Europe Automotive Lead-Acid Battery Market Size, Share, Trends and Forecast by Vehicle Type, Product, Type, Customer Segment, and Country, 2025-2033

Europe Automotive Lead-Acid Battery Market Size and Share:

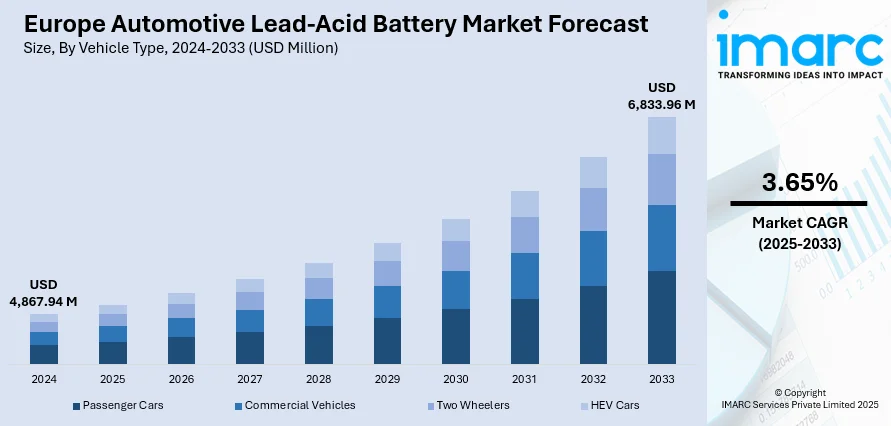

The Europe automotive lead-acid battery market size was valued at USD 4,867.94 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 6,833.96 Million by 2033, exhibiting a CAGR of 3.65% from 2025-2033. Germany currently dominates the market, holding a market share of 25.8% in 2024 owing to the widespread use of internal combustion engine and hybrid vehicles, which rely on these batteries for starting and powering auxiliary systems. The affordability, reliability, and familiarity of lead-acid technology support its continued demand. Additionally, the region’s strong recycling infrastructure and environmental regulations favor batteries with sustainable life cycles, reinforcing their appeal. As vehicles grow more technologically complex, the need for dependable secondary power sources further strengthening the Europe automotive lead-acid battery market share across both original equipment manufacturer (OEM) and aftermarket segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,867.94 Million |

| Market Forecast in 2033 | USD 6,833.96 Million |

| Market Growth Rate (2025-2033) | 3.65% |

Europe’s strong regulatory framework and public focus on sustainability significantly drive the lead-acid battery market. These batteries are favored for their nearly closed-loop recycling system, which allows materials to be reused with minimal waste. Manufacturers and suppliers benefit from this eco-friendly lifecycle, which aligns with EU environmental laws and corporate sustainability goals. The ease of recycling and reduced environmental impact compared to some newer battery types make lead-acid batteries an attractive and compliant choice, supporting their continued production and use in a region highly focused on reducing carbon footprints and promoting circular economy practices.

To get more information on this market, Request Sample

Despite the rise of electric vehicles (EVs), internal combustion engine (ICE) and hybrid electric vehicles still dominate Europe’s roads. In 2024, petrol vehicles accounted for 33.3% and hybrids for 30.9% of new EU car registrations, highlighting the ongoing reliance on traditional and hybrid powertrains. These vehicles depend on lead-acid batteries for starting, lighting, and ignition functions. Even EVs frequently use 12V lead-acid batteries to power auxiliary systems such as lights, infotainment, and safety features. As Europe’s large existing fleet continues to require battery replacements, demand remains steady. Combined with their affordability, reliability, and a strong recycling and supply infrastructure, lead-acid batteries continue to be a vital component in both automotive manufacturing and the aftermarket across the region.

Europe Automotive Lead-Acid Battery Market Trends:

Growing Use in Start-Stop and Auxiliary Systems

In Europe, vehicles equipped with start-stop technology rely heavily on lead-acid batteries due to their ability to handle frequent ignition cycles and quick power recovery. These systems are increasingly common as automakers strive to improve fuel efficiency and reduce emissions without transitioning entirely to electric drivetrains. Moreover, lead-acid batteries remain vital in electric and HEVs as secondary power sources, supporting lighting, braking, infotainment, and safety systems. Their durability, reliability, and low cost make them a favored choice for supporting essential vehicle functions. Even as lithium-ion batteries gain attention for primary propulsion, lead-acid batteries maintain a stronghold in auxiliary roles. Their long-standing presence in automotive systems makes them a dependable and familiar solution for manufacturers looking to maintain a balance between innovation, performance, and affordability.

Advances in Battery Technology and Design

Technological innovation is reshaping the lead-acid battery segment across the European automotive industry. Manufacturers are introducing designs that enhance battery performance, reduce maintenance, and improve safety. Modern versions, such as sealed or absorbent designs, are engineered to deliver longer life and greater resilience under demanding conditions. These advancements aim to meet the evolving needs of vehicles, particularly those with more electronics and energy-demanding features. The addition of smarter diagnostic capabilities, improved materials, and more efficient charging technologies has positioned lead-acid batteries as reliable, cost-effective power solutions for conventional and HEVs. As cars become increasingly complex, the market continues to demand batteries that can adapt to a wider range of performance requirements. These improvements ensure that lead-acid technology remains a relevant and competitive option even as other battery chemistries emerge.

