Europe Barium Carbonate Market Report Size, Share, Trends and Forecast by End Use and Country, 2025-2033

Europe Barium Carbonate Market Overview:

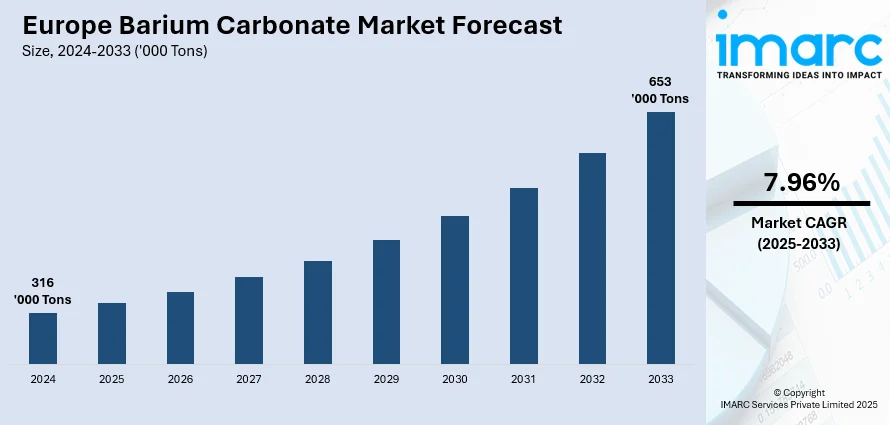

The Europe barium carbonate market size reached a volume of 316 Thousand Tons in 2024. Looking forward, the market is estimated to reach 653 Thousand Tons by 2033, exhibiting a CAGR of 7.96% during 2025-2033. Germany currently dominates the market in 2024. The market is driven by surging demand for high-quality ceramic tiles and specialty glass in infrastructure and construction, supported by the rapid expansion of the electronics sector requiring high-purity barium compounds. Ongoing investments in chemical processes and compliance with environmental regulations strengthen market fundamentals. Increasing adoption of advanced materials and efficient supply chains is expected to further augment the Europe barium carbonate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

316 Thousand Tons |

|

Market Forecast in 2033

|

653 Thousand Tons |

| Market Growth Rate 2025-2033 | 7.96% |

The Europe market is primarily driven by the rising demand for high-quality ceramic tiles across residential and commercial infrastructure projects. In line with this, the growing utilization of barium carbonate in the manufacturing of specialty glass products is also providing an impetus to the market. Moreover, the notable expansion of the electronics industry requiring high-purity barium compounds is also acting as a significant growth-inducing factor for the market. In February 2025, Pioneer Corporation launched its Europe R&D Center in Wetzlar, Germany, to drive innovation in car electronics for European automakers and strengthen its business ties in the region. The new facility focuses on developing advanced in-car audio systems tailored for the European market. In addition to this, the increasing adoption of advanced materials in green construction practices resulting in higher product uptake is leading to Europe barium carbonate market growth.

To get more information on this market, Request Sample

Besides this, the heightened focus on reducing impurities in glass and ceramic production to enhance product performance is creating lucrative opportunities in the market. For instance, in January 2025, AGC Glass Europe acquired Sicherheitsglastechnik Oelsnitz GmbH (SGT), one of Europe's largest safety glass manufacturers, along with associated operations in Germany, expanding its European network and enhancing its leadership in innovative glass solutions. The acquisition brings approximately 270 additional employees and strengthens AGC's capacity to supply complex structures and coatings for the European glass and ceramics market. Also, the surging investments in chemical and metallurgical processes involving barium salts is impacting the Europe barium carbonate market outlook positively. The market is further driven by the introduction of regulatory frameworks ensuring product quality and environmental compliance in manufacturing. Apart from this, easy access to raw materials and well-established supply chains across the region is propelling the market. Some of the other factors contributing to the market include ongoing technological advancements in production processes, the rising emphasis on durable and aesthetic construction materials, and sustained efforts in product innovation.

