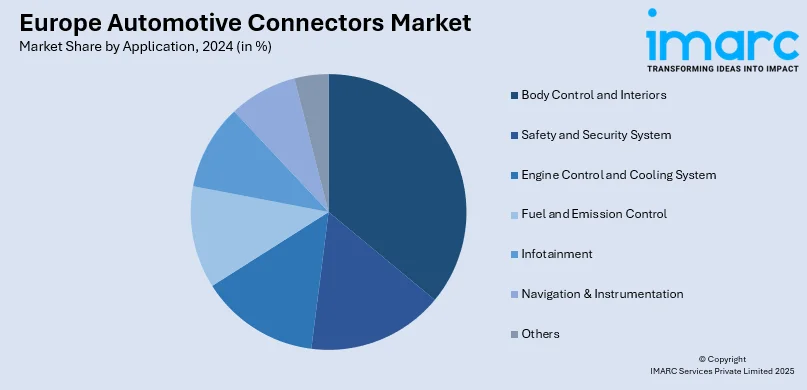

Analysis by Application:

- Body Control and Interiors

- Safety and Security System

- Engine Control and Cooling System

- Fuel and Emission Control

- Infotainment

- Navigation & Instrumentation

- Others

Body control and interior systems depend on lighting, HVAC, seat, and in-cabin electronics connectors. Good connections provide smooth functionality, integration, and user experience. Connectors facilitate the new vehicle architectures for contemporary vehicles by withstanding environmental and operating stresses. They play a critical role in the proper functioning of the complex interior electronics in passenger and commercial vehicles.

Safety and security systems need airbag, seatbelt pre-tensioner, ADAS, and collision-avoidance module connectors. These connectors guarantee dependable performance during emergencies, ensuring data integrity, reliability, and longevity. Quality connectors are essential for vehicle safety, regulatory compliance, and emerging protective technologies, enabling the deployment of innovative safety systems in European vehicles.

Engine control and cooling systems are reliant on sensor, actuator, and control module connectors. Reliable electrical performance under heat, vibration, and fluid exposure is provided by connectors. Enabling accurate monitoring and engine management and cooling system operation, these connectors are essential to efficiency, performance, and regulatory compliance in new vehicles.

Fuel and emission control systems need connectors for monitoring and managing fuel injectors, pumps, and emission sensors. Accurate data transmission, operation stability, and ruggedness in harsh environments are guaranteed by reliable connectors, providing emissions compliance, fuel economy, and regulatory requirements. Connectors are responsible for delivering efficient, environmentally friendly powertrain systems.

Infotainment systems employ connectors for displays, audio units, multimedia interfaces, and connectivity modules. Reliable and high-speed connectors facilitate smooth integration of navigation, entertainment, and connectivity capabilities. The connectors provide data transmission and power supply consistently, facilitating improved user experiences and incorporation of smart technologies into vehicles in Europe.

Navigation and instrument systems rely on GPS module connectors, instrument cluster connectors, and digital dashboard connectors. They offer high-reliability data and power interfaces for real-time monitoring, precise navigation, and driver information. Highly reliable connectors facilitate performance, safety, and integration of advanced electronic modules in contemporary automotive systems.

Some other uses are for telematics, communication modules, lighting, and auxiliary electronics. Connectors provide reliable performance, integration flexibility, and durability in different systems. They facilitate the easy integration of developing technologies to increase vehicle functionality, connectivity, and advanced electronic system uptake in the latest European vehicles.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is a market leader with advanced auto manufacturing, R&D strength, and upgrading towards new electronic systems, creating high demand for connectors. Its emphasis on innovation, quality production, and technology integration sees extensive rollout of advanced connectors in passenger, commercial, and electric vehicles across the nation.

France sustains the automotive connector market by virtue of robust vehicle production, incorporation of high-tech electronics, and implementation of advanced safety and infotainment systems. French vehicle connectors ensure the transmission of power and signals to various electronic modules, enabling technology development and expanded use of advanced automotive electronics.

The United Kingdom also contributes by way of automotive manufacturing, incorporation of connected and electrified vehicle technologies, and implementation of high-level electronics. High-performance connectors play a role in engine, safety, and infotainment systems to support efficiency, reliability, and seamless integration, enhancing European automotive connectors market share within the region.

Italy propels connector demand through expert automotive design, innovation, and integration of electronics in passenger cars and commercial vehicles. Quality connectors facilitate infotainment, safety, and control systems, allowing for advanced functionality, efficiency, and reliability in Italian-made vehicles throughout Europe.

Spain adds with rising automotive manufacturing, EV uptake, and incorporation of innovative electronic systems. Connectors provide robust communication and power delivery throughout passenger, commercial, and electric vehicles, enabling performance, durability, and uptake of advanced automotive technologies.

Other European nations collectively endorse market expansion through automobile production, car electrification, and incorporation of advanced electronics. High-performance connectors are increasingly used across various vehicle models, enabling technological progress and enhancing reliability, safety, and efficiency within the European automotive industry.

Competitive Landscape:

The competition in the Europe automotive connectors market is marked by relentless innovation, technological differentiation, and strategic partnerships. Industry leaders are concentrating on creating high-performance connectors that respond to the growing complexity of contemporary vehicles, such as hybrids and electrics. Lightweight designs, modular construction, and energy-efficient components are the focus, allowing producers to respond to changing industry standards and environmental legislation. The inclusion of connectors within advanced electronic systems, including infotainment, driver assistance, and communication networks, heightens competition even further, as businesses compete to provide reliable, long-lasting, and compact solutions. R&D activity is continually directed toward enhancing connector materials, thermal and vibration resilience, and high-speed data transmission. Collaborations and partnerships throughout the automotive supply chain are promoting innovation and expediting time-to-market for emerging solutions. These are likely to play the strongest role in shaping the Europe automotive connectors market forecast, depicting continued growth and technological development throughout the region.

The report provides a comprehensive analysis of the competitive landscape in the Europe automotive connectors market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Zuken launched CR-8000 2025 in Munich, introducing AI-driven schematic automation and intelligent layout acceleration. The updates enhanced early connector auto-generation and standardized circuit blocks like ESD protection and filters, enabling engineers to streamline high-density electronics design. These advances supported faster, more reliable development of connector-intensive systems in automotive applications.

Europe Automotive Connectors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connector Types Covered | PCB Connectors, IC Connectors, RF Connectors, Fiber Optic Connectors, Others |

| System Types Covered | Sealed Connector System, Unsealed Connector System |

| Vehicle Types Covered |

|

| Applications Covered | Body Control and Interiors, Safety and Security System, Engine Control and Cooling System, Fuel and Emission Control, Infotainment, Navigation & Instrumentation, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe automotive connectors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe automotive connectors market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive connectors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe automotive connectors market was valued at USD 5.32 Billion in 2024.

The Europe automotive connectors market is projected to exhibit a CAGR of 5.01% during 2025-2033, reaching a value of USD 8.45 Billion by 2033.

The market is driven mainly by the growing use of advanced electronics in cars, such as infotainment, safety, and engine control systems. Demand for hybrid and electric cars, increasing emissions regulations, and the emphasis on lightweight, energy-efficient components also drive growth. Technological advancements in high-speed, rugged, and compact connectors also aid in market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)