Stronger Emphasis on Sustainability and Recycling

Sustainability is increasingly influencing the direction of the automotive battery market in Europe. Lead-acid batteries have gained favor for their environmental compatibility, particularly due to their recyclable nature and the well-established infrastructure for their reuse. As environmental regulations grow stricter, battery manufacturers and vehicle producers alike are prioritizing eco-conscious practices in production, use, and end-of-life management. This includes cleaner manufacturing processes, better lifecycle tracking, and recycling systems that support circular economy goals. European consumers and regulators are more attentive than ever to the environmental footprint of automotive components, prompting brands to align their battery strategies with broader sustainability goals. The ease of recycling and relatively low environmental impact compared to some alternatives give lead-acid batteries a continued place in the market, especially where environmental responsibility is a key decision-making factor.

Europe Automotive Lead-Acid Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe automotive lead-acid battery market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, product, type, and customer segment.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- HEV Cars

Passenger cars account for the majority share of 58.7% in the European automotive lead-acid battery market, driven by their sheer volume and continued reliance on internal combustion engines and hybrid powertrains. These vehicles require dependable lead-acid batteries for starting, lighting, and powering auxiliary systems, ensuring steady demand for both OEM and replacement markets. The growth of hybrid passenger cars, which often use lead-acid batteries as secondary power sources, further supports this segment. Additionally, the large and diverse passenger car fleet across Europe, combined with ongoing vehicle replacement cycles, sustains consistent battery consumption. Affordability, reliability, and widespread availability of lead-acid batteries make them the preferred power solution for this dominant vehicle category, reinforcing Europe automotive lead-acid battery market growth.

Analysis by Product:

- SLI Batteries

- Micro Hybrid Batteries

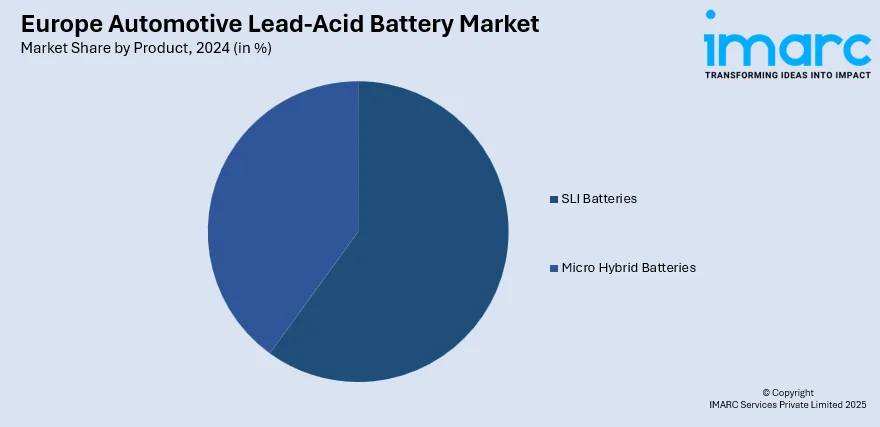

Based on the Europe automotive lead-acid battery market forecast, the SLI (Starting, Lighting, and Ignition) batteries represent the majority share of the European automotive lead-acid battery market because they are essential for vehicle operation. These batteries provide the initial power needed to start the engine and supply energy to lighting and ignition systems, making them indispensable for nearly all internal combustion engine and hybrid vehicles. Their widespread use across passenger cars, commercial vehicles, and two-wheelers ensures consistent demand. SLI batteries are valued for their reliability, affordability, and well-established manufacturing and recycling processes. Despite advancements in battery technology, SLI batteries remain the preferred choice due to their proven performance in delivering quick bursts of power, making them a fundamental component in both new vehicle production and aftermarket replacements across Europe.

Analysis by Type:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Flooded batteries dominate the European automotive lead-acid battery market with a 50.1% share primarily due to their proven reliability, cost-effectiveness, and widespread use in conventional vehicles. Their simple design and robust performance make them ideal for standard internal combustion engine cars and commercial vehicles, which still constitute a large portion of Europe’s automotive fleet. Although they require regular maintenance, their affordability and ease of manufacturing ensure continued preference among OEMs and aftermarket suppliers. Flooded batteries also benefit from a mature recycling infrastructure, supporting sustainability goals. While newer battery technologies gain traction, flooded batteries remain the backbone of automotive power solutions due to their balance of performance, availability, and compatibility with a wide range of vehicle types and applications.