Europe Barium Carbonate Market Trends:

Massive Public Spending Driving Infrastructure Demand

The Europe market is primarily driven by significant growth in the construction industry. In line with this, the German Parliament passed a staggering USD 1.1 Trillion spending bill focused on construction, infrastructure, and defense over the next decade, which is expected to strengthen the regional demand for industrial-grade materials such as barium carbonate. Moreover, this fiscal commitment underscores a long-term governmental push to upgrade public and private infrastructure, thereby boosting the use of barium-based compounds in glass and ceramic applications. In addition to this, growing focus on high-quality tiling and sanitaryware is further elevating the demand for refined ceramic inputs and is one of the emerging Europe barium carbonate market trends. Besides this, rising awareness regarding durability and performance standards is encouraging widespread use of barium carbonate. Also, the presence of well-developed supply chains and logistics hubs is supporting regional product movement. Apart from this, public procurement is increasingly aligned with sustainable, high-performance construction inputs. Some of the other factors contributing to the market include favorable spending cycles, urban redevelopment trends, and demand for regionally manufactured materials.

Strategic Infrastructure Funds Fueling Material Demand

In line with rising infrastructure upgrades, several countries are implementing long-term capital programs. For instance, Germany is set to implement a USD 540 Billion infrastructure fund, marking a significant shift in its fiscal regime and creating strong demand for inputs like barium carbonate used in glass, brick, and tile production. Moreover, this initiative reflects Germany’s intent to boost competitiveness through large-scale infrastructure spending, encouraging the adoption of ceramics in architectural and housing projects. In addition to this, the ongoing emphasis on transport networks, energy-efficient buildings, and public utility upgrades is acting as a significant growth-inducing factor. Besides this, quicker approval processes for construction projects are supporting greater material demand across the region. As per the Europe barium carbonate market forecast, the growing emphasis on performance materials is driving the use of additives like barium carbonate. Apart from this, enhanced collaboration between policymakers and private players is opening up standardization and procurement channels. Some of the other contributors include digital procurement tools, industrial policy reforms, and recovery-focused investment programs.

M&A Activity and Regional Projects Strengthening the Market

The market is further driven by targeted developments and strategic moves by key players. For instance, the Government of Norway is heavily investing in the construction of numerous tunnels and bridges across the fjords, which is expected to create a positive outlook for the market. In line with this, the widespread product utilization as a glazing agent in the manufacturing of ceramics continues to support its use across construction and design industries. Moreover, major regional firms are engaging in M&A to expand their footprint. For instance, Latour Capital, a Paris-based company, acquired Solvay’s barium businesses across Germany and Spain in an attempt to strengthen their market position. In addition to this, these acquisitions are enabling firms to scale operations and diversify supply chains. Besides this, growing preference for high-performance materials is accelerating the adoption of barium carbonate in advanced ceramic production. Also, the alignment of private capital with national infrastructure priorities is boosting investor confidence. Some of the other factors contributing to the market include strong intra-EU trade channels, rising product innovations, and localized manufacturing initiatives.

Europe Barium Carbonate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe barium carbonate market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on end use.

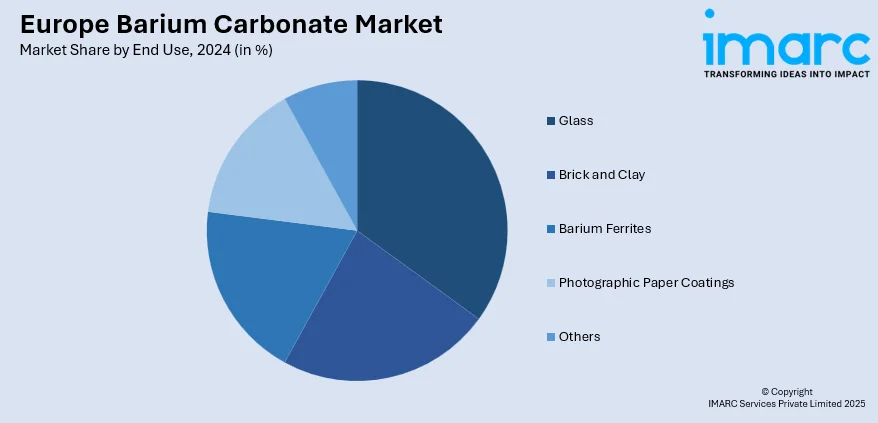

Analysis by End Use:

- Glass

- Brick and Clay

- Barium Ferrites

- Photographic Paper Coatings

- Others

Glass stands as the largest component in 2024. This dominance is primarily attributed to the widespread application of barium carbonate in the production of specialty, container, and optical glass. The compound enhances clarity, strength, and chemical resistance, making it an essential additive in both industrial and consumer-grade glassware. The construction and automotive sectors across Europe are witnessing increased demand for durable and aesthetically superior glass, further amplifying product usage. Additionally, the region's transition toward energy-efficient and insulated glass solutions in residential and commercial buildings is strengthening long-term demand.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. This leading position can be attributed to the country’s robust industrial infrastructure and well-established ceramics and glass manufacturing sectors. Germany’s substantial investments in public infrastructure, energy-efficient housing, and transportation networks have created sustained demand for high-quality materials such as barium carbonate. Additionally, the presence of major chemical companies and export-driven production facilities has strengthened the country’s role in regional supply chains. The government's support for sustainable manufacturing and circular economy initiatives is further encouraging the use of advanced materials in construction and industrial applications.

Competitive Landscape:

Key players in the Europe barium carbonate market are actively pursuing strategic initiatives to strengthen their market presence and expand production capabilities. Several companies are focusing on mergers and acquisitions to consolidate their position. Additionally, manufacturers are investing in modernizing production technologies to ensure higher product purity and environmental compliance, aligning with tightening EU regulations. Companies are also diversifying their end-use portfolios, targeting high-growth sectors such as electronics and specialty ceramics. Collaborations with regional distributors and R&D centers are further enabling firms to innovate product grades, streamline logistics, and address the evolving demands of construction and industrial applications across the continent.

The report provides a comprehensive analysis of the competitive landscape in the Europe barium carbonate market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: China Isotope & Radiation Corporation introduced C-14 Barium Carbonate, developed with Qinshan Nuclear Power Plant, to the European and American markets. The launch marked China’s first mass-production export of medical isotopes, with agreements secured in the UK, Switzerland, and Germany.

- June 2025: Fujifilm launched the LTO Ultrium 10 Data Cartridge with 75TB capacity using fine hybrid magnetic particles that included barium carbonate technology for the first time in the series. The new cartridge achieved a 70% higher storage capacity than its predecessor while ensuring secure and cost-effective data storage.

- May 2025: Honeywell agreed to acquire Johnson Matthey's Catalyst Technologies business for USD 2.8 Billion, expanding its portfolio in refining, petrochemical, and renewable fuel catalysts. The deal enhanced Honeywell's catalyst lineup, and supported its integrated solutions across process technologies.

- April 2025: Solvay inaugurated its rare earths production line for permanent magnets at its La Rochelle facility in France, enhancing Europe's rare earths sovereignty and aligning with the Critical Raw Materials Act. The expansion supported rare earth separation and production using compounds like barium carbonate, marking Solvay’s step toward supplying 30% of Europe’s demand by 2030.

- April 2025: Nippon Surfactant Industries newly acquired the EFfCI GMP certification at its Nasu Factory, which already produces barium carbonate, strengthening product quality and safety systems. The certification followed structural upgrades and reinforced employee education.

Europe Barium Carbonate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Glass, Brick and Clay, Barium Ferrites, Photographic Paper Coatings, and Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe barium carbonate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe barium carbonate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe barium carbonate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in the region reached a volume of 316 Thousand Tons in 2024.

The Europe barium carbonate market is projected to exhibit a CAGR of 7.96% during 2025-2033, reaching a volume of 653 Thousand Tons by 2033.

The Europe barium carbonate market is driven by rising demand for high-quality ceramic tiles in construction, increasing use in specialty glass production, significant public spending on infrastructure, technological advancements in manufacturing, the expansion of the electronics sector, and efforts to enhance product performance and sustainability through reduced impurities and regulatory compliance.

Glass stands as the largest end use segment in 2024, owing to its widespread application in specialty, container, and optical glass production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)