Analysis by Customer Segment:

- OEM

- Replacement

According to the Europe automotive lead-acid battery market outlook, the OEM (Original Equipment Manufacturer) segment holds the largest market share in the European automotive lead-acid battery market due to its critical role in supplying batteries for new vehicles. OEMs demand high-quality, reliable batteries that meet strict performance and safety standards, especially as vehicles become more technologically advanced with features like start-stop systems and hybrid drivetrains. Their preference for advanced lead-acid batteries such as Enhanced Flooded Batteries (EFB) and Valve-Regulated Lead-Acid (VRLA) batteries supports innovations in durability, efficiency, and environmental compliance. Additionally, OEMs benefit from strong partnerships with battery manufacturers, enabling seamless integration and supply chain efficiency. The consistent introduction of new vehicles and the need to comply with stringent EU emissions and sustainability regulations further drive the dominance of the OEM segment in this market.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the leading region in Europe’s automotive lead-acid battery market, holding a 25.8% share due to its strong automotive industry and high vehicle ownership. The country hosts major vehicle manufacturers and suppliers, fostering demand for high-quality, reliable batteries used in both internal combustion engine and HEVs. Germany’s commitment to advanced automotive technologies, including widespread adoption of start-stop systems and mild hybrids, drives the need for enhanced lead-acid batteries such as EFB and VRLA types. Additionally, stringent environmental regulations and well-developed recycling infrastructure support sustainable battery use and lifecycle management. The combination of a large passenger and commercial vehicle fleet, continuous innovation, and regulatory compliance solidifies Germany’s dominant position in the European lead-acid battery market.

Competitive Landscape:

The competitive landscape of the European automotive lead-acid battery market is defined by a mix of established manufacturers and regional suppliers focused on maintaining market presence through innovation, cost efficiency, and sustainability. Companies are competing on the basis of product quality, battery life, and the ability to meet evolving vehicle requirements, especially for start-stop systems and hybrid technologies. There is also strong emphasis on compliance with environmental regulations and circular economy principles, driving investments in recycling capabilities and eco-friendly production. Technological improvements, such as advanced battery chemistries and smart monitoring features, are becoming key differentiators. In addition, firms are expanding partnerships with automotive OEMs and aftermarket distributors to strengthen supply chains and customer reach. The market remains moderately consolidated, with entry barriers shaped by technical expertise, regulatory standards, and the need for reliable distribution networks across diverse European regions.

The report provides a comprehensive analysis of the competitive landscape in the Europe automotive lead-acid battery market with detailed profiles of all major companies, including:

Latest News and Developments:

- March 2025: DHL Supply Chain and Cox Automotive inaugurated the UK's largest EV battery services center in Rugby. Spanning 35,000 sq ft within DHL’s 146,000 sq ft EV Centre of Excellence, the facility offers comprehensive services including battery triage, repair, remanufacturing, logistics, and storage. Designed to handle thousands of batteries annually, it aims to enhance EV adoption by providing reliable and scalable battery services.

- November 2024: Exide Technologies launched Absorbed Glass Mat (AGM) lead-acid battery upgrades, increasing its coverage by almost 1 million more vehicles across Europe. The launch of this novel product offers car aftermarket experts an appealing opportunity to boost revenue by providing consumers with dependable, durable, and long-lasting batteries.

- August 2024: U.S.-based Clarios announced an EUR 200 million investment to expand its European production of advanced AGM lead-acid batteries. This initiative aims to boost AGM output by 50% by 2026, creating 150 jobs across Germany, Spain, France, and the Czech Republic. AGM batteries are crucial for modern vehicles, supporting start-stop systems and electrified powertrains, aligning with trends in electrification and sustainability.

- May 2024: Germany-based Infineon Technologies launched the PSoC 4 High Voltage Precision Analog (HVPA)-144K microcontroller for the monitoring and management of 12 V lead-acid batteries in automotive applications. As the new microprocessor complies with ISO26262, advanced battery sensing and management can be done in modern cars utilizing a small, secure package.

Europe Automotive Lead-Acid Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two Wheelers, HEV Cars |

| Products Covered | SLI Batteries, Micro Hybrid Batteries |

| Types Covered | Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries |

| Customer Segments Covered | OEM, Replacement |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe automotive lead-acid battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe automotive lead-acid battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe automotive lead-acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe automotive lead-acid battery market was valued at USD 4,867.94 Million in 2024.

The Europe automotive lead-acid battery market is projected to exhibit a CAGR of 3.65% during 2025-2033, reaching a value of USD 6,833.96 Million by 2033.

Key factors driving the Europe automotive lead-acid battery market include the dominance of ICE and hybrid vehicles relying on these batteries, cost-effectiveness, established recycling infrastructure, and regulatory support for sustainable practices. Additionally, growing demand for start-stop systems and auxiliary power in EVs sustains market growth.

Germany currently dominates the Europe automotive lead-acid battery market, accounting for a share of 25.8% due to its strong automotive industry, high vehicle ownership, and advanced adoption of start-stop and hybrid technologies. Robust recycling infrastructure and strict environmental regulations further support sustainable battery demand in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)